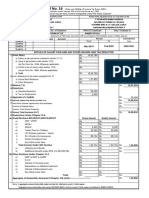

INCOME TAX STATEMENT FOR THE FINANCIAL YEAR 2022-23

ASSESSMENT YEAR 2023-24

NAME - Designation -

PAN No.- Office -

TOTAL SUB-TOTAL

PARTICULARS

Amounts (Rs.) Amounts (Rs.)

1- Gross Salary (Excluding Govt. Contribution to NPS)

Rs. 862108

(Including H.R.A.,Salary Arrears & All Allowance etc.)

2- Govt. Contribution to NPS (Part of Gross Salary) Rs.

3- Total Gross Salary- Add Above (1+2) Rs. 862108

4- Any Other Income (As Reported by Employer) Rs.

5- Total Income- Add Above (3+4) Rs. 862108

6- Less HRA U/S10(13A) Rs.

7- Less Standard Deduction (U/S 16 upto Rs. 50000/-) Budget 2019 Rs. 50000

8- Eligible Deduction under any other Section of IT Rs.

9- Net Income [5- (6+7+8)] Rs. 812108

10- REBATE U/S 80C

(a) GPF/EPF Contribution Rs.

(b) Employee Contribution to NPS u/s 80CCD(1) Rs. 30000

(c) GIS Contribution Rs.

(d) PPF Contribution Rs.

(e) LIC Contribution Rs. 120000

(f) House Loan Principal Amount Rs.

(g) Tution Fee Rs.

(h) Others Investments_______________ Rs.

(i) TOTAL (10a to 10h) (Deduction Allowed upto Rs.1.50 Lakhs) 150000 Rs. 150000

11- REBATE UNDER OTHER SECTIONS

(a) U/S 80D (Health Insurance) Rs.

(b) U/S 80E (Education Loan) Rs.

(c) U/S 80G, 80CCG (Charity to NGOs) Rs.

(d) U/S 80CCD(1B) NPS (Max Rs. 50000/-) Rs. 50000

(e) U/S 80DDB (Medical Treatment of Dependant) Rs.

(f) U/S 80U, 80DD (Self Disability, Depantant Disability) Rs.

(g) U/S 24(l) HBA Loan Interest (upto Rs. 2.00 Lakhs) Rs.

(h) U/S 80CCD(2) Govt. Contribution to NPS (14% of Basic+DA) Rs.

(i) TOTAL (11a to 11h) 50000 Rs. 50000

12- TAXABLE INCOME

(a) Net Income (9) Rs. 812108

(b) Less (10i+11i) Rs. 200000

(c) TOTAL TAXABLE INCOME Rs. 612108

13- TAX CALCULATION

(a) UPTO Rs. 250000/- (Rs. 300000/- in case of Senior Citizen) Rs. 0

(b) Rs. 250001/- to 500000/- @ 5% Rs. 12500

(c) Rs. 500001/- to 1000000/- @ 20% Rs. 22422

(d) Rs. 1000001/- to above @ 30% Rs. 0

(e) TOTAL Calculated Tax (13a to 13d) Rs. 34922

Relief U/S 87A (Max of Rs. 12500/-)

(f) Rs. 0

(Applicable where taxable income Rs. 5 Lakhs or Less)

(g) TOTAL Tax (13e-13f) Rs. 34922

(h) Education & Health Cess @ 4% on Tax Rs. 1397

(i) TOTAL Tax Liability (13g+13h) Rs. 36319

(j) TDS Paid upto JANUARY 2023 Rs. 33000

(k) Tax Payable (13i-13j) / Refundable Rs. 3319 Payable

14- Tax to be deducted from salary of February 2023 Rs. 3319

In Words- NIL

DECLERATION

I__________________ do hereby declare that what is stated above is true to the best of my information and belief.

Date :- __________________

Place :- __________________ Signature