0% found this document useful (0 votes)

42 views10 pagesCommon Comparative

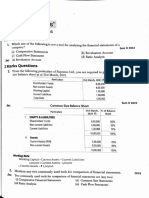

The document outlines various tools for financial statement analysis, including Comparative Statements, Common Size Statements, Ratio Analysis, and Cash Flow Statements. It provides illustrations for preparing Comparative Balance Sheets and Common Size Balance Sheets using sample financial data. Additionally, it includes examples of Comparative Statements of Profit & Loss and Common Size Statements for better understanding of financial performance analysis.

Uploaded by

brasmi901Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

42 views10 pagesCommon Comparative

The document outlines various tools for financial statement analysis, including Comparative Statements, Common Size Statements, Ratio Analysis, and Cash Flow Statements. It provides illustrations for preparing Comparative Balance Sheets and Common Size Balance Sheets using sample financial data. Additionally, it includes examples of Comparative Statements of Profit & Loss and Common Size Statements for better understanding of financial performance analysis.

Uploaded by

brasmi901Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd