0% found this document useful (0 votes)

53 views4 pagesUnderstanding Negotiable Instruments Law

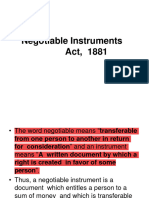

The document discusses various aspects of negotiable instruments, including promissory notes and bills of exchange, outlining their validity, characteristics, and the concept of holders in due course. It provides examples of different instruments and their legal implications, such as payment in due course and endorsement. Additionally, it addresses the responsibilities of parties involved in these instruments and the conditions under which they are considered valid or invalid.

Uploaded by

Umaymah MughalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

53 views4 pagesUnderstanding Negotiable Instruments Law

The document discusses various aspects of negotiable instruments, including promissory notes and bills of exchange, outlining their validity, characteristics, and the concept of holders in due course. It provides examples of different instruments and their legal implications, such as payment in due course and endorsement. Additionally, it addresses the responsibilities of parties involved in these instruments and the conditions under which they are considered valid or invalid.

Uploaded by

Umaymah MughalCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd