0% found this document useful (0 votes)

43 views2 pagesA014968229L

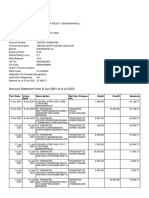

This document is a tax certificate issued by the Kenya Revenue Authority for taxpayer David Mwangi Mulei, confirming his registration and active income tax obligation since March 11, 2020. It includes contact information for the KRA Call Centre and specifies that the taxpayer's accounting end date is December 31. The certificate is system-generated and does not require a signature.

Uploaded by

Daud DaudCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

43 views2 pagesA014968229L

This document is a tax certificate issued by the Kenya Revenue Authority for taxpayer David Mwangi Mulei, confirming his registration and active income tax obligation since March 11, 2020. It includes contact information for the KRA Call Centre and specifies that the taxpayer's accounting end date is December 31. The certificate is system-generated and does not require a signature.

Uploaded by

Daud DaudCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd