0% found this document useful (0 votes)

165 views1 pageSalary Slip Jan 2025 .

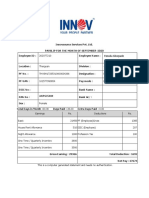

The payslip for Piyush Raman Rai for January 2025 details his earnings of INR 50,127, including a basic salary, allowances, and a statutory bonus. After deductions totaling INR 2,594, his net pay is INR 47,533. The total cost to the company, including employer contributions, amounts to INR 50,552.

Uploaded by

PIYUSH RAMAN RAICopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

165 views1 pageSalary Slip Jan 2025 .

The payslip for Piyush Raman Rai for January 2025 details his earnings of INR 50,127, including a basic salary, allowances, and a statutory bonus. After deductions totaling INR 2,594, his net pay is INR 47,533. The total cost to the company, including employer contributions, amounts to INR 50,552.

Uploaded by

PIYUSH RAMAN RAICopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd