0% found this document useful (0 votes)

24 views5 pagesAy 2324

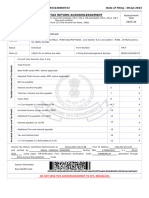

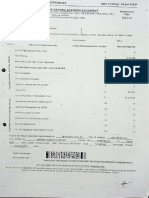

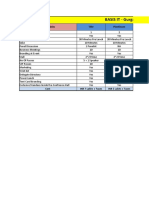

This document is an updated income tax return acknowledgment for the assessment year 2023-24 filed by Gubala Muralidhar, with a total income of ₹5,14,300 and a net tax payable of ₹290. The return was submitted electronically on May 13, 2024, and includes details of business profits, tax deductions, and a balance sheet. The document also outlines the financial performance of the business, including a profit and loss account for the year ending March 31, 2023.

Uploaded by

RA NACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

24 views5 pagesAy 2324

This document is an updated income tax return acknowledgment for the assessment year 2023-24 filed by Gubala Muralidhar, with a total income of ₹5,14,300 and a net tax payable of ₹290. The return was submitted electronically on May 13, 2024, and includes details of business profits, tax deductions, and a balance sheet. The document also outlines the financial performance of the business, including a profit and loss account for the year ending March 31, 2023.

Uploaded by

RA NACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd