0% found this document useful (0 votes)

147 views17 pagesSummary ISA

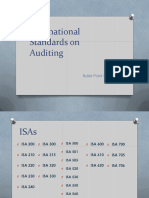

The document outlines the International Standards on Auditing (ISA) and the overall responsibilities of independent auditors when conducting audits of financial statements. It details various ISAs, including objectives, scope, and specific responsibilities related to audit engagements, risk assessment, audit evidence, and reporting. The document emphasizes the importance of professional skepticism and judgment in the audit process.

Uploaded by

Rachaita DawnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

147 views17 pagesSummary ISA

The document outlines the International Standards on Auditing (ISA) and the overall responsibilities of independent auditors when conducting audits of financial statements. It details various ISAs, including objectives, scope, and specific responsibilities related to audit engagements, risk assessment, audit evidence, and reporting. The document emphasizes the importance of professional skepticism and judgment in the audit process.

Uploaded by

Rachaita DawnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd