0% found this document useful (0 votes)

168 views1 pageSensitivity Analysis

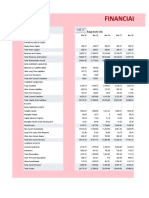

The document presents a sensitivity analysis template for discounted cash flow (DCF) and equity valuation, detailing assumptions such as discount rate and long-term cash flow growth rate. It includes a table showing the impact of varying these assumptions on the valuation outcomes, such as enterprise and equity values. The template is designed for use in Excel, allowing users to input different variables and see how they affect the valuation results.

Uploaded by

Nick Alwynson TandayagCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

168 views1 pageSensitivity Analysis

The document presents a sensitivity analysis template for discounted cash flow (DCF) and equity valuation, detailing assumptions such as discount rate and long-term cash flow growth rate. It includes a table showing the impact of varying these assumptions on the valuation outcomes, such as enterprise and equity values. The template is designed for use in Excel, allowing users to input different variables and see how they affect the valuation results.

Uploaded by

Nick Alwynson TandayagCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd