0% found this document useful (0 votes)

63 views1 pageForm 15G (1) - Removed

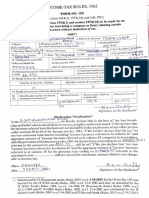

This document is Form No. 15G, a declaration made by Ganesh Pradhan, an individual, to claim certain incomes without tax deduction for the financial year 2023-2024. The estimated income for which the declaration is made is 20,142, with a total estimated income of 115,000 for the year. The form includes details about the individual's residential status, PAN, and the nature of income being declared, specifically a PF withdrawal.

Uploaded by

ramanandachakrabarti7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

63 views1 pageForm 15G (1) - Removed

This document is Form No. 15G, a declaration made by Ganesh Pradhan, an individual, to claim certain incomes without tax deduction for the financial year 2023-2024. The estimated income for which the declaration is made is 20,142, with a total estimated income of 115,000 for the year. The form includes details about the individual's residential status, PAN, and the nature of income being declared, specifically a PF withdrawal.

Uploaded by

ramanandachakrabarti7Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd