RBI RETAIL DIRECT

Introduction of UPI Mandate (single-block-and-single-debit) Facility on RBI Retail

Direct Platform

Payments are made by the Retail Investors at the time of placing the bid or before the

bidding closure time. Presently the RBI Retail Direct Portal facilitates payments through

NACH, Net Banking and UPI. Retail Direct has tied up with various payment Gateways for

NACH, Net Banking and UPI.

UPI Mandate (Single-Block-and-Single-Debit) payment facility is now being introduced on

RBI Retail Direct, in addition to the existing NACH, Net banking and UPI options.

This facilitates the block of the Indicative settlement Amount in the Investors account at the

time of placement of bid and the actual debit from the Investors account on the Auction date.

Thus Investors are not required to pay the bid amount at the time of placing the bid. This

facility presently has a limit of Rs 5 lacs.

The UPI Mandate payment processes involves the following:

1. While making Payment for a bid, Investors have to select the UPI Mandate Option.

2. Investors need to enter VPA id and select UPI extension in the field provided in the

payment page.

3. The Mandate Creation request will be received in the Investor’s UPI App and that

needs to be approved by investor.

4. The required amount will be blocked in the investor’s registered bank account.

5. Bid Indicative amount will be auto debited from the investors bank Account on

Auction day before the Bid is submitted to RBI for Auction.

6. Post Auction allocation, excess mark-up amount will credited back to the Investors

account.

� How to make Bids Payment using UPI Mandate.

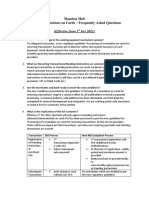

1. After Bid placement, move to Fund Transfer screen and select UPI Mandate

Payment option

Select Payment options as

UPI mandate

Enter VPA Id

Select VPA

Extension from the

Acknowledge Terms

list

and Conditions

Click on

2. The Investor is redirected to Payment Gateway Page. A UPI Mandate creation

request is also received on UPI App of the Investor. Once the Mandate Creation

request is approved in UPI App, a successful payment confirmation message will

be received in Retail Direct page. The required amount is also blocked in the

investor’s Bank Account.

3. Bid & Payment status appear on the My Bids screen

My Bid Screen Bid No

Bid status as ‘Applied’ & payment

status as ‘Pending Mandate

2

�4. Payment details appear on the Fund Activity screen

Payment Gateway displaying as ICICI BANK

Bid No and Order and Fund status as ‘Pending/ Pending Mandate

Execution/ Accepted/ Confirmed’

No

Fund Activity

Screen

Activity type as ‘Bid Payment’ and

Payment Mode as ‘UPI Mandate’

5. On Auction date, the bid amount is debited from the Investor Bank Account and

blocked amount is released. The same is also captured in the RD system in Bid

and Payment status. Once the bid amount is credited to Retail Direct Bank

Account and ‘Bid’ & ‘Payment’ status changes accordingly. The Bid is ready for

being submitted to RBI.

Once Bid amount is debited from Investor’s

Account, Bid and Payment status changes to

‘Funded’ and ‘Accepted’

Once Bid amount is credited to Retail Direct

Bank Account from Investor’s Account, Bid

and Payment status changes to ‘Sighted’ and

6. After UPI mandate Creation for an Active Bid, if the Investors withdraws the Bid,

the UPI Mandate is Revoked and Blocked amount is released from the Investors

bank Account.