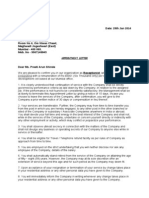

Office -707, 707-A, 708 and 708-A, "Brilliant Titanium", PSP Plot No.9, Scheme No.

78, Part-II, Indore 452 010

Ref: MLOSPL/HR//NR/OL-10/24 Date: October 24, 2024

Parth Verma,

161 doodhnath colony near Bus stand Chhatarpur (M.P.) 471001

Letter of Intent

Dear Parth Verma,

You are selected for the position of Associate Executive -Recruitment in our organization.

As discussed, your actual date of joining and timing will be communicated to you at a later date via e-mail & over

the phone. Please find the softcopy of the letter intent attached.

Your annual CTC would be INR 360000 (Three lakhs sixty thousand). Compensation details are confidential

and not to disclosed to any person other than your immediate manager or undersigned in case you need

clarifications.

Letter of appointment will be issued on your joining day.

We are confident you will find this new opportunity both challenging and rewarding. We look forward to the

opportunity to work with you in an atmosphere that is successful and mutually challenging and rewarding.

Please sign and return a copy of this letter as a token of your acceptance of our above offer.

Thanking you,

Yours faithfully,

For ml Outsourcing Services Pvt. Ltd.

Garima Khosla

Talent Acquisition

Registered Office: A-213/1/5, Som Dutt Chamber, Bhikaji Cama Place, New Delhi – 110066 CIN: U72200DL2004PTC12758 1/2

�ANNEXURE

Annual/Monthly CTC Parth Verma

Annual Monthly

Salary:

Basic 144000 12000

Total Salary (A) 144000 12000

Allowances:

House Rent 57600 4800

Bonus 28800 2400

Other Allowances 72600 6050

Total Allowances (B) 159000 13250

FBP

FBP CAR 0 0

FBP DRIVER 0 0

MEAL COUPONS 26400 2200

FBP TELEPHONE 0 0

FBP TECH BOOKS 0 0

LTA 0 0

Total FBP (C) 26400 2200

Total Gross Salary (A+B+C) 329400 27450

Fringe Benefits

Family Medical Insurance 9000 750.00

Employer Contribution to Provident Fund 21600 1800

Total Fringe Benefit (D) 30600 2550

Total CTC (A+B+C+D) 360000 30000

Note:

1)Medical Insurance is for up to Rs. 400,000/- for family (i.e, Self + Spouse + 2 Kids).

2) HRA will be exempted from the taxable salary in accordance with the Income Tax Rules, only on producing the

original rent receipts.

3) Any changes to the above would have to be confirmed in writing by the company. Income Tax will be deducted

on the taxable salary in accordance with the prevailing Income Tax Rules. If you plan to invest or have invested in

any Tax saving instruments, you are requested to declare the same in writing at the time of joining and in the April

month of subsequent years, in order to compute the appropriate amount of Tax.

4) Employee contribution to Provident Fund which is equal to the employer’s contribution will be deducted from

the monthly gross salary every month.

ml Outsourcing Services Pvt. Ltd. Agreed and Accepted

-------------------------------- --------------------------------

Garima Khosla Parth Verma

Talent Acquisition Associate Executive -Recruitment

2/2