0% found this document useful (0 votes)

60 views9 pagesIIT Implementation Rules 2018

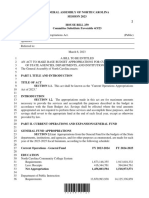

The Implementing Regulations of the Individual Income Tax Law of the People's Republic of China were revised in 2018 and became effective on January 1, 2019. The regulations outline the definitions of income sourced within and outside China, the categories of taxable income, and the conditions under which individuals are exempt from individual income tax. The document is issued by the State Council and aims to clarify the application of the Individual Income Tax Law.

Uploaded by

constancelam0903Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

60 views9 pagesIIT Implementation Rules 2018

The Implementing Regulations of the Individual Income Tax Law of the People's Republic of China were revised in 2018 and became effective on January 1, 2019. The regulations outline the definitions of income sourced within and outside China, the categories of taxable income, and the conditions under which individuals are exempt from individual income tax. The document is issued by the State Council and aims to clarify the application of the Individual Income Tax Law.

Uploaded by

constancelam0903Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd