0% found this document useful (0 votes)

36 views13 pagesChart 73

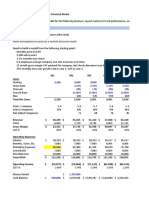

The document outlines a financial overview including sales plans, expense structures, and revenue projections for a business. It highlights the importance of slicers in Excel for data visualization, while also detailing monthly expenses and revenues from 2025 to 2028. Key metrics include a profit of $14,267 and a break-even level of $150,000.

Uploaded by

Iliano IlyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

36 views13 pagesChart 73

The document outlines a financial overview including sales plans, expense structures, and revenue projections for a business. It highlights the importance of slicers in Excel for data visualization, while also detailing monthly expenses and revenues from 2025 to 2028. Key metrics include a profit of $14,267 and a break-even level of $150,000.

Uploaded by

Iliano IlyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd