Auditing property, plant and equipment

Cheat sheet

This cheat sheet provides a reminder of the key accounting definitions and concepts, based on the

requirements as set out in the International Financial Reporting Standards, that you need to be

familiar with when auditing property, plant and equipment. You may wish to refer to this not only to

complete the e-learning Property, Plant & Equipment (PPE) - auditing, but also when performing your

audit work on PPE.

Property, plant and equipment definition

International Accounting Standard (IAS) 16 defines property, plant and equipment as "tangible items

that:

(a) are held for use in the production or supply of goods or services, for rental to others, or for

administrative purposes; and

(b) are expected to be used during more than one period."

Items of property, plant and equipment are physical assets that you can see or touch. Some common

examples of items of PPE are machinery and buildings.

Property, plant and equipment assets are usually grouped according to their nature - these are

referred to as classes of assets. Some common classes of PPE assets include plant and machinery,

land and buildings and fixtures and fittings.

Initial recognition

An item of property, plant and equipment is initially recognised at its cost when it is probable that

future economic benefits associated with the item will flow to the entity and its cost can be measured

reliably.

Cost = purchase price + directly attributable costs + dismantling provisions

Directly attributable costs are those costs incurred to get the asset to the location and in the

condition ready for it to operate in the manner intended by management.

Auditing dismantling provisions are outside of the scope of this e-learning as they a complex

audit area often involving significant estimates and judgements. These should be audited by senior

members of the audit team – if you come across these in your audit work, please speak to your audit

supervisor or manager.

Capitalisation is the process of recognising an asset in the financial statements, rather than

expensing the cost in the period it is incurred.

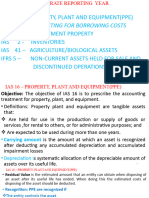

� DISTINCTION BETWEEN PPE, INVENTORY AND EXPENSE

This is a summary distinguishing between an item of PPE, an item of inventory (also referred to as stock) and an expense based on the related International

Financial Reporting Standards (IFRS) definitions.

Expense type Item Designed to be Duration of use

- Used in the production or For more than one

supply of goods and services; or accounting period.

Property, plant and - Controlled by the entity; and - Rented to third parties*; or

equipment (IAS 16) - Is the result of a past event; and - Used for internal administration (i.e. for longer-term use)

- Has the potential to produce / management purposes.

economic benefits.

- Sold in the normal course of Within the entity’s normal

(i.e. meets the definition of an business (both finished goods operating cycle.

asset) and goods in production); or

Inventory (IAS 2) - Used in the production process (i.e. for short-term use)

or provision of services.

Decrease in an asset or increase

in a liability (other than

distributions to equity holders).

Expense

(conceptual (i.e. a cost is classified as an

framework) expense if it does not meet the

definition of an asset)

* Please note that whilst this is included in the IAS 16 definition of property, plant and equipment, some specific assets may fall in the scope of other IFRSs and do not quality as PPE (for example:

land and buildings rented to third parties could fall in under IAS 40 Investment Property rather than under IAS 16).

�Depreciation

Depreciation is the systematic allocation of an asset's depreciable amount over its useful life.

The depreciable amount of an asset is its cost less its residual value.

The residual value of an asset is the estimated amount that an entity would currently obtain from

disposal of the asset, after deducting the estimated costs of disposal, if the asset were already of the

age and in the condition expected at the end of its useful life.

Useful life is:

• the period over which an asset is expected to be available for use by an entity; or

• the number of production or similar units expected to be obtained from the asset by an entity.

There are various depreciation methods that can be used and IAS 16 describes the three most

common ones we see, which are presented below. Entities can choose which depreciation method

they use for each class of asset, as long as it closely reflects how they receive the economic benefits

from the asset.

Note: IAS 16 does not permit an entity to adopt a depreciation method that is based on the revenue

generated by an activity that includes the use of an asset.

Straight-line method

This spreads the depreciable amount of an asset evenly over its useful life, resulting in a constant

charge in each accounting period (providing the residual value of the asset does not change).

The annual depreciation charge using the straight-line method can be calculated in either of the

following ways:

depreciable amount

Annual expense =

useful life (years)

Annual expense = depreciable amount x annual depreciation rate (%)

Diminishing balance method (also known as reducing balance)

This applies a set percentage to the value of the asset at the beginning of an accounting period,

resulting in a reducing depreciation expense as the asset gets older.

The annual depreciation charge using the diminishing balance method is calculated as:

Annual expense = asset value at the beginning of the year x depreciation rate (%)

Units of production method

This calculates depreciation based on the expected usage or output of the asset and results in

a higher depreciation charge when the asset is heavily used.

The annual depreciation charge using the units of production method is calculated as:

depreciable amount

Annual expense = x actual units produced in the year

total expected units

�Charging depreciation

In accordance with IAS 16, depreciation starts when an asset is available for use. In the majority of

cases, depreciation ceases when the asset is sold.

Impairment losses

Impairment losses are "abnormal" losses in value. The purpose of impairments is to ensure that

assets are not carried at more than their value to the entity, which is known as recoverable

amount and is calculated as the higher of:

• The value of the asset through its use within the business; and

• Its estimated net selling proceeds, after deducting the costs of disposal.

The amount an asset is recorded at in the financial statements is known as its carrying amount (or

net book value).

The cost model and the revaluation model

Accounting policy choice

After initially recognising an item of property, plant and equipment at its cost, IAS 16 gives the entity a

choice as to how to measure the asset going forwards. An entity can choose to apply either the cost

model or the revaluation model and must apply that model to the whole class of assets.

The cost model

Under this model, an item of property, plant and equipment is recorded in an entity's financial

statements at its original cost less any accumulated depreciation and any accumulated impairment

losses. The value recorded in the financial statements is referred to as the carrying amount (or net

book value) of the asset.

The revaluation model

The value of some items of property, plant and equipment can increase over time, for example a

building. An entity can choose to reflect this increase in value in their financial statements by applying

the revaluation model, which requires the asset's fair value to be determined.

Fair value is the price that the entity would receive if they were to sell the asset in an arm's length

transaction - for the majority of items of PPE (unless they are specialised or bespoke assets), the fair

value is market value.

When applying the revaluation model, an asset's carrying amount is calculated as its revalued

amount, less any subsequent accumulated depreciation and any subsequent accumulated

impairment losses. Revaluations are performed periodically over an asset's useful life. Note: assets

held under the revaluation model are still depreciated.

� The fixed asset register

Most entities operate a fixed asset register to keep track of all of the items of property, plant and

equipment they control. The level of detail contained will vary from entity to entity and depends on

circumstances such as the nature of their business, how many items of PPE they have and where

their assets are located.

A typical fixed asset register contains details such as:

Date of Expected Expected Depreciation Carrying

Description Location Cost

purchase useful life residual value charges amount

How long How much does How much How much is

How When was does the the entity expect depreciation has the asset worth

What is the Where is

much did the asset entity expect the asset to be been charged at the end of the

asset? the asset?

it cost? bought? to use the worth at the end against this financial

asset for? of its useful life? asset already? period?

An entity's fixed asset register may include other details too, such as names of the suppliers,

depreciation method, details of revaluations, impairment losses or dates of disposals.

Property, plant and equipment in the financial statements

An entity's statement of financial position usually has one line item (known as a Financial Statement

Area (FSA)) for property, plant and equipment. This is the total carrying amount of all the items of

property, plant and equipment that the entity controls.

The notes to the financial statements must disclose, for each class of asset, a reconciliation of the

carrying amount at the beginning and the end of the period showing all the movement(s) in the period,

including additions, disposals, depreciation charges, impairment losses and revaluations.

Here is an illustrative example of a property, plant and equipment note:

In this example, the property, plant and equipment line in the statement of financial position will

disclose only the $792,993 total carrying amount at the end of the current period (with a comparative

of $793,309 for the prior period).