0% found this document useful (0 votes)

46 views3 pagesFinal Return Set PB 2425

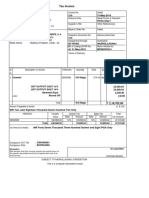

This document is an income tax return acknowledgment for Prashansa Bais for the assessment year 2025-26, filed on August 20, 2025. The total income reported is ₹6,96,280, with no tax payable after rebates. The return was filed electronically and verified using an Aadhaar OTP.

Uploaded by

prashansa.bais0709Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

46 views3 pagesFinal Return Set PB 2425

This document is an income tax return acknowledgment for Prashansa Bais for the assessment year 2025-26, filed on August 20, 2025. The total income reported is ₹6,96,280, with no tax payable after rebates. The return was filed electronically and verified using an Aadhaar OTP.

Uploaded by

prashansa.bais0709Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd