Fin 401

Problem Set #10

Discounted Cash Flow Analysis

Instructions: Complete all questions. This problem set is worth 10 points. Problems sets are graded

on effort and completeness; you must show your work in order to get full credit. Short answers

(“checkpoints”) are available for some questions on Learning Suite so that you can check your

answers. Full solutions are available on Learning Suite after the problem set is due.

1. a. You are performing a discounted cash flow analysis on a project that requires a

special piece of machinery that is owned by your firm but that is no longer being used

in any other capacity. If your firm sold the machinery today, it would probably sell

for about $10,000. The machinery was purchased for $50,000 two years earlier. One

year ago, your firm spent an additional $20,000 to modify the machine. What cash

flow should you include for the cost of the machine in your DCF analysis? (Ignore tax

consequences for now.)

The purchase price would only matter to consider tax shield from deprecation. So the only

price that matters (if we ignore taxes) is the $10,000 resale value. Modification is a sunk cost.

b. Now reconsider the question including tax consequences. Assume that the current book

value of the machinery is $5,000, and that the tax rate is 50%. What cash flow should you

include for the cost of the machine in your DCF analysis?

Gain= MV-BV=5000

Taxes on Gain=5000(.5)=2500

Sold for 10,000-2500 taxes=$7500 cash flow

c. Answer (b) again assuming the book value is $25,000.

Gain/loss= MV-BV=-15000

Taxes shield on loss=25000-10,000=15,000(.5 tax rate)=7,500 tax shield

Sold for 10,000-7,500 tax shield=$17,500 cash flow

d. Answer (b) one more time assuming the book value is $10,000.

Gain/Loss=MV-BV=10,000-10,000=0

No tax shield or taxes since sold at BV

$10,000 Cash flow

�2

�2. Calculate the annual free cash flow for 2015 based on the following information.

Income Statement Balance Sheets

201

5 2014 2015

110

Revenue 0 Cash 50 70

COGS 700 Accounts receivable 120 170

Operating expenses 100 Inventory 130 160

Depreciation 50 Total current assets 300 400

EBIT 250

Interest expense 50 Net PPE 100 200

Pretax Income 200 Total assets 400 600

Tax 80

Net income 120 Accounts payable 200 280

Short-term debt 40 60

Total current

liabilities 240 340

Long-term debt 140 150

Total liabilities 380 490

Shareholder's equity 20 110

Dep=50 (BS)

Capex:

200=100+CAPEX-50

Capex=150

Chg in NWC:

NWC 2014=50+120+130-200=100

NWC 2015=70+170+160-280=120

Change in NWC=20

FCFF=Ebit(1-t)+dep-CAPEX-chg in NWC

FCFF=250(1-.4)+50-150-20

FCFF=30

3

�4

�3. Your company is planning to purchase a piece of machinery for $100,000. The machinery

has a useful life of 5 years, and your company will use straight-line depreciation to a salvage

value of zero at the end of year 5. However, your company intends to use the machinery for

only 2 years. At the end of the year 2, the machinery will be sold to a competitor that has

agreed to purchase it at that time for $50,000. Your company is highly profitable, and its

marginal tax rate is 30%. What is the after-tax cash flow that you would project for the sale

of the machinery at the end of year 2?

Dep expense (straight-line)=100,000/5=20,000

[Link] at time os sale is 40,000, so BV at time of sale is 60,000

Gain/Loss on sale=MV-BV=50,000-60,000=10,000 loss

TS from loss= 10,000(.3)=3,000

Cash Flow= 50,000 from sale + 3000 ts=53,000

4. Wishbone Corp. is considering investing in a project with a projected life of 4 years. The

project would require a $60,000 initial investment in machinery, and the machinery is in the

3-year MACRS category. The machinery is expected to be sold for $5,000 at the end of the

project. The company has a 40% tax rate. The project is expected to bring $35,000 in

incremental annual revenues and $10,000 incremental annual expenses for each of the 4 years.

A $5,000 additional (one-time) investment in net working capital will be required, which will

be recouped at the end of the project. Wishbone considers a WACC of 15% to be appropriate

for this project. What is the NPV of this project? (You can do this by hand or in Excel. If

you do the problem in Excel, print out and attach your spreadsheet. You can find a MACRS

table online.)

Change in Initial

MACRS % Dep Exp CFS Investment

0.3333 19998 25000 tax rate

0.4445 26670 25000 Disc Rate

0.1481 8886 25000

0.0741 4446 25000

Year 0 1 2 3 4

Rev 0 35000 35000 35000 35000

Opex 0 -10000 -10000 -10000 -10000

EBITDA 0 25000 25000 25000 25000

dep 0 19998 26670 8886 4446

EBIT 0 5002 -1670 16114 20554

Net PP&E 60000 79998 106668 115554 120000

change in NWC 5000 0 0 0 -5000

Terminal CF (minus taxes on gain) 0 3000

5

� CAPEX 60000

FCFF -65000 22999.2 25668 18554.4 24778.4

NPV $774.95

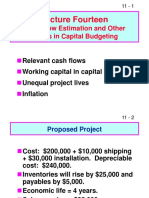

5. Complete the spreadsheet attached. In addition to the assumptions given on the

spreadsheet, assume that there is no change in working capital required, no additional capital

expenditures, and that there is no resale value for the equipment. (Answer parts (a) through

(e), and print out and attach your spreadsheet.)

a. Complete the spreadsheet attached by estimating the project’s annual after-tax cash

flow.

Yes, shown in the spreadsheet

b. What is the investment’s net present value at a discount rate of 10%?

$ 12,923

c. What is the investment’s internal rate of return?

11.0%

d. How does the internal rate of return change if the discount rate equals 20%?

IRR does not change. IRR represents the discount rate that would make a project NPV 0. A

discount rate of 20 would make NPV much smaller but does not change IRR.

e. How does the internal rate of return change if the growth rate in EBIT is 8% instead of

3%?

IRR is larger because the cash flows changed. EBIT grows at a larger rate, so CFs are larger

and thus it will require a larger discount rate to make these large cash flows equal 0 in present

value.

6. A developer offers lots for sale at $60,000, $10,000 to be paid at sale and $10,000 to be

paid at the end of each of the next five years with “no interest to be charged.” In discussing a

possible purchase, you find that you can get the same lot for $48,959 cash. You also find that

on a time purchase there will be a service charge of $2,000 at the date of purchase to cover

legal and handling expenses and the like. Approximately what rate of interest before income

taxes will actually be paid if the lot is purchased on this time payment plan?

6

�11% (work shown in “question 6” tab of excel attatchment)