PowerPoint Slides to Accompany

ESSENTIALS OF BUSINESS AND

ONLINE COMMERCE LAW

1st Edition

by Henry R. Cheeseman

Chapter 14

Negotiable Instruments and

Digital Banking

Slides developed by

Les Wiletzky

Copyright 2006 by Pearson Prentice-Hall. All rights reserved

�Negotiable Instruments (1 of 2)

To qualify as a negotiable instrument

(commercial paper), the document must meet

certain requirements established by Revised

Article 3 (Negotiable Instruments) of the

Uniform Commercial Code (UCC)

Article of the UCC that establishes rules for the creation of,

transfer of, enforcement of, and liability on negotiable

instruments

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 2

�Negotiable Instruments (2 of 2)

If the requirements of Article 3 are met, a

transferee who qualifies as a holder in due

course takes the instrument free of many

defenses that can be asserted against the

original payee

In addition, the document is considered an

ordinary contract that is subject to contract

law

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 3

�Functions of Negotiable Instruments

Negotiable instruments serve the following

functions:

Substitute for money

Credit device

Record-keeping device

Most purchases by businesses and many

individuals are made by negotiable

instruments instead of cash

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 4

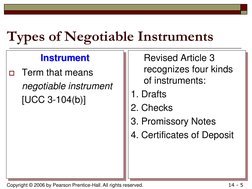

�Types of Negotiable Instruments

Instrument

Term that means

negotiable instrument

[UCC 3-104(b)]

Revised Article 3

recognizes four kinds

of instruments:

1. Drafts

2. Checks

3. Promissory Notes

4. Certificates of Deposit

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 5

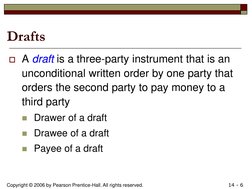

�Drafts

A draft is a three-party instrument that is an

unconditional written order by one party that

orders the second party to pay money to a

third party

Drawer of a draft

Drawee of a draft

Payee of a draft

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 6

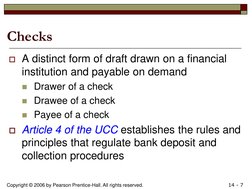

�Checks

A distinct form of draft drawn on a financial

institution and payable on demand

Drawer of a check

Drawee of a check

Payee of a check

Article 4 of the UCC establishes the rules and

principles that regulate bank deposit and

collection procedures

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 7

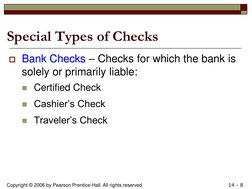

�Special Types of Checks

Bank Checks Checks for which the bank is

solely or primarily liable:

Certified Check

Cashiers Check

Travelers Check

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 8

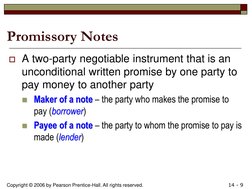

�Promissory Notes

A two-party negotiable instrument that is an

unconditional written promise by one party to

pay money to another party

Maker of a note the party who makes the promise to

pay (borrower)

Payee of a note the party to whom the promise to pay is

made (lender)

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 9

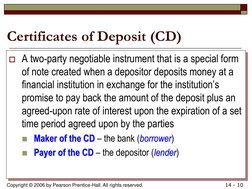

�Certificates of Deposit (CD)

A two-party negotiable instrument that is a special form

of note created when a depositor deposits money at a

financial institution in exchange for the institutions

promise to pay back the amount of the deposit plus an

agreed-upon rate of interest upon the expiration of a set

time period agreed upon by the parties

Maker of the CD the bank (borrower)

Payer of the CD the depositor (lender)

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 10

�Summary: Types of Negotiable

Instruments (1 of 2)

Orders to

Pay

Party

Description of Party

Draft

Drawer

Drawee

Person who issues the draft

Person who owes money to the drawer; person who is ordered

to pay the draft and accepts the draft

Person to whom the draft is made payable

Payee

Check

Drawer

Drawee

Payee

Owner of a checking account at a financial institution; person

who issues the check

Financial institution where drawers checking account is

located; party who is ordered to pay the check

Person to whom the check is made payable

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 11

�Summary: Types of Negotiable

Instruments (2 of 2)

Promises to

Pay

Party

Description of Party

Promissory

Note

Maker

Payee

Party who issues the promissory note; usually the borrower

Party to whom the promissory note is made payable; usually the

lender

Certificate of

Deposit (CD)

Maker

Payee

Financial institution that issues the certificate of deposit

Party to whom the certificate of deposit is made payable;

usually the depositor

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 12

�According to UCC 3-104(a), a negotiable

instrument must:

Be in writing

Be signed by the maker or drawer

Be an unconditional promise or order to pay

State a fixed amount of money

Not require any undertaking in addition to the payment

of money

Be payable on demand or at a definite time

Be payable to order or to bearer

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 13

�Summary: Formal Requirements for a

Negotiable Instrument (1 of 4)

Requirement

Description

Writing

Writing must be permanent and portable. Oral or implied

instruments are nonnegotiable [UCC 3-104(d)].

Signed by maker or drawer Signature must appear on the face of the instrument. It

may be any mark intended by the signer to be his or her

signature. Signature may be by an authorized

representative [UCC 3-104(a)].

Unconditional promise or

order to pay

Instrument must be an unconditional promise or order to

pay [UCC 3-104(a)]. Permissible notations listed in UCC

3-106(a) do not affect instruments negotiability. If

payment is conditional on the performance of another

agreement, the instrument is nonnegotiable.

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 14

�Summary: Formal Requirements for a

Negotiable Instrument (2 of 4)

Requirement

Description

Fixed amount of money

Fixed amount: Amount required to discharge the

instrument must be on the face of the instrument [UCC 3104(a)]. Amount may include payment of interest,

discount, and costs of collection.

Revised Article 3 provides that variable interest rate notes

are negotiable instruments.

In money: Amount must be payable in U.S. or foreign

countrys currency. If payment is to made in goods,

services, or non-monetary items, the instrument is

nonnegotiable [UCC 3-104(a)].

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 15

�Summary: Formal Requirements for a

Negotiable Instrument (3 of 4)

Requirement

Description

Cannot require any

undertaking in addition to

the payment of money

A promise or order to pay cannot state any other

undertaking to do an act in addition to the payment of

money [UCC 3-104(a)(3)]. A promise or order to may

include authorization or power to protect collateral,

dispose of collateral, waive any law intended to protect

the obligee, and the like.

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 16

�Summary: Formal Requirements for a

Negotiable Instrument (4 of 4)

Requirement

Description

Payable on demand or at a Payable on demand: Payable at sight, upon presentation,

definite time

or when no time for payment is stated [UCC 3-108(a)].

Payable at a definite time: Payable at a definite date, or

before a stated date, a fixed period after a stated date, or

at a fixed period after sight [UCC 3-108(b)(c)].

Instrument payable only upon the occurrence of an

uncertain act or event is nonnegotiable.

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 17

�Nonnegotiable Contract

A promise or order to pay that does not meet

the requirements of a negotiable instrument

It is not subject to the provisions of UCC

Article 3

A nonnegotiable contract can be enforced

under normal contract law

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 18

�Transfer by Assignment or Negotiation

Transfer by Assignment

The transfer of rights under

a contract

It transfers the rights of the

transferor (assignor) to the

transferee (assignee)

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

Transfer by Negotiation

The transfer of a negotiable

instrument by a person other

than the issuer

The person to whom the

instrument is transferred

becomes the holder

Negotiating order paper

Negotiating bearer paper

14 - 19

�Indorsement

The signature (and other directions) written

by or on behalf of the holder somewhere on

the instrument

The signature may:

Appear alone

Name an individual to whom the instrument is to

be paid, or

Be accompanied by other words

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 20

�Holder Versus Holder In Due Course

Holder

A person who is in

possession of a

negotiable instrument

that is drawn, issued,

or indorsed to him or

his order, or to bearer,

or in blank

Holder in Due Course

(HDC)

A person who takes a

negotiable instrument

for value, in good faith,

and without notice that

it is defective or is

overdue

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 21

�Requirements for HDC Status

To qualify as an HDC, the transferee must meet the

requirements established by the UCC

The person must be the holder of a negotiable

instrument that was taken:

1. For value

2. In good faith

3. Without notice that it is overdue, dishonored, or encumbered

in any way, and

4. Bearing no apparent evidence of forgery, alterations, or

irregularity [UCC 3-302]

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 22

�Holder in Due Course (HDC)

Maker or

Drawer

Negotiable

Instrument

Payee or

Bearer

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

Negotiable

Instrument

Holder in

Due

Course

(HDC)

1.

Holder

2.

Takes a negotiable

instrument

3.

For value

4.

In good faith

5.

Without notice of

defect

6.

The instrument bears

no apparent evidence

of forgery, alterations,

or irregularity

14 - 23

�Real Defenses

Real Defenses

1. Minority

2. Extreme duress

3. Mental incapacity

4. Illegality

5. Discharge in bankruptcy

6. Fraud in the inception

7. Forgery

8. Material alteration

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

Effect

Real defenses can be raised

against both holders and

holders in due course

14 - 24

�Personal Defenses

Personal Defenses

1. Breach of contract

2. Fraud in the inducement

3. Mental illness that makes a contract

voidable instead of void

4. Illegality of a contract that makes the

contract voidable instead of void

5. Ordinary duress or undue influence

6. Discharge of an instrument by payment

or cancellation

Effect

Personal defenses cannot

be raised against a holder in

due course

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 25

�HDC Status Eliminated with Respect to

Consumer Credit Transactions

The Federal Trade Commission (FTC) has adopted a

rule that eliminates HDC status with regard to

negotiable instruments that arise out of certain

consumer credit transactions

Sellers of goods and services are prevented from

separating the consumers duty to pay the credit and

the sellers duty to perform

Thus, both personal and real defenses can be raised

against an HDC

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 26

�The Bank Customer Relationship

Creditor Debtor Relationship

Created when a customer

deposits money into the bank

The customer is the creditor

and the bank is the debtor

Principal Agent Relationship

Created if the:

deposit is a check that the

bank must collect for the

customer or the

customer writes a check

against his or her account

The customer is the principal

and the bank is the agent

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 27

�The Collection Process

A bank is under duty to accept deposits into a

customers account

This includes collecting checks that are drawn

on other banks and made payable or indorsed

to the depositor

UCC Article 4 regulates the collection process

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 28

�The Check Collection Process

Drawer issues a check

to Payee drawn on

Country Bank

DRAWER

Drawer has a

checking account at

Country Bank

Payee deposits the

check in her account

at Metro Bank

Metro Bank sends

the check to City

Bank for collection

METRO

BANK

PAYEE

(Depository and

collecting bank)

COUNTRY

BANK

(Drawee and

payor bank)

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

CITY

BANK

(Intermediary and

collecting bank)

City Bank sends the

check to Country

Bank for collection

14 - 29

�Electronic Fund Transfer Systems

Electronic fund transfer

systems (EFTS) are

supported by contracts

among and between

customers, banks, private

clearinghouses, and other

third parties

The most common forms of

EFTS are:

1. Automated Teller Machines

(ATM)

2. Point-of-Sale (POS) Terminals

3. Direct Deposits and Withdrawals

4. Paid-by-Internet

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 30

�Wire Transfers (1 of 2)

UCC Article 4A Fund Transfers governs

wholesale wire transfers:

Applies only to commercial electronic fund

transfers

Consumer fund transfers subject to the

Electronic Fund Transfer Act are not subject to

Article 4A

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 31

�Wire Transfers (2 of 2)

UCC Article 4A (continued)

Governs the rights and obligations between

parties to a fund transfer unless they have

entered into a contrary agreement

If a receiving bank mistakenly pays a greater

amount to the beneficiary than ordered, the

originator is liable for only the amount he or she

instructed to be paid

Copyright 2006 by Pearson Prentice-Hall. All rights reserved.

14 - 32