INTERNAL

AUDIT

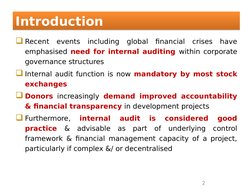

�Introduction

Recent

events including global financial crises have

emphasised need for internal auditing within corporate

governance structures

Internal

audit function is now mandatory by most stock

exchanges

Donors

increasingly demand improved accountability

& financial transparency in development projects

Furthermore,

internal audit is considered good

practice & advisable as part of underlying control

framework & financial management capacity of a project,

particularly if complex &/ or decentralised

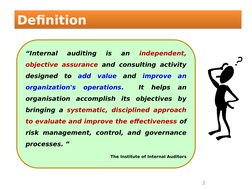

�Definition

Internal

auditing

is

an

independent,

objective assurance and consulting activity

designed to

organization's

add value

and improve

operations.

It

helps

an

an

organisation accomplish its objectives by

bringing a systematic, disciplined approach

to evaluate and improve the effectiveness of

risk management, control, and governance

processes.

The Institute of Internal Auditors

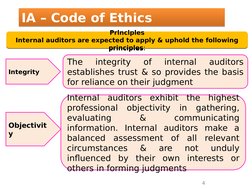

�IA Code of Ethics

Principles

Internal auditors are expected to apply & uphold the following

principles:

Integrity

Objectivit

y

The

integrity

of

internal

auditors

establishes trust & so provides the basis

for reliance on their judgment

Internal auditors exhibit the highest

professional objectivity in gathering,

evaluating

&

communicating

information. Internal auditors make a

balanced assessment of all relevant

circumstances & are not unduly

influenced by their own interests or

others in forming judgments

4

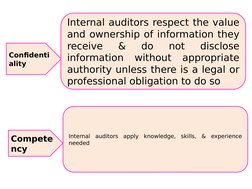

�Confidenti

ality

Compete

ncy

Internal auditors respect the value

and ownership of information they

receive

&

do

not

disclose

information without appropriate

authority unless there is a legal or

professional obligation to do so

Internal auditors apply knowledge, skills, & experience

needed

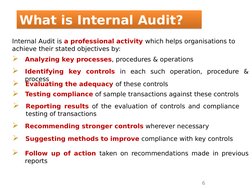

�What is Internal Audit?

Internal Audit is a professional activity which helps organisations to

achieve their stated objectives by:

Analyzing key processes, procedures & operations

Identifying key controls in each such operation, procedure &

process

Evaluating the adequacy of these controls

Testing compliance of sample transactions against these controls

Reporting results of the evaluation of controls and compliance

testing of transactions

Recommending stronger controls wherever necessary

Suggesting methods to improve compliance with key controls

Follow up of action taken on recommendations made in previous

reports

6

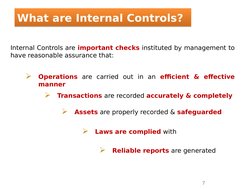

�What are Internal Controls?

Internal Controls are important checks instituted by management to

have reasonable assurance that:

Operations are carried out in an efficient & effective

manner

Transactions are recorded accurately & completely

Assets are properly recorded & safeguarded

Laws are complied with

Reliable reports are generated

�Some examples of Internal Control

Budgetary Control

Budgetary Control

Fixed Assets Register

Fixed Assets Register

Bank & Special Account Reconciliations

Bank & Special Account Reconciliations

Reconciliation of Financial & Physical M & E Reports

Reconciliation of Financial & Physical M & E Reports

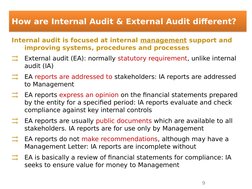

�How are Internal Audit & External Audit different?

Internal audit is focused at internal management support and

improving systems, procedures and processes

External audit (EA): normally statutory requirement, unlike internal

audit (IA)

EA reports are addressed to stakeholders: IA reports are addressed

to Management

EA reports express an opinion on the financial statements prepared

by the entity for a specified period: IA reports evaluate and check

compliance against key internal controls

EA reports are usually public documents which are available to all

stakeholders. IA reports are for use only by Management

EA reports do not make recommendations, although may have a

Management Letter: IA reports are incomplete without

EA is basically a review of financial statements for compliance: IA

seeks to ensure value for money to Management

9

�Benefits of IA

External audit checks overall compliance

controls related to financial transactions.

Supervision Missions conduct only spot checks.

Internal audit is inherent in government structures in most

developing countries.

Sample IA Terms of Reference enclosed

IA has a key role in Risk management of IFAD Projects

to

internal

10

�Internal Audit (IA) Mandate

Compliance & Advisory

roles

What does it do?

Primary role in improving internal control, accuracy,

reliability & integrity of information including financial &

operational reporting

Monitoring & evaluation

management processes

Role in corporate oversight, safeguarding of assets,

economical & efficient use of resources, compliance with

laws & regulations, deterring fraud

of

effectiveness

of

risk

What does it not do?

Perform management activities/ responsibilities (these

include establishing internal controls)

11

�Internal Control Practices

How?

Internal control is a process. It's a means to an

end, not an end in itself

Internal control is effected by people as a team,

not by internal auditor. It's not merely policy

manuals & forms, but people at every level of an

organization

Internal control can be expected to provide only

reasonable assurance, not absolute assurance,

to an entity's management and governing bodies/

committees

Uses systematic methodology for analysing

business processes, procedures & activities

The cost of IA should not exceed expected

benefits to be derived

12

�Role in Internal Control

1. Compliance audit: review of financial & operating

controls & transactions for conformity with laws,

regulations & procedures, e.g.,

.

.

.

.

.

.

Access to IT system appropriate to users role

Segregation of duties in high risk areas

Balancing & reconciliation between systems

Systems back up & recovery

Physical safeguard & access restriction controls

Reconciliations, comparison budget of actual

2. Operational audit: review of various functions within

project to evaluate efficiency, effectiveness, & economy

13

�IA Role in Corporate Oversight

Four pillars internal audit, executive management, external

audit, & Board of directors/ steering committee

Combination of processes & organisational structures

implemented by management to inform, direct, manage and

monitor the projects resources, strategies & policies towards the

achievement of its objectives

Public sector governance Principles

- transparency, integrity, accountability

May include review of sufficiency of human resources,

training needs, policies, etc.

14

�Nature of Internal Audit Activity

Establish scope & activities for audit to Management

Identify control procedures used to ensure each key risk is

properly controlled & monitored

Develop & execute risk based sampling & testing approach

to determine whether most important controls are operating as

intended (NB: input from Management required e.g. 100%

sampling of WA review)

Report issues/make recommendations/negotiate action

plans with Management to address issues

Follow up on reported findings periodically

Describe key risks facing the business activities within scope of

audit

15

�Contents of Audit Plan

Updated annually

Risk based audit plan developed with input from project

staff including Management

Summary of key goals, risks & corresponding major audits, to

illustrate alignment

Based on risk assessment & available resources

Appendix materials, such as planning approach, assumptions &

brief descriptions of all planned audits & related prioritization

Approved by management/ appropriate oversight Committee

16

�Contents of Audit Report

Observations

Narration/ description

Remedial action

Consequences/ fall out

Recommendation for improvement (prioritized

between high and normal)

Response (action plan) who, when and how

17

�IAs Proactive Role

Identify Risks

Find Better Ways and Best Practices

Partner With Management to Find Solutions

Prevent Problems

Provide training

Respond to policy & technical accounting questions

Offer suggestions for improvement

Advisory role

18

�The Audit Schedule

Prepare an audit schedule. Each area

must be audited at least one a year,

but for an effective program plan on

auditing each area at least twice.

�Audit Steps

Internal audit steps:

Create audit schedule

Complete audit plan

Hold opening meeting

Conduct audit

Document Findings

Prepare audit report

Hold closing meeting

Prepare audit file

Follow up

�Performing the Audit

After the opening meeting you will

start your audit.

Using your checklists and procedures as

references, go out to observe the process

and talk to people in the department

You are looking for evidence that the

Company Safety Management System is

working effectively

An effective audit will depend on your ability

to put people at ease and encourage open

honest communication

�Key Auditor Attributes

Communication skills

Tactful

Ability to listen

Reword questions when needed

Use local terminology

Objective

Flexible

Persistent

Curious

�Techniques

The auditee may be stressed

Smile, relax

Point out good things that you see

Summarize with Everything looks

good here when you can

As the auditor, you are creating the

audit culture for your organization

�Techniques

Use open ended questions, they

provide more information. Ask

What

Where

Why

Who

When

Ask for clarification or more

information if you do not understand.

�Techniques

Keep people informed of what you

are finding

Point out nonconformances as you go

Make sure the auditee understands

what you see as the nonconformance

There should not be surprises at the

closing meeting when you present

your findings

�Performing the Audit

As an auditor you will:

Check documents and records

Ask questions

Observe processes and compare them

with documented procedures and work

instructions

Investigate any differences

Follow audit trails, be curious

Take good notes

�Performing the Audit

Throughout the audit, you will take

detailed notes on what you find.

Be specific on what is reviewed and what is

found

The information you write down will be used to

identify nonconformance and to assist the

department in finding and understanding what

you observed

�Documenting the Audit

Once you complete your audit, you will

prepare an audit report.

The report will also include:

General information

Documents reviewed

Persons interviewed

General summary and assessment of

how the system is performing

�Documenting the Audit

When

your

documentation

is

complete you will be ready to hold

your closing meeting. The lead

auditor will lead the meeting.

Thank the group for their cooperation

Remind them that this is an evaluation

of the processes not the people

�The Closing Meeting

Summarize the findings

Highlight areas that are working well

Review each of the nonconformances, allow

questions and discuss the finding to make sure that

the group understands the non conformances

Discuss any corrective actions that you followed up

on that were not found to be effective

Have the group sign the audit report as a record of

attendance

Give a copy of the table of nonconformances to the

area management

�The Audit File

Final audit file includes:

Audit plan

Audit checklists

Audit report