100% found this document useful (1 vote)

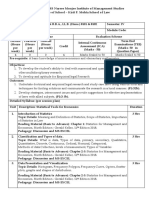

176 views20 pagesSWOT Analysis of Infosys 2023

Infosys is India's second largest IT company based on revenues. It generates over 80% of its revenues from exports and only 20% from domestic business. While it has strengths like low costs, skilled workforce, and global delivery capabilities, it also has weaknesses such as over-dependence on the US and banking sectors for revenues. Opportunities for Infosys include increasing focus on high-value services, while threats include the global economic slowdown reducing IT spending and rising salaries diminishing its cost advantage.

Uploaded by

Ashutosh Kumar DubeyCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

176 views20 pagesSWOT Analysis of Infosys 2023

Infosys is India's second largest IT company based on revenues. It generates over 80% of its revenues from exports and only 20% from domestic business. While it has strengths like low costs, skilled workforce, and global delivery capabilities, it also has weaknesses such as over-dependence on the US and banking sectors for revenues. Opportunities for Infosys include increasing focus on high-value services, while threats include the global economic slowdown reducing IT spending and rising salaries diminishing its cost advantage.

Uploaded by

Ashutosh Kumar DubeyCopyright

© Attribution Non-Commercial (BY-NC)

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd