0% found this document useful (0 votes)

404 views2 pagesNet Operating Income Approach (Noi) : Meaning Assumptions

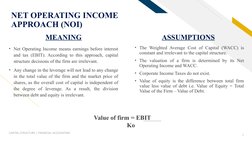

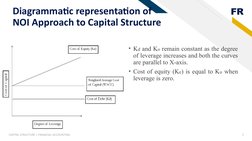

The Net Operating Income (NOI) approach assumes that a firm's capital structure decisions do not impact its total value. It assumes the weighted average cost of capital (WACC) is constant regardless of capital structure. The value of the firm is determined solely by its net operating income and WACC. Changes in leverage will not change the total firm value or share price as the overall cost of capital is independent of leverage. The division of debt and equity is considered irrelevant under this approach.

Uploaded by

Rahul punjabiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

404 views2 pagesNet Operating Income Approach (Noi) : Meaning Assumptions

The Net Operating Income (NOI) approach assumes that a firm's capital structure decisions do not impact its total value. It assumes the weighted average cost of capital (WACC) is constant regardless of capital structure. The value of the firm is determined solely by its net operating income and WACC. Changes in leverage will not change the total firm value or share price as the overall cost of capital is independent of leverage. The division of debt and equity is considered irrelevant under this approach.

Uploaded by

Rahul punjabiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

- Net Operating Income Approach (NOI): Explains the Net Operating Income approach including its implications and underlying assumptions in capital structure decisions.