0% found this document useful (0 votes)

356 views22 pagesGAM Inventory Presentation

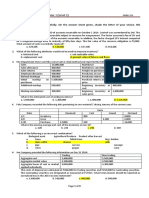

This document discusses inventory management for government agencies. It defines different types of inventories and how they are classified. Inventories are initially measured at cost and subsequently at the lower of cost or net realizable value. The document outlines inventory procedures for requisition, receipt, issuance, and disposal. It also provides examples of accounting entries and disclosure requirements for inventories. Physical counts are conducted annually and losses are recognized as expenses.

Uploaded by

Robert CastilloCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

356 views22 pagesGAM Inventory Presentation

This document discusses inventory management for government agencies. It defines different types of inventories and how they are classified. Inventories are initially measured at cost and subsequently at the lower of cost or net realizable value. The document outlines inventory procedures for requisition, receipt, issuance, and disposal. It also provides examples of accounting entries and disclosure requirements for inventories. Physical counts are conducted annually and losses are recognized as expenses.

Uploaded by

Robert CastilloCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd