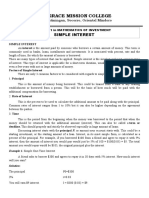

SIMPLE INTEREST

OBJECTIVES:

DEFINE SIMPLE INTEREST

COMPUTE INTEREST AND MATURITY VALUE

�SIMPLE INTEREST

It is a charge only on the loan amount called

the principal. Thus, interest on the interest

previously earned is not included. Simple

interest is calculated by multiplying the

principal by the rate of interest by the number

of payment periods in a year.

�SIMPLE INTEREST

It is also an amount equal to P x R x T, where P is the principal, R is the annual simple

interest rate and T is time interval in a years or terms.

I = PRT, a) P= b) R= c) T=

I – Interest is the amount paid for the use of another amount of money, called the principal

amount or simply principal.

P – Principal is the base in which interest is computed. If an amount is loaned or

borrowed, this amount is referred to as principal.

T – Term is the unit of time for which the principal is loaned, or the length of time the

principal is borrowed.

R – Rate is the multiplier expressed as percent of the principal to be paid each term.

�Example:

1. Teresa borrowed $120,000.00 from her uncle. If Teresa

agreed to pay an 8% interest rate, calculate the amount

of interest she needs to pay if the loan period is

a.) 1 year

b.) 9 months

c.) 18 months

�Example

To buy the school supplies for the coming school year, you get a summer job at a

resort. Suppose you save $4,200.00 of your salary and deposit it into an account that

earns simple interest. After 9 months, the balance is $4,263.00. What is the interest

rate?

MATURITY VALUE

It is the sum of the principal and the interest that accumulates over the agreed

term.

A = P + I or A = P + PRT or A = P ( 1 + RT)

Where: A = Maturity Value, P = Principal and I = Interest

�Example

1. If $10,000.00 is invested at 4.5% simple interest, how long will it take to

grow to $11,800.00

PRESENT VALUE

The present value P at a simple interest rate R of a given amount A for a

given term T can be determined by the formula

P=

�Example

1. Find the present value of $86,000.00 at 8% simple interest for 3

years

2. Find the present value of the following at the given simple

interest rate

a) $1,000.00 after 2 years at 3$ interest

b) $2,500.00 after 5years at 1.5% interest

c) $10,000.00 after 10 years at 5% interest

� Instead of terms stated in months or years., short –term bank loans have terms

stated in days. To count the number of days, one way is to look at a regular

calendar and start counting

The day after the date of the loan is day 1, and so on. This method is called

the “days-in-month”. The other way is to use a day-of-the-year calendar.

Example:

Find

a.) 90 days from September 8,2014

b.) the number of days between February 8,2015 and October 8,2015

�Ordinary Interest or Banker’s Interest

interest based on a 360-day year

Exact Interest

interest based on a 365-day year

Example:

You get a 180-day P200,000.00 loan from a bank at a 10.5% interest. Calculate

interest using

a.) Ordinary Interest

b.) Exact Interest

�Seatwork:

I

1. Find the amount of simple interest for the following

a.) P2,500.00 at 3.5% annual simple interest rate after 2 years

b.) P5,300.00 at 2% annual simple interest rate for 3.5 years

c.) P10,000.00 at 4% annual simple interest rate for 6 months.

2. Jose deposited P1,000.00 today in bank providing 3% simple interest per year. He wants to have

savings worth P1,450.00 in the future. If he will not withdraw any amount, how long must he wait?

3. Mrs. Reyes currently has P25,000.00 in an amount providing 3% simple interest per year. She

wishes to have P50,000.00 in 3 years but she noticed that her savings are not enough to accumulate

that amount. How much additional money must she deposit now in order to achieve her goal?

�II. Answer each of the following

1. Find:

a.) 50 days from March 11, 2014 b.) 150 days from December 7,2016

c.) 200 days from April 20, 2015

2. Find the number of days between each set of dates:

a.) June 12 to September 27 b.) August 8 to December 13

c.) January 10,2012 to May 11, 2012

3. Find the ordinary and exact interest on P10,800.00 for 5 days at 8% simple interest.

4. Find the amount due if P120,000.00 was invested at 10% for 160 days using:

a.) ordinary interest b.) Exact Interest

�• 1. Find the simple interest and amount in each of the following

(a) P = $1800 R = 5% T = 1 year

• (b) P = $2600 R = 12% T = 3 years

• (c) P = $3125 R = 15% T = 73 days

• (d) P = $5660 R = 11% T = 9 months

• (e) P = $180 R = 3% T = 1¹/₄ year

2. What sum would yield an interest of $36 in 3 years at 3% p.a.?

3. At what rate per cent per annum will $250 amount to $330 in 4 years?

4. At what rate per cent per annum will $400 yield an interest of $78 in 1¹/₂ years ?

5. In what time will $400 amount to $512 if the simple interest is the calculated at

14% p.a.?