0% found this document useful (0 votes)

238 views32 pagesModule III - Methods & Instruments of Payment

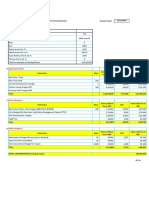

This document discusses methods of payment and financing for international trade. It outlines five primary methods of payment from most to least secure: cash in advance, letter of credit, documentary collection, open account, and consignment. It also describes pre-shipment and post-shipment financing, the forms they take, eligible beneficiaries, and periods of credit extension. Uniform rules like UCP 600 and eUCP are meant to standardize practices and facilitate digital trade documentation.

Uploaded by

Manushree PatankarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

238 views32 pagesModule III - Methods & Instruments of Payment

This document discusses methods of payment and financing for international trade. It outlines five primary methods of payment from most to least secure: cash in advance, letter of credit, documentary collection, open account, and consignment. It also describes pre-shipment and post-shipment financing, the forms they take, eligible beneficiaries, and periods of credit extension. Uniform rules like UCP 600 and eUCP are meant to standardize practices and facilitate digital trade documentation.

Uploaded by

Manushree PatankarCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd