0% found this document useful (1 vote)

1K views21 pages2 - Formation of Insurance Contract

The document discusses the basics of insurance contracts, including:

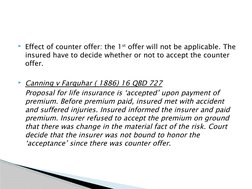

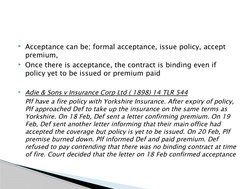

- Insurance contracts must follow the basic principles of contract law, including offer and acceptance, capacity of parties, intention, and consideration.

- A cover note provides temporary coverage before a formal policy is issued, and incorporates the terms of the insurer's usual policy through an inclusion clause.

- The policy itself contains important details of the insurance agreement such as coverage details, premium, exclusions, conditions, and claims process. It represents the formal agreement between insurer and insured.

Uploaded by

chong huisinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (1 vote)

1K views21 pages2 - Formation of Insurance Contract

The document discusses the basics of insurance contracts, including:

- Insurance contracts must follow the basic principles of contract law, including offer and acceptance, capacity of parties, intention, and consideration.

- A cover note provides temporary coverage before a formal policy is issued, and incorporates the terms of the insurer's usual policy through an inclusion clause.

- The policy itself contains important details of the insurance agreement such as coverage details, premium, exclusions, conditions, and claims process. It represents the formal agreement between insurer and insured.

Uploaded by

chong huisinCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

- Cover: The cover page of the document with an image representing insurance policy documentation.

- Introduction: Introduces the basic principles of insurance contracts and outlines the main topics covered.

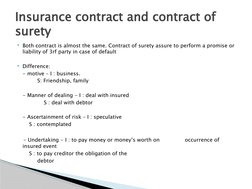

- Insurance Contract: Describes what constitutes an insurance contract and the necessity of determining its enforceability.

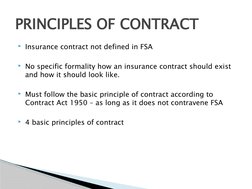

- Principles of Contract: Outlines the principles that must be followed in insurance contracts, as defined by contract law.

- Proposal Form: Discusses the role and importance of proposal forms in insurance, serving as the basis of the insurance agreement.

- Cover Notes: Explains what cover notes are, their purpose, and the validity of such notes in insurance agreements.

- Policy: Provides information on insurance policy content including terms, conditions, and risk coverage details.

- Commencement of Coverage: Details when coverage typically begins in insurance contracts and any conditions that may affect this.

- Cooling Off Period: Describes the period available to insured parties to cancel their policy and return to pre-contract conditions.