0% found this document useful (0 votes)

281 views13 pagesCH 08 Clearing House System

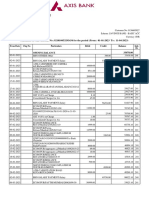

The document describes the clearing house system between 4 banks - Sonali, Rupali, Janata, and Agrani. Each bank prepares clearing statements showing the credits and debits from transactions with other banks. At the end of the day, a net clearing statement is prepared showing the net balance for each bank after factoring in all interbank transactions. The clearing house, facilitated by the central bank, acts as an intermediary to settle the net credit or debit balances between the banks on a daily basis.

Uploaded by

Moshhiur RahmanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

281 views13 pagesCH 08 Clearing House System

The document describes the clearing house system between 4 banks - Sonali, Rupali, Janata, and Agrani. Each bank prepares clearing statements showing the credits and debits from transactions with other banks. At the end of the day, a net clearing statement is prepared showing the net balance for each bank after factoring in all interbank transactions. The clearing house, facilitated by the central bank, acts as an intermediary to settle the net credit or debit balances between the banks on a daily basis.

Uploaded by

Moshhiur RahmanCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPT, PDF, TXT or read online on Scribd