0% found this document useful (0 votes)

317 views12 pagesCash Collection

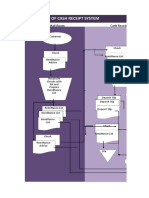

This document discusses cash collection processes in accounting. It defines cash collection as activities involved in collecting cash payments from customers for goods and services. It lists key input documents like invoices, remittance advices, and bank deposit slips. It also lists output documents including cash receipts journals, accounts receivable aging reports, bank reconciliation statements, collection letters, and cash flow statements. Each document type is then defined in more detail outlining their important attributes.

Uploaded by

Roy LobriguitoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

317 views12 pagesCash Collection

This document discusses cash collection processes in accounting. It defines cash collection as activities involved in collecting cash payments from customers for goods and services. It lists key input documents like invoices, remittance advices, and bank deposit slips. It also lists output documents including cash receipts journals, accounts receivable aging reports, bank reconciliation statements, collection letters, and cash flow statements. Each document type is then defined in more detail outlining their important attributes.

Uploaded by

Roy LobriguitoCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PPTX, PDF, TXT or read online on Scribd