Professional Documents

Culture Documents

Property Tax 2012

Uploaded by

The Salt Lake TribuneOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Tax 2012

Uploaded by

The Salt Lake TribuneCopyright:

Available Formats

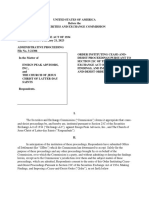

Proposed property tax hikes, 2012

27 local governments in Utah are proposing property tax hikes this year.

They will hold Truth in Taxation hearings on the proposals in August.

Entity

SALT LAKE VALLEY LAW ENFORCEMENT

SERVICE AREA (New tax)

MANILA TOWN

HARRISVILLE CITY

SALT LAKE SUBURBAN SANITARY DISTRICT #1

UINTAH CITY

HIGHLAND CITY

SUMMIT CO. MUNICIPAL TYPE SERVICE AREA

OREM CITY

MANTUA TOWN

SUMMIT COUNTY SERVICE AREA #6

KAMAS CITY

WEST JORDAN CITY

TAYLORSVILLE CITY

HURRICANE CITY

OQUIRRH RECREATION AND PARKS DISTRICT

TOOELE COUNTY SCHOOL DISTRICT

PARK CITY SCHOOL DISTRICT

GRAND COUNTY SCHOOL DISTRICT

MONTICELLO CITY

ELWOOD TOWN

CARBON COUNTY SCHOOL DISTRICT

MORGAN COUNTY SCHOOL DISTRICT

SALT LAKE CITY

BEAVER COUNTY SCHOOL DISTRICT

DAGGETT COUNTY SCHOOL DISTRICT

LOGAN CITY SCHOOL DISTRICT

WEST VALLEY CITY

Taxes without

proposed

increase

$0.00

$73.92

$81.18

$22.66

$80.85

$220.55

$51.92

$211.31

$282.15

$54.78

$178.75

$254.65

$211.53

$299.53

$128.26

$1,012.44

$497.20

$632.50

$276.98

$135.85

$747.12

$849.42

$606.87

$735.13

$484.22

$904.09

$532.07

Source: Salt Lake Tribune analysis of Utah State Tax Commission data.

Tax, if

increase is

approved

$219.89

$161.92

$164.67

$43.01

$142.34

$348.37

$78.76

$318.12

$387.09

$66.55

$211.75

$294.14

$242.22

$342.21

$146.19

$1,104.95

$541.64

$685.41

$295.13

$140.03

$764.06

$864.38

$614.79

$743.38

$488.73

$911.35

$534.27

Amount of

increase

$219.89

$88.00

$83.49

$20.35

$61.49

$127.82

$26.84

$106.81

$104.94

$11.77

$33.00

$39.49

$30.69

$42.68

$17.93

$92.51

$44.44

$52.91

$18.15

$4.18

$16.94

$14.96

$7.92

$8.25

$4.51

$7.26

$2.20

Percent

difference

N/A

119.0%

102.8%

89.8%

76.1%

58.0%

51.7%

50.5%

37.2%

21.5%

18.5%

15.5%

14.5%

14.2%

14.0%

9.1%

8.9%

8.4%

6.6%

3.1%

2.3%

1.8%

1.3%

1.1%

0.9%

0.8%

0.4%

You might also like

- Richter Et Al 2024 CRB Water BudgetDocument12 pagesRichter Et Al 2024 CRB Water BudgetThe Salt Lake Tribune100% (4)

- NetChoice V Reyes Official ComplaintDocument58 pagesNetChoice V Reyes Official ComplaintThe Salt Lake TribuneNo ratings yet

- Salt Lake City Council Text MessagesDocument25 pagesSalt Lake City Council Text MessagesThe Salt Lake TribuneNo ratings yet

- U.S. Army Corps of Engineers LetterDocument3 pagesU.S. Army Corps of Engineers LetterThe Salt Lake TribuneNo ratings yet

- Upper Basin Alternative, March 2024Document5 pagesUpper Basin Alternative, March 2024The Salt Lake TribuneNo ratings yet

- Spectrum Academy Reform AgreementDocument10 pagesSpectrum Academy Reform AgreementThe Salt Lake TribuneNo ratings yet

- The Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseDocument66 pagesThe Church of Jesus Christ of Latter-Day Saints Petition For Rehearing in James Huntsman's Fraud CaseThe Salt Lake TribuneNo ratings yet

- Gov. Cox Declares Day of Prayer and ThanksgivingDocument1 pageGov. Cox Declares Day of Prayer and ThanksgivingThe Salt Lake TribuneNo ratings yet

- Unlawful Detainer ComplaintDocument81 pagesUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- Park City ComplaintDocument18 pagesPark City ComplaintThe Salt Lake TribuneNo ratings yet

- Settlement Agreement Deseret Power Water RightsDocument9 pagesSettlement Agreement Deseret Power Water RightsThe Salt Lake TribuneNo ratings yet

- Opinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchDocument41 pagesOpinion Issued 8-Aug-23 by 9th Circuit Court of Appeals in James Huntsman v. LDS ChurchThe Salt Lake Tribune100% (2)

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- HB 499 Utah County COG LetterDocument1 pageHB 499 Utah County COG LetterThe Salt Lake TribuneNo ratings yet

- Employment Contract - Liz Grant July 2023 To June 2025 SignedDocument7 pagesEmployment Contract - Liz Grant July 2023 To June 2025 SignedThe Salt Lake TribuneNo ratings yet

- Superintendent ContractsDocument21 pagesSuperintendent ContractsThe Salt Lake TribuneNo ratings yet

- Teena Horlacher LienDocument3 pagesTeena Horlacher LienThe Salt Lake TribuneNo ratings yet

- Wasatch IT-Jazz ContractDocument11 pagesWasatch IT-Jazz ContractThe Salt Lake TribuneNo ratings yet

- Goodly-Jazz ContractDocument7 pagesGoodly-Jazz ContractThe Salt Lake TribuneNo ratings yet

- 2023.03.28 Emery County GOP Censure ProposalDocument1 page2023.03.28 Emery County GOP Censure ProposalThe Salt Lake TribuneNo ratings yet

- SEC Cease-And-Desist OrderDocument9 pagesSEC Cease-And-Desist OrderThe Salt Lake Tribune100% (1)

- David Nielsen - Memo To US Senate Finance Committee, 01-31-23Document90 pagesDavid Nielsen - Memo To US Senate Finance Committee, 01-31-23The Salt Lake Tribune100% (1)

- PLPCO Letter Supporting US MagDocument3 pagesPLPCO Letter Supporting US MagThe Salt Lake TribuneNo ratings yet

- Proc 2022-01 FinalDocument2 pagesProc 2022-01 FinalThe Salt Lake TribuneNo ratings yet

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- Final Signed Republican Governance Group Leadership LetterDocument3 pagesFinal Signed Republican Governance Group Leadership LetterThe Salt Lake TribuneNo ratings yet

- US Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022Document5 pagesUS Magnesium Canal Continuation SPK-2008-01773 Comments 9SEPT2022The Salt Lake TribuneNo ratings yet

- Redistricting LawsuitDocument2 pagesRedistricting LawsuitThe Salt Lake TribuneNo ratings yet

- Utah Senators Encourage Gov. DeSantis To Run For U.S. PresidentDocument3 pagesUtah Senators Encourage Gov. DeSantis To Run For U.S. PresidentThe Salt Lake TribuneNo ratings yet

- Ruling On Motion To Dismiss Utah Gerrymandering LawsuitDocument61 pagesRuling On Motion To Dismiss Utah Gerrymandering LawsuitThe Salt Lake TribuneNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)