Professional Documents

Culture Documents

2009 - 04 - 16 - Column

Uploaded by

Councillor Marianne WilkinsonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2009 - 04 - 16 - Column

Uploaded by

Councillor Marianne WilkinsonCopyright:

Available Formats

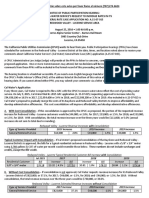

KANATA NORTH NEWS Marianne Wilkinson Councillor, Kanata North 2009 PROPERTY TAXES

Determining the property taxes paid is a complex matter, only partially dependent on the city budget. These include which of the 15 classes of property your property falls within, various mitigation measures to help low income seniors, disabled persons and farm properties, the tax ratio for each class of property, provincial regulations which reduce the taxes paid by commercial properties to 50% of any budgetary increase, your new property assessment, school taxes payable, and capping provisions such as having only 25% of any increase in your property assessment apply this year. Council approved a budget for this year that had a 4.9% average tax increase. This will now be decreased because of a number of factors. First, since the increase in property values in Ottawa was at a lower per cent than the provincial average, the education taxes you pay will be reduced. Also, since the value of commercial properties increased more than residential values there would have been a shift to those properties but under provincial policy only 50% of any tax increase can be passed on to commercial properties, meaning that a greater share has to be borne by residential properties. However, due to the drop in educational taxes and taking into account all of the other measures required the increase this year will be 4.1% in urban areas (average property assessed at 285,000 paying $3,580) and 4.6 % for rural properties ($3,036 for a $285,000 home). The higher % increase in rural areas is because the urban transit levy is not increasing this year, resulting in a lower % overall increase. Between 1993 and 2009 property tax increases were much lower than the cost of living or other increases. During that time the average Ottawa house value increased by 90.5%, the consumer price index increased 37%, federal pensions increased 35% and property taxes increased 24% (in Kanata the increase was 23.6%). For your own property this year, the change in taxes will be influenced by the change in your market value assessment. If your property increase is below 13% you will have a decrease in taxes. If your assessment grew by more than 13% taxes will increase, phased in over 4 years.

CARP RIVER

The Third Party Review of the Carp River Restoration Plan was released last week and has been posted on the City website at ottawa.ca/carpriver. If you

wish to comment on the review you can send them to carp.review@ottawa.ca by 9 am on Monday, Apr. 20 and your comments will be considered in the report that will be tabled at the Planning and Environment Committee in May. You can also make representations at that meeting. After approval by Council, the environmental assessments impacted by this review will be posted for 30 days during which representation can be made to the Ministry of the Environment, following which the Minister will make appropriate approvals. The review concluded that the hydrologic and hydraulic models that were prepared throughout stages of the planning process, as corrected when an initial error was discovered, are suitable for use in development in Kanata West. The report outlines an interim implementation strategy involving providing for an additional volume of 85,600 cubic metres of water storage spreads among all development lands. Of the 22 separate environmental assessments that form part of three concurrent and integrated Class Environmental Assessments, 15 are still valid, while 7 will need to have the 30 day posting and some adjustments. I am pleased that this very comprehensive review has shown that there are no significant problems with the Carp River restoration. As well as the consultants report staff will provide information on the impact of climate change in the report to Committee in order to fulfill all of the requirements of the Provincial Minister of the Environment.

MARK YOUR CALENDAR

April 15 - May 15 Cleaning the Capital. Sign up now. April 18 9 am, Big cookie sale, St. Johns, 325 Sandhill (including my donation!) April 18 10 am 5 pm, Eco-Stewardship Fair, RA Centre April 20 6 pm, Public Library Board meets at the Mlacak Centre April 25 9 am - noon, Electronics Recycling Depot, Waste Management April 25 Annual Briarbrook & Morgans Grant Clean Up Day April 27 7 - 9 pm, Kanata North Ward Council May 2 9:30 am, Annual Beaverbrook Clean Up Day with BBQ, Kids Crafts May 30 8 am noon, Beaverbrook & Morgans Grant Yard Sale

Serving the residents and businesses in Kanata North

To receive the Kanata North Newsletter, to deal with a concern or make a suggestion contact me at 613-580-2474, email Marianne.Wilkinson@ottawa.ca or through www.mariannewilkinson.com.

You might also like

- U.S. Climate Policy: Change of Power = Change of Heart - New Presidential Order vs. Laws & Actions of the Former President: A Review of the New Presidential Orders as Opposed to the Legacy of the Former PresidentFrom EverandU.S. Climate Policy: Change of Power = Change of Heart - New Presidential Order vs. Laws & Actions of the Former President: A Review of the New Presidential Orders as Opposed to the Legacy of the Former PresidentNo ratings yet

- 2008 - 09 - 12 - ColumnDocument2 pages2008 - 09 - 12 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Kitsap County Assesment Book, 2016Document38 pagesKitsap County Assesment Book, 2016Chris HenryNo ratings yet

- 2008 - 07 - 04 - ColumnDocument2 pages2008 - 07 - 04 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- FY 2015-2016 Budget Message - FranklinDocument4 pagesFY 2015-2016 Budget Message - FranklinThunder PigNo ratings yet

- 2007 - 12 - 21 - ColumnDocument2 pages2007 - 12 - 21 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- The Price Is RightDocument4 pagesThe Price Is RightrazorbrailleNo ratings yet

- PRR 8999 Ordinance 11820 C.M.S 2004 City Fees Amendment Staff Report PDFDocument9 pagesPRR 8999 Ordinance 11820 C.M.S 2004 City Fees Amendment Staff Report PDFRecordTrac - City of OaklandNo ratings yet

- Fiscal Sustainability Analysis: Nassau CountyDocument22 pagesFiscal Sustainability Analysis: Nassau Countyapi-298511181No ratings yet

- LINN 2013 BudgetDocument18 pagesLINN 2013 Budgetsteve_gravelleNo ratings yet

- Revenue Hearing 2016 BudgetDocument34 pagesRevenue Hearing 2016 BudgetSpokane City CouncilNo ratings yet

- 2012-10-18 - ColumnDocument2 pages2012-10-18 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Calcca q2 2018 PDF 2 2Document8 pagesCalcca q2 2018 PDF 2 2Rob NikolewskiNo ratings yet

- Energyforum Climate Leadership Plan LetterDocument3 pagesEnergyforum Climate Leadership Plan LetterCKNW980No ratings yet

- 2009 - 03 - 06 - ColumnDocument2 pages2009 - 03 - 06 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Web Pearland 2016 Annualreport CalendarDocument32 pagesWeb Pearland 2016 Annualreport Calendarapi-306549584No ratings yet

- 2007 - 05 - 25 - ColumnDocument3 pages2007 - 05 - 25 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Lower Athabasca Regional Plan: Implementation Progress Report For 2020 and 2021Document24 pagesLower Athabasca Regional Plan: Implementation Progress Report For 2020 and 2021abdulloh aqilNo ratings yet

- County Executive Marc Elrich's Budget Message For FY21Document10 pagesCounty Executive Marc Elrich's Budget Message For FY21David LublinNo ratings yet

- LTEP Northern ChambersDocument1 pageLTEP Northern ChambersTyler McLeanNo ratings yet

- BudgetMessage2008 09Document8 pagesBudgetMessage2008 09Thunder PigNo ratings yet

- Corbett Marcellus AnnouncementDocument4 pagesCorbett Marcellus AnnouncementPoliticsPANo ratings yet

- Semi AnnualDocument24 pagesSemi AnnualM-NCPPCNo ratings yet

- 2007 - 02 - 16 - ColumnDocument2 pages2007 - 02 - 16 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Vote No PresentationDocument29 pagesVote No PresentationKen GieseNo ratings yet

- Pocketbook Items of The Three PartiesDocument1 pagePocketbook Items of The Three PartiesThe London Free PressNo ratings yet

- LIPA Proposed Budget 2010Document47 pagesLIPA Proposed Budget 2010Long Island Business NewsNo ratings yet

- 2016 Financial Plan Presentation Feb 18 PDFDocument60 pages2016 Financial Plan Presentation Feb 18 PDFreporter4No ratings yet

- 2011-11-03 - ColumnDocument3 pages2011-11-03 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- Open LetterDocument1 pageOpen LetterTeamWildrose100% (1)

- Road RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportDocument20 pagesRoad RA Case For Increasing Provincial Fuel Taxes (On A Temporary Basis) EportCityNewsTorontoNo ratings yet

- California Public Utilities Commission Lucerne Meeting NoticeDocument3 pagesCalifornia Public Utilities Commission Lucerne Meeting NoticeLakeCoNewsNo ratings yet

- 2017 Comprehensive Energy Strategy: Executive SummaryDocument15 pages2017 Comprehensive Energy Strategy: Executive SummaryHelen BennettNo ratings yet

- Jindal FY16 Proposed BudgetDocument48 pagesJindal FY16 Proposed BudgetRepNLandryNo ratings yet

- Carbon Tax Research PapersDocument7 pagesCarbon Tax Research Paperswrglrkrhf100% (1)

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Document45 pagesBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationNo ratings yet

- Dawson Creek 2016 Draft Financial PlanDocument151 pagesDawson Creek 2016 Draft Financial PlanJonny WakefieldNo ratings yet

- 2007 - 02 - 09 - ColumnDocument2 pages2007 - 02 - 09 - ColumnCouncillor Marianne WilkinsonNo ratings yet

- 2014-15 Budget Highlights PDFDocument4 pages2014-15 Budget Highlights PDFilyasNo ratings yet

- Reg Doc 6Document7 pagesReg Doc 6langleyrecord8339No ratings yet

- Ontario Municipalites Energy Audit ProgramDocument8 pagesOntario Municipalites Energy Audit ProgramMarcelo Germán VegaNo ratings yet

- Shallotte Water RatesDocument1 pageShallotte Water RatesCarole WirszylaNo ratings yet

- Prime Minister Treasurer Minister For Climate Change: Australia To Move To A Floating Price On Carbon Pollution in 2014Document3 pagesPrime Minister Treasurer Minister For Climate Change: Australia To Move To A Floating Price On Carbon Pollution in 2014Political AlertNo ratings yet

- Ecology Ottawa, P.O. Box 52002, 298 Dalhousie Street, Ottawa, ON K1N 1S0 613.860.5353 Info@ecologyottawa - Ca WWW - Ecologyottawa.caDocument3 pagesEcology Ottawa, P.O. Box 52002, 298 Dalhousie Street, Ottawa, ON K1N 1S0 613.860.5353 Info@ecologyottawa - Ca WWW - Ecologyottawa.caEcologyOttawaNo ratings yet

- For Immediate Release - Wake County Budget Unsustainable, 6-3-18Document3 pagesFor Immediate Release - Wake County Budget Unsustainable, 6-3-18WakeCitizensNo ratings yet

- Allan Sutherland - Moreton Living - July 2010Document8 pagesAllan Sutherland - Moreton Living - July 2010mayorsutherlandNo ratings yet

- PRR 11279 Sewer Service Charge Rate PDFDocument1 pagePRR 11279 Sewer Service Charge Rate PDFRecordTrac - City of OaklandNo ratings yet

- Atglen December 2011 NewsletterDocument3 pagesAtglen December 2011 NewsletterKen KnickerbockerNo ratings yet

- 1 Budget OverviewDocument4 pages1 Budget OverviewGuntoro AliNo ratings yet

- County Administrator 2017 Budget MemoDocument20 pagesCounty Administrator 2017 Budget MemoFauquier NowNo ratings yet

- PA Environment Digest Dec. 10, 2012Document27 pagesPA Environment Digest Dec. 10, 2012www.PaEnvironmentDigest.comNo ratings yet

- Budget 2014 Release1Document5 pagesBudget 2014 Release1Steve ForsethNo ratings yet

- Affordable Green ChoicesDocument16 pagesAffordable Green ChoicesontarionewdemocratNo ratings yet

- Carbon Price PackageDocument35 pagesCarbon Price PackageTransitionKenmoreNo ratings yet

- Mayor Watson, City of Ottawa - 2014 Election QuestionsDocument2 pagesMayor Watson, City of Ottawa - 2014 Election QuestionsJon WillingNo ratings yet

- December 17 2015Document1 pageDecember 17 2015Councillor Marianne WilkinsonNo ratings yet

- Manitoba Hydro Annual Report 2015-16Document116 pagesManitoba Hydro Annual Report 2015-16ChrisDcaNo ratings yet

- Dcwater Factsheet 2012Document2 pagesDcwater Factsheet 2012Martin AustermuhleNo ratings yet

- 12-11-26 Postcard On Throne SpeechDocument5 pages12-11-26 Postcard On Throne SpeechRob AltemeyerNo ratings yet

- Aug 9.2018 RevisedDocument3 pagesAug 9.2018 RevisedCouncillor Marianne WilkinsonNo ratings yet

- MOSQUITOS - For The Past Few Weeks We've Been Experiencing More AdultDocument3 pagesMOSQUITOS - For The Past Few Weeks We've Been Experiencing More AdultCouncillor Marianne WilkinsonNo ratings yet

- Sept 20 2018Document2 pagesSept 20 2018Councillor Marianne WilkinsonNo ratings yet

- Nov 9.17Document2 pagesNov 9.17Councillor Marianne WilkinsonNo ratings yet

- Light Rail Open House Tonight ! - : Angela - Taylor@ottawa - CaDocument2 pagesLight Rail Open House Tonight ! - : Angela - Taylor@ottawa - CaCouncillor Marianne WilkinsonNo ratings yet

- May 3.2018Document2 pagesMay 3.2018Councillor Marianne WilkinsonNo ratings yet

- May 17 2018Document2 pagesMay 17 2018Councillor Marianne WilkinsonNo ratings yet

- Give Away Weekend - : WWW - Ottawa.caDocument2 pagesGive Away Weekend - : WWW - Ottawa.caCouncillor Marianne WilkinsonNo ratings yet

- Apr 19 2018Document2 pagesApr 19 2018Councillor Marianne WilkinsonNo ratings yet

- During The Month of October, The City Is Offering Trick or Swim or Skate Tickets As A Healthy and Fun AlternativeDocument2 pagesDuring The Month of October, The City Is Offering Trick or Swim or Skate Tickets As A Healthy and Fun AlternativeCouncillor Marianne WilkinsonNo ratings yet

- Sept 7.17Document2 pagesSept 7.17Councillor Marianne WilkinsonNo ratings yet

- Oct 26.17Document2 pagesOct 26.17Councillor Marianne WilkinsonNo ratings yet

- Nov 2.17Document2 pagesNov 2.17Councillor Marianne WilkinsonNo ratings yet

- Sept 14.17Document2 pagesSept 14.17Councillor Marianne WilkinsonNo ratings yet

- July 12 FinalDocument2 pagesJuly 12 FinalCouncillor Marianne WilkinsonNo ratings yet

- WWW - Ottawa.ca: S.T.E.P - Ottawa Police STEP Program This Month Will Be Focusing On How To SafetyDocument2 pagesWWW - Ottawa.ca: S.T.E.P - Ottawa Police STEP Program This Month Will Be Focusing On How To SafetyCouncillor Marianne WilkinsonNo ratings yet

- July 20 17Document2 pagesJuly 20 17Councillor Marianne WilkinsonNo ratings yet

- Aug 24.17Document2 pagesAug 24.17Councillor Marianne WilkinsonNo ratings yet

- Do You Have A Family Business in Kanata? - As Part of Canada 150 TheDocument2 pagesDo You Have A Family Business in Kanata? - As Part of Canada 150 TheCouncillor Marianne WilkinsonNo ratings yet

- Aug 17.17Document2 pagesAug 17.17Councillor Marianne WilkinsonNo ratings yet

- May 25 17Document2 pagesMay 25 17Councillor Marianne WilkinsonNo ratings yet

- Info - Mosquito@gdg - Ca: Do You Have A Family Business in Kanata?Document2 pagesInfo - Mosquito@gdg - Ca: Do You Have A Family Business in Kanata?Councillor Marianne WilkinsonNo ratings yet

- May 11 17Document2 pagesMay 11 17Councillor Marianne WilkinsonNo ratings yet

- WWW - Ottawa.ca: HYDRO ONE CORRIDORS - Hydro One Now Plans To Clear The Corridor inDocument2 pagesWWW - Ottawa.ca: HYDRO ONE CORRIDORS - Hydro One Now Plans To Clear The Corridor inCouncillor Marianne WilkinsonNo ratings yet

- June 1Document2 pagesJune 1Councillor Marianne WilkinsonNo ratings yet

- June 7Document2 pagesJune 7Councillor Marianne WilkinsonNo ratings yet

- Resettlement Policy FrameworkDocument85 pagesResettlement Policy FrameworkEDEN2203No ratings yet

- Draft DCR-2034 English PDFDocument397 pagesDraft DCR-2034 English PDFUttara Rajawat100% (3)

- Best Design Report and Detail Scope of Jetty Invested by JapanDocument139 pagesBest Design Report and Detail Scope of Jetty Invested by Japanmustafurade1No ratings yet

- Impacts of Sand and Clay Mining On The Riverine and Coastal Ecosystems of The Maha Oya Legal and Policy Issues and RecommendationsDocument35 pagesImpacts of Sand and Clay Mining On The Riverine and Coastal Ecosystems of The Maha Oya Legal and Policy Issues and RecommendationsWickramathilaka1981No ratings yet

- Ecodesign Manual Noruego (En Ingles - Circa 1999)Document181 pagesEcodesign Manual Noruego (En Ingles - Circa 1999)gcanale_2No ratings yet

- Final EIA Project Report For 3d Seismic Survey in Block 13tDocument253 pagesFinal EIA Project Report For 3d Seismic Survey in Block 13tEzzadin BabanNo ratings yet

- Pakistan National Conservation Strategy 1990 PDFDocument39 pagesPakistan National Conservation Strategy 1990 PDFUrooj Fatima100% (1)

- Yanacocha - Project Conga - Executive Summary (Inglish)Document104 pagesYanacocha - Project Conga - Executive Summary (Inglish)Mi Mina CorruptaNo ratings yet

- Planning Law (Property Law) Est 322Document48 pagesPlanning Law (Property Law) Est 322efeNo ratings yet

- Contaminated Land GuideDocument28 pagesContaminated Land GuideKa Chun ChanNo ratings yet

- AY 2017 Sem 2 A309 ESEDocument17 pagesAY 2017 Sem 2 A309 ESELim Liang XuanNo ratings yet

- Law of Property Case Law (Aventura)Document33 pagesLaw of Property Case Law (Aventura)galia margalitNo ratings yet

- MDSW TamilNadu06Document14 pagesMDSW TamilNadu06miningnova1No ratings yet

- AFC Project DescriptionDocument14 pagesAFC Project DescriptionbonnmengulloNo ratings yet

- Eco Profile Ass Norway EngDocument15 pagesEco Profile Ass Norway EngRafał JuraszekNo ratings yet

- Environmental & Social Review Procedures ManualDocument78 pagesEnvironmental & Social Review Procedures ManualIFC SustainabilityNo ratings yet

- Royal HaskoningDHV Shipyards Brochure PDFDocument20 pagesRoyal HaskoningDHV Shipyards Brochure PDFharyanto99No ratings yet

- Types of EIADocument2 pagesTypes of EIAabc_122178% (23)

- DCR ReportDocument70 pagesDCR ReportAr SoniNo ratings yet

- Allied Mumbai Trans Harbour LinkDocument232 pagesAllied Mumbai Trans Harbour LinkVarun VashiNo ratings yet

- KGN BIO TECH EIA Report PDFDocument275 pagesKGN BIO TECH EIA Report PDFjyothi0% (1)

- Afirmation of Gedalye SzegedinDocument261 pagesAfirmation of Gedalye SzegedinJohn N. AllegroNo ratings yet

- Introduction To Environmental Management SystemsDocument16 pagesIntroduction To Environmental Management SystemsCherry Karen100% (2)

- Oswin CV - March 2013Document10 pagesOswin CV - March 2013Dr. Deiva Oswin StanleyNo ratings yet

- CMR TemplateDocument4 pagesCMR TemplateLeoJamesPerez100% (1)

- Technical EIA Guidance Manual For Chlor-Alkali IndustryDocument203 pagesTechnical EIA Guidance Manual For Chlor-Alkali IndustrySaurabh GuptaNo ratings yet

- Eiar Rock Salt Final Near NaliDocument29 pagesEiar Rock Salt Final Near NaliZubair KhanNo ratings yet

- EIADocument268 pagesEIACamila PinzonNo ratings yet

- Green Road in Nepal - Best PracticesDocument144 pagesGreen Road in Nepal - Best PracticesBipin Adhikari100% (1)

- Enciclica-Laudato-Si - en - PDF: LAUDATO SI (If You Want To Refer To The Orig Text)Document15 pagesEnciclica-Laudato-Si - en - PDF: LAUDATO SI (If You Want To Refer To The Orig Text)Aehrold GarmaNo ratings yet