Professional Documents

Culture Documents

ECON 330 Lecture 5 Notes From Professor

Uploaded by

Rafael Aleman0 ratings0% found this document useful (0 votes)

26 views14 pagesThe United States has the largest economy in the world due to its large GDP and highly productive, private sector-driven market economy. While US firms have significant advantages, their economic dominance has declined since World War II as other nations have caught up technologically. The structure of the US economy has shifted dramatically over time from agriculture to industry to a now predominantly service-based economy. This transition has impacted the nature of work and contributed to rising inequality.

Original Description:

lecture notes

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe United States has the largest economy in the world due to its large GDP and highly productive, private sector-driven market economy. While US firms have significant advantages, their economic dominance has declined since World War II as other nations have caught up technologically. The structure of the US economy has shifted dramatically over time from agriculture to industry to a now predominantly service-based economy. This transition has impacted the nature of work and contributed to rising inequality.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views14 pagesECON 330 Lecture 5 Notes From Professor

Uploaded by

Rafael AlemanThe United States has the largest economy in the world due to its large GDP and highly productive, private sector-driven market economy. While US firms have significant advantages, their economic dominance has declined since World War II as other nations have caught up technologically. The structure of the US economy has shifted dramatically over time from agriculture to industry to a now predominantly service-based economy. This transition has impacted the nature of work and contributed to rising inequality.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

The United States Economy

Past and Present

I. The U.S. Economy: Introduction

The US has the largest and most technologically powerful economy in the world, with a per capita GDP of $48,100. In this market-oriented economy, private individuals and business firms make most of the decisions, and the federal and state governments buy needed goods and services predominantly in the private marketplace. US business firms enjoy greater flexibility than their counterparts in Western Europe and Japan in decisions to expand capital plant, to lay off surplus workers, and to develop new products. At the same time, they face higher barriers to enter their rivals' home markets than foreign firms face entering US markets. US firms are at or near the forefront in technological advances, especially in computers and in medical, aerospace, and military equipment; their advantage has narrowed since the end of World War II. The onrush of technology largely explains the gradual development of a "two-tier labor market" in which those at the bottom lack the education and the professional/technical skills of those at the top and, more and more, fail to get comparable pay raises, health insurance coverage, and other benefits.

The U.S. Economy: Introduction

Since 1975, practically all the gains in household income have gone to the top 20% of households. Since 1996, dividends and capital gains have grown faster than wages or any other category of after-tax income. Imported oil accounts for nearly 55% of US consumption. Oil prices doubled between 2001 and 2006, the year home prices peaked; higher gasoline prices ate into consumers' budgets and many individuals fell behind in their mortgage payments. Oil prices increased another 50% between 2006 and 2008. In 2008, soaring oil prices threatened inflation and caused a deterioration in the US merchandise trade deficit, which peaked at $840 billion. In 2009, with the global recession deepening, oil prices dropped 40% and the US trade deficit shrank, as US domestic demand declined, but in 2011 the trade deficit ramped back up to $803 billion, as oil prices climbed once more.

The US Economy: Introduction

The global economic downturn, the sub-prime mortgage crisis, investment bank failures, falling home prices, and tight credit pushed the United States into a recession by mid-2008. GDP contracted until the third quarter of 2009, making this the deepest and longest downturn since the Great Depression. To help stabilize financial markets, in October 2008 the US Congress established a $700 billion Troubled Asset Relief Program (TARP). The government used some of these funds to purchase equity in US banks and industrial corporations, much of which had been returned to the government by early 2011. In January 2009 the US Congress passed and President Barack OBAMA signed a bill providing an additional $787 billion fiscal stimulus to be used over 10 years - two-thirds on additional spending and one-third on tax cuts to create jobs and to help the economy recover. In 2010 and 2011, the federal budget deficit reached nearly 9% of GDP; total government revenues from taxes and other sources are lower, as a percentage of GDP, than that of most other developed countries.

The U.S. Economy: Introduction

The wars in Iraq and Afghanistan required major shifts in national resources from civilian to military purposes and contributed to the growth of the US budget deficit and public debt - through 2011, the direct costs of the wars totaled nearly $900 billion, according to US government figures. In March 2010, President OBAMA signed into law the Patient Protection and Affordable Care Act, a health insurance reform bill that will extend coverage to an additional 32 million American citizens by 2016, through private health insurance for the general population and Medicaid for the impoverished. Total spending on health care - public plus private - rose from 9.0% of GDP in 1980 to 17.9% in 2010. In July 2010, the president signed the DODD-FRANK Wall Street Reform and Consumer Protection Act, a law designed to promote financial stability by protecting consumers from financial abuses, ending taxpayer bailouts of financial firms, dealing with troubled banks that are "too big to fail," and improving accountability and transparency in the financial system - in particular, by requiring certain financial derivatives to be traded in markets that are subject to government regulation and oversight. Long-term problems include inadequate investment in deteriorating infrastructure, rapidly rising medical and pension costs of an aging population, sizable current account and budget deficits - including significant budget shortages for state governments - energy shortages, and stagnation of wages for lower-income families.

The U.S. Economy: Facts

Population: 313,847,465 (July 2012 est.). country comparison to the world: 3 GDP: $15.09 trillion (2011 est.). country comparison to the world: 2 GDP per capita: $49,000 (2011 est.) country comparison to the world: 11 Labor force: 153.6 million Unemployment rate: 9% (2011 est.) Population below poverty line: 15.1% (2010 est.) Distribution of family income - Gini index: 45 (2007) Public debt: 67.7% of GDP (2011 est.) Inflation rate (consumer prices): 3.1% (2011 est.)

II. Rugged Individualism, Melting Pot and changing Structure of US Economy

I. Factors with Lasting Impact on the US Economy and Society Rugged Individualism: (i) philosophy of individualism basis of American dream (ii) belief that individual wealth reward for hard work and frugality (iii)American oppose schemes to redistribute wealth and income. Government should take responsibility for those who cannot take care of themselves(USA 25%, Germany 50%, Britain 62%, Spain 72%) (iv) philosophy of individualism also explains Am preoccupation with higher education (among those in their 20s US (66%),Jpan (39%), Europe (30%) 2. The philosophy of melting pot: Positives (US benefits from diversity of skills and talents) Negatives (discrimination: economic inefficiency 3. Changing structure of US economy

Sector Agriculture Industry Services 1870 1900 1920 1940 1995 47 35 24 19 3 27 34 41 35 20 26 31 35 46 77 2011 1 90 80

III. The U.S. Service Sector

1. Phases of service sector: (i) end of civil war (1865) to the Great Depression (1929), mainly wholesale and retail trade (ii) Expansion of public sector services during the GD (iii) Since WWII increased prosperity, education, recreation and health 2. Causes of rapid growth of service sector: (i) Income elasticity of demand hypothesis (Americans richer) (ii) deindustrialization hypothesis (Americans less competitive) (iii) cost disease hypothesis (service sector productivity slower, employment must increase rapidly to compensate for lower growth of productivity. Also prices up, so as a proportion of GDP up (iv) Economies of scale hypothesis: Growth of SS arose from efforts to improve organizational efficiency. Many business such as accounting, computer programming, mailing and printing may be performed more efficiently if moved from small offices in industrial firms into specialized firms in the service sector. (v) Labor supply hypothesis: changing structure of LF (women 1950=28%today 47%. Many women found jobs in SS. Therefore SS increased.

The U.S. Service Sector

3. Significance of Shift to Service Sector: (i)Changed Nature of Work and Employment (more Americans engaged in sales than manufacturing, college students 1950-60 specialized in engineering, now in business, computers, education, recreation.(ii) SS employees more likely to be part time, self employed employees, less likely to join labor unions. (iii) SS increase contributed to inequality. Divided in low income jobs like barbers and janitors and high income financial and professional services.(iii) SS faces little foreign competition, so prices have increased in this than any other sector of the economy.(iv) SS immune to recession: many self employed (lawyers, realtors, barbers, child care workers. Decreased demand for services means decreased income but not loss of job, in manufacturing industries wages less flexible, cannot store inventories, no surpluses to be sold before production resumes. (v) SS automatic stabilizer as government services not reduced during recession. (vi) SS contributes positively to US BOP, 1993 merchandise deficit $133B, SS surplus$57B.

IV. The U.S. Industrial Sector

IV. The US Industrial Sector:

1.Before civil war : (i) US economy about text book model of perfect competition (large number of Buyers and sellers, no barriers, homogenous product, firm price taker, no single plant controlled as much as 10 percent of the output. (ii) 1870s average firm in oil and steel industry employed fewer than 100 people. (iii) Govt. played limited role. 2. Emergence of US Giants: (i) Spread transportation and communication network (Erie canal 1825 linked NYC with agricultural areas of western NY . Many other canals, by 1850, 1.6 B tons of cargo transported by river/canals (ii) 1828 first steam engine railways, by 1860, 30,000 miles of railway track (iv) 1837 Sam Morse invented telegraph, and telegraph lines of western union reached the pacific coast by 1861 (v) These rapid advances in transportation and communication formed a national market (vi) Factories would be built with the assurance that output could be sold throughout the US and overseas. (vi) By 1880 many US giants established (Standard Oil, Westinghouse, Edison, General Electric. (vii) 1879 standard oil trust (Rockefeller) controlled 90% of US oil refining (viii) Carnegie in 1900 produced half of US steel (viii)1889 NJ legislature legalized formation of holding companies and mergers (ix) 1880 US by-passed UK ,to become Worlds leading producer of industrial goods.

Concentration of Economic Power: Measurement, Levels, extent

3. Concentration of Economic Power/Measuring Level of Concentration :

Most familiar yard stick is four firm concentration ratio (FFCR). It is the percentage of output that is produced by the four largest firms of an industry. Higher more monopolistic, lower less monopolistic.

4. Levels of concentration/Strucuture of Industrial Firms Each industrial sector could be assigned in one out of 4 categories. (i) Pure monopoly: market share 100%, no rivals, strong entry barriers, price controls (ii) dominant firm: market share 50-90 %, no close rivals, entry barriers, price controls (iii) Oligopoly: FFCR above 60%, stable market share, medium to high barriers, rigid prices (iv) Effective competition: FFCR below 40%, unstable market share , no barriers, flexible pricing. (v) A recent estimate shows the following. Vehicle aircraft alum. steel sp.goods jewelry 90 72 74 44 13 12

Concentration of Economic Power: Backlash and Anti-Trust Laws

5. Social Costs of Industrial concentration: (i) public opinion against political and economic Power concentration (ii) Am. believe profits of large corporations excessive (iii) monopolies restrict output and raise prices (iv) All K expenditure and investment in manufacturing sector is controlled by 200 large firms. If a small number of corporate executives become pessimistic about business outlook, then: a decrease in investment, growth, recession and Unemployment.

6. Backlash against monopolies and anti-trust laws: (i) In 1887 interstate commerce commission (ISCC) established to regulate railroad rates (ii) 1890 Sherman anti trust act: to prohibit conspiracy in restraint of trade or any attempt to monopolize any part of trade and commerce (iii) 1914 Clayton Act: declared 4 specific practices illegal (1) merger of competing Cos. (2) Price discrimination (3) Tying contracts (requiring purchasers to buy from the sellers (4) interlocking Directorates (director of one company sitting in the board of directors of a competing company).

V. The U.S. Labor Markets

V. The US Labor Market: (i) Labor allowed to unionize and collectively bargain in USA since 1930s Wagner Act. Unionization at its peak in 1955 at 33% of LF (ii) Unions in USA organized along industry lines all union workers in auto industry members of united auto workers (UAW) (iii) Britain organized along occupational lines. All electricians belong to an electricians union irrespective of industry (iv) In Japan organized along company lines and represent white and blue collar workers. (v) The US labor markets competitive; no monopolies on employer side and or monopoly on labor side, yet there is unemployment (vi) Why? According to classical economic theory this is because of (i) downward inflexibility of wages stemming from (a) long term contracts/unions (b) minimum wage laws. Reasons for declining Unionization: (i) job satisfaction hyp (ii) employer resistance hyp (iii) Govt. substitution hyp (iv) growth of service sector/self employment (v) late labor legislation giving collective bargaining rights to labor (vi) perceived association of communism and socialism.

VI. The U.S. Financial Sector

VI. The Financial Sector Financial institutions (banks, securities firms, insurance) provide efficient methods for payments between buyers and sellers, savings, extend credit, allow individuals to share their risks with larger number of people. . Trends in US banking (i) before 1863. unregulated banking, 2000 banks could issue their own currency. (ii) Banking act 1863-64 established uniform and safe banking system. The federal reserve act of 1913 established 12 federal reserve districts each owned by member banks. Each district bank controlled by 7 member board of governors appointed by the president of the US for a period of 14 years. Chairman appointed for a period of 4 years. The Fed controls the Money supply by increasing/decreasing discount rates, increasing/decreasing the RRR and by selling/buying bonds/securities.

You might also like

- Summary Of "The American Crisis And The Persian Gulf War" By Pablo Pozzi: UNIVERSITY SUMMARIESFrom EverandSummary Of "The American Crisis And The Persian Gulf War" By Pablo Pozzi: UNIVERSITY SUMMARIESNo ratings yet

- Jarrett - Davis Critical Analysis PaperDocument8 pagesJarrett - Davis Critical Analysis PaperJarrett DavisNo ratings yet

- Holy Capitalism: Origins, Workings and Energy CatalystFrom EverandHoly Capitalism: Origins, Workings and Energy CatalystNo ratings yet

- United States of America: Career Service Country GuidesDocument8 pagesUnited States of America: Career Service Country GuidesJennifer JonesNo ratings yet

- Why Nothing Works: The Anthropology of Daily LifeFrom EverandWhy Nothing Works: The Anthropology of Daily LifeRating: 4 out of 5 stars4/5 (30)

- Financial Dependence: The Other Side of GlobalisationDocument6 pagesFinancial Dependence: The Other Side of GlobalisationChristian CopeNo ratings yet

- Powerpoint Presentation On Usa EconomyDocument19 pagesPowerpoint Presentation On Usa EconomyPiyush_jain00450% (2)

- United States, Financial and Economic Crisis: The Recovery EconomicsFrom EverandUnited States, Financial and Economic Crisis: The Recovery EconomicsNo ratings yet

- Roots of The Current CrisisDocument12 pagesRoots of The Current CrisisMelanie O'HaganNo ratings yet

- The Free Trade DebateDocument20 pagesThe Free Trade DebatenonsenseNo ratings yet

- Enlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansFrom EverandEnlightened Public Finance: Fiscal Literacy for Democrats, Independents, Millennials and CollegiansNo ratings yet

- Summary: CAFTA and Free Trade: Review and Analysis of Greg Spotts's BookFrom EverandSummary: CAFTA and Free Trade: Review and Analysis of Greg Spotts's BookNo ratings yet

- US EconomyDocument3 pagesUS EconomyAbhijit KunduNo ratings yet

- Solution Manual For Economics 12th Edition Stephen SlavinDocument35 pagesSolution Manual For Economics 12th Edition Stephen Slavinhematinchirper.ov9x100% (41)

- Economy - OverviewDocument11 pagesEconomy - OverviewMitali PatelNo ratings yet

- On New Terrain: How Capital Is Reshaping the Battleground of Class WarFrom EverandOn New Terrain: How Capital Is Reshaping the Battleground of Class WarRating: 4 out of 5 stars4/5 (1)

- Indian Economy V/s American Economy: A Comparative StatementDocument9 pagesIndian Economy V/s American Economy: A Comparative StatementSid KamatNo ratings yet

- The Betrayal of American Prosperity: Free Market Delusions, America's Decline, and How We Must Compete in the Post-Dollar EraFrom EverandThe Betrayal of American Prosperity: Free Market Delusions, America's Decline, and How We Must Compete in the Post-Dollar EraNo ratings yet

- An Update On ImperialismDocument7 pagesAn Update On ImperialismTed D. MagalonaNo ratings yet

- Counter Punch 1 LoosingDocument5 pagesCounter Punch 1 LoosingNazmul AlamNo ratings yet

- Pandemic Billionaires: What Happened? Great Injustice, Great InequalityFrom EverandPandemic Billionaires: What Happened? Great Injustice, Great InequalityNo ratings yet

- Gale Researcher Guide for: The Disappearing Middle Class in AmericaFrom EverandGale Researcher Guide for: The Disappearing Middle Class in AmericaNo ratings yet

- Summary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookFrom EverandSummary: Stephen Roach on the Next Asia: Review and Analysis of Stephen S. Roach's BookNo ratings yet

- Socioeconomic Stratification: A Case Study on Sustainable Growth in a Declining PopulationFrom EverandSocioeconomic Stratification: A Case Study on Sustainable Growth in a Declining PopulationNo ratings yet

- International Marketing CH2Document7 pagesInternational Marketing CH2Nour AliNo ratings yet

- America DataDocument3 pagesAmerica DataAnj TabiosNo ratings yet

- What Is GlobalizationDocument3 pagesWhat Is GlobalizationAgrammmmNo ratings yet

- U2 Evidencia 2Document4 pagesU2 Evidencia 2api-299857592No ratings yet

- Summary of No Trade Is Free by Robert Lighthizer: Changing Course, Taking on China, and Helping America's WorkersFrom EverandSummary of No Trade Is Free by Robert Lighthizer: Changing Course, Taking on China, and Helping America's WorkersNo ratings yet

- Local Media2973770499710902264Document7 pagesLocal Media2973770499710902264Everly Mae ElondoNo ratings yet

- The Road to Prosperity: How to Grow Our Economy and Revive the American DreamFrom EverandThe Road to Prosperity: How to Grow Our Economy and Revive the American DreamNo ratings yet

- Open: The Progressive Case for Free Trade, Immigration, and Global CapitalFrom EverandOpen: The Progressive Case for Free Trade, Immigration, and Global CapitalRating: 3.5 out of 5 stars3.5/5 (5)

- The U.S. Economy and ChinaDocument10 pagesThe U.S. Economy and ChinaNixie ShresthaNo ratings yet

- EMEA Group11 MexicoDocument21 pagesEMEA Group11 MexicoRAJARSHI ROY CHOUDHURYNo ratings yet

- Six Reasons Manufacturing Is Central To The Economy - Next New Deal PDFDocument3 pagesSix Reasons Manufacturing Is Central To The Economy - Next New Deal PDFakaretlerNo ratings yet

- A Study On Subprime Crisis and Its Effects On India Mba ProjectDocument75 pagesA Study On Subprime Crisis and Its Effects On India Mba ProjectSagar ChitrodaNo ratings yet

- Politics in the New Hard Times: The Great Recession in Comparative PerspectiveFrom EverandPolitics in the New Hard Times: The Great Recession in Comparative PerspectiveNo ratings yet

- 9 Chart-JamesDocument1 page9 Chart-JamesRafael Aleman100% (1)

- Luke:: "Presenting Jesus As The Ideal Man": Ministry Begins A.D. 29 Crucifixion A.D. 33Document1 pageLuke:: "Presenting Jesus As The Ideal Man": Ministry Begins A.D. 29 Crucifixion A.D. 33Rafael Aleman100% (1)

- 1 2-3 4-22 The Seal Judgments The Trumpet Judgments The Bowl Judgments 19Document1 page1 2-3 4-22 The Seal Judgments The Trumpet Judgments The Bowl Judgments 19Rafael Aleman100% (1)

- "The Acts of The Apostles" (Acts) :: "The Call of The Missional"Document1 page"The Acts of The Apostles" (Acts) :: "The Call of The Missional"Rafael Aleman100% (1)

- 11 Chart-RomansDocument2 pages11 Chart-RomansRafael Aleman100% (1)

- John:: "Progress of Belief"Document1 pageJohn:: "Progress of Belief"Rafael Aleman100% (1)

- 1 Chart-I-CorinthiansDocument1 page1 Chart-I-CorinthiansRafael Aleman100% (1)

- Notes MKTG 353 November 27 and 29Document5 pagesNotes MKTG 353 November 27 and 29Rafael AlemanNo ratings yet

- 5 Chart-PhilippiansDocument1 page5 Chart-PhilippiansRafael Aleman100% (1)

- Old Testament Chronologically Arranged: Assyrian CaptivityDocument1 pageOld Testament Chronologically Arranged: Assyrian CaptivityRafael Aleman100% (1)

- How The New Testament Fits TogetherDocument1 pageHow The New Testament Fits TogetherRafael Aleman100% (1)

- Notes MKTG 353 October 23Document3 pagesNotes MKTG 353 October 23Rafael AlemanNo ratings yet

- BAO Esri: Tapestry vs. PRIZM AssignmentDocument1 pageBAO Esri: Tapestry vs. PRIZM AssignmentRafael AlemanNo ratings yet

- Notes MKTG 353 November 27 FinalDocument4 pagesNotes MKTG 353 November 27 FinalRafael AlemanNo ratings yet

- Notes MKTG 353 November 13Document3 pagesNotes MKTG 353 November 13Rafael AlemanNo ratings yet

- Notes MKTG 353 December 13Document5 pagesNotes MKTG 353 December 13Rafael AlemanNo ratings yet

- Notes MKTG 353 December 11Document5 pagesNotes MKTG 353 December 11Rafael AlemanNo ratings yet

- Target Kohl's Orange Label Art + Advertising Landsberg Anaheim/OC Visitor & Convention Bureau Enterprise HoldingsDocument1 pageTarget Kohl's Orange Label Art + Advertising Landsberg Anaheim/OC Visitor & Convention Bureau Enterprise HoldingsRafael AlemanNo ratings yet

- Activity 1 IaDocument4 pagesActivity 1 IaRikka TakanashiNo ratings yet

- Marketing Plan Assignment - ArcX Sports Rings - Winter 2021Document4 pagesMarketing Plan Assignment - ArcX Sports Rings - Winter 2021Sahiba MaingiNo ratings yet

- Absorption and Margin CostingDocument8 pagesAbsorption and Margin CostingIshfaq AhmadNo ratings yet

- Indian Rayon 2009-10Document54 pagesIndian Rayon 2009-10Vimal100% (2)

- GMM Pfaudler - Initiating Coverage - Axis Direct - 07042017 - 10-04-2017 - 08Document22 pagesGMM Pfaudler - Initiating Coverage - Axis Direct - 07042017 - 10-04-2017 - 08MADHAVI SARINNo ratings yet

- Site Accountant Store Keeper Updated On 30-11-06Document15 pagesSite Accountant Store Keeper Updated On 30-11-06farrukhsharifzadaNo ratings yet

- Mba - Group 5 - Cooperative Strategy FinalDocument21 pagesMba - Group 5 - Cooperative Strategy FinalAwneeshNo ratings yet

- Gregory Mankiw Slides For Chapter 12Document57 pagesGregory Mankiw Slides For Chapter 12nixen99_gella100% (2)

- Quantitative Analysis of WiproDocument3 pagesQuantitative Analysis of WiproAditi DaryanNo ratings yet

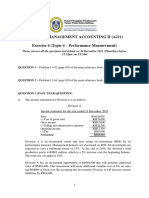

- A211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Document3 pagesA211 MA2 EXERCISE 4 (TOPIC 4 Performance Measurement) - Questions - Upoladed 18 Dec 2021Amirul Hakim Nor AzmanNo ratings yet

- Costing:: CSWPA-SM Certified SOLIDWORKS Professional - Advanced Sheet MetalDocument1 pageCosting:: CSWPA-SM Certified SOLIDWORKS Professional - Advanced Sheet MetalMech SathyaNo ratings yet

- Managerial Economics PPT at Mba 2009Document31 pagesManagerial Economics PPT at Mba 2009Babasab Patil (Karrisatte)No ratings yet

- Midterm Sol (1) Microeconomics PHDDocument8 pagesMidterm Sol (1) Microeconomics PHDrhoNo ratings yet

- IFT CFA Level I Facts and Formula Sheet 2018 SAMPLEDocument2 pagesIFT CFA Level I Facts and Formula Sheet 2018 SAMPLETapan BhattNo ratings yet

- Amhara BOA Bid Preface-BDocument55 pagesAmhara BOA Bid Preface-BtilahunthmNo ratings yet

- Supply and Demand: Learning ObjectivesDocument30 pagesSupply and Demand: Learning Objectivessk001No ratings yet

- The Global Supermarket ActivityDocument3 pagesThe Global Supermarket ActivityKeyjey GarciaNo ratings yet

- Statman - Behaviorial Finance Past Battles and Future EngagementsDocument11 pagesStatman - Behaviorial Finance Past Battles and Future EngagementsFelipe Alejandro Torres CastroNo ratings yet

- High Level DI PDFDocument38 pagesHigh Level DI PDFabhiNo ratings yet

- Test 4 Review SheetDocument2 pagesTest 4 Review SheetBea Cassandra EdnilaoNo ratings yet

- Mcminn Central HsDocument2 pagesMcminn Central Hsapi-167245952No ratings yet

- Precision Worldwide FinalDocument17 pagesPrecision Worldwide Finalmarjunem100% (5)

- Group Project FinalDocument15 pagesGroup Project FinalmohamedNo ratings yet

- GDP AnalysisDocument1 pageGDP Analysisheartful2855No ratings yet

- EFE & IFE Matrix of Walt DisneyDocument2 pagesEFE & IFE Matrix of Walt DisneyWinne You100% (2)

- Performance 6.10Document2 pagesPerformance 6.10George BulikiNo ratings yet

- Questions (Fun With Economics)Document7 pagesQuestions (Fun With Economics)Bhoomi SinghNo ratings yet

- SiaHuatCatalogue2017 2018Document350 pagesSiaHuatCatalogue2017 2018Chin TecsonNo ratings yet

- Why People Really Buy Hybrids: Jonathan KleinDocument9 pagesWhy People Really Buy Hybrids: Jonathan KleinfkkfoxNo ratings yet

- Group Assignment On Variable PricingDocument1 pageGroup Assignment On Variable PricingKowshik MoyyaNo ratings yet