Professional Documents

Culture Documents

Cost of Inventory Year-End

Uploaded by

Rikka TakanashiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Inventory Year-End

Uploaded by

Rikka TakanashiCopyright:

Available Formats

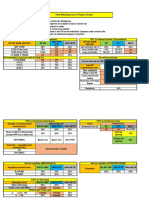

PROBLEM 1 – 1 pt

Company A provided the ff information at current year-end:

Finished goods in storeroom at cost including overhead

of P400,000 P 2,000,000

Finished goods in transit, including freight charge of

P20,000, FOB shipping point 250,000

Goods in process, at cost of materials and direct labor 720,000

Materials 1,000,000

Material in transit, FOB shipping point 50,000

Defective materials returned to suppliers for replacement 100,000

Shipping supplies 20,000

Gasoline and oil for testing finished goods 110,000

Machine lubricants 60,000

Determine cost of inventory at year-end.

PROBLEM 2 – 10 pts

Company A began operations in the current year. The entity used perpetual inventory system.

During the year, the company purchased merchandise having a gross invoice cost of

P1,500,000. All purchases were made under the terms 5/10, n/30, FOB destination. Relative to

this, the company paid freight expenses of P100,000.

The company was able to pay 80% of the purchases within the discount period but the

remaining purchases were paid beyond 10 days.

70% of the purchases were sold for P1,200,000.

Prepare journal entries to record the transactions using gross method and net method.

PROBLEM 3 – 3 pts

Company A reported that a flood recently destroyed many of their financial records. The entity

used average cost inventory valuation.

The entity made a physical count at the end of each month in order to determine monthly ending

inventory value.

By examining various documents, the following data are gathered:

Ending inventory at July 31 60,000 units

Total cost of units available for sale in July 1,452,100

Cost of goods sold during July 1,164,100

Cost of beginning inventory, July 1 4.00 per unit

Gross profit on sales for July 935,900

Units Unit Cost Total Cost

July 5 55,000 5.1 280,500

July 11 53,000 5 265,000

July 15 45,000 5.5 247,500

July 16 47,000 5.3 249,100

Total purchases 200,000 1,042,100

Determine:

(1) Cost of ending inventory on July 31

(2) Cost of goods sold under FIFO valuation method

(3) Cost of ending inventory on July 31 under FIFO valuation method

PROBLEM 4 – 6 pts

The following information were obtained from Company A’s accounting records:

Sales for the 11 months ended November 30 P 3,400,000

Sales for the year ended December 31 3,840,000

Purchases for 11 months ended November 30 2,700,000

Purchases for year ended December 31 3,200,000

Inventory, January 1 350,000

Inventory, November 30 (per physical count) 380,000

Additionally, the following were noted:

Shipments received in unsalable condition and excluded

from physical inventory:

Total at November 30 4,000

Total at December 31 (incl. Nov. 30

Unrecorded returns) 6,000

The returns were not recorded because no credit memos

were received from vendors.

Deposit made with vendor and charged to

Purchases in October. The goods were shipped

in January of the current year. 8,000

Deposit made with vendor and charged to

Purchases in November. The goods were

shipped FOB destination on November 29 and

were included in the physical inventory as

goods in transit. 22,000

Shipments received in November and included

in the physical count at November 30 but

recorded as December purchases. 30,000

Due to the carelessness of the receiving

department, a December shipment was

damaged by rain. These goods were later

sold at cost in December. 40,000

Based on the preceding information, determine:

(1) Net purchases for the year ended December 31

(2) Cost of goods sold for the year ended December 31

(3) Estimated ending inventory as of December 31

PROBLEM 5 – 3 pts

Company A provided the following data:

Beginning inventory

Cost P 500,000

Selling price 770,000

Purchases:

Cost 3,070,000

Selling price 4,300,000

Transportation in 70,000

Purchase discount 45,000

Purchase return:

Cost 25,000

Selling price 40,000

Sales return 80,000

Sales discount 20,000

Markup 100,000

Markdown 350,000

Cancelation of markup 30,000

Cancelation of markdown 10,000

Sales 4,000,000

Determine estimated cost of ending inventory under:

(1) LCNRV approach

(2) Average cost approach

(3) FIFO approach

PROBLEM 6 – 1 pt

Company A is engaged in raising dairy livestock. The entity provided the following information

during the current year:

Carrying amount on January 1 P 5,000,000

Increase due to purchases 2,000,000

Gain arising from change in fair value less cost of

disposal attributable to price change 400,000

Gain arising from change in fair value less cost of

disposal attributable to physical change 600,000

Decrease due to sales 850,000

Decrease due to harvest 300,000

Determine the carrying amount of the biological asset on December 31.

PROBLEM 7 – 3 pts

Company A had a herd of 10 2 y/o animals at the beginning of the current year. One animal

aged 2.5 years was purchased on July 1 for P108 and one animal was born on July 1. No

animals were sold or disposed of during the year.

Fair value less cost of disposal per unit:

Jan 1 Jul 1 Dec 31

New born animal 70 72

6-month old animal 80

2 y/o animal 100 105

2.5 y/o animal 108 111

3 y/o animal 120

Determine:

(1) Fair value of the biological assets on December 31

(2) Gain from change in fair value of biological assets that should be recognized in the

current year

(3) Gain from change in fair value due to price change

You might also like

- Inventory and Cost of Goods AdjustmentsDocument11 pagesInventory and Cost of Goods AdjustmentsjjabarquezNo ratings yet

- Practice Set Inventories Inventory EstimationDocument4 pagesPractice Set Inventories Inventory EstimationChristine De LeonNo ratings yet

- Drills Acc 106Document2 pagesDrills Acc 106brmo.amatorio.uiNo ratings yet

- Bio AssetDocument8 pagesBio AssetJessie jorgeNo ratings yet

- FAR Practical Exercises InventoriesDocument5 pagesFAR Practical Exercises InventoriesAB Cloyd0% (1)

- Audit of Inventory - SW6Document8 pagesAudit of Inventory - SW6d.pagkatoytoyNo ratings yet

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- Handout Audit of InventoriesDocument4 pagesHandout Audit of InventoriesJAY AUBREY PINEDA0% (2)

- Ia Inventories Practice-ProblemsDocument10 pagesIa Inventories Practice-ProblemsDiana AcostaNo ratings yet

- Quarantine Company, A Manufacturer of Small Tools, Provided The Following Information For The Year Ended December 31, 2019Document9 pagesQuarantine Company, A Manufacturer of Small Tools, Provided The Following Information For The Year Ended December 31, 2019Ann louNo ratings yet

- AC - IntAcctg1 Quiz 2Document4 pagesAC - IntAcctg1 Quiz 2john hellNo ratings yet

- Assessment 2 2024 FAR - 1Document6 pagesAssessment 2 2024 FAR - 1ARBYLESA JUNIONo ratings yet

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- PAS 2 - Inventories (Chapter 7)Document3 pagesPAS 2 - Inventories (Chapter 7)Monica MonicaNo ratings yet

- Notes PayableDocument9 pagesNotes Payablerencelor21No ratings yet

- Biological AssetsDocument2 pagesBiological AssetsAnonymous LC5kFdtcNo ratings yet

- 04audit of InventoriesDocument5 pages04audit of InventoriesJeanette FormenteraNo ratings yet

- Pas 2 - Inventories (Continuation of Part 1)Document3 pagesPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangNo ratings yet

- Accounting Test Bank 6Document32 pagesAccounting Test Bank 6likesNo ratings yet

- Accounting Test Bank 2Document73 pagesAccounting Test Bank 2likesNo ratings yet

- AUDIT PROBLEM INVENTORIES PART 1Document4 pagesAUDIT PROBLEM INVENTORIES PART 1Rio Cyrel CelleroNo ratings yet

- M4.1-M4.5 Exercise ProblemsDocument5 pagesM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNo ratings yet

- Miljane Perdizo - Inventory QuizDocument3 pagesMiljane Perdizo - Inventory Quizmiljane perdizoNo ratings yet

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- FINANCIAL ACCOUNTING INVENTORY REPORTINGDocument10 pagesFINANCIAL ACCOUNTING INVENTORY REPORTINGLorenzo LapuzNo ratings yet

- Accounting 1aDocument23 pagesAccounting 1aFaith Marasigan88% (16)

- INVENTORYDocument10 pagesINVENTORYGiulia Tabara100% (1)

- Inventory accounting questionsDocument4 pagesInventory accounting questionsAerielle De GuzmanNo ratings yet

- Quiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresDocument8 pagesQuiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresCassandra MarieNo ratings yet

- Inventory Cost Estimation Problems & SolutionsDocument2 pagesInventory Cost Estimation Problems & SolutionsWillyn LachicaNo ratings yet

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- P1 Day3 RM 2020Document5 pagesP1 Day3 RM 2020P De GuzmanNo ratings yet

- Substantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataDocument17 pagesSubstantive Testing For Inventories: Problem 1: The Makati Company Is On A Calendar Year Basis. The Following DataPaul Anthony AspuriaNo ratings yet

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- PSBA Refresher Course Hyperinflation Accounting QuestionsDocument2 pagesPSBA Refresher Course Hyperinflation Accounting QuestionsAna Marie IllutNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- QUIZ 3. Audit of Inventories ManuscriptDocument3 pagesQUIZ 3. Audit of Inventories ManuscriptJulie Mae Caling MalitNo ratings yet

- Intermediate Accounting 1 Inventories AssignmentDocument3 pagesIntermediate Accounting 1 Inventories AssignmentGabriel Adrian Obungen0% (1)

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- FAR-03-Inventories-2nd Sem AY2324Document5 pagesFAR-03-Inventories-2nd Sem AY2324Nanase SenpaiNo ratings yet

- Activity Audit in InventoryDocument4 pagesActivity Audit in InventoryKizzea Bianca GadotNo ratings yet

- Audit of Asingan Corporation Financial StatementsDocument4 pagesAudit of Asingan Corporation Financial StatementsKizzea Bianca GadotNo ratings yet

- College of Accountancy and Business Administration: Quiz: Intermediate Accounting 1Document5 pagesCollege of Accountancy and Business Administration: Quiz: Intermediate Accounting 1BSA 1BRICHELL ASHLEY M. PAGADUANNo ratings yet

- Chapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentDocument21 pagesChapter 31 - Lower of Cost and Net Realizable Value: Purchase CommitmentKimberly Claire Atienza100% (5)

- Audit of InventoriesDocument4 pagesAudit of InventoriesVel JuneNo ratings yet

- Problem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Document9 pagesProblem15 The Cost of Inventory of Coffee Beans 1,850,000 LCRNV 50,000Kyle Vincent SaballaNo ratings yet

- PRC AUD Prelim Wit Ans KeyDocument10 pagesPRC AUD Prelim Wit Ans KeyJeanette FormenteraNo ratings yet

- Intermediate 1A: Problem CompilationDocument24 pagesIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- Audit of Inventory ProblemsDocument2 pagesAudit of Inventory ProblemsZeeNo ratings yet

- ACt1104 Final Quiz No. 1wit AnsDocument7 pagesACt1104 Final Quiz No. 1wit AnsDyenNo ratings yet

- QuizDocument15 pagesQuizMark Domingo Mendoza100% (1)

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- Inventory LatojaDocument2 pagesInventory Latojalisa juganNo ratings yet

- Funamentals of Acct - II - Chapter 1 InventoriesDocument47 pagesFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- A Practical Guide to Forecasting Financial Market VolatilityFrom EverandA Practical Guide to Forecasting Financial Market VolatilityNo ratings yet

- Quick Guide To Final Witholding Tax (Indi and Corp)Document3 pagesQuick Guide To Final Witholding Tax (Indi and Corp)Juvy LynNo ratings yet

- COSTAC Quiz 1 Font 10 1st YrDocument2 pagesCOSTAC Quiz 1 Font 10 1st YrRikka TakanashiNo ratings yet

- CH 5 Answers 2014 PDFDocument6 pagesCH 5 Answers 2014 PDFDenise Villanueva100% (1)

- Chapter 1 Concept and ApplicationsDocument11 pagesChapter 1 Concept and ApplicationsRikka TakanashiNo ratings yet

- Cost Accounting (De Leon) Chapter 3 SolutionsDocument9 pagesCost Accounting (De Leon) Chapter 3 SolutionsLois Alveez Macam85% (26)

- Non-Current Assets Held For Sale and Discontinued OperationsDocument20 pagesNon-Current Assets Held For Sale and Discontinued OperationsKryztel BranzuelaNo ratings yet

- 2016 Vol 3 CH 1 AnsDocument2 pages2016 Vol 3 CH 1 AnsRikka TakanashiNo ratings yet

- Necessary Fictions: Philippine Literature and The Nation, 1946-1980Document5 pagesNecessary Fictions: Philippine Literature and The Nation, 1946-1980Hannah GomezNo ratings yet

- Must Try Pivot Exercise HouseSalesDocument11 pagesMust Try Pivot Exercise HouseSalesmoira libresNo ratings yet

- ISSUESPOLICIESDocument4 pagesISSUESPOLICIESRikka TakanashiNo ratings yet

- HandoutDocument3 pagesHandoutRikka TakanashiNo ratings yet

- Functions in MS ExcelDocument11 pagesFunctions in MS ExcelRikka TakanashiNo ratings yet

- Chapter 1-Introduction To Cost Management: Learning ObjectivesDocument15 pagesChapter 1-Introduction To Cost Management: Learning Objectivesshineshoujo100% (1)

- Costacc HWDocument2 pagesCostacc HWRikka Takanashi100% (1)

- Revenue From Contracts With Customers: Ifrs 15Document62 pagesRevenue From Contracts With Customers: Ifrs 15Quennie Riva CuaresmaNo ratings yet

- Accounting For Labor CostsDocument15 pagesAccounting For Labor CostsRikka TakanashiNo ratings yet

- 1economics Institutions and Development A Global PerspectiveDocument22 pages1economics Institutions and Development A Global PerspectiveRikka TakanashiNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument18 pagesAccounting Policies, Changes in Accounting Estimates and ErrorscindhyNo ratings yet

- 1Document1 page1Rikka TakanashiNo ratings yet

- 1economics Institutions and Development A Global PerspectiveDocument22 pages1economics Institutions and Development A Global PerspectiveRikka TakanashiNo ratings yet

- 1economics Institutions and Development A Global PerspectiveDocument22 pages1economics Institutions and Development A Global PerspectiveRikka TakanashiNo ratings yet

- Permut CombinDocument10 pagesPermut CombinRikka TakanashiNo ratings yet

- ExamDocument2 pagesExamRikka TakanashiNo ratings yet

- OM Blog Template As of August 13 2018 - Chapters 1 To 5Document8 pagesOM Blog Template As of August 13 2018 - Chapters 1 To 5Rikka TakanashiNo ratings yet

- Co VarianceDocument7 pagesCo VarianceRikka TakanashiNo ratings yet

- Ferdinand Magellan's Historic Voyage Around the WorldDocument3 pagesFerdinand Magellan's Historic Voyage Around the WorldRikka TakanashiNo ratings yet

- ProportionDocument4 pagesProportionRikka TakanashiNo ratings yet

- GROUP 2 Development For Mental Health AwarenessDocument15 pagesGROUP 2 Development For Mental Health AwarenessRikka TakanashiNo ratings yet

- Group#1 Fundamentals of Group DynamicsDocument18 pagesGroup#1 Fundamentals of Group DynamicsRikka Takanashi100% (4)

- Assignment Number 2Document4 pagesAssignment Number 2Elson TalotaloNo ratings yet

- Republic vs. Roque - JD1ADocument4 pagesRepublic vs. Roque - JD1AQueenie Boado100% (1)

- Datasheet - CI 7432Document5 pagesDatasheet - CI 7432Alexandre NettoNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- Power Semiconductor Devices ClassificationDocument9 pagesPower Semiconductor Devices ClassificationdevchandarNo ratings yet

- Ball ValveDocument12 pagesBall ValveIdabaNo ratings yet

- National Power Corporation vs Philipp Brothers Oceanic Ruling on Moral DamagesDocument2 pagesNational Power Corporation vs Philipp Brothers Oceanic Ruling on Moral DamagesRandy SiosonNo ratings yet

- L27 - Optical Measuring InstrumentsDocument14 pagesL27 - Optical Measuring Instrumentschaitanyamohod2020No ratings yet

- Fire Resistance UL 1709Document2 pagesFire Resistance UL 1709ednavilod100% (3)

- Signed-Off Komunikasyon-at-Pananaliksik11 q1 m2 - Konseptong-Pangwika v3 PDFDocument24 pagesSigned-Off Komunikasyon-at-Pananaliksik11 q1 m2 - Konseptong-Pangwika v3 PDFChristian Ocon100% (1)

- Forms6i 10GDocument42 pagesForms6i 10GRolando OcañaNo ratings yet

- Study Guide Rev08242018Document188 pagesStudy Guide Rev08242018chong pak limNo ratings yet

- MD Anderson Medical Oncology 4th Edition 2022Document1,694 pagesMD Anderson Medical Oncology 4th Edition 2022Iskandar414100% (6)

- Empowerment Technologies Week 1-2 - Final Term: Prepared By: Mr. Jake Indico Edited By: Ms. Shaira G. RaquilDocument5 pagesEmpowerment Technologies Week 1-2 - Final Term: Prepared By: Mr. Jake Indico Edited By: Ms. Shaira G. RaquilJustine Evasco RubiaNo ratings yet

- Stolle Cupping Systems: ConnectingDocument2 pagesStolle Cupping Systems: ConnectingHieu NguyenNo ratings yet

- Notaries Act 1999 rules for Dutch notariesDocument45 pagesNotaries Act 1999 rules for Dutch notariesAnt1603No ratings yet

- 802 11 Qos OverviewDocument38 pages802 11 Qos Overviewswapnil tiwariNo ratings yet

- PR100 Locks With Aperio Wireless Technology: Key FeaturesDocument2 pagesPR100 Locks With Aperio Wireless Technology: Key FeaturesMay SamboNo ratings yet

- Motor Vehicles and Road Traffic Regulation 48.50Document411 pagesMotor Vehicles and Road Traffic Regulation 48.50Clayton AllenNo ratings yet

- Haslinda Mohd Anuar Senior Lecturer School of Law ColgisDocument24 pagesHaslinda Mohd Anuar Senior Lecturer School of Law ColgisSHAHEERANo ratings yet

- CSC V CADocument2 pagesCSC V CAAllen GrajoNo ratings yet

- +1 TM Slow Learner Material For Reduced Portion 2021-22Document55 pages+1 TM Slow Learner Material For Reduced Portion 2021-22Prasanth Prasanth100% (2)

- PCD Notes - Unit - 1Document15 pagesPCD Notes - Unit - 1Jaga DeesanNo ratings yet

- Thk2e BrE L3 Vocabulary Standard Unit 3Document2 pagesThk2e BrE L3 Vocabulary Standard Unit 3Suki ChuahNo ratings yet

- Databases 2 Exercise Sheet 4Document2 pagesDatabases 2 Exercise Sheet 4Shivam ShuklaNo ratings yet

- Blockchain For IBMers - Eng Model v2.01Document25 pagesBlockchain For IBMers - Eng Model v2.01ayanmukherjee1No ratings yet

- Sand Patch TestDocument5 pagesSand Patch TestgreatpicNo ratings yet

- Cbam Faq 1701387432Document34 pagesCbam Faq 1701387432zamarrillaNo ratings yet

- Walmart Drug ListDocument6 pagesWalmart Drug ListShirley Pigott MDNo ratings yet

- GT Protection Type TestDocument24 pagesGT Protection Type Testashwani2101100% (1)