Professional Documents

Culture Documents

Audit of Inventory Problems

Uploaded by

ZeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Inventory Problems

Uploaded by

ZeeCopyright:

Available Formats

UL COA

ACC412/415: AUDITING PROBLEMS

AUDIT OF INVENTORY

PROBLEM 1

The Maria Company is a wholesale distributor of automotive replacement parts. Initial amounts taken from Maria’s

accounting records are as follows:

Inventory at December 31, 2018 (based on physical count of goods

in Maria’s warehouse on December 31, 2018) P1,250,000

Accounts payable at December 31, 2018:

Vendor Terms Amount

Baker Company 2%/10 days, net 30 P265,000

Charlie Company net 30 210,000

Dolly Company net 30 300,000

Eager Company net 30 225,000

Full Company net 30 -

Greg Company net 30 -

P1,000,000

Sales in 2018 P9,000,000

Additional information:

1. Parts held on consignment from Charlie to Allen, the consignee, amounting to P155,000, were included in the

physical count of goods in Allen’s warehouse on December 31, 2018.

2. P22,000 of parts which were purchased from Full and paid for in December 2018 sold in the last week of 2018

and appropriately recorded as sales of P28,000. The parts were included in the physical count of goods in

Allen’s warehouse on December 31, 2018, because the parts were on the loading dock waiting to the picked up

by customers.

3. Parts in transit on December 31, 2018, to customers, shipped F.O.B. shipping point, on December 28, 2018,

amounted to P34,000. The customers received the parts on January 2, 2019. Sales of P40,000 to the

customers for the parts were recorded by Allen on January 2, 2019.

4. Retailers were holding P210,000 at cost (P250,000 at retail), of goods on consignment from Allen, the

consignor, at their stores on December 31, 2019.

5. Goods were in transit from Greg to Allen on December 31, 2018. The cost of the goods was, P25,000, and they

were shipped F.O.B. shipping point on December 29, 2018.

6. A quarterly freight bill in the amount of P2,000 specifically relating to merchandise purchases in December

2018, all of which was still in the inventory at December 31, 2018, was received on January 3, 2019. The freight

bill was not included in either the inventory or in accounts payable at December 31, 2018.

7. All of the purchases from Baker occurred during the last seven days of the year. These items have been

recorded in accounts payable and accounted for in the physical inventory at cost before discount. Allen’s policy

is to pay invoices in time to take advantage of all cash discounts, adjust inventory accordingly, and record

accounts payable, net of cash discounts.

Required: Prepare a schedule of adjustments to the initial amounts using the format shown below. Show the effect, if

any, of each of the transactions separately and if the transactions would have no effect on the amount shown, state

NONE.

Inventory Accounts Payable Sales

Initial amounts P1,250,000 P1,000,000 P9,000,000

Adjustments –

Increase (Decrease)

1 (155,000) NONE NONE

2 (22,000) NONE NONE

3 NONE NONE 40,000

4 210,000 NONE NONE

5 25,000 25,000 NONE

6 2,000 2,000 NONE

7 NONE (5,300) NONE

Total adjustments 60,000 21,700 40,000

Adjusted amounts P1,310,000 .P1,021,700 P9,040,000

UL COA

ACC412/415: AUDITING PROBLEMS

PROBLEM 2 (HIGHLIGHT YOUR ANSWER)

You are engaged in an audit of the Roche Mfg. Company for the year ended December 31, 2019. To reduce the

workload at year end, the company took its annual physical inventory under your observation on November 30, 2019.

The company’s inventory account, which includes raw materials and work in process, is on a perpetual basis, and it uses

the FIFO method of pricing. It has no finished goods inventory. The company’s physical inventory revealed that the book

inventory of P 60,570 was understated by P 3,000. To avoid distorting the interim financial statements, the company

decided not to adjust the book inventory until year-end except for obsolete inventory items. Your audit revealed this

information about the November 30 inventory:

a. Pricing tests showed that the physical inventory was overpriced by P 2,200.

b. Footing and extension errors resulted in a P150 understatement of the physical inventory.

c. Direct labor included in the physical inventory amounted to P10, 000. Overhead was included at the rate of 200

% of direct labor. You determined that the amount for direct labor was correct and the overhead rate was proper.

d. The physical inventory included obsolete materials recorded at P250. During December, these materials were

removed from the inventory account by a charge to cost of sales.

Your audit also discloses the following information about the December 31, 2019 inventory.

a. Total debits to certain accounts during December are

Purchases P24,700

Direct Labor 12,100

Manufacturing overhead expense 25,200

Cost of Sales 68,600

f. The cost of sales of P68, 600 included direct labor of P13,800.

g. Normal scrap loss on established product lines is negligible. However, a special order started and completed

during December had excessive scrap loss of P800, which was charged to Manufacturing Overhead Expense.

1. The corrected physical inventory on November 30, 2019 is:

a. P63,720 c. P61,520

b. P61,270 d. P63,570

2. Assume that the correct amount of physical inventory on November 30, 2019 was P57,700. What is the inventory

on December 31, 2019?

a. P52,400 c. P49,550

b. P24,900 d. P49,300

3. Which of the following is not one of the independent auditor's objectives regarding the examination of inventories?

a. Verifying that inventory counted is owned by the client

b. Verifying that the client has used proper inventory pricing

c. Ascertaining the physical quantities of inventory on hand

d. Verifying that all inventory owned by the client is on hand at the time of the count.

4. The auditors will usually trace the details of the test counts made during the observation of the physical inventory

taking to a final inventory schedule. This audit procedure is undertaken to provide evidence that items physically

present and observed by the auditors at the time of the physical inventory count are:

a. Owned by the client

b. Not obsolete

c. Physically present at the time of the preparation of the final inventory schedule

d. Included in the final inventory schedule

5. Which of the following is not a reason for the special significance attached by the auditors to the verification of

inventories?

a. The determination of inventory valuation directly affects net income

b. The existence of inventories is inherently difficult to substantiate

c. Special valuation problems often exist for inventories

d. Inventories are often the largest current asset of an enterprise

You might also like

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Document11 pagesCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- CPA REVIEW: Calculating Depreciation and Estimated LiabilityDocument41 pagesCPA REVIEW: Calculating Depreciation and Estimated LiabilityalellieNo ratings yet

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- ConsolidatedDocument18 pagesConsolidatedjikee11No ratings yet

- AUDP DIS02 Receivables Key-AnswersDocument7 pagesAUDP DIS02 Receivables Key-AnswersKristina KittyNo ratings yet

- Finals SWDocument115 pagesFinals SWAira Jaimee GonzalesNo ratings yet

- Land & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleDocument4 pagesLand & Building Cost Adjustments"TITLE "Machinery Depreciation Calculation" TITLE "Factory Equipment Impairment Analysis"TITLE "Mining Property Depletion & Depreciation ScheduleLlyod Francis LaylayNo ratings yet

- Midterm Exam KeyDocument5 pagesMidterm Exam KeyRiña Lizte AlteradoNo ratings yet

- Audit of Ppe ModuleDocument19 pagesAudit of Ppe ModuleEunice Enriquez100% (4)

- Page Comprehensive Theories and ProblemsDocument7 pagesPage Comprehensive Theories and Problemsharley_quinn11No ratings yet

- Problem 5: QuestionsDocument6 pagesProblem 5: QuestionsTk KimNo ratings yet

- Set ADocument5 pagesSet ASomersNo ratings yet

- CHAPTER 10 - Pre-Board Examinations-1Document35 pagesCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNo ratings yet

- Measurement of Inventory and Inventory Shortage5Document3 pagesMeasurement of Inventory and Inventory Shortage5CJ alandyNo ratings yet

- AP.1901 Inventories.Document8 pagesAP.1901 Inventories.Erlinda Esguerra Guiang100% (9)

- Quizzer Answers KeyDocument4 pagesQuizzer Answers KeyDaneen GastarNo ratings yet

- Exercises: Financial Accounting and ReportingDocument6 pagesExercises: Financial Accounting and ReportingIvy NisorradaNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- AP Problems 2016Document26 pagesAP Problems 2016RosejaneLim100% (1)

- Audit of PPE 2Document2 pagesAudit of PPE 2Raz MahariNo ratings yet

- RecvbleDocument24 pagesRecvbleJoseph Salido100% (1)

- INVESTMENTS inDocument7 pagesINVESTMENTS inJessa May MendozaNo ratings yet

- Auditing ProblemsDocument6 pagesAuditing ProblemsMaurice AgbayaniNo ratings yet

- Adjusted financials for HONESTY CORPORATIONDocument3 pagesAdjusted financials for HONESTY CORPORATIONAireyNo ratings yet

- Audit of Cash PDFDocument3 pagesAudit of Cash PDFVincent SampianoNo ratings yet

- ApaDocument2 pagesApaPaula Villarubia100% (1)

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Auditing Problems MC Quizzer 05Document5 pagesAuditing Problems MC Quizzer 05Aibhy Cacho YapNo ratings yet

- Petty Cash Audit and Bank ReconciliationDocument50 pagesPetty Cash Audit and Bank ReconciliationJohn Lloyd Yasto100% (1)

- AudcisDocument6 pagesAudcisJessa May MendozaNo ratings yet

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDocument8 pagesEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNo ratings yet

- Audit Ar With SolutionsDocument14 pagesAudit Ar With Solutionsbobo kaNo ratings yet

- Cash and Cash EquivDocument8 pagesCash and Cash EquivMonina Cabalag0% (1)

- Auditing Problems PPE Self-Construction CostsDocument17 pagesAuditing Problems PPE Self-Construction CostsMakiri Sajili II50% (2)

- Auditing Problems Ocampo/Soliman/Ocampo AP.2905-Audit of Receivables OCTOBER 2020Document7 pagesAuditing Problems Ocampo/Soliman/Ocampo AP.2905-Audit of Receivables OCTOBER 2020moNo ratings yet

- Solution AP Test Bank 2Document9 pagesSolution AP Test Bank 2imaNo ratings yet

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Audit Problem UzDocument7 pagesAudit Problem UzRaies JumawanNo ratings yet

- Audit of Inventories Roque 2018Document61 pagesAudit of Inventories Roque 2018Anna TaylorNo ratings yet

- Problem NoDocument19 pagesProblem Notery100% (3)

- 4 - Audit of InvestmentsDocument11 pages4 - Audit of InvestmentsSharmaine Clemencio0No ratings yet

- Audit Problem Inventories AnswerDocument6 pagesAudit Problem Inventories AnswerJames PaulNo ratings yet

- APPLIED AUDITING PRELIM EXAMDocument9 pagesAPPLIED AUDITING PRELIM EXAMChristopher NogotNo ratings yet

- Tiger Corporation (Contributed by Oliver C. Bucao)Document4 pagesTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaNo ratings yet

- Problem 1: University of San Jose-Recoletos Auditing ProblemsDocument9 pagesProblem 1: University of San Jose-Recoletos Auditing ProblemsPaul Doroin100% (1)

- Audit of Liabilities Problem No. 1: Auditing ProblemsDocument8 pagesAudit of Liabilities Problem No. 1: Auditing ProblemsSailah DimakutaNo ratings yet

- College: of Business AdministrationDocument5 pagesCollege: of Business AdministrationAna Mae HernandezNo ratings yet

- Comprehensive Audit Problem (Julie&Angelo)Document8 pagesComprehensive Audit Problem (Julie&Angelo)Julie Ann Pili100% (3)

- Audit of Inventory ProblemsDocument3 pagesAudit of Inventory Problemsmarili ZarateNo ratings yet

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Document6 pagesProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- AP03 Audit of Inventories QDocument6 pagesAP03 Audit of Inventories Qbobo kaNo ratings yet

- Ap 17 PDFDocument5 pagesAp 17 PDFPdf FilesNo ratings yet

- Development For ProductionDocument6 pagesDevelopment For Productiongazer beamNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- QuizDocument15 pagesQuizMark Domingo Mendoza100% (1)

- Audit of InventoriesDocument4 pagesAudit of InventoriesVel JuneNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- M2.3e Diy-Problems (Answer Key)Document7 pagesM2.3e Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- Annoyance Synonyms and CausesDocument7 pagesAnnoyance Synonyms and CausesZeeNo ratings yet

- Operating Activities Cash Flow GuideDocument4 pagesOperating Activities Cash Flow GuideZeeNo ratings yet

- Final Intermediate 1 2015 2016Document10 pagesFinal Intermediate 1 2015 2016ZeeNo ratings yet

- Answers Quiz Chapter 4Document4 pagesAnswers Quiz Chapter 4Anthony MartinezNo ratings yet

- Lower of Cost or Net Realizable ValueDocument2 pagesLower of Cost or Net Realizable ValueZeeNo ratings yet

- Operating Activities Cash Flow GuideDocument4 pagesOperating Activities Cash Flow GuideZeeNo ratings yet

- Teacher Caroline Intro QuestionsDocument9 pagesTeacher Caroline Intro QuestionsZeeNo ratings yet

- Fill in The Blank (Checklist MAX)Document2 pagesFill in The Blank (Checklist MAX)ZeeNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- Halloween TriviasDocument3 pagesHalloween TriviasZeeNo ratings yet

- Mock Board Exam for Advanced Financial AccountingDocument15 pagesMock Board Exam for Advanced Financial AccountingirishjadeNo ratings yet

- Answers Quiz Chapter 4Document4 pagesAnswers Quiz Chapter 4Anthony MartinezNo ratings yet

- PAS 2 INVENTORIES SUMMARYDocument7 pagesPAS 2 INVENTORIES SUMMARYNhicoleChoiNo ratings yet

- Level Test Report for Anna Shows Progress in English SkillsDocument4 pagesLevel Test Report for Anna Shows Progress in English SkillsZeeNo ratings yet

- Audit PPE Transactions and Calculate Land and Building AccountsDocument4 pagesAudit PPE Transactions and Calculate Land and Building AccountsZeeNo ratings yet

- VIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingDocument11 pagesVIRAY, NHICOLE S. Midterm Exam in Acc417 - Acc412 - Refresher - For PostingZeeNo ratings yet

- VIRAY, NHICOLE S. Asset - PPE - 1 - For PostingDocument4 pagesVIRAY, NHICOLE S. Asset - PPE - 1 - For PostingZeeNo ratings yet

- p2 - Guerrero Ch7Document35 pagesp2 - Guerrero Ch7JerichoPedragosa66% (38)

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- T AccountsDocument2 pagesT AccountsZeeNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsDocument5 pagesViray, Nhicole S. Asynchronous Quiz 2 - Accounting Changes and ErrorsZeeNo ratings yet

- Summary of Significant Findings-1Document3 pagesSummary of Significant Findings-1ZeeNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Coa Dof DBM - JC4 86 ADocument15 pagesCoa Dof DBM - JC4 86 AZyki Zamora LacdaoNo ratings yet

- Unilever Annual Report and Accounts 2018 - tcm244 534881 - en PDFDocument173 pagesUnilever Annual Report and Accounts 2018 - tcm244 534881 - en PDFDale burlatNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- 4 5 Questionnaire REVISEDDocument105 pages4 5 Questionnaire REVISEDZeeNo ratings yet

- Apple SummaryDocument6 pagesApple SummaryZeeNo ratings yet

- Asking and Giving OpinionsDocument2 pagesAsking and Giving OpinionsZeeNo ratings yet

- Jurisprudence: by Mary Jane L. Molina RPH, MspharmDocument17 pagesJurisprudence: by Mary Jane L. Molina RPH, MspharmRofer ArchesNo ratings yet

- FAQ's For Web 7 AugustDocument4 pagesFAQ's For Web 7 AugustChayan KocharNo ratings yet

- I Twin Technology11 PDFDocument14 pagesI Twin Technology11 PDFChandhanNo ratings yet

- Arta Bilali ZendeliDocument14 pagesArta Bilali ZendeliBashir KanumaNo ratings yet

- Damasco - Cpi - Activity No. 11Document7 pagesDamasco - Cpi - Activity No. 11LDCU - Damasco, Erge Iris M.100% (1)

- Acca Timetable June 2024Document13 pagesAcca Timetable June 2024Anish SinghNo ratings yet

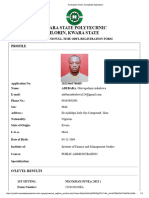

- Kwarapoly Portal - Completed ApplicationDocument3 pagesKwarapoly Portal - Completed ApplicationosinoluwatosinNo ratings yet

- Constitutional Law II Digest on Poe vs. Comelec and TatadDocument49 pagesConstitutional Law II Digest on Poe vs. Comelec and TatadMica Joy FajardoNo ratings yet

- Water Resources in TamilnaduDocument4 pagesWater Resources in TamilnaduVignesh AngelNo ratings yet

- Assignment 3: Research Reflection PaperDocument9 pagesAssignment 3: Research Reflection PaperDang HuynhNo ratings yet

- Bank Asia - Annual Report - 2017 PDFDocument405 pagesBank Asia - Annual Report - 2017 PDFFahim KhanNo ratings yet

- India Cement IndustryDocument2 pagesIndia Cement IndustryLayana SekharNo ratings yet

- Notification No.54/2021 - Customs (N.T.) : Schedule-IDocument3 pagesNotification No.54/2021 - Customs (N.T.) : Schedule-Ianil nayakanahattiNo ratings yet

- Jesus - Who Is He?Document8 pagesJesus - Who Is He?Sam ONiNo ratings yet

- Resume-Roberta Strange 2014Document3 pagesResume-Roberta Strange 2014Jamie RobertsNo ratings yet

- BCG (Task 2 Additional Data) - VIPULDocument13 pagesBCG (Task 2 Additional Data) - VIPULvipul tutejaNo ratings yet

- The Value of Cleanliness in The View of The Students of Two Higher Education InstitutionsDocument7 pagesThe Value of Cleanliness in The View of The Students of Two Higher Education InstitutionsjueNo ratings yet

- Extreme TourismDocument2 pagesExtreme TourismRodrigo RezendeNo ratings yet

- Finland's Top-Ranking Education SystemDocument6 pagesFinland's Top-Ranking Education Systemmcrb_19100% (2)

- ICAR IARI 2021 Technician T1 Recruitment NotificationDocument38 pagesICAR IARI 2021 Technician T1 Recruitment NotificationJonee SainiNo ratings yet

- Asme Sec I A2001Document4 pagesAsme Sec I A2001Sidney LinsNo ratings yet

- Tower Heist PDFDocument1 pageTower Heist PDFFawziah SelamatNo ratings yet

- CO2 Adsorption On Turkish CoalsDocument133 pagesCO2 Adsorption On Turkish CoalsMaria De La HozNo ratings yet

- The Global Diamond Industry: So-Young Chang MBA '02Document17 pagesThe Global Diamond Industry: So-Young Chang MBA '02Pratik KharmaleNo ratings yet

- WebpdfDocument343 pagesWebpdfRahma AbdullahiNo ratings yet

- Ethical Relations Among Parties in Scientific Research: Johnmark ErigbeDocument10 pagesEthical Relations Among Parties in Scientific Research: Johnmark Erigbetheijes100% (1)

- Business Intelligence For Small Enterprises: An Open Source ApproachDocument46 pagesBusiness Intelligence For Small Enterprises: An Open Source Approachrstml100% (1)

- Undertaking Form For Shifters and TransfereesDocument1 pageUndertaking Form For Shifters and TransfereesAngela JingcoNo ratings yet

- SY 2020-2021 Region IV-A (Visually Impairment)Document67 pagesSY 2020-2021 Region IV-A (Visually Impairment)Kristian Erick BautistaNo ratings yet

- From Modernism To Post Modernism - Net PDFDocument40 pagesFrom Modernism To Post Modernism - Net PDFshrabana chatterjeeNo ratings yet