Professional Documents

Culture Documents

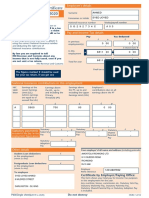

Solar Tax Sales and Use Tax Exemption Form

Uploaded by

Cara MatthewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solar Tax Sales and Use Tax Exemption Form

Uploaded by

Cara MatthewsCopyright:

Available Formats

Publication 718CS

(5/13)

Local Sales and Use Tax Rates on Sales and Installations of Commercial Solar Energy Systems Equipment

Effective June 1, 2013

Recently enacted legislation provides an exemption from New York State sales and use tax on the retail sale and installation of commercial solar energy systems equipment. See TSBM12(14)S, Sales and Use Tax Exemption for the Sale and Installation of Commercial Solar Energy Systems Equipment. The retail sale and installation of commercial solar energy equipment are exempt from the 4% New York State sales and use tax rate and the 3/8% sales and use tax rate imposed in the Metropolitan Commuter Transportation District (MCTD). Purchases are exempt from local sales and use taxes only if the jurisdiction specifically enacts the exemption. This publication provides a listing of the local sales and use tax rates for retail sales and installations of commercial solar energy systems equipment. It will be updated when local rate changes occur or when jurisdictions enact or repeal the exemption. Any items changed from the previous version are noted in boldface italics.

Part 1 Jurisdictions that do not provide the exemption for commercial solar energy systems equipment

Purchases and uses occurring in the jurisdictions listed below are subject to tax at the rate shown. Taxing jurisdiction

Albany County Allegany County Cattaraugus County (outside the following) Olean (city) Salamanca (city) Cayuga County (outside the following) Auburn (city) Chautauqua County Chemung County Chenango County (outside the following) Norwich (city) Clinton County Columbia County Cortland County Delaware County Dutchess County Erie County Essex County Franklin County Fulton County (outside the following) Gloversville (city) Johnstown (city) Genesee County Greene County Hamilton County Herkimer County Jefferson County Lewis County Livingston County Madison County (outside the following) Oneida (city) Monroe County Montgomery County Nassau County Niagara County Oneida County (outside the following) Rome (city) Utica (city)

Tax rate %

4 4 4 4 4 4 4 3 4 4 4 4 4 4 4 3 4 3 4 4 4 4 4 4 3 4 3 3 4 4 4 4 4 4 4 4 4 4

Taxing jurisdiction

Onondaga County Ontario County Orange County Orleans County Oswego County (outside the following) Oswego (city) Otsego County Putnam County Rensselaer County St. Lawrence County Saratoga County (outside the following) Saratoga Springs (city) Schenectady County Schoharie County Schuyler County Seneca County Steuben County (outside the following) Corning (city) Hornell (city) Sullivan County Tioga County Tompkins County (outside the following) see Part 2 Ithaca (city) Warren County (outside the following) Glens Falls (city) Washington County Wayne County Westchester County (outside the following) Mount Vernon (city) New Rochelle (city) White Plains (city) Yonkers (city) Wyoming County Yates County New York City

Tax rate %

4 3 3 4 4 4 4 4 4 3 3 3 4 4 4 4 4 4 4 4 4 1 3 3 3 4 3 4 4 4 4 4 4 4

Publication 718-CS (5/13) (back)

Part 2 Jurisdictions that provide the exemption for commercial solar energy systems equipment

Taxing jurisdiction

Broome County Rockland County Suffolk County Tompkins County (outside the following) Ithaca (city) see Part 1 Ulster County

Purchases and uses occurring in the jurisdictions listed below are exempt from New York State and local sales and use taxes. Tax rate %

0 0 0 0 0

See Publication 718-S, Local Sales and Use Tax Rates on Sales and Installations of Residential Solar Energy Systems Equipment, for a listing of local rates applicable to that exemption.

Need help?

Visit our Web site at www.tax.ny.gov

Telephone assistance Sales Tax Information Center: To order forms and publications: (518) 485-2889 (518) 457-5431

get information and manage your taxes online check for new online services and features

Text Telephone (TTY) Hotline (for persons with hearing and speech disabilities using a TTY): If you have access to a TTY, contact us at (518) 485-5082. If you do not own a TTY, check with independent living centers or community action programs to find out where machines are available for public use.

Persons with disabilities: In compliance with the Americans with Disabilities Act, we will ensure that our lobbies, offices, meeting rooms, and other facilities are accessible to persons with disabilities. If you have questions about special accommodations for persons with disabilities, call the information center.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Ossining Board of Education ResolutionDocument1 pageOssining Board of Education ResolutionCara MatthewsNo ratings yet

- Theracare AuditDocument31 pagesTheracare AuditCeleste KatzNo ratings yet

- Apology Letters by Robert Potanovic and Potanovic SonsDocument2 pagesApology Letters by Robert Potanovic and Potanovic SonsCara MatthewsNo ratings yet

- 2013 PenniesDocument144 pages2013 PenniesAmanda JordanNo ratings yet

- Putnam County Industrial Development AgencyDocument25 pagesPutnam County Industrial Development AgencyCara MatthewsNo ratings yet

- New York Library Association 2014 Budget Talking PointsDocument1 pageNew York Library Association 2014 Budget Talking PointsCara MatthewsNo ratings yet

- Villages in Financial Distress, Fiscal Years Ending 2013, February 2014Document1 pageVillages in Financial Distress, Fiscal Years Ending 2013, February 2014Cara MatthewsNo ratings yet

- Mount Pleasant AuditDocument14 pagesMount Pleasant AuditCara MatthewsNo ratings yet

- 2013 Annual Report To Congress Executive SummaryDocument76 pages2013 Annual Report To Congress Executive SummaryKelly Phillips ErbNo ratings yet

- Putnam County CandidatesDocument4 pagesPutnam County CandidatesCara MatthewsNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Vendor Side Trasactions WorkflowDocument9 pagesVendor Side Trasactions WorkflowVivek TripathiNo ratings yet

- IRS Issues Guidance On State Tax Payments To Help TaxpayersDocument2 pagesIRS Issues Guidance On State Tax Payments To Help TaxpayersMeaghan BellavanceNo ratings yet

- 208 Wise V MeerDocument1 page208 Wise V Meeragnes13No ratings yet

- Heathify PremiumDocument1 pageHeathify PremiumdishandshahNo ratings yet

- Filling Penalties and Remedies CparDocument7 pagesFilling Penalties and Remedies CparGelyn CruzNo ratings yet

- Authorise Agent 64-8Document3 pagesAuthorise Agent 64-8Hannah LeedhamNo ratings yet

- Case 2 Miguel J. Osorio Pension Foundation vs. CADocument2 pagesCase 2 Miguel J. Osorio Pension Foundation vs. CAlenvfNo ratings yet

- Self-Declaration Form To Avail CPE Hours Credit For Unstructured Learning Activities For The Calendar Year 2013Document3 pagesSelf-Declaration Form To Avail CPE Hours Credit For Unstructured Learning Activities For The Calendar Year 2013manishNo ratings yet

- Solution Manual For Pearsons Federal Taxation 2019 Corporations Partnerships Estates and Trusts 32nd Edition Timothy J Rupert Kenneth e Anderson 48Document8 pagesSolution Manual For Pearsons Federal Taxation 2019 Corporations Partnerships Estates and Trusts 32nd Edition Timothy J Rupert Kenneth e Anderson 48initiate.papesdb4p5100% (12)

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDocument69 pagesBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- Taxation Law Case Doctrines (4DF1920)Document45 pagesTaxation Law Case Doctrines (4DF1920)roigtcNo ratings yet

- Metropolis Town Villa Cost SheetDocument1 pageMetropolis Town Villa Cost SheetpreanandNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- First Solar Inc. Ratio ComparisonsDocument7 pagesFirst Solar Inc. Ratio ComparisonsSameer ChoudharyNo ratings yet

- Indian Tax ManagmentDocument242 pagesIndian Tax ManagmentSandeep SandyNo ratings yet

- Revenue Memorandum Circular No. 45-01Document1 pageRevenue Memorandum Circular No. 45-01rnrbacNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Post Office DepositsDocument6 pagesAssignment of Security Analysis & Portfolio Management On Post Office DepositsShubhamNo ratings yet

- Tata Consultancy PayslipDocument2 pagesTata Consultancy PayslipSitharth VkrNo ratings yet

- Analysis of Rates For Pacca Brick WorkDocument1 pageAnalysis of Rates For Pacca Brick WorkMujahid ChishtiNo ratings yet

- Dashboard For Ebitda Analysis InvestmentsDocument41 pagesDashboard For Ebitda Analysis InvestmentsDiyanaNo ratings yet

- IRC Codes and RegulationsDocument34 pagesIRC Codes and RegulationsWilly BeaminNo ratings yet

- Amontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20Document1 pageAmontola Richmond LTD - Form P60 - SYED JOYED AHMED - 19-20shamiaNo ratings yet

- K Municipal Plan. & Dev. Coordinator KDocument32 pagesK Municipal Plan. & Dev. Coordinator KMary Jane Katipunan CalumbaNo ratings yet

- Michigan Property Assessment FormDocument2 pagesMichigan Property Assessment FormIsabelle PasciollaNo ratings yet

- TAX-402: Percentage TAX (P 2) : - T R S ADocument5 pagesTAX-402: Percentage TAX (P 2) : - T R S AEira ShaneNo ratings yet

- Side Letter Exhibits 03152013 PDFDocument9 pagesSide Letter Exhibits 03152013 PDFNeshaminyNo ratings yet

- Customs, Excise and GST Full MaterialDocument55 pagesCustoms, Excise and GST Full MaterialramNo ratings yet

- Tax 2 - Output VAT (Regular Sales) .PPTX Version 1Document38 pagesTax 2 - Output VAT (Regular Sales) .PPTX Version 1EmersonNo ratings yet

- IF23050633774478 InvoiceDocument1 pageIF23050633774478 InvoiceAnshum GuptaNo ratings yet

- TDS Section ListDocument3 pagesTDS Section Listprince vadgamaNo ratings yet