Professional Documents

Culture Documents

Taxation Review - Midterms Coverage

Uploaded by

Aicka Bustamante SingsonOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation Review - Midterms Coverage

Uploaded by

Aicka Bustamante SingsonCopyright:

Available Formats

Multiple Choice 1. Systems of Income Tax A.

Global One where the taxpayer is required to lump all of the items of income earned during a taxable period and pay under a single set of tax rules on different items of income. B. Progressive Tax System Income tax in the Philippines is a progressive tax, as people with higher incomes pay more than people with lower incomes.

2. Feature of Schedular System A tax system used which income levels are divided into different classifications for determining tax rates. Each income classification represents a different source of income such as business profits, capital gains, employment income, entitlements, that is taxed according to the specific provision of the Tax Act to which it applies.

3. Taxable Income The pertinent items of gross income specified in the tax code of the philippines, less the deductions and/or personal and additional exemptions, if any, authorized for such types of income by the tax code or other special laws.

4. Compensation for Injuries or Sickness amounts received, through Accident or Health Insurance or under Workmen's Compensation Acts, as compensation for personal injuries or sickness, plus the amounts of any damages received, whether by suit or agreement, on account of such injuries or sickness.

5. Narecieve ng namatayan How treated

6. Gifts given in the occassion of wecking Is it deductible?

7. Capital Vs. Ordinary Asset Holding period (1) Capital Assets. - The term "capital assets" means property held by the taxpayer

(whether or not connected with his trade or business), but does not include stock in trade of the taxpayer or other property of a kind which would properly be included in the inventory of the taxpayer if on hand at the close of the taxable year, or property held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business, or property used in the trade or business, of a character which is subject to the allowance for depreciation provided in Subsection (F) of Section 34; or real property used in trade or business of the taxpayer. Ordinary assets. a. Stock in trade of taxpayer b. Property which would properly be included in the inventory of the taxpayer on hand c. Merchandise inventory d. Depreciable assets used in the trade or business e. Real property used in trade and business 8. Losses from rel transaction from rel pwhl

9. Merger and Consolidation Section 40 - No gain or loss shall be recognized if in pursuance of a plan of merger or consolidation (a) A corporation, which is a party to a merger or consolidation, exchanges property solely for stock in a corporation, which is a party to the merger or consolidation; or (b) A shareholder exchanges stock in a corporation, which is a party to the merger or consolidation, solely for the stock of another corporation also a party to the merger or consolidation; or (c) A security holder of a corporation, which is a party to the merger or consolidation, exchanges his securities in such corporation, solely for stock or securities in such corporation, a party to the merger or consolidation.

No gain or loss shall also be recognized if property is transferred to a corporation by a person in exchange for stock or unit of participation in such a corporation of which as a result of such exchange said person, alone or together with others, not exceeding four (4) persons, gains control of said corporation: Provided, That stocks issued for services shall not be considered as issued in return for property.

10.What is taxable income in the disposition of real estate

11.Personal and Additional personal exemptions

12.Who are entitled to income Vis-a-vis other types of taxpayer resident foreign corporation

13.Proceeds of life insurance and premiums

14.Treatment of bonuses - Wedding

15.What are deductible expenses allowable deductions section 34 Essay 1. Stages and aspects of taxation a. Levy Refers to the act of the legislative in determining what are subject to tax, the amount of tax, those who are liable to pay the tax and other aspects of taxation. b. Assessment Refers to the enforcement of the law that is enacted by the legislature which includes the collection of the said taxes imposed by law. c. Payment Refers to the manner of payment to which the taxpayer is made to comply with their tax obligations imposed by law.

2. Principles of taxation (example, ordinance that requires payment of annual tax, double taxation)

An ordinance passed that requires the payment of an annual fee is not done in the exercise of the power of taxation. It is passed for regulatory purposes and not for revenue purposes, It is made in the exercise of police power.

There is double taxation occurs when the same person or property is taxed by the same authority, under the same jurisdiction, and under the same purpose.

3. Nature of income Church having a business is taxable A non-resident alien is liable to pay taxes for income derived or realized in the philippines.

4.

Exclusions in gross Income

5. 3 types of deduction on gross income

6. Validity of ordinance Effectivity of the code Presidential decree 1158 June 3, 1997 Republic act 8424 January 1, 1998 Republic act 9504 July 1, 2008

7. Different kinds of income tax under NIRC a. Personal income tax b. Regular corporate income tax c. Minimum corporate income tax d. Capital Gains tax e. Passive investment income tax f. fringe benefit tax g. improperly accumulated income tax h. Final witholding tax

8. 180 day rule in relation to a foreigner to be considered doing business or not doing business. GENERALLY, a non-resident alien engaged in trade or business within the Philippines shall be subject to an withholding income tax rate of 20 percent on the total amount received thereof consistent with Section 25(A)(1) of the Tax Code. A nonresident alien individual who shall come to the Philippines and stay for an aggregate period of more than 180 days during any calendar year shall be deemed a nonresident alien doing business in the Philippines. Furthermore, Section 28 (B) (1) states that foreign corporations not engaged in trade or business in the Philippines shall be subject to 30 percent withholding income tax only when the income is derived from sources within the Philippines.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Pubcorp DigestDocument33 pagesPubcorp DigestedmarkarcolNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Domestic Corporation TableDocument3 pagesDomestic Corporation TableAicka Bustamante SingsonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Nego CasesDocument1 pageNego CasesAicka Bustamante SingsonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- IncomeTax Tables (Annex B)Document9 pagesIncomeTax Tables (Annex B)IzrahNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- What Is International LawDocument2 pagesWhat Is International LawAicka Bustamante SingsonNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Rule 11 Civ ProDocument16 pagesRule 11 Civ ProAicka Bustamante SingsonNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Pubcorp DigestDocument33 pagesPubcorp DigestedmarkarcolNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Rule 11 Civ ProDocument16 pagesRule 11 Civ ProAicka Bustamante SingsonNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- PersonsDocument13 pagesPersonsAicka Bustamante SingsonNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- ConstiDocument20 pagesConstiAicka Bustamante SingsonNo ratings yet

- RTC Case on Anti-Carnapping ChargesDocument5 pagesRTC Case on Anti-Carnapping ChargesAicka Bustamante SingsonNo ratings yet

- The 2007-2008 Outline in Constitutional LawDocument14 pagesThe 2007-2008 Outline in Constitutional Lawhardcore88No ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- LGCDocument30 pagesLGCAicka Bustamante SingsonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Rakshit KashyapNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Tax Review Class-Msu Case DigestDocument156 pagesTax Review Class-Msu Case DigestShiena Lou B. Amodia-RabacalNo ratings yet

- Real Property Company: Understanding Malaysia's Definition and Tax TreatmentDocument4 pagesReal Property Company: Understanding Malaysia's Definition and Tax TreatmentAngel Lim100% (1)

- Winebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDocument24 pagesWinebrenner-Inigo-Insurance-Brokers-Inc-v-CIRDarrel John SombilonNo ratings yet

- Tax Reviewer MonteroDocument61 pagesTax Reviewer MonteroJan Ceasar ClimacoNo ratings yet

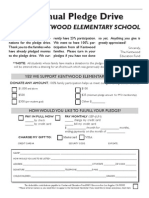

- PLEDGELTR11711Document1 pagePLEDGELTR11711MarkYamaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableTJ JanssenNo ratings yet

- ItunganDocument8 pagesItunganIjal dhiaulhaqNo ratings yet

- NYS-45 quarterly tax filingDocument2 pagesNYS-45 quarterly tax filingMichael WalkerNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Advance Ruling on Input Tax Credit EligibilityDocument20 pagesAdvance Ruling on Input Tax Credit EligibilityAshish AgarwalNo ratings yet

- Conneqt Business Solutions Limited: 304994 Ashitosh MoreDocument1 pageConneqt Business Solutions Limited: 304994 Ashitosh MoreBhushan JadhavNo ratings yet

- Erd.2.f.006 Application For Vat Zero Rating Certification Rev.05Document1 pageErd.2.f.006 Application For Vat Zero Rating Certification Rev.05ivee.upak032023No ratings yet

- Solved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFDocument1 pageSolved Assume Gail Is A Wealthy Widow Whose Husband Died Last PDFAnbu jaromiaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- ABAKADA GURO PARTY LIST V ERMITA DigestDocument4 pagesABAKADA GURO PARTY LIST V ERMITA DigestAndrea Tiu100% (3)

- The Profit and Loss Appropriation AccountDocument4 pagesThe Profit and Loss Appropriation AccountSarthak GuptaNo ratings yet

- Ds Policy Schedule 11230218156300 v1.0 Removed RemovedDocument1 pageDs Policy Schedule 11230218156300 v1.0 Removed RemovedBalaji ArumugamNo ratings yet

- Income Tax Calculation for Corporations, Partnerships, Trusts and EstatesDocument1 pageIncome Tax Calculation for Corporations, Partnerships, Trusts and EstatesElla Apelo100% (1)

- Payslip 03-01-2024Document1 pagePayslip 03-01-2024ernestkozar8No ratings yet

- Phil. Nat'l Police Multi-Purpose Cooperative, Inc. v. CirDocument11 pagesPhil. Nat'l Police Multi-Purpose Cooperative, Inc. v. CirCharismaPerezNo ratings yet

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- TSP 70Document15 pagesTSP 70onetimer64100% (1)

- Useful Invoice ProjectDocument1 pageUseful Invoice ProjectAruna100% (1)

- Solved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingDocument1 pageSolved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingAnbu jaromiaNo ratings yet

- Payslip To Print - Report Design 10-01-2020Document1 pagePayslip To Print - Report Design 10-01-2020martin avinaNo ratings yet

- Report on Corporate Tax Planning StrategiesDocument16 pagesReport on Corporate Tax Planning StrategiesRutu Patel0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bank payment voucher titleDocument1 pageBank payment voucher titleSyed Oneeb JafriNo ratings yet

- Sesi 1 - Covid and Tax Avoidance - SubagioDocument6 pagesSesi 1 - Covid and Tax Avoidance - Subagioaslam hanifNo ratings yet

- House Budget Committee Republicans Letter On Debt LimitDocument4 pagesHouse Budget Committee Republicans Letter On Debt LimitFox NewsNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet