Professional Documents

Culture Documents

2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part B

Uploaded by

Anonymous IIj5AOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part B

Uploaded by

Anonymous IIj5AOCopyright:

Available Formats

01035837/BDWPA5357C Abhaya Deshmukh

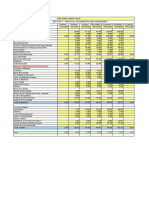

Annexure to Form 16 Part B

INR INR INR

2(f) Amount of any other exemption under section 10

Gross Amount Qualifying Amount Deductible Amount

10(k) Amount deductible under any other provision(s) of Chapter VI-A

01035837/BDWPA5357C Abhaya Deshmukh

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

Mindtree Ltd, Global Village,RVCE Post,Mysore Rd,Bangalore-560059, Karnataka

2) TAN: BLRM02397D

3) TDS Assessment Range of the employer :

TDS Circle-18(1), No.59,HMT Bhavan,6Th Flr,Bellary Rd, Ganganagar,Bangalore, 560032, Karnataka

4) Name, designation and PAN of employee :

Mr/Ms: Abhaya Deshmukh, Desig.:SENIOR ENGINEER, Emp #:01035837, PAN:BDWPA5357C

5) Is the employee a director or a person with :

substantial interest in the company (where the

employer is a company)

6) Income under the head "Salaries" of the employee : 390613.60

(other than from perquisites)

7) Financial year : 2018-2019

8) Valuation of Perquisites

S.No Nature of perquisites Value of perquisite Amount, if any, recovered Amount of perquisite

(see rule 3) as per rules(INR) from the employee(INR) chargeable to tax(INR)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

Sweeper , gardener , watchman or

3 0.00 0.00 0.00

personal attendant

4 Gas , electricity , water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional Travel 0.00 0.00 0.00

8 Free meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts,vouchers etc. 8625.00 0.00 8625.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit

0.00 0.00 0.00

/amenity/service/privilege

16 Stock options ( non-qualified options ) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 8625.00 0.00 8625.00

19 Total value of Profits in lieu of salary

0.00 0.00 0.00

as per section 17 (3)

Details of tax

(a) Tax deducted from salary of the employee under section 192(1) 2395.00

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0.00

(c) Total tax paid 2395.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, KUMAR SENTHIL Son/daughter of JAGADESAN working as GENERAL MANAGER FINANCE (designation ) do hereby declare on behalf of

Mindtree Ltd ( name of the employer ) that the information given above is based on the books of account , documents and other relevant

records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed

thereunder and that such information is true and correct.

Place : BANGALORE Full Name:KUMAR SENTHIL Signature of person responsible

Date : 08.07.2019 Designation:GENERAL MANAGER FINANCE for deduction of tax

01035837/BDWPA5357C Abhaya Deshmukh

Annexure to Form No.16

Name: Abhaya Deshmukh Emp No.: 01035837

Particulars Amount(INR)

Emoluments paid

Basic Salary 222036.00

Conveyance Allowance 30000.00

House Rent Allowance 111024.00

Children Education Allowance 24000.00

Bonus 57750.00

Special Allowance 54000.00

Perquisites

Gifts, vouchers etc. 8625.00

Gross emoluments 507435.00

Income from other sources

Income

Total income from other sources 0.00

Exemptions u/s 10

Allowance

House rent allowance u/s 10(13A) 65796.40

Total Exemption 65796.40

Date: 08.07.2019 Full Name: KUMAR SENTHIL

Place:BANGALORE Designation: GENERAL MANAGER FINANCE

You might also like

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- FunnelyticsDocument56 pagesFunnelyticspubliciceroNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- February 2017 Payslip for Thalari RaoDocument1 pageFebruary 2017 Payslip for Thalari RaoThammineni Vishwanath Naidu100% (1)

- Tyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Document20 pagesTyco Scandal (2002) : (Acc C607-302A Auditing and Good Governance)Jericho Dupaya100% (2)

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- MSQ-10 - Cost of CapitalDocument11 pagesMSQ-10 - Cost of CapitalMIKHAELALOUISSE MARIANONo ratings yet

- Accounting 1: Fundamental ofDocument78 pagesAccounting 1: Fundamental ofLuisitoNo ratings yet

- Question of The ReportDocument8 pagesQuestion of The ReportMushfika MuniaNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- ISO 9001:2000 Goat Production Profitability AnalysisDocument38 pagesISO 9001:2000 Goat Production Profitability AnalysisJay AdonesNo ratings yet

- AISATS Payslip April 2023Document1 pageAISATS Payslip April 2023Sahil shahNo ratings yet

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterNo ratings yet

- Production of Sterile Water For Injection. WFI (Water For Injection) Manufacturing. Water For Pharmaceutical Purposes.-792178 PDFDocument64 pagesProduction of Sterile Water For Injection. WFI (Water For Injection) Manufacturing. Water For Pharmaceutical Purposes.-792178 PDFGajjkNo ratings yet

- Standard Costing & Variance Analysis BreakdownDocument26 pagesStandard Costing & Variance Analysis BreakdownAnuruddha RajasuriyaNo ratings yet

- PW37196 34541005Document2 pagesPW37196 34541005rajan singhNo ratings yet

- Model Project On Rice Milling: Prepared by NABARD Consultancy Services Private LimitedDocument13 pagesModel Project On Rice Milling: Prepared by NABARD Consultancy Services Private LimitedAnkush BajoriaNo ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- Annexures to Form 16 and 12BADocument3 pagesAnnexures to Form 16 and 12BAVikram RaiNo ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Tax deductions and perquisites statementDocument3 pagesTax deductions and perquisites statementDharmendra ParmarNo ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Akcpm0324m 12ba 2023-24Document2 pagesAkcpm0324m 12ba 2023-24Indra Nath MishraNo ratings yet

- BSDocument4 pagesBSSadia HossainNo ratings yet

- Icrrs 2Document3 pagesIcrrs 2Sadia HossainNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Financial Statement For PcabDocument5 pagesFinancial Statement For Pcabma ana hiponiaNo ratings yet

- Tax computation for Alkem employeeDocument3 pagesTax computation for Alkem employeeMAHESH A TNo ratings yet

- Confidential PayslipDocument1 pageConfidential PayslipNiteesh KumarNo ratings yet

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainNo ratings yet

- Budget Control Hydrate Income ExpensesDocument1 pageBudget Control Hydrate Income ExpensesMarco Thaddeus AlabaNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Ndsu Cares ReportDocument15 pagesNdsu Cares ReportMatt BrownNo ratings yet

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694No ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Financial Projections Rabbit FarmDocument9 pagesFinancial Projections Rabbit FarmKunal SinghNo ratings yet

- CMA DATA (Bhargav Roadways)Document7 pagesCMA DATA (Bhargav Roadways)Mahim DangiNo ratings yet

- Model Raport Financiar Cooperativa AgricolaDocument4 pagesModel Raport Financiar Cooperativa AgricolalorenapallNo ratings yet

- LGU Receipts and Expenditures Report for Q2 2020Document4 pagesLGU Receipts and Expenditures Report for Q2 2020Ann LiNo ratings yet

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterNo ratings yet

- Adani Green Energy Limited: PrintDocument3 pagesAdani Green Energy Limited: PrintBijal DanichaNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Eicher Motors: PrintDocument3 pagesEicher Motors: PrintAryan BagdekarNo ratings yet

- EW17593 NovDocument2 pagesEW17593 Novfaraz.ahmad.roseNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- BIR FORM 1701Document1 pageBIR FORM 1701Carol MNo ratings yet

- M/S OXFORD AGENCIES financial analysisDocument12 pagesM/S OXFORD AGENCIES financial analysisDhruv ChandwaniNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

- June 2022Document1 pageJune 2022BHASKAR pNo ratings yet

- MANIMARAN NOV PAYSLIP SHRIRAMDocument2 pagesMANIMARAN NOV PAYSLIP SHRIRAMManiNo ratings yet

- Adjusted Trial Balance: Media Foundation 360 For Oct, 15Document2 pagesAdjusted Trial Balance: Media Foundation 360 For Oct, 15Abbas WazeerNo ratings yet

- Meghmani Organics Standalone Balance Sheet FY22, FY21, FY20Document3 pagesMeghmani Organics Standalone Balance Sheet FY22, FY21, FY20milanNo ratings yet

- Mostafa Mahmud Pay SlupDocument1 pageMostafa Mahmud Pay SlupMostofa MahmudNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Bijurappai PDFDocument1 pageBijurappai PDFTAV CreditNo ratings yet

- IET membership fees guide - rates for Fellows, Members, Students in 2018Document2 pagesIET membership fees guide - rates for Fellows, Members, Students in 2018KOJANo ratings yet

- Taxation 1Document11 pagesTaxation 1graciaNo ratings yet

- Si and Ci HandoutDocument2 pagesSi and Ci HandoutVijay Durga PrasadNo ratings yet

- Bir 2306Document2 pagesBir 2306Caroline Sanchez90% (10)

- LICDocument41 pagesLICceogauravv100% (2)

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Accounting concepts and conventions explainedDocument4 pagesAccounting concepts and conventions explainedakhilNo ratings yet

- Tax Treaty Relief Application - RCU 5 25 17Document3 pagesTax Treaty Relief Application - RCU 5 25 17Jee JeeNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document24 pagesCambridge International AS & A Level: ACCOUNTING 9706/32waheeda17No ratings yet

- Accounting For Agency, Home Office and Branch - Special ProblemsDocument5 pagesAccounting For Agency, Home Office and Branch - Special ProblemsJen AcodeNo ratings yet

- Calculate Break-Even Point for ProfitsDocument1 pageCalculate Break-Even Point for Profitspremium stockNo ratings yet

- Lm-Tle-6-HeDocument53 pagesLm-Tle-6-HeRachelle Ann Dizon100% (1)

- Brief HistoryDocument6 pagesBrief Historyzee abadillaNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisKamran Ali AnsariNo ratings yet

- From Brad's Desk - 24 May - FinalDocument2 pagesFrom Brad's Desk - 24 May - Finalkhalfan saidNo ratings yet

- New Pension CaseDocument138 pagesNew Pension CaseZIA UL HAQ KHANNo ratings yet

- Peacock Co Trial Balance Fire Loss ProblemDocument2 pagesPeacock Co Trial Balance Fire Loss ProblemmhikeedelantarNo ratings yet

- Enron Collapse: Causes and Accounting ScandalDocument8 pagesEnron Collapse: Causes and Accounting ScandalChincel G. ANINo ratings yet

- Case Study - AutoZoneDocument2 pagesCase Study - AutoZoneedselNo ratings yet

- Direct Labor Budget Manufacturing Overhead Budget Selling and Administration Expanse Budget.Document4 pagesDirect Labor Budget Manufacturing Overhead Budget Selling and Administration Expanse Budget.Muhammad AbdullahNo ratings yet

- Adjusting entries and financial statements for Yorkis PerezDocument5 pagesAdjusting entries and financial statements for Yorkis Perezmelvina siregar100% (1)