Professional Documents

Culture Documents

1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trusts

Uploaded by

melanie vistalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trusts

Uploaded by

melanie vistalCopyright:

Available Formats

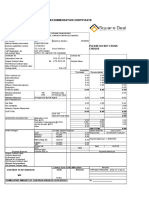

BIR Form No.

1701 Annual Income Tax Return

January 2018 (ENCS) Individuals (including MIXED Income Earner), Estates and Trusts

Page 3

TIN Taxpayer/Filer's Last Name

163 222 353 000 ELEUTERIO

3.B - For 8% Flat Income Tax Rate (DO NOT enter Centavos; 49 Centavos or less drop down; 50 or more round up)

Particulars A. Taxpayer/Filer B. Spouse

26 Sales/Revenues/Receipts/Fees (net of sales returns, allowances and discounts) 0.00 0.00

Add: Other Non-Operating Income (specify below)

27 0.00 0.00

28 Total Income (Sum of Items 26 and 27) 0.00 0.00

Less: Allowable reduction from gross sales/receipts and other non-operating income

29 of purely self-employed individuals and/or professionals in the amount of P250,000 0.00 0.00

(not applicable if with compensation income)

30 Taxable Income/(Loss) (Item 28 Less Item 29) 0.00 0.00

31 Tax Due-Business Income (Item 30 x 8% Flat Income Tax Rate) 0.00 0.00

Total Tax Due-Compensation & Business Income (under flat rate)(Sum of Items

32 7 and 31) (To Part VI Item 1) 0.00 0.00

Schedule 4 - Ordinary Allowable Itemized Deductions (attach additional sheet/s, if necessary)

1 Amortizations 0.00 0.00

2 Bad Debts 0.00 0.00

3 Charitable and Other Contributions 0.00 0.00

4 Depletion 0.00 0.00

5 Depreciation 0.00 0.00

6 Entertainment, Amusement and Recreation 0.00 0.00

7 Fringe Benefits 0.00 0.00

8 Interest 0.00 0.00

9 Losses 0.00 0.00

10 Pension Trusts 0.00 0.00

11 Rental 50,000.00 0.00

12 Research and Development 0.00 0.00

13 Salaries, Wages and Allowances 50,000.00 0.00

14 SSS, GSIS, Philhealth, HDMF and Other Contributions 0.00 0.00

15 Taxes and Licenses 25,000.00 0.00

16 Transportation and Travel 33,000.00 0.00

17 Others (Deductions Subject to Withholding Tax and Other Expenses) [specify below; Add additional sheet(s), if necesary]

a Janitorial and Messengerial Services 0.00 0.00

b Professional Fees 0.00 0.00

c Security Services 0.00 0.00

d COMMUNICATION, LIGHT, WATER 39,000.00 0.00

Total Ordinary Allowable itemized Deductions (Sum of Items 1 to 17d) (To part V

18 Schedule 3.A Item 13)

197,000.00 0.00

Schedule 5 - Special Allowable Itemized Deductions (attach additional sheet/s, if necessary)

5.A - Taxpayer/Filer Description Legal Basis Amount

1 0.00

2 0.00

3 Total Special Allowable Itemized Deductions-Taxpayer/Filer (Sum of Items 1 and 2) (To part V Schedule 3.A Item 14A) 0.00

5.B - Spouse

4 0.00

5 0.00

6 Total Special Allowable Itemized Deductions-Spouse (Sum of Items 4 and 5) (To part V Schedule 3.A Item 14B) 0.00

Schedule 6 - Computation of Net Operating Loss carry Over (NOLCO)

6.A - Computation of NOLCO

Description A. Taxpayer/Filer B. Spouse

1 Gross Income 0.00 0.00

2 Less: Ordinary Allowable Itemized Deductions 0.00 0.00

Net Operating Loss (Item 1 Less Item 2) (To Schedule 6.A.1 Item 7A and/or

3 Schedule 6.A.2 Item 12A) 0.00 0.00

6.A.1 - Taxpayer/Filer's Detailed Computation of Available NOLCO

Net Operating Loss E. Net Operating Loss

B. NOLCO Appliead D. NOLCO Appliead

C. NOLCO Expired (Unapplied)

Year Incurred A. Amount Previous Year/s Current Year

[(E)=A-(B+C+D)]

4 0.00 0.00 0.00 0.00 0.00

5 0.00 0.00 0.00 0.00 0.00

6 0.00 0.00 0.00 0.00 0.00

7 0.00 0.00 0.00 0.00 0.00

8 Total NOLCO - taxpayer/Filer (Sum of Items 4D to 7D) (To Part V Schedule 3.A Item 15A) 0.00

You might also like

- BIR FORM 1701Document1 pageBIR FORM 1701Carol MNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJheza Mae PitogoNo ratings yet

- Sample ITR Page 3Document1 pageSample ITR Page 3Eduardo BallesterNo ratings yet

- Page 3 ItrDocument1 pagePage 3 ItrariannemungcalcpaNo ratings yet

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterNo ratings yet

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Barangay Financial Report Receipts ExpendituresDocument5 pagesBarangay Financial Report Receipts ExpendituresJomidy MidtanggalNo ratings yet

- Home Budget Worksheet by Vertex42Document3 pagesHome Budget Worksheet by Vertex42dakehi11883421No ratings yet

- Home Budget Worksheet by Vertex42Document3 pagesHome Budget Worksheet by Vertex42davidjc77No ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- Annexures to Form 16 and 12BADocument3 pagesAnnexures to Form 16 and 12BAVikram RaiNo ratings yet

- Sysnet Global Technologies Private Limited: Earnings Deductions Amount AmountDocument1 pageSysnet Global Technologies Private Limited: Earnings Deductions Amount AmountSmart Com TechNo ratings yet

- Household Yearly Budget Template ExcelDocument3 pagesHousehold Yearly Budget Template ExcelianachieviciNo ratings yet

- SMEToolkit 5 CashflowsensitivityDocument2 pagesSMEToolkit 5 CashflowsensitivityLizanne GauranaNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- View your payslip detailsDocument1 pageView your payslip detailsWinston YutaNo ratings yet

- Tuv Sud Employee Tax ComputationDocument2 pagesTuv Sud Employee Tax Computationprashanth kumarNo ratings yet

- 144171_OCT2023Document2 pages144171_OCT2023ManiNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper Reportakmeljundi092No ratings yet

- Payment Recommendation CertificateDocument2 pagesPayment Recommendation CertificateDeepum HalloomanNo ratings yet

- Feliciano Property Appraisals Trial Balance: As of December 4, 2020Document1 pageFeliciano Property Appraisals Trial Balance: As of December 4, 2020JessaNo ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- 144171_NOV2023Document2 pages144171_NOV2023ManiNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- SDN+Company Trial+BalanceDocument2 pagesSDN+Company Trial+BalanceDianne PañoNo ratings yet

- Confidential PayslipDocument1 pageConfidential PayslipNiteesh KumarNo ratings yet

- SEP2023 STFC PaySlipDocument2 pagesSEP2023 STFC PaySlipJHP CreationsNo ratings yet

- Home Budget WorksheetDocument6 pagesHome Budget WorksheetWahyudi SantosoNo ratings yet

- Home Budget WorksheetDocument6 pagesHome Budget WorksheetDahlan MuksinNo ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- SUAExcelDocument5 pagesSUAExcelElizabethNo ratings yet

- 883997_0_GPIND_TMCGOFFOCT2022_V2_gpinit01 (1)Document2 pages883997_0_GPIND_TMCGOFFOCT2022_V2_gpinit01 (1)lakb5304No ratings yet

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocument5 pagesConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31No ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Home Budget Worksheet: NET Income - Expenses Saldo AwalDocument7 pagesHome Budget Worksheet: NET Income - Expenses Saldo AwalArkhana RizkyNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- Home Budget WorksheetDocument6 pagesHome Budget WorksheetAJOY DUTTANo ratings yet

- LGU Receipts and Expenditures Report for Q2 2020Document4 pagesLGU Receipts and Expenditures Report for Q2 2020Ann LiNo ratings yet

- 5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Document1 page5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Shreyash Sahay0% (1)

- No.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210Document1 pageNo.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210amitNo ratings yet

- FINANCIAL STATEMENT For PCABDocument5 pagesFINANCIAL STATEMENT For PCABRodel Ryan YanaNo ratings yet

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Document1 pageHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNo ratings yet

- Noim LPCDocument1 pageNoim LPCmdnoim25No ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARNo ratings yet

- 3-Year Cash Flow Projections for Electronics CompanyDocument8 pages3-Year Cash Flow Projections for Electronics CompanyVipin UniyalNo ratings yet

- IOCL FEBRUARYDocument1 pageIOCL FEBRUARYDipankar BarmanNo ratings yet

- View Your W-2, 1099 and SSA-1099 Tax FormsDocument144 pagesView Your W-2, 1099 and SSA-1099 Tax FormsKasirun -No ratings yet

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Frespac Ginger (Fiji) Pte Limited Audited Financials 30.6.23 8.9.23Document135 pagesFrespac Ginger (Fiji) Pte Limited Audited Financials 30.6.23 8.9.23Augustine SamiNo ratings yet

- FAQ - CompanyDocument1 pageFAQ - Companymelanie vistalNo ratings yet

- Invoice OCTOBER 2024 - RegularDocument1 pageInvoice OCTOBER 2024 - Regularmelanie vistalNo ratings yet

- STUDENT VISA RequirementsDocument1 pageSTUDENT VISA Requirementsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- Explanation of Fund FormationDocument1 pageExplanation of Fund Formationmelanie vistalNo ratings yet

- 1Document1 page1melanie vistalNo ratings yet

- CERTIFICATIONDocument1 pageCERTIFICATIONmelanie vistalNo ratings yet

- Notes Form 2 Chapter 4Document4 pagesNotes Form 2 Chapter 4lembu_sihat7783% (6)

- Suhana Pravin Masale & PicklesDocument11 pagesSuhana Pravin Masale & PicklesSijo Kunjumon100% (1)

- Folder Hexa EngDocument8 pagesFolder Hexa EngMuresan MVNo ratings yet

- Perineal Care Procedure GuideDocument2 pagesPerineal Care Procedure GuideAlhadzra AlihNo ratings yet

- Edwards Auto 306 CharacteristicsDocument4 pagesEdwards Auto 306 CharacteristicsJuan Antonio Rubio-LaraNo ratings yet

- ODN102001 ATN Products Hardware Introduction ISSUE 1.00Document43 pagesODN102001 ATN Products Hardware Introduction ISSUE 1.00Jonathan Eduardo Tapias BeltranNo ratings yet

- S# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusDocument25 pagesS# Isin CFI Code (As Per New ISO) Security Name Security Symbol Sector Name Security Type StatusahmedalishNo ratings yet

- 2 - FNCPDocument5 pages2 - FNCPIlda Lekka RequizaNo ratings yet

- ANPATH1 ReviewerDocument17 pagesANPATH1 ReviewerRashid DayaoNo ratings yet

- How Game-Based Teaching Strategy Affect The Student's Learning in MathematicsDocument13 pagesHow Game-Based Teaching Strategy Affect The Student's Learning in MathematicsAaron Jay BulataoNo ratings yet

- Mutual harm: The potential and risks of using allelopathic chemicals in agricultureDocument11 pagesMutual harm: The potential and risks of using allelopathic chemicals in agricultureMinh Anh NguyễnNo ratings yet

- C612Document5 pagesC612dinhtung2210100% (1)

- 01 Well Head ComponentsDocument46 pages01 Well Head ComponentsKhanh Pham Minh100% (7)

- Come Back To Your Senses Use Your Body: Psychologyt LsDocument1 pageCome Back To Your Senses Use Your Body: Psychologyt LsMarina Moran100% (1)

- Berca Engineering SUBMITTEDDocument20 pagesBerca Engineering SUBMITTEDJohandika FerbiantokoNo ratings yet

- General Psychology Mid Term ExamDocument2 pagesGeneral Psychology Mid Term Examapi-534780597No ratings yet

- WorkbookEdition 12 A Theory of HumorismDocument4 pagesWorkbookEdition 12 A Theory of HumorismMabel Ferr50% (2)

- Checklist PDFDocument84 pagesChecklist PDFJeremiah Miko LepasanaNo ratings yet

- DL420 15c SpecificationsDocument4 pagesDL420 15c Specificationsesteban muñozNo ratings yet

- Candidates applied for Medical Officer post on contract basisDocument11 pagesCandidates applied for Medical Officer post on contract basiszephyrNo ratings yet

- 03 - 03 Product Index PDFDocument5 pages03 - 03 Product Index PDFWilder Fernando Vilca OreNo ratings yet

- Modified Pfirrmann Grading System For Lumbar Intervertebral Disc DegenerationDocument6 pagesModified Pfirrmann Grading System For Lumbar Intervertebral Disc DegenerationZack StylesNo ratings yet

- Kristeva On Melanie Klein's "Oresteia"Document6 pagesKristeva On Melanie Klein's "Oresteia"danthetoasterNo ratings yet

- Plane Bearings: Material Indicator Shape or SeriesDocument4 pagesPlane Bearings: Material Indicator Shape or SeriesJuan LoaizaNo ratings yet

- Pengaruh Ukuran Potongan Kopra Dalam Proses Pengeringan: Effect of The Copra Cut Size in The Drying ProcessDocument5 pagesPengaruh Ukuran Potongan Kopra Dalam Proses Pengeringan: Effect of The Copra Cut Size in The Drying ProcessAlexia Desi Ratnasari Loi 1841100210No ratings yet

- 311970536Document1 page311970536Codrut RadantaNo ratings yet

- Presentation on Chancroid: Bacterial STI Causes Painful Genital UlcersDocument12 pagesPresentation on Chancroid: Bacterial STI Causes Painful Genital UlcersBikash Sah0% (1)

- BONDING: Understanding Chemical AttractionsDocument201 pagesBONDING: Understanding Chemical AttractionsKhaled OsmanNo ratings yet

- TECHNICAL DATA SHEET of RUST CONVERTERDocument1 pageTECHNICAL DATA SHEET of RUST CONVERTERArmando AballeNo ratings yet

- The Taste of Tradition: Submitted byDocument14 pagesThe Taste of Tradition: Submitted byvijay malikNo ratings yet