Professional Documents

Culture Documents

Form No. 12ba: Declaration by Employer

Uploaded by

Vaibhav Sharad DhandeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 12ba: Declaration by Employer

Uploaded by

Vaibhav Sharad DhandeCopyright:

Available Formats

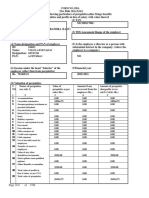

FORM NO.

12BA

{See Rule 26A(2)(B)}

Statement showing particulars of perquisites, other fringe benifits or amenities and profits in lieu of salary with value thereof

1. Name & Address of the Employer VARROC POLYMERS PVT. LTD

Gut No- 99, Village- PharolaTaluka-Paithan

Pathardi-431105

2. TAN

3. TDS Assessment Range of the employer

4. Name, designation and PAN of employee Vaibhav Sharad Dhande

Sr.Engineer-ProductEngineering

BULPD0240F

5. Is the employee a director or a person with a

substantial interest in the company

(where the employer is a company)

6. Income under the head "Salaries" of the 220,306

employee (other than from perquisites)

7. Financial Year 2020-2021

8. Valuation of Perquisites

S.No. Nature of perquisites Value of perquisites Amount, if any Amount of perquisite

(see rule 3) as per rules recovered from chargeable to tax

(Rs.) the employee (Rs.) Col.(3) - Col.(4) (Rs.)

(1) (2) (3) (4) (5)

1 ACCOMODATION 0 0 0

2 CAR PERK 0 0 0

3 SWEEPER, GARDNER, WATCHMAN OR PERSONAL ATTENDANNT 0 0 0

4 GAS, ELECTRICITY, WATER 0 0 0

5 INTEREST FREE OR CONCESSIONAL LOANS 0 0 0

6 HOLIDAY EXPENSES 0 0 0

7 FREE OR CONCESSIONAL TRAVEL 0 0 0

8 FREE MEALS 0 0 0

9 FREE EDUCATION 0 0 0

10 GIFTS, VOUCHERS ETC. 0 0 0

11 CREDIT CARD EXPENSES 0 0 0

12 SODEXHO PERK 0 0 0

13 USE OF MOVABLE ASSETS BY EMPLOYEES 0 0 0

14 TRANSFER OF ASSETS TO EMPLOYEES 0 0 0

15 VALUE OF ANY OTHER BENEFIT/AMENITY/SERVICE/PRIVILEGE 0 0 0

16 STOCK OPTIONS (NON QUALIFED OPTIONS) 0 0 0

17 OTHER PERK 0 0 0

18 Total value of perquisites 0 0 0

19 Total value of profits in lieu of salary as per section 17(3) 0 0 0

9. Details of Tax :

(a) Tax Deducted from salary of the employee under section 192(1) 0

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0

(c) Total tax paid 0

(d) Date of payment into Government treasury As per Form 16

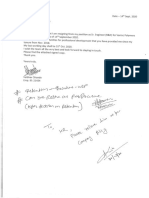

DECLARATION BY EMPLOYER

I KEDAR AMBIKAR Son / Daughter of DEEPAK GOVIND AMBIKAR working as SR MANAGER HR do hereby declare on behalf of

VARROC POLYMERS PVT. LTD that the information given above is based on the books of account, documents and other relevant

records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules

framed there under and that such information is true and correct.

Signature of the Person Responsible for

Deduction of Tax

Place : PUNE Full Name : KEDAR AMBIKAR

Date : 25/08/2020 Designation : SR MANAGER HR

You might also like

- 1st Pre-Board TaxationDocument11 pages1st Pre-Board Taxationrandyblanza2014No ratings yet

- Chapter 04 Feasibility Studies and Business Plan LastDocument134 pagesChapter 04 Feasibility Studies and Business Plan LastMelkamu LimenihNo ratings yet

- Mansa Building: Indian Institute of Management Ahmedabad IIMA/F&A0089Document6 pagesMansa Building: Indian Institute of Management Ahmedabad IIMA/F&A0089shriNo ratings yet

- Interview Question Senior AuditorDocument4 pagesInterview Question Senior AuditorSalman LeghariNo ratings yet

- OM No. 2018-04-03Document2 pagesOM No. 2018-04-03Christian Albert HerreraNo ratings yet

- Din Iso 4892-2Document14 pagesDin Iso 4892-2bladdeeNo ratings yet

- Globalization and Its Impact On EducationDocument14 pagesGlobalization and Its Impact On EducationSutrisno Spd96% (27)

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- Annexure To Form 16 - TCSDocument3 pagesAnnexure To Form 16 - TCSRupini RavichandranNo ratings yet

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BVikram RaiNo ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- 12BADocument1 page12BAmanas022No ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Akcpm0324m 12ba 2023-24Document2 pagesAkcpm0324m 12ba 2023-24Indra Nath MishraNo ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- 16 Apr 2022.PROPERTY - TAX - 0322 19 2541 0001 L1249460681024052807Document1 page16 Apr 2022.PROPERTY - TAX - 0322 19 2541 0001 L1249460681024052807viren mehtaNo ratings yet

- Model Raport Financiar Cooperativa AgricolaDocument4 pagesModel Raport Financiar Cooperativa AgricolalorenapallNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- 22 GST Council MeetDocument2 pages22 GST Council Meetkumar45caNo ratings yet

- Acrow MisrDocument63 pagesAcrow MisrAmir MamdouhNo ratings yet

- Bharatbhai Tax Bill Godown No-7Document1 pageBharatbhai Tax Bill Godown No-7VaghasiyaBipinNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Assets 2012 2011: CompanyDocument8 pagesAssets 2012 2011: CompanyMeuthia AlamsyahNo ratings yet

- CONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Document2 pagesCONVEYANCE Exemption HRA Exemption: 9394 Rs. Rs. 0Akshay ShettyNo ratings yet

- Acrow MisrDocument66 pagesAcrow MisrAmir MamdouhNo ratings yet

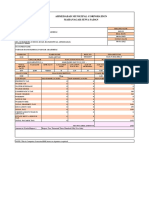

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanNeil RathodNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanJohn FernendiceNo ratings yet

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamNo ratings yet

- T S REDDYB MAY 20 CrystalViewer - 2020-06-24T121055.800Document1 pageT S REDDYB MAY 20 CrystalViewer - 2020-06-24T121055.800Tallapureddy SarweswarareddyNo ratings yet

- Banco Gaskets (India) Ltd. An Division: Earnings DeductionsDocument1 pageBanco Gaskets (India) Ltd. An Division: Earnings DeductionsAnkur J PatelNo ratings yet

- 15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176Document1 page15 Sep 2022.PROPERTY - TAX - 0517 17 1201 0001 R3108942281157440176DHANU DANGINo ratings yet

- Nov 2022Document1 pageNov 2022sunil kumarNo ratings yet

- Parmar Mayurbhai Ahmedabad Property Tex PDFDocument1 pageParmar Mayurbhai Ahmedabad Property Tex PDFANISH SHAIKHNo ratings yet

- SNGPL Budget - Funds Available AnalysisDocument7 pagesSNGPL Budget - Funds Available AnalysisGulraiz ShaukatNo ratings yet

- Nov 2023Document1 pageNov 2023sobhisingh069No ratings yet

- Shown For Tax Purpose Only # Includes CLA & COLA. (Upto Officer Level Below A.M)Document1 pageShown For Tax Purpose Only # Includes CLA & COLA. (Upto Officer Level Below A.M)rahimshahNo ratings yet

- Tax ComputationDocument2 pagesTax Computationng28No ratings yet

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Document2 pages1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNo ratings yet

- Vitran Pvt. Ltd. Grp4 OC-6Document27 pagesVitran Pvt. Ltd. Grp4 OC-6ADNo ratings yet

- Proknjižen Grupe Računa: Račun Naziv Saldo Potražuje DugujeDocument1 pageProknjižen Grupe Računa: Račun Naziv Saldo Potražuje DugujeSaša StankovićNo ratings yet

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDocument6 pages2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNo ratings yet

- Project at A Glance: Taluk/Block: District: Pin: State: E-Mail: MobileDocument8 pagesProject at A Glance: Taluk/Block: District: Pin: State: E-Mail: MobilesandeepNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- Account Balance SheetDocument2 pagesAccount Balance Sheetsaikatdn555No ratings yet

- GSTR1 09abdcs7847l1zl 062023Document4 pagesGSTR1 09abdcs7847l1zl 062023prateek gangwaniNo ratings yet

- Miscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post AdjDocument1 pageMiscellaneous/Post Adj. Earnings::::::: Miscellaneous/Post Adjnicole.dimayuga3No ratings yet

- Amdavad Municipal Corporation: Mahanagar Sewa SadanDocument1 pageAmdavad Municipal Corporation: Mahanagar Sewa SadanJaydeep ParmarNo ratings yet

- Z00150 Scanned Tax BillDocument1 pageZ00150 Scanned Tax Billhardik22222290No ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Small Business Cash Flow Projection1Document5 pagesSmall Business Cash Flow Projection1Rana MasudNo ratings yet

- Capt. Culanag Pay SlipDocument1 pageCapt. Culanag Pay Slipvatosreal187No ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanGOLD COINNo ratings yet

- As 480086Document2 pagesAs 480086mohit yagyikNo ratings yet

- Form 1608112023 131300Document3 pagesForm 1608112023 131300baisanebuddheshNo ratings yet

- Pay Slip For June - 2021: EarningsDocument2 pagesPay Slip For June - 2021: EarningsBagadi AvinashNo ratings yet

- Payslip Feb2022Document2 pagesPayslip Feb2022MaruthiNo ratings yet

- KRA Summary Last YearDocument9 pagesKRA Summary Last YearVaibhav Sharad DhandeNo ratings yet

- ImportDocument2 pagesImportVaibhav Sharad DhandeNo ratings yet

- Hero Splendor Plus Vs HF Deluxe Comparison: Note - Snap Shows RH Assembly. LH Is SymmetricalDocument3 pagesHero Splendor Plus Vs HF Deluxe Comparison: Note - Snap Shows RH Assembly. LH Is SymmetricalVaibhav Sharad DhandeNo ratings yet

- Sr. No. Metal Parts: 1 Stay 2 Hex Nut 3 Special Nut 4 Bolt Adapter 5 M5/M8 Nut 6 Washer 7 Spring Washer 8 Screw 9 SpringDocument3 pagesSr. No. Metal Parts: 1 Stay 2 Hex Nut 3 Special Nut 4 Bolt Adapter 5 M5/M8 Nut 6 Washer 7 Spring Washer 8 Screw 9 SpringVaibhav Sharad DhandeNo ratings yet

- Resign Letter - AcceptanceDocument1 pageResign Letter - AcceptanceVaibhav Sharad DhandeNo ratings yet

- WFH Daily WorkDocument14 pagesWFH Daily WorkVaibhav Sharad DhandeNo ratings yet

- LogoDocument1 pageLogoVaibhav Sharad DhandeNo ratings yet

- Steel Dynamics Bar Book Rev 2 New CoverDocument194 pagesSteel Dynamics Bar Book Rev 2 New CoverNina LazuardiNo ratings yet

- Receipt - 1200537Document1 pageReceipt - 1200537Vaibhav Sharad DhandeNo ratings yet

- PaymenthistoryredirecturlDocument1 pagePaymenthistoryredirecturlVaibhav Sharad DhandeNo ratings yet

- You Are Just Like A Cycle Without Stand !!! You MUST Keep Moving ..!!!Document2 pagesYou Are Just Like A Cycle Without Stand !!! You MUST Keep Moving ..!!!Vaibhav Sharad DhandeNo ratings yet

- Hero Winker Mirror Assembly Proto Parts Developments TimelineDocument3 pagesHero Winker Mirror Assembly Proto Parts Developments TimelineVaibhav Sharad DhandeNo ratings yet

- Gantt-Chart LDocument1 pageGantt-Chart LVaibhav Sharad DhandeNo ratings yet

- 3D-Tool PrintoutDocument1 page3D-Tool PrintoutVaibhav Sharad DhandeNo ratings yet

- Annexure-A Undertaking Containment Zone 8-5-2020Document1 pageAnnexure-A Undertaking Containment Zone 8-5-2020Vaibhav Sharad DhandeNo ratings yet

- Surface Treatment of Powder Material by Metal Coatings - Study of Corrosion PropertiesDocument6 pagesSurface Treatment of Powder Material by Metal Coatings - Study of Corrosion PropertiesVaibhav Sharad DhandeNo ratings yet

- 20160323110453-11SMn30 (9SMn28)Document1 page20160323110453-11SMn30 (9SMn28)novkovic1984No ratings yet

- HXM 8 o ABqmio Spjo JDocument2 pagesHXM 8 o ABqmio Spjo JVaibhav Sharad DhandeNo ratings yet

- Tour Report Pune 15-01-2020Document2 pagesTour Report Pune 15-01-2020Vaibhav Sharad DhandeNo ratings yet

- AbstractDocument3 pagesAbstractVaibhav Sharad DhandeNo ratings yet

- Fig3.4.1 Schematic of Atomic Force MicroscopeDocument4 pagesFig3.4.1 Schematic of Atomic Force MicroscopeVaibhav Sharad DhandeNo ratings yet

- Index)Document3 pagesIndex)Vaibhav Sharad DhandeNo ratings yet

- of CRM of IdbiDocument29 pagesof CRM of IdbiABHISHEK GUPTANo ratings yet

- Jaipur Airport TenderDocument19 pagesJaipur Airport TenderRafikul RahemanNo ratings yet

- RMC No. 77-2021 Annex FDocument1 pageRMC No. 77-2021 Annex Fannalyn pobleteNo ratings yet

- Ravi Bhalla NJ Supreme Court CensureDocument16 pagesRavi Bhalla NJ Supreme Court CensureMile Square ViewNo ratings yet

- VAT-User-Guide English V0.7.0 User-AmendmentsDocument44 pagesVAT-User-Guide English V0.7.0 User-AmendmentsSami SattiNo ratings yet

- GD TopicsDocument20 pagesGD Topicsapi-3832523100% (4)

- TDS On Printing & StationeryDocument11 pagesTDS On Printing & StationeryVivek Reddy100% (1)

- Teaching Resume - Eqao - Stephen Beech Mba Cma May 2017Document2 pagesTeaching Resume - Eqao - Stephen Beech Mba Cma May 2017api-360221229No ratings yet

- Basis of Taxation:: Benefits-Protection TheoryDocument2 pagesBasis of Taxation:: Benefits-Protection TheoryKisha Alyana ColindresNo ratings yet

- 10 Point Agenda 1Document12 pages10 Point Agenda 1jrduronio100% (1)

- 04-17-15 EditionDocument33 pages04-17-15 EditionSan Mateo Daily JournalNo ratings yet

- CH 05 Financial AccountingDocument5 pagesCH 05 Financial AccountingkashifNo ratings yet

- Ashton Gray - 5107 East Riverside DriveDocument14 pagesAshton Gray - 5107 East Riverside DrivePrateek AhujaNo ratings yet

- The Western Union Company - Form 10-K (Feb-20-2015)Document171 pagesThe Western Union Company - Form 10-K (Feb-20-2015)bpd3kNo ratings yet

- Problems For Practice - Portal Upload - 01 - Oct - 2019Document1 pageProblems For Practice - Portal Upload - 01 - Oct - 2019Yasir MalikNo ratings yet

- GCR 2BR - 7J Molave SpecialDocument1 pageGCR 2BR - 7J Molave SpecialMia NungaNo ratings yet

- Sa Lesson13Document1 pageSa Lesson13api-263754616No ratings yet

- MBADocument9 pagesMBAumamaheswari palanisamyNo ratings yet

- Introduction of Tata Iron and Steel CompanyDocument10 pagesIntroduction of Tata Iron and Steel CompanyNIHARIKA AGARWALNo ratings yet

- Chapter 9 MCQs On Capital GainDocument34 pagesChapter 9 MCQs On Capital GainNiraj Pandey100% (1)

- CFS FATCA - & - CRS - Declaration - (Individual) - CDSLDocument1 pageCFS FATCA - & - CRS - Declaration - (Individual) - CDSLAkash AgarwalNo ratings yet

- ADIT Syllabus 2020Document86 pagesADIT Syllabus 2020owaistedNo ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Black MoneyDocument5 pagesBlack Moneyroy lexterNo ratings yet