Professional Documents

Culture Documents

Annexure To Form 16 Part B (2020)

Uploaded by

Dharmendra ParmarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annexure To Form 16 Part B (2020)

Uploaded by

Dharmendra ParmarCopyright:

Available Formats

00082462/ADUPP2446G DHARMENDRA PARMAR

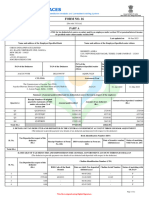

Annexure to Form 16 Part B

2(f). Break up for 'Amount of any other exemption under section 10' to be filled in the table below

Particular's of Amount of any other exemption under section 10' INR

10(k). Break up for 'Amount deductible under any other provision(s) of Chapter VI-A ' to be filled in the table below

Particular's of amount deductible under any other provision(s) of Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

Place SCOPE MINAR DELHI (Signature of person responsible for deduction of tax)

Date 30.04.2021 Full Name: YOGESH KUMAR

Signature Not Verified

Digitally signed by YOGESH KUMAR

Date: 2021.05.27 01:45:56 IST

Reason: Document Validation

Location: Delhi

00082462/ADUPP2446G DHARMENDRA PARMAR

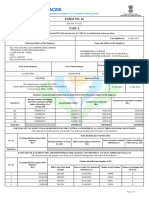

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of employer : Oil & Natural Gas Corporation Ltd., Scope Minar,, Laxmi Nagar, New Delhi,110092,

2. TAN : DELO04887B

3. TDS Assessment Range of the employer : CIT (TDS), Aayakar Bhawan, Laxmi Nagar,New Delhi,110092,

4. Name, designation and Permanent Account Number or

Aadhaar Number of employee

: DHARMENDRA PARMAR,ASM AR3 I/M- INSRUMENTATI,00082462,ADUPP2446G

5. Is the employee a director or a person with substantial interest

in the company(where the employer is a company) :

6. Income under the head “Salaries” of the employee

(other than from perquisites)

: 4703392.10

7. Financial year : 2020-2021

8. Valuation of Perquisites :

Amount of perquisite

Amount, if any, recovered

S. Value of perquisite as per chargeable to tax

Nature of perquisites (see rule 3) from the employee

No. (Rs.) Col. (3) - Col(4)

(Rs.)

(Rs.)

(1) (2) (3) (4) (5)

1. Accommodation 84841.31 0.00 84841.31

2. Cars/Other automotive 130045.00 0.00 130045.00

Sweeper, gardener, watchman or

3. 0.00 0.00 0.00

personal attendant

4. Gas, electricity, water 462.00 0.00 462.00

5. Interest free or concessional loans 24.17 0.00 24.17

6. Holiday expenses 0.00 0.00 0.00

7. Free or concessional travel 0.00 0.00 0.00

8. Free meals 0.00 0.00 0.00

9. Free education 0.00 0.00 0.00

10. Gifts, vouchers, etc. 0.00 0.00 0.00

11. Credit card expenses 0.00 0.00 0.00

12. Club expenses 0.00 0.00 0.00

13. Use of movable assets by employees 30000.00 30000.00 0.00

14. Transfer of assets to employees 7200.00 0.00 7200.00

15. Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16. Stock options allotted or transferred by employer being

0.00 0.00 0.00

an eligible start-up referred to in section 80-IAC.

17. Stock options (non-qualified options) other than ESOP in

0.00 0.00 0.00

col 16 above.

18. Contribution by employer to fund and scheme taxable

under section 17(2)(vii). 0.00 0.00 0.00

19. Annual accretion by way of interest, dividend etc. to the

balance at the credit of fund and scheme referred to in 0.00 0.00 0.00

section 17(2)(vii) and taxable under section 17(2)(viia).

20. Other benefits or amenities 0.00 0.00 0.00

21. Total value of perquisites 252572.48 30000.00 222572.48

22. Total value of profits in lieu of salary as per section 17(3) 0.00 0.00 0.00

Details of tax

(a) Tax deducted from salary of the employee under section 192(1) 1170539.53

(b) Tax paid by employer on behalf of the employee under section 192(1A) 21821.25

(c) Total tax paid 1192360.78

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, YOGESH KUMAR Son/daughter of SHRI DHARAM PRAKASH working as DGM(F&A) (designation ) do hereby declare on behalf of Oil & Natural

Gas Corporation Ltd. ( name of the employer ) that the information given above is based on the books of account , documents and other relevant

records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules framed thereunder

and that such information is true and correct. Signature Not Verified

Digitally signed by YOGESH KUMAR

Date: 2021.05.27 01:45:56 IST

Reason: Document Validation

Signature of person responsible for deduction of tax

Location: Delhi

Place : SCOPE MINAR DELHI Full Name:YOGESH KUMAR

Date : 30.04.2021 Designation:DGM(F&A)

00082462/ADUPP2446G DHARMENDRA PARMAR

Annexure to Form No.16

Name: DHARMENDRA PARMAR Emp No.: 00082462

Particulars Amount(INR)

Emoluments paid

Basic Salary 2193990.00

Variable DA 405324.00

House Rent Allowance 526557.60

Bonus 131178.08

Previous Employment Salary u/s 17(1) 430810.20

Other Allowances 979984.87

Other Reimbursement 149399.40

Arrears from previous yr/s -149235.05

Perquisites

Accommodation 84841.31

Cars/Other automotive 130045.00

Gas,electricity,water 462.00

Interest free or concessional loans 24.17

Transfer of assets to employees 7200.00

Gross emoluments 4978460.58

Income from other sources

Income

Income from interests 10000.00

Deductions u/s 24 - Interest -200000.00

Total income from other sources -190000.00

Exemptions u/s 10

Allowance

Total Exemption 0.00

Signature Not Verified

Digitally signed by YOGESH KUMAR

Date: 2021.05.27 01:45:56 IST

Reason: Document Validation

Location: Delhi

Date: 30.04.2021 Full Name: YOGESH KUMAR

Place:SCOPE MINAR DELHI Designation: DGM(F&A)

You might also like

- Innovative Infrastructure Financing through Value Capture in IndonesiaFrom EverandInnovative Infrastructure Financing through Value Capture in IndonesiaRating: 5 out of 5 stars5/5 (1)

- FormANNX 2022 1Document3 pagesFormANNX 2022 1spider14No ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Invetech Lighting PVT LTD Form 16Document5 pagesInvetech Lighting PVT LTD Form 16Saikiran SharonNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- R17 Acepa6021b 20-21Document1 pageR17 Acepa6021b 20-21rajeshre2No ratings yet

- Globallogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EDocument4 pagesGloballogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EneerajNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Form 16: Wavelabs Technologies Private LimitedDocument11 pagesForm 16: Wavelabs Technologies Private LimitedrshserhsrtNo ratings yet

- Tech Mahindra Business Services Limited: Tax Return E-Filing ServiceDocument5 pagesTech Mahindra Business Services Limited: Tax Return E-Filing ServiceDavidroy MunimNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- Form 16 Data 1 PDFDocument5 pagesForm 16 Data 1 PDFRISHABH JAINNo ratings yet

- Traces: Details of SalaryDocument4 pagesTraces: Details of SalaryMadu JaguNo ratings yet

- 12bb NR Baria 00402749 2122Document3 pages12bb NR Baria 00402749 2122Dipak PArmarNo ratings yet

- Delhi Metro Rail Corporation Limited Payment Advice NoteDocument16 pagesDelhi Metro Rail Corporation Limited Payment Advice NoteashishNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- Chintha Hari PrasadDocument4 pagesChintha Hari Prasadchintha hari prasadNo ratings yet

- PART B (Annexure)Document4 pagesPART B (Annexure)AnbarasanNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Epsf Form12bb 903949Document2 pagesEpsf Form12bb 903949MALLA SAI YASWANTH REDDYNo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Kapil Mittal (SR Garments)Document12 pagesKapil Mittal (SR Garments)SHRUTI AGRAWALNo ratings yet

- Certfcate No.: NB/01992 Form No. 12 BaDocument7 pagesCertfcate No.: NB/01992 Form No. 12 BaKanishk JamwalNo ratings yet

- Mar-24 ChallanDocument1 pageMar-24 ChallanVinay KushwahaNo ratings yet

- Aaacl4159l Q2 2024-25Document3 pagesAaacl4159l Q2 2024-25vbgrandvizagNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Ecr CHLN Rec Mhban2796847000 3102403004244 1709629130572 2024030552130572479Document1 pageEcr CHLN Rec Mhban2796847000 3102403004244 1709629130572 2024030552130572479prasadriri45No ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- FORM No. 16: Pune Municipal CorporationDocument2 pagesFORM No. 16: Pune Municipal CorporationAtharv MarneNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedAYUSH PRADHANNo ratings yet

- Ecr CHLN Rec GNGGN1624154000 2032404022573 1714129443580 2024042659643580567Document1 pageEcr CHLN Rec GNGGN1624154000 2032404022573 1714129443580 2024042659643580567reyeya2419No ratings yet

- Annual 3683form16Document9 pagesAnnual 3683form16modi jiNo ratings yet

- TANGEDCO - Application PortalDocument2 pagesTANGEDCO - Application Portalsubash nateshanNo ratings yet

- Form No. 12ba: Declaration by EmployerDocument1 pageForm No. 12ba: Declaration by EmployerVaibhav Sharad DhandeNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Feb-24 ChalalnDocument1 pageFeb-24 ChalalnVinay KushwahaNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Webfurther India Private Limited: Form 16Document8 pagesWebfurther India Private Limited: Form 16RAHUL MITTAPALLYNo ratings yet

- FORM16 (Year 2020 - 21)Document11 pagesFORM16 (Year 2020 - 21)Siva RamakrishnaNo ratings yet

- Form 16 Fy 2020-2021 Ahbpd9289q Partb Ay 2021-2022Document3 pagesForm 16 Fy 2020-2021 Ahbpd9289q Partb Ay 2021-2022CrcNo ratings yet

- Form No. 16 Part B (2020)Document3 pagesForm No. 16 Part B (2020)Dharmendra ParmarNo ratings yet

- Form No. 16 Part A (2020)Document2 pagesForm No. 16 Part A (2020)Dharmendra ParmarNo ratings yet

- Form No. 16 Part A (2019)Document2 pagesForm No. 16 Part A (2019)Dharmendra ParmarNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Summary of Evaluation: 1 17.80 Fail Civil Engineering Research and Consultancy PVT - LTDDocument27 pagesSummary of Evaluation: 1 17.80 Fail Civil Engineering Research and Consultancy PVT - LTDChandeshwor ShahNo ratings yet

- Labour EconomicsDocument2 pagesLabour EconomicsElla CaraanNo ratings yet

- Internship Report On Service Industry CompressDocument50 pagesInternship Report On Service Industry Compressvansham malikNo ratings yet

- Jurisdictions - Labrel PDFDocument6 pagesJurisdictions - Labrel PDFPriscilla DawnNo ratings yet

- Bba 103 AssignmentDocument7 pagesBba 103 AssignmentjasonNo ratings yet

- Final ReportDocument20 pagesFinal ReportFardin IslamNo ratings yet

- Chap 005Document20 pagesChap 005Barbara Encisa Parado100% (1)

- Central Problems of EconomicsDocument2 pagesCentral Problems of EconomicsPugazhenthi RajagopalNo ratings yet

- My Turtle DiagramDocument8 pagesMy Turtle DiagramSathyaprakash HsNo ratings yet

- Psychologia Mind Study: Industrial Psychology and Group DynamicsDocument6 pagesPsychologia Mind Study: Industrial Psychology and Group DynamicsAlmie TabulongNo ratings yet

- TOEIC Practise Test - Incomplete Sentences - Error Recognition A Reading ComprehensionDocument8 pagesTOEIC Practise Test - Incomplete Sentences - Error Recognition A Reading ComprehensionSylvie Yunjae CassiopeiaNo ratings yet

- IBM Case AnalysisDocument7 pagesIBM Case AnalysisJustine Nelson BurhNo ratings yet

- Parts of A ProposalDocument56 pagesParts of A ProposalMd.Azizul Islam0% (1)

- Nebosh Igc1 Element 1 Foundations For H S Rev ADocument38 pagesNebosh Igc1 Element 1 Foundations For H S Rev ANaveen C PaulNo ratings yet

- Strategic Com. Ass 1 Case StudyDocument12 pagesStrategic Com. Ass 1 Case StudyVeronica Geddes0% (1)

- Payslip - 2019 08 31 - ID 40025704Document1 pagePayslip - 2019 08 31 - ID 40025704R KNo ratings yet

- Human Resource Management Strategy in Itc LTD.: 1.1 Basic PrinciplesDocument34 pagesHuman Resource Management Strategy in Itc LTD.: 1.1 Basic PrincipleshwagdareNo ratings yet

- Cambridge English Empower Empower C1 Reading Plus U09 WorksheetDocument2 pagesCambridge English Empower Empower C1 Reading Plus U09 WorksheetGERESNo ratings yet

- Aggregate Demand and SupplyDocument41 pagesAggregate Demand and SupplySonali JainNo ratings yet

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- 2018 Chapter 3-4 Ergonomics PDFDocument76 pages2018 Chapter 3-4 Ergonomics PDFLove StrikeNo ratings yet

- 323 Chapter 1 Methods, Standards, and Work DesignDocument18 pages323 Chapter 1 Methods, Standards, and Work DesignCristi EteganNo ratings yet

- Luther Employment LawDocument144 pagesLuther Employment LawAung Ko ZawNo ratings yet

- Byju'S Important Interview Questions and Answers: Q. 1 Why Do You Want To Do This Job After Studying B Tech/ Bcom/ Ba?Document5 pagesByju'S Important Interview Questions and Answers: Q. 1 Why Do You Want To Do This Job After Studying B Tech/ Bcom/ Ba?navneet vishwakarma33% (3)

- HR ChecklistDocument8 pagesHR ChecklistVivek ViswanathanNo ratings yet

- 15 June 2015 - GOSL Statement On Report by SR On MigrantsDocument11 pages15 June 2015 - GOSL Statement On Report by SR On MigrantsAda DeranaNo ratings yet

- How To Respond To Interview Questions - BEST SAMPLE ANSWERS: 1. Tell Me About YourselfDocument2 pagesHow To Respond To Interview Questions - BEST SAMPLE ANSWERS: 1. Tell Me About YourselfTania GomezNo ratings yet

- Final Report - Priority Vocational SkillsDocument224 pagesFinal Report - Priority Vocational SkillsAhmad Rizal SatmiNo ratings yet

- Paws For The Cause - Final ProposalDocument22 pagesPaws For The Cause - Final Proposalapi-347900756No ratings yet