Professional Documents

Culture Documents

Form 16 Data 1 PDF

Uploaded by

RISHABH JAINOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16 Data 1 PDF

Uploaded by

RISHABH JAINCopyright:

Available Formats

00759664/BWAPM6496B PRITAM PRADEEPKUMAR MANGRULKAR

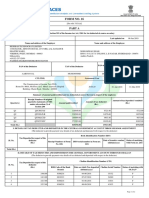

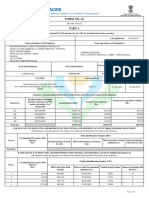

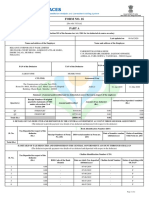

FORM NO.16

[See rule 31(1)(a)] "Non TRACES Generated"

PART A

Certificate under section 203 of the Income-tax Act, 1961 taxdeducted at source on salary

Certificate No. Last updated on

Name and address of the Employer Name and address of the Employee

TATA CONSULTANCY SERVICES LTD. PRITAM PRADEEPKUMAR MANGRULKAR

8th Flr, Nirmal Bldg, Nariman Point

Mumbai ,400021

Maharashtra

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Refernece No. provided

by the Employer (If available)

AAACR4849R MUMT11446B BWAPM6496B 00759664

CIT (TDS) Assessment Year Period with the Employer

Address 900A,9th flr,K.G Mittal Hsptl bldg From To

Charni Rd

City : MUMBAI Pin Code 400002 2014-2015 02.07.2013 31.03.2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s) Receipt Numbers of original quarterly statements Amount Amount of tax deducted Amount of tax deposited/

of TDS under sub-section (3) of section 200 paid/credited ( INR ) remitted ( INR )

Quarter 1 0 0

Quarter 2 0 0

Quarter 3 0 0

Quarter 4 0 0

Total (INR) 0.00 0.00 0.00

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH

CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No. Tax Deposited in Challan Identification Number (CIN)

respect of the

deductee (INR) BSR Code of the Bank Date on which tax deposited Challan Serial Status of

Branch (dd/mm/yyyy) Number matching with OLTAS

00759664/BWAPM6496B PRITAM PRADEEPKUMAR MANGRULKAR

Total (INR) 0.00

Verification

I, BHIKHOO J. KATRAK, son/daughter of JEHANGIRJI working in the capacity of SENIOR GENERAL MANAGER (designation) do hereby

certify that a sum of INR 0.00 [Rupees. NIL (in words)] has been deducted and deposited to the credit of the Central Government. I further

certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements,

TDS deposited and other available records.

Place MUMBAI

Date 30.05.2014 (Signature of person responsible for deduction of tax)

Designation: SENIOR GENERAL MANAGER Full Name: BHIKHOO J. KATRAK

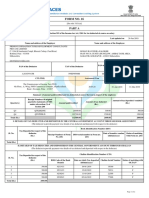

00759664/BWAPM6496B PRITAM PRADEEPKUMAR MANGRULKAR

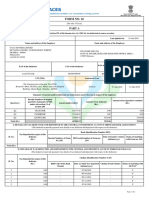

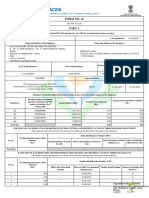

PART B (Annexure)

Details of Salary paid and any other income and tax deducted INR INR INR

1. Gross Salary

(a) Salary as per provisions contained in sec.17(1) 198280.00

(b) Value of perquisites u/s 17(2)

(as per Form No.12BA, wherever applicable) 0.00

(c) Profits in lieu of salary under section 17(3)

(as per Form No.12BA, wherever applicable) 0.00

(d) Total 198280.00

2. Less: Allowance to the extent exempt u/s 10 7174.00

Conveyance Exemption 7174.00

3. Balance(1-2) 191106.00

4. Deductions :

(a) Entertainment allowance 0.00

(b) Tax on employment 1750.00

5. Aggregate of 4(a) and (b) 1750.00

6. Income chargeable under the head 'salaries' (3-5) 189356.00

7. Add: Any other income reported by the employee 0.00

8. Gross total income (6+7) 189356.00

9. Deductions under chapter VI-A Gross amount Deductible amount

(A) sections 80C, 80CCC and 80CCD

(a) section 80C

i) Employee Provident Fund 10438.00 10438.00

(b) section 80CCC 0.00 0.00

(c) section 80CCD 0.00 0.00

Note: 1. Aggregate amount deductible under sections 80C, 80CCC and

80CCD(1) shall not exceed one lakh rupees.

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A. Gross amount Qualifying amount Deductible amount

(a) 80D(01) 2810.00 2810.00 2810.00

(b) 80D(03) 8092.00 8092.00 8092.00

10. Aggregate of deductible amount under Chapter VIA 21340.00

11. Total Income (8-10) 168020.00

12. Tax on total income 0.00

13. Education cess @ 3 % ( on tax computed at S.No.12 ) 0.00

14. Tax Payable (12+13) 0.00

15. Less: Relief under section 89 (attach details) 0.00

16. Tax payable (14-15) 0.00

Verification

I, BHIKHOO J. KATRAK, son/daughter of JEHANGIRJI working in the capacity of SENIOR GENERAL MANAGER (designation) do hereby

certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, and

other available records.

Place MUMBAI

Date 30.05.2014 (Signature of person responsible for deduction of tax)

Designation: SENIOR GENERAL MANAGER Full Name: BHIKHOO J. KATRAK

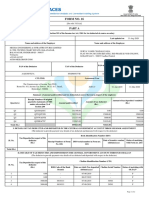

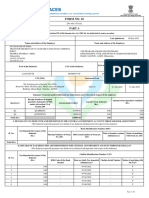

Annexure to Form No.16

Name: PRITAM PRADEEPKUMAR MANGRULKAR Emp No.: 00759664

Particulars Amount(Rs.)

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Emoluments paid

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Basic Salary 86987.00

Conveyance Allowance 7174.00

House Rent Allowance 34795.00

Leave Travel Allowance 7438.00

Medical Allowance 5234.00

Food Coupons 1234.00

Personal Allowance 23885.00

Variable Allowance 31533.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Perks

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Gross emoluments 198280.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Income from other sources

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total income from other sources 0.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Exemptions u/s 10

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- --

Conveyance Exemption 7174.00

--------------------------------------------------------------- --------------------------------------------------------------- --------------------------------------------------------------- -------

Total Exemption 7174.00

Digitally Signed By BHIKHOO J KATRAK

(TATA CONSULTANCY SERVICES LIMITED)

Date : 31-May-2014

Date: 30.05.2014 Full Name: BHIKHOO J. KATRAK

Place: MUMBAI Designation: SENIOR GENERAL MANAGER

00759664/BWAPM6496B PRITAM PRADEEPKUMAR MANGRULKAR

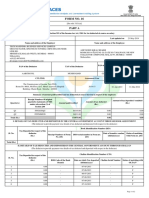

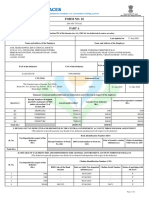

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisites, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1) Name and address of employer :

TATA CONSULTANCY SERVICES LTD. , 8th Flr, Nirmal Bldg, Nariman Point Mumbai - 400021 , Maharashtra

2) TAN: MUMT11446B

3) TDS Assesment Range of the employer :

,,,,

4) Name, designation and PAN of employee :

Mr/Ms: PRITAM PRADEEPKUMAR MANGRULKAR , Desig.: A.S.E-Trainee , Emp #: 00759664 , PAN: BWAPM6496B

5) Is the employee a director or a person with substantial interest in

the company (where the employer is a company):

6) Income under the head "Salaries" of the employee : 189356.00

(other than from perquisites)

7) Financial year : 2013-2014

8) Valuation of Perquisites

S.No Nature of perquisite Value of perquisite Amount, if any, recovered Amount of perquisite

(see rule 3) as per rules ( INR ) from the employee (INR) chargeable to tax( INR)

(1) (2) (3) (4) Col(3)-Col(4) (5)

1 Accommodation 0.00 0.00 0.00

2 Cars/Other automotive 0.00 0.00 0.00

3 Sweeper, gardener, watchman or 0.00 0.00 0.00

personal attendant

4 Gas, electricity, water 0.00 0.00 0.00

5 Interest free or concessional loans 0.00 0.00 0.00

6 Holiday expenses 0.00 0.00 0.00

7 Free or concessional travel 0.00 0.00 0.00

8 Free meals 0.00 0.00 0.00

9 Free Education 0.00 0.00 0.00

10 Gifts, vouchers, etc. 0.00 0.00 0.00

11 Credit card expenses 0.00 0.00 0.00

12 Club expenses 0.00 0.00 0.00

13 Use of movable assets by employees 0.00 0.00 0.00

14 Transfer of assets to employees 0.00 0.00 0.00

15 Value of any other benefit 0.00 0.00 0.00

/amenity/service/privilege

16 Stock options ( non-qualified options ) 0.00 0.00 0.00

17 Other benefits or amenities 0.00 0.00 0.00

18 Total value of perquisites 0.00 0.00 0.00

19 Total value of profits in lieu of salary 0.00 0.00 0.00

as per section 17 (3)

9. Details of tax, -

(a) Tax deducted from salary of the employee under section 192(1) 0.00

(b) Tax paid by employer on behalf of the employee under section192(1A) 0.00

(c) Total tax paid 0.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, BHIKHOO J. KATRAK son/daughter of JEHANGIRJI working as SENIOR GENERAL MANAGER (designation ) do hereby declare on

behalf of TATA CONSULTANCY SERVICES LTD. ( name of the employer ) that the information given above is based on the books of

account, documents and other relevant records or information available with us and the details of value of each such perquisite are in

accordance with section 17 and rules framed thereunder and that such information is true and correct.

Signature of the person responsible

for deduction of tax

Place: MUMBAI Full Name : BHIKHOO J. KATRAK

Date : 30.05.2014 Designation : SENIOR GENERAL MANAGER

You might also like

- Form 16 FY 19-20Document6 pagesForm 16 FY 19-20Anurag SharmaNo ratings yet

- Form16.part A 630430Document2 pagesForm16.part A 630430mohammadNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument5 pagesFORM 16 TAX DEDUCTION CERTIFICATEJagdeep SinghNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- FORM 16 DETAILSDocument2 pagesFORM 16 DETAILSdivanshuNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Form16 2022 2023Document8 pagesForm16 2022 2023HeetNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- Form 16 SummaryDocument2 pagesForm 16 SummaryAkchikaNo ratings yet

- Part A 1991 PDFDocument2 pagesPart A 1991 PDFDARSHAN NAIKNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Form 16: TLG India Private LimitedDocument9 pagesForm 16: TLG India Private LimitedcagopalofficebackupNo ratings yet

- FORM 16 DETAILSDocument2 pagesFORM 16 DETAILSKushal MalhotraNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- Form 16 TDS certificate summaryDocument7 pagesForm 16 TDS certificate summaryrajNo ratings yet

- TDS Certificate Form 16Document6 pagesTDS Certificate Form 16naveen kumarNo ratings yet

- Accenture Form 16Document7 pagesAccenture Form 16Srikrishna PadmannagariNo ratings yet

- Form 16 - IT DEPT Part A - 20202021Document2 pagesForm 16 - IT DEPT Part A - 20202021Kritansh BindalNo ratings yet

- BLJPM3369M 2014-15Document2 pagesBLJPM3369M 2014-15jackproewildNo ratings yet

- G CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFDocument2 pagesG CR RK Gia 1 X 57 AV0 T64 P DF6 Xrog DAEWFFjay krishnaNo ratings yet

- EyspsDocument2 pagesEyspsrasoolvaliskNo ratings yet

- Form No. 16: Part ADocument2 pagesForm No. 16: Part AasifNo ratings yet

- Aoapk6856n 2019-20 PDFDocument2 pagesAoapk6856n 2019-20 PDFSiva Kumar KNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part Asamir royNo ratings yet

- Form 16 Salary CertificateDocument9 pagesForm 16 Salary CertificateHarish KumarNo ratings yet

- Jay - Kashyap@vedanta - Co.in F16Document8 pagesJay - Kashyap@vedanta - Co.in F16Jay kashyapNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AFarhan23inamdaRNo ratings yet

- Form 16 Tax Deduction CertificateDocument2 pagesForm 16 Tax Deduction CertificateyyyNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Form 16 NikitaDocument3 pagesForm 16 Nikitaravinder singhalNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part ARohan SalokheNo ratings yet

- Documents - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFDocument5 pagesDocuments - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFsadanand kanadeNo ratings yet

- Agcpa9205b 2019-20Document2 pagesAgcpa9205b 2019-20HRNo ratings yet

- Aikpd4798c 2019-20Document2 pagesAikpd4798c 2019-20Satyanarayana Sharma ValluriNo ratings yet

- Ahxxxxxxxq q4 2022-23Document2 pagesAhxxxxxxxq q4 2022-23AMAN DEEP SINGHNo ratings yet

- Aofpc1472d 2020-21Document2 pagesAofpc1472d 2020-21uday digumarthiNo ratings yet

- Form 16 FYbilDocument8 pagesForm 16 FYbilBilalNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS CertificateKesava KesNo ratings yet

- Form 16 SummaryDocument9 pagesForm 16 SummarySujata ChoudharyNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Fy2018-19 Part A PDFDocument2 pagesFy2018-19 Part A PDFVoot VootNo ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- Form 16 TDS Certificate SummaryDocument4 pagesForm 16 TDS Certificate Summarychintha hari prasadNo ratings yet

- Form 16 2021-2022Document10 pagesForm 16 2021-2022ArchanaNo ratings yet

- Htaimrb Form16 54079Document6 pagesHtaimrb Form16 54079Akhil AggarwalNo ratings yet

- 2018-19 - Part B - 1Document4 pages2018-19 - Part B - 1Shivam DixitNo ratings yet

- Form 16 Salary CertificateDocument6 pagesForm 16 Salary CertificatePritha DasNo ratings yet

- Form16 2012 AAXPE4654P 2023-24Document2 pagesForm16 2012 AAXPE4654P 2023-24Srinivas EtikalaNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Form16 Parta AQLPK9881A 2018-19Document2 pagesForm16 Parta AQLPK9881A 2018-19Rakesh KumarNo ratings yet

- Ajay Kumar Jaiswal TDS 2019-20Document10 pagesAjay Kumar Jaiswal TDS 2019-20AJAY KUMAR JAISWALNo ratings yet

- Form 16Document7 pagesForm 16Finisher SquadNo ratings yet

- Weekly BeePedia 16th To 22nd October 2020Document62 pagesWeekly BeePedia 16th To 22nd October 2020RISHABH JAINNo ratings yet

- Ideal Handbook of MathDocument19 pagesIdeal Handbook of MathDurgaNo ratings yet

- Monthly BeePedia September 2020Document118 pagesMonthly BeePedia September 2020RISHABH JAINNo ratings yet

- Solved NEET 2019 Paper With SolutionsDocument48 pagesSolved NEET 2019 Paper With SolutionsRISHABH JAINNo ratings yet

- Solved IIFT 2019 Paper With SolutionsDocument63 pagesSolved IIFT 2019 Paper With SolutionsRISHABH JAINNo ratings yet

- Solved IIFT 2019 Paper With SolutionsDocument63 pagesSolved IIFT 2019 Paper With SolutionsRISHABH JAINNo ratings yet

- Economic Reforms in India Since 1991: An AppraisalDocument21 pagesEconomic Reforms in India Since 1991: An AppraisalShem W LyngdohNo ratings yet

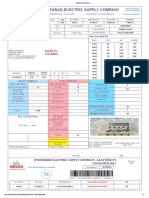

- Najeeb Gas BillDocument1 pageNajeeb Gas BillAbdul ghaffarNo ratings yet

- Significance of Procedures and Documentation in International TradeDocument8 pagesSignificance of Procedures and Documentation in International TradetarunNo ratings yet

- Rajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.Document2 pagesRajat Communication: Butler Plaza Bareilly Bareilly - 243001 Mo. No.arjun guptaNo ratings yet

- Material Control: Ashim Bhatta (CA, MBS, ISA)Document49 pagesMaterial Control: Ashim Bhatta (CA, MBS, ISA)Safal BhandariNo ratings yet

- Dwnload Full Introductory Statistics 2nd Edition Gould Solutions Manual PDFDocument36 pagesDwnload Full Introductory Statistics 2nd Edition Gould Solutions Manual PDFilorlamsals100% (11)

- Gaz GBDocument1 pageGaz GBhiri6puvNo ratings yet

- Confirmation For Booking ID # 717946689Document1 pageConfirmation For Booking ID # 717946689shiddiqi01No ratings yet

- HESCO Online Bill SummaryDocument1 pageHESCO Online Bill SummaryBLACK SQUADNo ratings yet

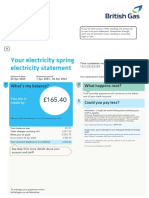

- Your Electricity Spring Electricity Statement: What's My Balance?Document1 pageYour Electricity Spring Electricity Statement: What's My Balance?Maxi KiMNo ratings yet

- Industrial gas bill detailsDocument1 pageIndustrial gas bill detailsMaan AliNo ratings yet

- Subsidy and Countervailing DutyDocument16 pagesSubsidy and Countervailing DutyShaina DalidaNo ratings yet

- 1-International Economics - Nature & ScopeDocument13 pages1-International Economics - Nature & ScopeAvni Ranjan Singh100% (1)

- Contemporary World: Concrete Liberal MeasuresDocument2 pagesContemporary World: Concrete Liberal MeasuresRika MiyazakiNo ratings yet

- VAT RoadmapDocument29 pagesVAT RoadmapGiven RefilweNo ratings yet

- Import Substitution Strategy for Industrial DevelopmentDocument35 pagesImport Substitution Strategy for Industrial DevelopmentGoodluck MalekoNo ratings yet

- Travel Itinerary: SDG39JDocument3 pagesTravel Itinerary: SDG39JArman BentainNo ratings yet

- Vietnam Power Sector Offers Long-Term Value on Strong Demand GrowthDocument68 pagesVietnam Power Sector Offers Long-Term Value on Strong Demand GrowthLuong Thu HaNo ratings yet

- Income Taxation On Corporations Exercise ProblemsDocument2 pagesIncome Taxation On Corporations Exercise ProblemsRico, Jalaica B.No ratings yet

- Types of Customs DutyDocument2 pagesTypes of Customs Dutyshiva ramanNo ratings yet

- Exercise Chapter 11 - Intermediate MicroeconomicsDocument3 pagesExercise Chapter 11 - Intermediate MicroeconomicsdeltakoNo ratings yet

- The Customs Legislation and Procedures Diploma CourseDocument2 pagesThe Customs Legislation and Procedures Diploma CourseBewovic50% (2)

- Super Chem: Certified That The Particulars Given Above Are True and CorrectDocument1 pageSuper Chem: Certified That The Particulars Given Above Are True and CorrectAman PrajapatiNo ratings yet

- 028 Ptrs Modul Matematik t4 Sel-96-99Document4 pages028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88No ratings yet

- TRAIN Law Comparative SummaryDocument3 pagesTRAIN Law Comparative SummaryBien Bowie A. Cortez100% (1)

- Solutions To Problems: Pe On Estate TaxDocument11 pagesSolutions To Problems: Pe On Estate TaxErica NicolasuraNo ratings yet

- A Study On Impact of Implementation of Goods and Service Tax Among Retailers in Warora CityDocument11 pagesA Study On Impact of Implementation of Goods and Service Tax Among Retailers in Warora Cityप्रेम हेNo ratings yet

- Voluntary Export RestraintsDocument4 pagesVoluntary Export RestraintsRed VelvetNo ratings yet

- Explain The Meaning of Trade LiberalizationDocument1 pageExplain The Meaning of Trade LiberalizationMARISSE BALBOANo ratings yet

- Reimbursement Expense Receipt Reimbursement Expense Receipt: Appendix 18 Appendix 18Document1 pageReimbursement Expense Receipt Reimbursement Expense Receipt: Appendix 18 Appendix 18tineosiervo23No ratings yet