Professional Documents

Culture Documents

FormANNX 2022 1

Uploaded by

spider14Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FormANNX 2022 1

Uploaded by

spider14Copyright:

Available Formats

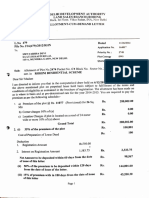

52155533/DCYPA9976C AJITHKAR K

Annexure to Form 16 Part B

2(f). Break up for 'Amount of any other exemption under section 10' to be filled in the table below

Particular's of Amount of any other exemption under section 10' INR

10(k). Break up for 'Amount deductible under any other provision(s) of Chapter VI-A ' to be filled in the table below

Particular's of amount deductible under any other provision(s) of Chapter VI-A Gross Amount Qualifying Amount Deductible Amount

Place NEW DELHI (Signature of person responsible for deduction of tax)

Date 30.05.2023 Full Name: MR.SUNIL IDNANI

Signature Not Verified

Signed By:Sunil Idnani

Reason:I attest to the accuracy of

this document

Location:

Signing Date:08.06.2023 13:09

52155533/DCYPA9976C AJITHKAR K

FORM No.12BA

{See Rule 26A(2)(b)}

Statement showing particulars of perquisities, other fringe

benefits or amenities and profits in lieu of salary with value thereof

1. Name and address of employer : HCL Technologies Limited,806 Siddharth, 96 Nehru Place,, New Delhi,110019,Delhi

2. TAN : DELH01586E

3. TDS Assessment Range of the employer : TDS Circle 74(1),Aayakar Bhawan, Laxmi Nagar,Delhi,110092,Delhi

4. Name, designation and Permanent Account Number or

Aadhaar Number of employee

: AJITHKAR K,CONSULTANT,52155533,DCYPA9976C

5. Is the employee a director or a person with substantial interest

in the company(where the employer is a company) :

6. Income under the head “Salaries” of the employee

(other than from perquisites)

: 98822.47

7. Financial year : 2022-2023

8. Valuation of Perquisites :

Amount of perquisite

Amount, if any, recovered

S. Value of perquisite as per chargeable to tax

Nature of perquisites (see rule 3) from the employee

No. (Rs.) Col. (3) - Col(4)

(Rs.)

(Rs.)

(1) (2) (3) (4) (5)

1. Accommodation 0.00 0.00 0.00

2. Cars/Other automotive 0.00 0.00 0.00

Sweeper, gardener, watchman or

3. 0.00 0.00 0.00

personal attendant

4. Gas, electricity, water 0.00 0.00 0.00

5. Interest free or concessional loans 0.00 0.00 0.00

6. Holiday expenses 0.00 0.00 0.00

7. Free or concessional travel 0.00 0.00 0.00

8. Free meals 0.00 0.00 0.00

9. Free education 0.00 0.00 0.00

10. Gifts, vouchers, etc. 0.00 0.00 0.00

11. Credit card expenses 0.00 0.00 0.00

12. Club expenses 0.00 0.00 0.00

13. Use of movable assets by employees 0.00 0.00 0.00

14. Transfer of assets to employees 0.00 0.00 0.00

15. Value of any other benefit/amenity/service/privilege 0.00 0.00 0.00

16. Stock options allotted or transferred by employer being

0.00 0.00 0.00

an eligible start-up referred to in section 80-IAC.

17. Stock options (non-qualified options) other than ESOP in

0.00 0.00 0.00

col 16 above.

18. Contribution by employer to fund and scheme taxable

under section 17(2)(vii). 0.00 0.00 0.00

19. Annual accretion by way of interest, dividend etc. to the

balance at the credit of fund and scheme referred to in 0.00 0.00 0.00

section 17(2)(vii) and taxable under section 17(2)(viia).

20. Other benefits or amenities 0.00 0.00 0.00

21. Total value of perquisites 0.00 0.00 0.00

22. Total value of profits in lieu of salary as per section 17(3) 0.00 0.00 0.00

Details of tax

(a) Tax deducted from salary of the employee under section 192(1) 0.00

(b) Tax paid by employer on behalf of the employee under section 192(1A) 0.00

(c) Total tax paid 0.00

(d) Date of payment into Government treasury

DECLARATION BY EMPLOYER

I, MR.SUNIL IDNANI Son/daughter of LATE MR.ISHWAR LAL IDNANI working as DIRECTOR (designation ) do hereby declare on behalf of HCL

Signature Not Verified

Technologies Limited ( name of the employer ) that the information given above is based on the books of account , documents and other relevant

Signed By:Sunil Idnani

records or information available with us and the details of value of each such perquisite are in accordance with section 17 and rules

Reason:I framed

attest to thereunder

the accuracy of

this document

and that such information is true and correct. Location:

Signing Date:08.06.2023 13:09

Signature of person responsible for deduction of tax

Place : NEW DELHI Full Name:MR.SUNIL IDNANI

Date : 30.05.2023 Designation:DIRECTOR

52155533/DCYPA9976C AJITHKAR K

Annexure to Form No.16

Name: AJITHKAR K Emp No.: 52155533

Particulars Amount(INR)

Emoluments paid

Basic Salary 55942.29

House Rent Allowance 27972.97

Bonus 8354.71

Leave Encashment 252.00

Other Allowances (Including NPS Employer Income) 57550.50

Perquisites

Gross emoluments 150072.47

Income from other sources

Income

Total income from other sources 0.00

Exemptions u/s 10

Allowance

Total Exemption 0.00

Signature Not Verified

Signed By:Sunil Idnani

Reason:I attest to the accuracy of

this document

Location:

Signing Date:08.06.2023 13:09

Date: 30.05.2023 Full Name: MR.SUNIL IDNANI

Place: NEW DELHI Designation: DIRECTOR

You might also like

- Annexure To Form 16 Part B (2020)Document3 pagesAnnexure To Form 16 Part B (2020)Dharmendra ParmarNo ratings yet

- 2023-24 12baDocument3 pages2023-24 12baiammouliNo ratings yet

- 2f10k 2022-23 1Document3 pages2f10k 2022-23 1Md shamirNo ratings yet

- FY2022 23 Annexure To Form16Document3 pagesFY2022 23 Annexure To Form16Joydip MukhopadhyayNo ratings yet

- Place Mumbai: Annexure To Form 16 Part BDocument3 pagesPlace Mumbai: Annexure To Form 16 Part BsivaNo ratings yet

- Annexure To Form 16Document3 pagesAnnexure To Form 16mohitverma.840No ratings yet

- Annexure To Form 16 - TCS - 20202021Document3 pagesAnnexure To Form 16 - TCS - 20202021Kritansh BindalNo ratings yet

- Ay2021-22 12baDocument2 pagesAy2021-22 12bazaffsanNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Bob Form12baDocument1 pageBob Form12baruchi561No ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfspoojameher644No ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Epsf Form12bb 903949Document2 pagesEpsf Form12bb 903949MALLA SAI YASWANTH REDDYNo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Delhi Metro Rail Corporation Limited Payment Advice NoteDocument16 pagesDelhi Metro Rail Corporation Limited Payment Advice NoteashishNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Annexure To Form 16 Part B (2019)Document3 pagesAnnexure To Form 16 Part B (2019)Dharmendra ParmarNo ratings yet

- Key Fact Sheet: DelhiDocument3 pagesKey Fact Sheet: Delhisales.kayteeautoNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- Adobe Scan Feb 23, 2022Document1 pageAdobe Scan Feb 23, 2022Hari KNo ratings yet

- Sanction LetterDocument16 pagesSanction LetterKiran Kumar DevajjiNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With KfsibtfaizabadNo ratings yet

- Kulkarni Sarang MilindDocument21 pagesKulkarni Sarang MilindSarang KulkarniNo ratings yet

- F12ba 1005009 2016Document2 pagesF12ba 1005009 2016Nikhil121314No ratings yet

- Proj - No.04. Salary July - 2023Document7 pagesProj - No.04. Salary July - 2023EENo ratings yet

- Kapil Mittal (SR Garments)Document12 pagesKapil Mittal (SR Garments)SHRUTI AGRAWALNo ratings yet

- Diana Ogerio PayslipDocument2 pagesDiana Ogerio PayslipAimee DavidNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form 27 Dec 2022Document3 pagesForm 27 Dec 2022srinivasgateNo ratings yet

- Form 16 TDS CertificateDocument4 pagesForm 16 TDS Certificateqwerty9999499949No ratings yet

- Form 16 Part BDocument4 pagesForm 16 Part BDharmendraNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NODocument3 pagesForm No.12Ba: Savan Gurudas Anvekar Development Manager AAOPA9108A NOsavan anvekarNo ratings yet

- Gjwpp7325e Q1 2024 25Document3 pagesGjwpp7325e Q1 2024 25Adarsh PandeyNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Dot Notice ZD070923053452D 20230926013050Document2 pagesDot Notice ZD070923053452D 20230926013050Himanshu GugnaniNo ratings yet

- Globallogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EDocument4 pagesGloballogic India Limited: Pan No - Aabci2526F Tan No. Deli04813EneerajNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Aadcp9992n Q3 2023-24Document3 pagesAadcp9992n Q3 2023-24Harikrishan BhattNo ratings yet

- Apr22 Mar23 TaxsheetDocument3 pagesApr22 Mar23 TaxsheetKritika GuptaNo ratings yet

- 103120000000007839Document3 pages103120000000007839ShilpaMurthyNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- © The Institute of Chartered Accountants of India: ST ST STDocument14 pages© The Institute of Chartered Accountants of India: ST ST STRITZ BROWNNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportANTHONI FERNANDESNo ratings yet

- FORM16Document10 pagesFORM16Siva Ramakrishna100% (1)

- 2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BDocument3 pages2 (F) Amount of Any Other Exemption Under Section 10: Annexure To Form 16 Part BAnonymous IIj5AONo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Public Office, Private Interests: Accountability through Income and Asset DisclosureFrom EverandPublic Office, Private Interests: Accountability through Income and Asset DisclosureNo ratings yet

- Harvard Bus Review - Crown Cork & Seal in 1989: January 2017Document9 pagesHarvard Bus Review - Crown Cork & Seal in 1989: January 2017Indra FerdynanNo ratings yet

- Receivables Study Guide Solutions Fill-in-the-Blank EquationsDocument19 pagesReceivables Study Guide Solutions Fill-in-the-Blank EquationsPelin CanikliNo ratings yet

- The Recalcitrant Director at Byte ProductsDocument4 pagesThe Recalcitrant Director at Byte Productssimsim sasaNo ratings yet

- Proforma Ata#119 7 02 2022Document32 pagesProforma Ata#119 7 02 2022Jamir FloresNo ratings yet

- Hana Leulseged 2324 Intl Student Fin Aid App PDFDocument5 pagesHana Leulseged 2324 Intl Student Fin Aid App PDFHana LeulsegedNo ratings yet

- Nantong Winsun PowerDocument2 pagesNantong Winsun PowerJeffrey L. MedinaNo ratings yet

- Procedure QueryDocument22 pagesProcedure QuerySiddiq MohammedNo ratings yet

- View PDFServletDocument1 pageView PDFServletRakesh kumar JhaNo ratings yet

- International Trade PoliciesDocument12 pagesInternational Trade Policieskateangel ellesoNo ratings yet

- Instruments of International Trade PolicyDocument43 pagesInstruments of International Trade PolicyThe logical humanNo ratings yet

- E TicketDocument1 pageE TicketKamal Raj MohanNo ratings yet

- Chapter 2162Document38 pagesChapter 2162Sheetal Bhingardive100% (2)

- Bandhan Statement SandipDocument4 pagesBandhan Statement SandipIndranilGhosh0% (1)

- Intro To Inclusive BuisnessDocument27 pagesIntro To Inclusive BuisnessKhalid AhmedNo ratings yet

- National Security: The Role of Investment Screening MechanismsDocument37 pagesNational Security: The Role of Investment Screening MechanismsRocking MeNo ratings yet

- Various Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaDocument11 pagesVarious Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaIAEME PublicationNo ratings yet

- Bir Rulings Compilation 2022Document2 pagesBir Rulings Compilation 2022RANADA John BernardNo ratings yet

- I HousingDocument8 pagesI Housingamahle NeneNo ratings yet

- Conversion Cycle ReportDocument2 pagesConversion Cycle ReportNikki BaltazarNo ratings yet

- Bcg-white-paper-2021-u.S. Mortgage Predictions and Priorities - Jan 2021Document12 pagesBcg-white-paper-2021-u.S. Mortgage Predictions and Priorities - Jan 2021Muhammad MuaviaNo ratings yet

- Mitchells Balance Sheet: Question 1)Document3 pagesMitchells Balance Sheet: Question 1)Hamna RizwanNo ratings yet

- Economics Ss1 3Document11 pagesEconomics Ss1 3tjahmed87No ratings yet

- Gujarat Labour Welfare Board: This Is A Computer Generated Receipt. Hence, Doesn't Required SignatureDocument1 pageGujarat Labour Welfare Board: This Is A Computer Generated Receipt. Hence, Doesn't Required SignatureS S Electricals DahejNo ratings yet

- Hyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)Document2 pagesHyderabad Electric Supply Company - Electricity Consumer Bill (Mdi)aurang zaibNo ratings yet

- Intermediate Microeconomics and Its Application 11th Edition Nicholson Solutions ManualDocument9 pagesIntermediate Microeconomics and Its Application 11th Edition Nicholson Solutions Manualkietcuongxm5100% (24)

- Operations Management - Kellogs Role ProductDocument11 pagesOperations Management - Kellogs Role ProductAishwarya BawaNo ratings yet

- Compensation Plan: GlobalDocument24 pagesCompensation Plan: GlobalPándi ÁdámNo ratings yet

- Aula 6. Viscusi, W. Kip Vernon, John M. Harrington JR., Joseph E. Econ..Document13 pagesAula 6. Viscusi, W. Kip Vernon, John M. Harrington JR., Joseph E. Econ..Diego JanssonNo ratings yet

- Five Key Asset Management StrategiesDocument6 pagesFive Key Asset Management StrategiesFemi ObiomahNo ratings yet

- Impact of Black-MoneyDocument26 pagesImpact of Black-MoneyDevikaSharma100% (2)