Professional Documents

Culture Documents

State Audit of SUNY Travel Expenses

Uploaded by

Cara MatthewsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

State Audit of SUNY Travel Expenses

Uploaded by

Cara MatthewsCopyright:

Available Formats

New York State Office of the State Comptroller Thomas P.

DiNapoli

Division of State Government Accountability

Selected Employee Travel Expenses State University of New York System Administration Office

Report 2012-S-100

July 2013

2012-S-100

Executive Summary

Purpose

To determine whether the use of travel monies by selected government employees complied with rules and regulations and is free from fraud, waste, and abuse. The audit covers the period April 1, 2008 to March 31, 2011.

Background

New York States executive agencies spend between $100 million and $150 million each year on travel expenses. These expenses, which are discretionary and under the control of agency management, include car rentals, meals, lodging, transportation, fuel, and incidental costs such as airline baggage and travel agency fees. As part of a statewide audit initiative to determine whether the use of travel money by selected government employees was appropriate, we audited travel expenses for the highest-cost travelers in the State, each of whom incurred over $100,000 in travel expenses during the three year audit period, as well as other outliers. As a result of this analysis, we selected one State University of New York System Administration Office (System Administration) employee for audit whose expenses ranked among the highest in the State in the area of lodging. In total, we examined $188,074 in travel costs associated with this employee.

Key Findings

Most of the expenses we examined were appropriate. However, the employee selected for audit had charges totaling $5,021 that were either for non-reimbursable expenses ($200 hotel room smoking charge) or lacked adequate assurance that the charges were for the most reasonable and economical method of travel ($4,821 in car service charges).

Key Recommendation

Recover the $200 hotel room smoking charge from the hotel or the employee.

Other Related Audits/Reports of Interest

SUNY College at Cobleskill: Selected Employee Travel Expenses (2012-S-143) SUNY College at Oneonta: Selected Employee Travel Expenses (2012-S-145)

Division of State Government Accountability

2012-S-100

State of New York Office of the State Comptroller Division of State Government Accountability

July 31, 2013

Dr. Nancy L. Zimpher Chancellor State University of New York State University Plaza Albany, NY 12246 Dear Chancellor Zimpher: The Office of the State Comptroller is committed to helping State agencies, public authorities and local government agencies manage government resources efficiently and effectively and, by so doing, providing accountability for tax dollars spent to support government operations. The Comptroller oversees the fiscal affairs of State agencies, public authorities and local government agencies, as well as their compliance with relevant statutes and their observance of good business practices. This fiscal oversight is accomplished, in part, through our audits, which identify opportunities for improving operations. Audits can also identify strategies for reducing costs and strengthening controls that are intended to safeguard assets. Following is a report of our audit of the State University of New York System Administration Office entitled Selected Employee Travel Expenses. The audit was performed pursuant to the State Comptrollers authority as set forth in Article V, Section 1 of the State Constitution and Article II, Section 8, of the State Finance Law. This audits results and recommendations are resources for you to use in effectively managing your operations and in meeting the expectations of taxpayers. If you have any questions about this report, please feel free to contact us. Respectfully submitted, Office of the State Comptroller Division of State Government Accountability

Division of State Government Accountability

2012-S-100

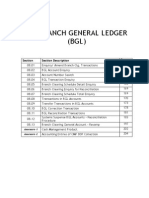

Table of Contents

Background Audit Findings and Recommendation Non-Reimbursable Expenses Reasonable and Economical Methods of Travel Recommendation Audit Scope and Methodology Authority Reporting Requirements Contributors to This Report Agency Comments 4 5 5 5 5 6 6 7 8 9

State Government Accountability Contact Information: Audit Director: John Buyce Phone: (518) 474-3271 Email: StateGovernmentAccountability@osc.state.ny.us Address: Office of the State Comptroller Division of State Government Accountability 110 State Street, 11th Floor Albany, NY 12236 This report is also available on our website at: www.osc.state.ny.us Division of State Government Accountability 3

2012-S-100

Background

New York States executive agencies spend between $100 million and $150 million each year on travel expenses. These expenses, which are discretionary and under the control of agency management, include car rentals, meals, lodging, transportation, fuel, and incidental costs such as airline baggage and travel agency fees. The mission of the State University is to provide high-quality educational services to the people of New York. The System Administration Office (System Administration) spent $3,040,827 on travel expenses from April 1, 2008 through March 31, 2011. Of that amount, $2,253,530 (or 74 percent), was for reimbursements to employees for travel expenses, direct payments to vendors, and cash advances; and $787,297 (or 26 percent) related to charges on State-issued travel cards. The audit at the State University of New York System Administration Office (SUNY System Administration) is part of a statewide initiative to determine whether the use of travel monies by selected government employees complies with rules and regulations and is free from fraud, waste, and abuse. Auditors focused their audit efforts on the highest cost travelers in the State, each of whom incurred over $100,000 in travel expenses during the three-year period, as well as on other outliers. As a result of this analysis, we examined the travel expenses for one System Administration Office employee whose expenses ranked among the highest in the State. In total, we examined $188,074 in travel costs associated with this employee. The Office of the State Comptroller sets rules and regulations for payment of expenses employees incur while traveling on official State business. The Comptrollers Travel Manual (Travel Manual) helps agencies and employees understand and apply the States travel rules and regulations, and provides instructions for reimbursing expenses. In general, when traveling on official State business, only actual, necessary and reasonable business expenses will be reimbursed. According to the Travel Manual, agencies are responsible for ensuring: all authorized travel is in the best interest of the State, all charges are actual, reasonable and necessary, all expenses comply with travel rules and regulations, the most economical method of travel is used in the best interest of the State, compliance with Internal Revenue Service (IRS) regulations, the official station of each employee is designated in the best interest of the State, employees obtain appropriate approvals prior to traveling, and exceptions or waivers are justified and necessary, and adequate funds are available for travel.

Division of State Government Accountability

2012-S-100

Audit Findings and Recommendation

We examined the travel expenses for one System Administration employee whose expenses ranked among the highest in the State in the area of lodging. In total, we examined $188,074 in travel costs associated with this employee. The employee serves as an administrative director responsible for coordinating Board of Trustee meetings, strategic planning sessions and campus tours. The majority of travel expenses for the employee included lodging, transportation expenses and meal reimbursements for the State University of New York (SUNY) Board of Trustees and other SUNY administrative support staff. We found that most of the $188,074 in travel expenses we examined for the employee selected for audit were documented and adhered to State travel rules and regulations, with some exceptions totaling $5,021. The exceptions were an instance of non-compliance with travel policy regarding a $200 non-reimbursable expense (hotel room smoking charge) and the reasonableness of car service charges totaling $4,821.

Non-Reimbursable Expenses

Certain travel expenses are non-reimbursable, such as hotel room smoking charges. The employee we sampled incurred a $200 smoking charge for a room she stayed in during April 2010. System Administration paid for the charge, but noted a credit would be requested from the hotel. However, System Administration never received credit from the hotel or the employee for this smoking charge. Because this charge is a non-reimbursable expense, System Administration should recover the $200 from the hotel or the employee who incurred it.

Reasonable and Economical Methods of Travel

The Travel Manual states that agencies should ensure that most economical method of travel is used in the best interest of the State. The employee we sampled used their credit card to purchase car services (51 transactions) totaling $8,793 for the Chancellor, Board of Trustees, job candidates and other officials on SUNY-related business. The majority of the car service transactions we reviewed ranged from $80 to $150. However, 11 of these transactions, totaling $4,821 (55 percent) of the total spent on car services, were for car services costing $350 or more per day. For example, a $735 charge was incurred for one day when the Chancellor traveled round-trip from Manhattan to Stony Brook. Four other transactions, representing two consecutive round-trip day trips by one Board member, totaled $690 and $674 respectively. These transactions did not have supporting documentation indicating special circumstances to justify the expenditures or that less expensive methods of transportation were considered. When asked about these charges, SUNY System Administration officials stated that the car service vendors they used between 2009 and early 2010 were expensive; and noted that SUNY System Administration discontinued doing business with them. We did not identify similarly high charges after January 2010.

Recommendation

1. Recover the $200 hotel room smoking charge from hotel or the employee. Division of State Government Accountability 5

2012-S-100

Audit Scope and Methodology

We audited selected travel expenses for one System Administration employee for the period April 1, 2008 to March 31, 2011. The objectives of our audit were to determine whether the use of travel monies by selected government employees complied with rules and regulations, and is free from fraud, waste, and abuse. To accomplish our objectives, we analyzed travel expenses incurred by and on behalf of State employees for the three years ended March 31, 2011. As a result of this analysis, we examined the travel expenses for one System Administration employee whose expenses ranked among the highest in the State. We examined this employees travel expenses, including reimbursements and credit card charges. As part of our examination, we obtained vouchers, receipts, and credit card statements for all selected transactions. We then verified that documentation supported the charges and showed the expenses incurred were for legitimate business purposes. We reviewed System Administration Offices internal policies and procedures and determined that the travel expenses selected for examination were approved and complied with this guidance, as well as with OSC procedures. We also became familiar with the internal controls related to travel, and assessed their adequacy related to the limited transactions we tested. Finally, we matched timesheet and travel records to ensure the travelers were working on days for which they requested travel reimbursement, and reviewed E-ZPass records, where applicable, to match against travel vouchers. We conducted our performance audit in accordance with generally accepted government auditing standards. Those standards require that we plan and perform the audit to obtain sufficient, appropriate evidence to provide a reasonable basis for our findings and conclusions based on our audit objectives. We believe that the evidence obtained provides a reasonable basis for our findings and conclusions based on our audit objectives. In addition to being the State Auditor, the Comptroller performs certain other constitutionally and statutorily mandated duties as the chief fiscal officer of New York State. These include operating the States accounting system; preparing the States financial statements; and approving State contracts, refunds, and other payments. In addition, the Comptroller appoints members to certain boards, commissions and public authorities, some of whom have minority voting rights. These duties may be considered management functions for purposes of evaluating organizational independence under generally accepted government auditing standards. In our opinion, these functions do not affect our ability to conduct independent audits of program performance.

Authority

The audit was performed pursuant to the State Comptrollers authority under Article V, Section 1 of the State Constitution and Article II, Section 8 of the State Finance Law.

Division of State Government Accountability

2012-S-100

Reporting Requirements

A draft copy of this report was provided to University officials for their review and comment. The Universitys response was considered in preparing this final report and is attached in its entirety to this report. University officials agreed with our recommendation and, as a result, have recovered the money from the individual. Within 90 days after final release of this report, as required by Section 170 of the Executive Law, the Chancellor of the State University of New York shall report to the Governor, the State Comptroller, and the leaders of the Legislature and fiscal committees, advising what steps were taken to implement the recommendation contained herein, and if the recommendation was not implemented, the reasons why.

Division of State Government Accountability

2012-S-100

Contributors to This Report

John Buyce, Audit Director Melissa Little, Audit Manager Karen Bogucki, Audit Supervisor Nadine Morrell, Audit Supervisor Sharon Salembier, Audit Supervisor Mary Roylance, Examiner-in-Charge Jason Dessureault, Staff Examiner

Division of State Government Accountability

Andrew A. SanFilippo, Executive Deputy Comptroller 518-474-4593, asanfilippo@osc.state.ny.us Elliot Pagliaccio, Deputy Comptroller 518-473-3596, epagliaccio@osc.state.ny.us Jerry Barber, Assistant Comptroller 518-473-0334, jbarber@osc.state.ny.us

Vision

A team of accountability experts respected for providing information that decision makers value.

Mission

To improve government operations by conducting independent audits, reviews and evaluations of New York State and New York City taxpayer financed programs.

Division of State Government Accountability

2012-S-100

Agency Comments

Division of State Government Accountability

You might also like

- Ossining Board of Education ResolutionDocument1 pageOssining Board of Education ResolutionCara MatthewsNo ratings yet

- Apology Letters by Robert Potanovic and Potanovic SonsDocument2 pagesApology Letters by Robert Potanovic and Potanovic SonsCara MatthewsNo ratings yet

- Theracare AuditDocument31 pagesTheracare AuditCeleste KatzNo ratings yet

- Putnam County Industrial Development AgencyDocument25 pagesPutnam County Industrial Development AgencyCara MatthewsNo ratings yet

- 2013 PenniesDocument144 pages2013 PenniesAmanda JordanNo ratings yet

- New York Library Association 2014 Budget Talking PointsDocument1 pageNew York Library Association 2014 Budget Talking PointsCara MatthewsNo ratings yet

- Villages in Financial Distress, Fiscal Years Ending 2013, February 2014Document1 pageVillages in Financial Distress, Fiscal Years Ending 2013, February 2014Cara MatthewsNo ratings yet

- Putnam County CandidatesDocument4 pagesPutnam County CandidatesCara MatthewsNo ratings yet

- 2013 Annual Report To Congress Executive SummaryDocument76 pages2013 Annual Report To Congress Executive SummaryKelly Phillips ErbNo ratings yet

- Mount Pleasant AuditDocument14 pagesMount Pleasant AuditCara MatthewsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- MF Working CapitalDocument81 pagesMF Working CapitalJansen Alonzo BordeyNo ratings yet

- 01 08-BGLDocument40 pages01 08-BGLmevrick_guy100% (2)

- 2024 21 2 21 47 56 Passbookstmt - 1708532276443Document7 pages2024 21 2 21 47 56 Passbookstmt - 1708532276443sheeladevi1951No ratings yet

- Form 176 MDB Ecfmg2Document10 pagesForm 176 MDB Ecfmg2Swati TyagiNo ratings yet

- American Express: Chargeback CodesDocument32 pagesAmerican Express: Chargeback CodesPriya DasNo ratings yet

- April 2020 2 PDFDocument4 pagesApril 2020 2 PDFSueyloo250% (2)

- HSBC Dispute FormDocument1 pageHSBC Dispute FormaluamanNo ratings yet

- Expended Use Case Model: Online Train Ticket Reservation SystemDocument15 pagesExpended Use Case Model: Online Train Ticket Reservation Systemapi-19764076No ratings yet

- Allen Wu: March 15 - March 31, 2021Document4 pagesAllen Wu: March 15 - March 31, 2021Brandie HamptomNo ratings yet

- ACC291 Principles of Accounting IIDocument40 pagesACC291 Principles of Accounting IIG JhaNo ratings yet

- BAC 8k PDFDocument94 pagesBAC 8k PDFDaniel KwanNo ratings yet

- Pos Fraud Trends and Counter-Actions To Mass Fraud: iSIGHT Partners, USADocument5 pagesPos Fraud Trends and Counter-Actions To Mass Fraud: iSIGHT Partners, USAdrewqq krishnaNo ratings yet

- Ebook EbayDocument54 pagesEbook EbaySAADIA BOUALOULOUNo ratings yet

- Gelato Training CoursesDocument6 pagesGelato Training CoursesJason McLyte0% (1)

- KCC (PNB Kisan Credit Card Scheme) 261218Document2 pagesKCC (PNB Kisan Credit Card Scheme) 261218Ramanpreet SinghNo ratings yet

- Reading - de 3Document18 pagesReading - de 3anh100% (1)

- Mrunal Handout Complied PDFDocument290 pagesMrunal Handout Complied PDFhirdyanshuNo ratings yet

- Tata Neu Plus OnePager 10aug22Document2 pagesTata Neu Plus OnePager 10aug22Bollywood ForeverNo ratings yet

- Cash Advance - Travel, Payroll, PCF, & Operational ExpensesDocument1 pageCash Advance - Travel, Payroll, PCF, & Operational ExpensesPgas PaccoNo ratings yet

- Bitcoin and Blockchain B094G62PPMDocument289 pagesBitcoin and Blockchain B094G62PPMDương Nguyễn BìnhNo ratings yet

- Workshop 4 Job Responsabilities - Ev Conocimiento (1)Document4 pagesWorkshop 4 Job Responsabilities - Ev Conocimiento (1)AlejandraNo ratings yet

- Houghton Mifflin Math Homework Grade 1Document6 pagesHoughton Mifflin Math Homework Grade 1flbsrhzod100% (1)

- A) Consulting Services AgreementDocument7 pagesA) Consulting Services AgreementPeter Smith0% (1)

- Wine, Beer & Liquor Retail Software - SAP Business One With Ivend RetailDocument5 pagesWine, Beer & Liquor Retail Software - SAP Business One With Ivend RetailCitiXsys TechnologiesNo ratings yet

- Boston Consulting Group Potential Test Free Practice TestDocument26 pagesBoston Consulting Group Potential Test Free Practice TestSuyash AgrawalNo ratings yet

- 2015 Ibps Po GK CapsuleDocument71 pages2015 Ibps Po GK CapsuleChandrakantKumarNo ratings yet

- So Called Laws David LangDocument12 pagesSo Called Laws David LangLuca Avie25% (4)

- A Study On Financial Products Provided by My Money MantraDocument18 pagesA Study On Financial Products Provided by My Money Mantrasivagami100% (1)

- 2014 UECC Registration FormDocument5 pages2014 UECC Registration FormUtah Association for the Education of Young ChildrenNo ratings yet

- 0RRC Enrolment PackDocument4 pages0RRC Enrolment Packom prakashNo ratings yet