Professional Documents

Culture Documents

Sabine Spohn Micash PNG 22aug2013

Uploaded by

ADBGADOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSabine Spohn Micash PNG 22aug2013

Uploaded by

ADBGADBreaking down gender barriers for Pacific women through Micash: Banking for the Unbankable

Sabine Spohn, Private Sector Development Specialist, Pacific Liaison and Coordination Office

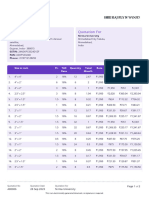

Papua New Guinea (PNG) is an incredibly diverse, vibrant country of many challenges, but also of boundless opportunities. When members of ADBs Executive Board visited Papua New Guinea earlier in 2013, they were able to witness firsthand the impact of ADBs assistance on improving the livelihoods of the rural poor, especially women. In the small village of Boera, about 30 minutes outside Port Moresby, ADB Members met with a street vendor, a local Micash agent, and several women in the community who used the service. Women expressed their great appreciation for this type of service, since previously they were not able to access such financial services in their villages. Now I can easily do my little business, save the money and only use it whenever I need it a village woman said. . A service of Nationwide Microbank (NMB), MiCash is the first bankled mobile phone banking product in the Pacific. MiCash allows vendors and consumers who may live hundreds of kilometers from the nearest bricks and mortar bank branch to access their money, make and receive payments, even save a little for a rainy day - all through their mobile device. Most people with MiCash accounts are accessing financial services for the first time in their lives. MiCashs roll out was developed with the support of the Pacific Private Sector Development Initiative (PSDI). The PSDI is a regional technical assistance facility, cofinanced by the Australian Agency for International Development, the New Zealand Aid Programme, and the Asian Development Bank (ADB). The first pilot in Papua New Guinea was introduced in West New Britain Province in 2012. It has since been rolled out across Papua New Guinea. In August 2012, NMB won the 2012 PNG Institute of Directors Award for the most innovative company of the year for the MiCash product. More broadly, MiCash and NMB have been a powerful driver to enhance the economic empowerment of women. MiCash may still be in the pilot stage, but early feedback has revealed some specific advantages that mobile phone banking can provide women: (i) (ii) (iii) a reduced need to have cash and the ability to store it safely; the ability to transact at a network of agents, without needing to travel to bank branches (recognizing the limitations on time due to womens double burden of work, and the security risk of lone travel in Papua New Guinea); and the ability to share their banking information only with whom they choose (compared to a passbook savings account, which cannot be easily kept private).

As of April 2013 it had nearly 12,000 active customers (34 per cent female and 55 per cent rural), with 81 per cent thereof previously unbanked.

END

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- New World Order A Cup of TeaDocument48 pagesNew World Order A Cup of Teaapi-19972088100% (3)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Airbnb Travel Receipt RCBND8DMQM-2Document1 pageAirbnb Travel Receipt RCBND8DMQM-2Josiah Emmanuel CodoyNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Indian Stock MarketDocument60 pagesIndian Stock Marketmokshasinchana100% (1)

- Arrow and The Apparel IndustryDocument6 pagesArrow and The Apparel IndustryShikha Prakash0% (1)

- Business Analysis of NestleDocument39 pagesBusiness Analysis of NestleFaiZan Mahmood100% (2)

- Report On Summer Training (July 2019) : Organization: Irrigation Department, Guwahati West Division, UlubariDocument22 pagesReport On Summer Training (July 2019) : Organization: Irrigation Department, Guwahati West Division, UlubariKunal Das75% (4)

- The Total Environment of The FirmDocument27 pagesThe Total Environment of The FirmNikko Albano100% (2)

- Economics of Strategy Worksheet 1Document4 pagesEconomics of Strategy Worksheet 1Matt ParsonsNo ratings yet

- Anouj Metha, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document3 pagesAnouj Metha, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Andrew McIntyre, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document3 pagesAndrew McIntyre, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Adnan Tareen, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document2 pagesAdnan Tareen, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Gender Equality at The Water Authority of Fiji - Asian Development Bank Case StudyDocument3 pagesGender Equality at The Water Authority of Fiji - Asian Development Bank Case StudyADBGAD100% (1)

- Farzana Ahmed, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document3 pagesFarzana Ahmed, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Mohd Sani Mohd Ismail, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document2 pagesMohd Sani Mohd Ismail, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Chris Spohr, Unsung Gender Hero, Asian Development Bank (ADB)Document4 pagesChris Spohr, Unsung Gender Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- The Economic Cost of Exclusion of LGBT PeopleDocument25 pagesThe Economic Cost of Exclusion of LGBT PeopleADBGAD100% (1)

- Sanitation Services Improves Health and Lives of I-Kiribati Women (Dec 2016)Document6 pagesSanitation Services Improves Health and Lives of I-Kiribati Women (Dec 2016)ADBGADNo ratings yet

- Md. Shahidul Alam, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document4 pagesMd. Shahidul Alam, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- The Social Institutions and Gender Index (SIGI) by Keiko NowackaDocument22 pagesThe Social Institutions and Gender Index (SIGI) by Keiko NowackaADBGADNo ratings yet

- Martin Lemoine, Unsung Gender Hero, Asian Development Bank (ADB)Document3 pagesMartin Lemoine, Unsung Gender Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- Karin Schelzig, Unsung Gender Equality Hero, Asian Development Bank (ADB)Document3 pagesKarin Schelzig, Unsung Gender Equality Hero, Asian Development Bank (ADB)ADBGADNo ratings yet

- One Million Women Initiative by UberDocument25 pagesOne Million Women Initiative by UberADBGADNo ratings yet

- Where Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaDocument7 pagesWhere Are The Women in The Water Pipeline? Wading Out of The Shallows - Women and Water Leadership in GeorgiaADBGADNo ratings yet

- Son Preference and Child Marriage in Asia by Shobhana Boyle PDFDocument17 pagesSon Preference and Child Marriage in Asia by Shobhana Boyle PDFADBGADNo ratings yet

- Jumping Hurdles: Changing Business Law To Speed Up Gender Equality in The Pacific IslandsDocument5 pagesJumping Hurdles: Changing Business Law To Speed Up Gender Equality in The Pacific IslandsADBGADNo ratings yet

- Economic Empowerment of Women in PSDIDocument13 pagesEconomic Empowerment of Women in PSDIADBGADNo ratings yet

- SEAGEN Waves Newsletter, Issue No. 1, 2015Document18 pagesSEAGEN Waves Newsletter, Issue No. 1, 2015ADBGADNo ratings yet

- Women's Perception of Empowerment-Findings From The Pathways of Women's Empowerment Program by Maheen Sultan PDFDocument11 pagesWomen's Perception of Empowerment-Findings From The Pathways of Women's Empowerment Program by Maheen Sultan PDFADBGAD100% (1)

- Women's Economic Empowerment-Coca-Cola 5by20 by Jackie Duff PDFDocument7 pagesWomen's Economic Empowerment-Coca-Cola 5by20 by Jackie Duff PDFADBGADNo ratings yet

- SEWA-A Collective Voice of Women by Shruti Gonsalves PDFDocument13 pagesSEWA-A Collective Voice of Women by Shruti Gonsalves PDFADBGADNo ratings yet

- Creating An Enabling Environment For The WE3 by Sultan Tiwana PDFDocument11 pagesCreating An Enabling Environment For The WE3 by Sultan Tiwana PDFADBGADNo ratings yet

- Nepal: High Mountain Agribusiness and Livelihood Improvement Project (HIMALI) by Arun RanaDocument12 pagesNepal: High Mountain Agribusiness and Livelihood Improvement Project (HIMALI) by Arun RanaADBGAD100% (2)

- Handmade in Bangladesh-BRAC Enterprises: Aarong PDFDocument11 pagesHandmade in Bangladesh-BRAC Enterprises: Aarong PDFADBGADNo ratings yet

- MAS Holdings-12 Years of Empowering Women by Shanaaz Preena PDFDocument53 pagesMAS Holdings-12 Years of Empowering Women by Shanaaz Preena PDFADBGADNo ratings yet

- Quant Checklist 476 by Aashish Arora For Bank Exams 2024Document118 pagesQuant Checklist 476 by Aashish Arora For Bank Exams 2024palanimesh420No ratings yet

- NTPCDocument26 pagesNTPCShradha LakhmaniNo ratings yet

- Featurs of Marketing Strategy - Meaning and Its ImportanceDocument2 pagesFeaturs of Marketing Strategy - Meaning and Its ImportanceChetan ChanneNo ratings yet

- Nirma University Revise.Document2 pagesNirma University Revise.mahayogiconsultancyNo ratings yet

- Amul PresentationDocument28 pagesAmul PresentationChirag GoyalNo ratings yet

- Managerial Remuneration Checklist FinalDocument4 pagesManagerial Remuneration Checklist FinaldhuvadpratikNo ratings yet

- Ftna History 5Document9 pagesFtna History 5Macame Junior100% (1)

- Fuel CellDocument14 pagesFuel Celltest 123testNo ratings yet

- 50 Largest Hedge Funds in The WorldDocument6 pages50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comNo ratings yet

- The Surplus Economy: and The Battle of BrandingDocument8 pagesThe Surplus Economy: and The Battle of Brandinga4yNo ratings yet

- Coins PH Buy SellDocument10 pagesCoins PH Buy Selljoshann251No ratings yet

- Chapter 6 - Industry AnalysisDocument30 pagesChapter 6 - Industry AnalysisTehniat ZafarNo ratings yet

- The Language of Report WritingDocument22 pagesThe Language of Report WritingAgnes_A100% (1)

- Interview PaperAssessment PDFDocument24 pagesInterview PaperAssessment PDFMary Ann Haylar UnayNo ratings yet

- Org Management Week 10Document15 pagesOrg Management Week 10Jade Lyn LopezNo ratings yet

- Industrialization WebquestDocument4 pagesIndustrialization WebquestmrsorleckNo ratings yet

- Gift Card Laws in NVDocument2 pagesGift Card Laws in NVander5171431No ratings yet

- MIT2 96F12 Quiz11qDocument11 pagesMIT2 96F12 Quiz11qClaudia Silvia AndreiNo ratings yet

- Banco Central de Chile - Indicadores Diarios - Euro (Pesos Por Euro) - Año 2017Document9 pagesBanco Central de Chile - Indicadores Diarios - Euro (Pesos Por Euro) - Año 2017Lorena MutizábalNo ratings yet

- Centre Wise CPI IW September 2019Document2 pagesCentre Wise CPI IW September 2019Heeranand ChandwaniNo ratings yet

- Chapter 1 Introduction To Human Resource ManagementDocument31 pagesChapter 1 Introduction To Human Resource Managementnorlaily arshad100% (1)

- Stringing IRDocument10 pagesStringing IRRohit Kumar MishraNo ratings yet