Professional Documents

Culture Documents

7.22.2013 True The Vote - Doc. 14-3 - Exhibit C

Uploaded by

True The Vote0 ratings0% found this document useful (0 votes)

57 views6 pagesTTV v. IRS

Original Title

7.22.2013 True the Vote - Doc. 14-3 - Exhibit C

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTTV v. IRS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

57 views6 pages7.22.2013 True The Vote - Doc. 14-3 - Exhibit C

Uploaded by

True The VoteTTV v. IRS

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

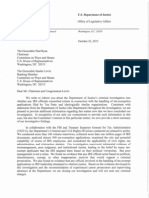

Exhibit C:

IRS Request for Information #1

(February 15, 2011)

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 1 of 6

Exhibit C, Page 1

Xnternal Revenue Service

P.O. Box 2508 - Room 4511

Cincinnati, Ohio 45201

Date: February 15, 2011

KSP/True the Vote

C/0 Deren R Harrington JD CPA

2225 County Road 90, Ste 115

Pearland, TX 77584

Dear Sir or Madam:

Department of the Treasury

Employer Xdentification NUmber:

27-2860095

Person to Contact - Group #:

Susan Maloney 7824

ID# 0203218

Contact Telephone NUmbers:

513-263-3649 Phone

513-263-3690 Fax

Response Due Date:

March 8, 2011

we need more information before we can complete our consideration of your

application for exemption. Please provide the information requested on the

enclosure by the response due date shown above. Your response must be signed

by an authorized person or an officer whose name is listed on your

application. Also, the information you submit should be accompanied by the

following declaration:

Under penalties of perjury, I declare that I have examined this

information, including accompanying documents, and, to the best of

my knowledge and belief, the information contains all the relevant

facts relating to the request for the information, and such facts

are true, correct, and complete.

To facilitate processing of your application, please attach a copy of this

letter to your response. This will enable us to quickly and accurately

associate the additional documents with your case file.

If we do not hear from you within that time, we will assume you no longer

want us to consider your application for exemption and will close your case.

As a result, the Internal Revenue Service will treat you as a taxable entity.

If we receive the information after the response due date, we may ask you to

send us a new application.

In addition, if you do not respond to the information request by the due

date, we will conclude that you have not taken all reasonable steps to

complete your application for exemption. Under code section 7428(b) (2), you

must show that you have taken all the reasonable steps to obtain your

exemption letter under IRS procedures in a timely manner and exhausted your

administrative remedies before you can pursue a declaratory judgment.

Accordingly, if you fail to timely provide the information we need to enable

us to act on your application, you may lose your rights to a declaratory

judgment under Code section 7428.

If you have any questions, please contact the person whose name and telephone

number are shown in the heading of this letter.

Letter 1312 (TEDS)

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 2 of 6

Exhibit C, Page 2

KSP/True the Vote

27-2860095

Enclosure: Information Request

Page 2

ly yours,

! A u ( / 1 ~

s s n Maloney

E pt Organizations Specialist

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 3 of 6

Exhibit C, Page 3

KSP/True the Vote

27-2860095

Additional Information Requested:

Page 3

1. In order to meet the organizational test for exemption under section

501(c) (3)r your organizational document, Articles of Incorporation, must be

amended to include the following provision:

a. Said organization is organized exclusively for charitable, religious,

educational, and scientific purposes, including, for such the

making of distributions to organizations that qualify as exempt

organizations under section 501(c) (3) of the Internal Revenue Code, or

corresponding section of any future federal tax code.

PLEASE SUBMIT A COMPLETE COPY OF THIS AMENDMENT. SINCE YOU ARE INCORPORATED

IN THE STATE OF TEXAS, THE COPY YOU SUBMIT TO US MUST SHOW THAT IT HAS BEEN

PROPERLY FILED WITH YOUR APPROPRIATE STATE AGENCY. WE CANNOT ACCEPT A COPY

STAMPED "RECEIVED".

2. Your board is narrow and related. This could lead to substantial private

benefit or both of which are prohibited under 501(c) (3). In

Better Business Bureau of Washington[ D.C., Inc. v. United States, 326 U.S.

279 (1945), the Court held that the presence of a single non-exempt purpose,

if substantial in nature, will destroy a claim for exemption regardless of

the number or importance of truly exempt purposes.

To insure that your organization will serve public interests and not the

personal or private interests of a few individualsr unrelated individuals

selected from the community you will serve should control your Board of

Directors. Members of the Board should be selected from the following

categories; (1) community leaders, such as elected or appointed officialsr

members of the clergy[ civic leaders, or other such individuals

representing a broad cross-section of the views and interests of your

community, (2) individuals having special knowledge or expertise in your

particular field or discipline in which your organization is operating[ (3)

public officials acting in their capacities as suchr (4) individuals

selected by public officials, and (5) individuals selected pursuant to your

organizations governing instrument or bylaws by a broadly based membership.

it is recommended that you modify your Board of Directors to place

control in the hands of unrelated individuals selected from the community you

will serve.

Please submit the names and qualifications of the new board membersr as well

as a statement signed by each that they will take an active part in your

operation.

If you are unwilling to do so, please explain your position.

3. The activities narrative submitted with your application statesr "KSP/True

the Vote is a non-partisan initiative to recruit and train volunteers to

inside polling places for elections. True the Vote initiatives are the

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 4 of 6

Exhibit C, Page 4

KSP/True the Vote

27-2860095

Page 4

Mobilizing and training volunteers who are willing to work as election

monitors.

Aggressively pursuing fraud reports to ensure prosecution when

appropriate.

Providing a support system for volunteers that includes live and online

training, quick reference guides, a call bank to phone in problem

reportss, information on videotaping at polling places, and security as

necessary.

Creating documentaries and instructional videos for use in recruiting

and training.

Raising awareness of the problem through strategic outreach efforts

including advertising, social networking, media relations, and

relational marketing.

Voter registration programs and efforts to validate existing

registration lists, including the use of pattern recognition software

to detect problem areas."

Please answer the following questions regarding your activities:

a. Provide a job description of an election monitor. Do they go to the

polls on election day? If so, where are they located at the polls?

What do they do?

b. How will the organization pursue fraud reports and ensure prosecution.

Explain each step in detail. Who will do this?

c. Explain videotaping at a polling place. Who will do this? What purpose

will it serve? Explain in detail.

d. How will the organization raise awareness through advertising, social

networking, media relations and relational marketing? Provide examples

and explain in detail.

e. Why is pattern recognition software needed to detect problem areas?

What problem areas? Explain in detail.

f. Explain how voter registration fulfills an exempt purpose.

g. What percentage of the organization's time and resources is devoted to

each of the listed activities? The percentage, when applied, should

total 100.

h. Explain how each of your activities fulfill an exempt purpose.

4. Form 1023, Part V, page 4(enclosed) was answered with anN/A. Please check

the boxes yes or no and return to us.

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 5 of 6

Exhibit C, Page 5

KSP/True the Vote

27-2860095

Page 5

PLEASE DIRECT ALL CORRESPONDENCE REGARDING YOUR CASE TO:

us Mail:

Internal Revenue Service

Exempt Organizations

P. 0. Box 2508

Cincinnati/ OH 45201

ATT: Susan Maloney

Room 4511

Group 7824

Letter 1312 (Rev. 12/2007)

Street Address:

Internal Revenue Service

Exempt Organizations

550 Main St/ Federal Bldg.

Cincinnati/ OH 45202

ATT: Susan Maloney

Room 4511

Group 7824

Case 1:13-cv-00734-RBW Document 14-3 Filed 07/22/13 Page 6 of 6

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- DIY Research GuideDocument2 pagesDIY Research GuideTrue The VoteNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Ownership of ChildrenDocument4 pagesCorporate Ownership of ChildrenKali_EL100% (3)

- 2012 October 5 TTV Cummings LetterDocument3 pages2012 October 5 TTV Cummings LetterTrue The VoteNo ratings yet

- 12 Lorenzo vs. PosadasDocument2 pages12 Lorenzo vs. PosadasJoshua Erik MadriaNo ratings yet

- Roa Vs CustomsDocument2 pagesRoa Vs CustomsHerrieGabicaNo ratings yet

- La Naval Drug Corp Vs CADocument2 pagesLa Naval Drug Corp Vs CAMariz GalangNo ratings yet

- United States v. Alvarez MachainDocument2 pagesUnited States v. Alvarez MachainAnonymous PYorid9ANo ratings yet

- Garcia Vs SandiganbayanDocument2 pagesGarcia Vs SandiganbayanMarion Nerisse Kho100% (2)

- Basic Rights of EmployeesDocument14 pagesBasic Rights of EmployeesDyanna ApilNo ratings yet

- Case Digest Biraogo vs. Truth CommissionDocument1 pageCase Digest Biraogo vs. Truth CommissionDarwin Dionisio ClementeNo ratings yet

- Hidalgo Vs RepublicDocument2 pagesHidalgo Vs RepublicAnonymous 5MiN6I78I0No ratings yet

- True The Vote Files Prelim InjunctionDocument4 pagesTrue The Vote Files Prelim InjunctionTrue The VoteNo ratings yet

- Cummings Quote From Martin Bashir ShowDocument1 pageCummings Quote From Martin Bashir ShowTrue The VoteNo ratings yet

- Doc27 Motion To Intervene As DefsDocument180 pagesDoc27 Motion To Intervene As DefsRiley SnyderNo ratings yet

- Final Brief in Support of New Mexico Voters' Motion To InterveneDocument21 pagesFinal Brief in Support of New Mexico Voters' Motion To InterveneTrue The VoteNo ratings yet

- True The Vote Sues Nevada To Protect Voters' RightsDocument2 pagesTrue The Vote Sues Nevada To Protect Voters' RightsTrue The VoteNo ratings yet

- Congress of Ttje Urnteti States: One Hundred Twelfth CongressDocument8 pagesCongress of Ttje Urnteti States: One Hundred Twelfth CongressTrue The VoteNo ratings yet

- True The Vote Joins New Mexico Citizens To Stop Court-Controlled Mail-In ElectionsDocument2 pagesTrue The Vote Joins New Mexico Citizens To Stop Court-Controlled Mail-In ElectionsTrue The VoteNo ratings yet

- Dem Committee Screen CaptureDocument1 pageDem Committee Screen CaptureTrue The VoteNo ratings yet

- Letter To Cummings From TTV Attorney Brock AkersDocument3 pagesLetter To Cummings From TTV Attorney Brock AkersTrue The VoteNo ratings yet

- TTV National Mail TrainingDocument20 pagesTTV National Mail TrainingTrue The VoteNo ratings yet

- TTV Press Release: True The Vote Wins Stunning Court Ruling Against The IRSDocument2 pagesTTV Press Release: True The Vote Wins Stunning Court Ruling Against The IRSTrue The VoteNo ratings yet

- D. 162 Memorandum Opinion On Attorney's FeesDocument25 pagesD. 162 Memorandum Opinion On Attorney's FeesTrue The Vote50% (2)

- 2.5.14 OCE ComplaintDocument7 pages2.5.14 OCE ComplaintTrue The VoteNo ratings yet

- IRS D.152 Opposition To True The VoteDocument26 pagesIRS D.152 Opposition To True The VoteTrue The VoteNo ratings yet

- In The United States Court of Appeals For The District of ColumbiaDocument63 pagesIn The United States Court of Appeals For The District of ColumbiaTrue The VoteNo ratings yet

- CO Mail Ballot Observer TrainingDocument23 pagesCO Mail Ballot Observer TrainingTrue The VoteNo ratings yet

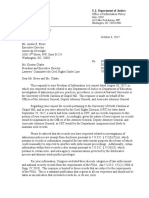

- 2015-10-23 Doj To HWM (Irs) - CHMN Ryan RM LevinDocument8 pages2015-10-23 Doj To HWM (Irs) - CHMN Ryan RM LevinTrue The VoteNo ratings yet

- Social Contract Theory: Thomas Hobbes'S TheoryDocument10 pagesSocial Contract Theory: Thomas Hobbes'S Theorylandry NowaruhangaNo ratings yet

- MalabananDocument7 pagesMalabananRose AnnNo ratings yet

- Warrior Kids Workshop-MainDocument1 pageWarrior Kids Workshop-MainFirstMedical BattalionNo ratings yet

- 3E WOLFERT Chapter 1Document8 pages3E WOLFERT Chapter 1Wendy Pedron AbulenciaNo ratings yet

- Elections and Voting, Pressure GroupsDocument7 pagesElections and Voting, Pressure GroupsAnonymousNo ratings yet

- The Chork v. Berk - ComplaintDocument49 pagesThe Chork v. Berk - ComplaintSarah BursteinNo ratings yet

- Fraud - Rights of Action and Defenses: Statute of Frauds Does Not Preclude The Assertion of A Deceit Claim 2011 ND 22, 794 N.W.2d 715 ADocument17 pagesFraud - Rights of Action and Defenses: Statute of Frauds Does Not Preclude The Assertion of A Deceit Claim 2011 ND 22, 794 N.W.2d 715 AMeek MillNo ratings yet

- Situation Comes From Different Circumstances. - Nsure That The Person Who Is Doing The BullyingDocument1 pageSituation Comes From Different Circumstances. - Nsure That The Person Who Is Doing The BullyingBTM-0617 Agilandeshwari A/P Rama LinggamNo ratings yet

- Deles vs. Aragona, 27 SCRA 633 (1969)Document5 pagesDeles vs. Aragona, 27 SCRA 633 (1969)Edgar Joshua TimbangNo ratings yet

- Labor JurisprudenceDocument24 pagesLabor JurisprudenceEarl ConcepcionNo ratings yet

- ADULTERY (Zina) : PunishmentDocument2 pagesADULTERY (Zina) : Punishmentgelly bilsNo ratings yet

- Thai PoliticsDocument8 pagesThai PoliticsHa Korkiat KorsoongsakNo ratings yet

- Steven Madden Ltd. v. Yves Saint Laurent - ComplaintDocument124 pagesSteven Madden Ltd. v. Yves Saint Laurent - ComplaintSarah BursteinNo ratings yet

- NNA - Hawaii Notary Commission Process - ChecklistDocument1 pageNNA - Hawaii Notary Commission Process - ChecklistX MediaNo ratings yet

- The Role of Feelings in Moral DecisionsDocument14 pagesThe Role of Feelings in Moral DecisionsDana IsabelleNo ratings yet

- Alia: "There Is No Doubt That She Deliberately Concealed Material Facts About Her Physical Condition andDocument17 pagesAlia: "There Is No Doubt That She Deliberately Concealed Material Facts About Her Physical Condition andArtson ElumbaNo ratings yet

- Martinez vs. MorfeDocument2 pagesMartinez vs. MorfeButch Sui GenerisNo ratings yet

- Influencer Terms Agreement: Sample Template Provided byDocument2 pagesInfluencer Terms Agreement: Sample Template Provided byImranKhanNo ratings yet

- 09-06-2019 Objection To Extortion Certificate Service 18pDocument14 pages09-06-2019 Objection To Extortion Certificate Service 18pStatewide Common Law Grand Jury100% (1)

- DOJ FOIA Response To Lawyers' Committee For Civil Rights Under LawDocument2 pagesDOJ FOIA Response To Lawyers' Committee For Civil Rights Under LawLawyers' CommitteeNo ratings yet

- 22 - Puyat vs. de Guzman Jr.Document2 pages22 - Puyat vs. de Guzman Jr.Giancarlo FernandoNo ratings yet