Professional Documents

Culture Documents

Itns-281 TDS Challan

Uploaded by

virendra36999Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Itns-281 TDS Challan

Uploaded by

virendra36999Copyright:

Available Formats

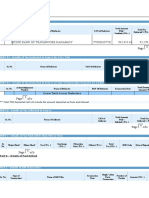

*Important : Please see notes overleaf Single Copy (to be sent to

before filling up the challan. T.D.S/TCS TAX CHALLAN the ZAO)

CHALLAN NO./ Tax Applicable (Tick One)* Assessment Year

ITNS TAX DEDUCTED/COLLECTED AT SOURCE FROM -

281 (0020) COMPANY √ (0021) NON-COMPANY

DEDUCTEES DEDUCTEES

Tax Deduction Account No. (T.A.N)

Full Name

Complete Address with City & State

Tel. No. Pin

Type of Payment Code * 9 2 B

(Tick One) (Please see overleaf)

TDS/TCS Payable by Taxpayer [200] √ FOR USE IN RECEIVING BANK

TDS/TCS Regular Assessment (Raised by I.T Deptt.) [400]

DETAILS OF PAYMENT Amount (in Rs. Only)

Income Tax Debit to A/c / Cheque credited on

Surcharge

Education Cess

Interest D D M M Y Y

Penalty

Total 0

Total (in words) SPACE FOR BANK SEAL

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

Paid in Cash/Debit to A/c /Cheque No. Dated

Drawn On.

(Name of the Bank and Branch)

Date :

Signature of person making payment Rs.

Taxpayers Counterfoil (To be filled up by taxpayer) SPACE FOR BANK SEAL

TAN 0 0 0 0 0 0 0 0 0 0

Received from

(Name)

Cash/ Debit to A/c /Cheque No. 0 For Rs. 0

Rs. ( in words)

drawn on 0

(Name of the Bank and Branch)

Company √ Non-Company Code*

on account of Tax Deducted at Source (TDS) √ Tax Collected at Source (TCS)

(Strike out whichever is not applicable)

for the Assessment Year Rs.

You might also like

- Amul TransportDocument2 pagesAmul TransportCharles Wood83% (6)

- Employee Training at Hyundai Motor IndiaDocument105 pagesEmployee Training at Hyundai Motor IndiaRajesh Kumar J50% (12)

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDocument1 pageSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemNo ratings yet

- Paper 5 PDFDocument529 pagesPaper 5 PDFTeddy BearNo ratings yet

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- Challan 280Document1 pageChallan 280Jayesh BajpaiNo ratings yet

- Zentds KDK SoftwareDocument1 pageZentds KDK Softwarear8ku9sh0aNo ratings yet

- ImportantDocument1 pageImportantWilliam SureshNo ratings yet

- TDS TCS Tax Challan PaymentDocument5 pagesTDS TCS Tax Challan PaymentSachin KumarNo ratings yet

- Challan No. ITNS 280Document2 pagesChallan No. ITNS 280RAHUL AGARWALNo ratings yet

- TDS Challan for Shree Raghuvanshi Lohana MahajanDocument2 pagesTDS Challan for Shree Raghuvanshi Lohana Mahajannilesh vithalaniNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- ITNS 281 TDS/TCS ChallanDocument3 pagesITNS 281 TDS/TCS ChallanC.A. Ankit JainNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Form 281 Candeur Constructions - 92bDocument1 pageForm 281 Candeur Constructions - 92bReddeppa Reddy BisaigariNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- (0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FDocument1 page(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048FAngad MundraNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- Challan No./ ITNS 282: Tax Applicable (Tick One)Document2 pagesChallan No./ ITNS 282: Tax Applicable (Tick One)satishkumar.mandora.smNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- GST FormatDocument3 pagesGST FormatAnmol GoyalNo ratings yet

- TDS Challan FormDocument1 pageTDS Challan FormVipin Kumar ChandelNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- Tds Challan 281 Nov'2021Document6 pagesTds Challan 281 Nov'2021tojendra laltenNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Itns 285Document2 pagesItns 285Anurag SharmaNo ratings yet

- Tax Payment Challan 280Document2 pagesTax Payment Challan 280analystbankNo ratings yet

- ChallanDocument1 pageChallanabhi7991No ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNo ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- TDS Challan2009-2010Document18 pagesTDS Challan2009-2010ANJAIAHCHARYNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- Single Copy Tax Challan for Self Assessment TaxDocument1 pageSingle Copy Tax Challan for Self Assessment TaxShilesh GargNo ratings yet

- 1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Document2 pages1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Bhargavaramireddy GadeNo ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- TDS-ChallanFormatDocument1 pageTDS-ChallanFormatAnand_Gupta_6499No ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearSuresh KumarNo ratings yet

- ChallanFormDocument1 pageChallanFormmanpreet singhNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document2 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961ViJaY HaLdErNo ratings yet

- Form 16B TDS CertificateDocument1 pageForm 16B TDS CertificateSurendra Kumar BaaniyaNo ratings yet

- Tds Challan 281 Excel FormatDocument459 pagesTds Challan 281 Excel FormatSaravana Kumar0% (1)

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- Form 16 ADocument2 pagesForm 16 AParminderSinghNo ratings yet

- Class 11 CH 2 NotesDocument10 pagesClass 11 CH 2 NotesJay KakadiyaNo ratings yet

- Technical Analysis GuideDocument3 pagesTechnical Analysis GuideQwerty QwertyNo ratings yet

- Subcontracting Process in Production - SAP BlogsDocument12 pagesSubcontracting Process in Production - SAP Blogsprasanna0788No ratings yet

- 5 Why AnalysisDocument2 pages5 Why Analysislnicolae100% (2)

- The Role of Business ResearchDocument23 pagesThe Role of Business ResearchWaqas Ali BabarNo ratings yet

- Chapter1 - Fundamental Principles of ValuationDocument21 pagesChapter1 - Fundamental Principles of ValuationだみNo ratings yet

- Cabanlit - Module 2 SPDocument2 pagesCabanlit - Module 2 SPJovie CabanlitNo ratings yet

- Zong Presentation1Document18 pagesZong Presentation1shaddyxp2000No ratings yet

- Bharathi Real EstateDocument3 pagesBharathi Real Estatekittu_sivaNo ratings yet

- CE462-CE562 Principles of Health and Safety-Birleştirildi PDFDocument663 pagesCE462-CE562 Principles of Health and Safety-Birleştirildi PDFAnonymous MnNFIYB2No ratings yet

- Assignment 2 - IPhonesDocument6 pagesAssignment 2 - IPhonesLa FlâneurNo ratings yet

- Pest Analysis of Soccer Football Manufacturing CompanyDocument6 pagesPest Analysis of Soccer Football Manufacturing CompanyHusnainShahid100% (1)

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocument2 pagesDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNo ratings yet

- Finance TestDocument3 pagesFinance TestMandeep SinghNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Edvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFDocument10 pagesEdvinsson, L. - 1997 - Developing Intellectual Capital at Skandia PDFreg_kata123No ratings yet

- PDFDocument14 pagesPDFBibhuti B. Bhardwaj100% (1)

- Appendix - Structural Vetting ProjectsDocument37 pagesAppendix - Structural Vetting Projectsqsultan100% (1)

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovNo ratings yet

- Managing Human Resources at NWPGCLDocument2 pagesManaging Human Resources at NWPGCLMahadi HasanNo ratings yet

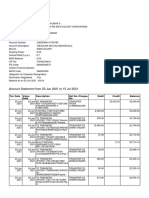

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Money ClaimDocument1 pageMoney Claimalexander ongkiatcoNo ratings yet

- Compare Q1 and Q2 productivity using partial factor productivity analysisDocument3 pagesCompare Q1 and Q2 productivity using partial factor productivity analysisDima AbdulhayNo ratings yet

- ANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Document41 pagesANFARM HELLAS S.A.: Leading Greek Pharma Manufacturer Since 1967Georgios XydeasNo ratings yet

- LIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SDocument1 pageLIFO, SEC, GAAP, and Earnings Management in Early 1900s U.SMohammad ShuaibNo ratings yet

- Customer Sample Report BSR For S4hanaDocument79 pagesCustomer Sample Report BSR For S4hanaHarpy AhmedNo ratings yet