Professional Documents

Culture Documents

TDS Challan

Uploaded by

JayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TDS Challan

Uploaded by

JayCopyright:

Available Formats

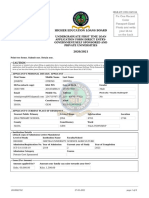

T.D.S.

/ TCS TAX CHALLAN Single Copy (to be sent to the ZAO)

Tax Applicable (Tick one)

Assessment

CHALLAN TAX AT SOURCE FROM

Year

NO./ ITNS

(0020) COMPANY DEDUCTEES [] (0021) NON-COMPANY DEDUCTEES []

281

Tax Deduction Account No. (T.A.N.)

Full Name

Complete Address with City & State

Phone

Pin

No.

Type of Payment Code

Payable by Tax Payer 200 FOR USE IN RECEIVING BANK

Regular Assessment (Raised by I.T.deptt.) 400 Debit to A/c / Cheque credited on

DETAILS OF PAYMENTS

Amount (In Rs. Only) DD MM YY

Income Tax SPACE FOR BANK SEAL

Surcharge

Education Cess

Interest

Penalty

Total

Total (in words):

CRORE

LACS THOUSANDS HUNDERDS TENS UNITS

S

Paid Dated

Drawn

on

(Name of the Bank and Branch)

Date: Signature of the Person making payment Rs.

Taxpayers Counterfoil (To be filled up by tax payer) SPACE FOR BANK SEAL

TAN

Received from

For Rs.

Rs. (in Words)

Drawn on

(Name of the Bank and Branch)

on account of Tax from

For the Assessment Year Rs.

ZENTDS - A KDK Software Product

You might also like

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjasNo ratings yet

- Form 16 WORD FORMATEDocument2 pagesForm 16 WORD FORMATEJay83% (46)

- Form No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBDocument1 pageForm No. 10-I: Certificate of Prescribed Authority For The Purposes of Section 80DDBIam KarthikeyanNo ratings yet

- Mr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Document7 pagesMr. Bhanu Pratap Singh Yadav: Rs 924.82 Rs 1,032.50 Rs 1,032.50 Rs 0.00 Rs 824.82Bhanu Pratap Simgh YadavNo ratings yet

- Certificate of Registration-Form 23Document1 pageCertificate of Registration-Form 23Joy GudivadaNo ratings yet

- 1563614521775Document1 page1563614521775JatinderPalNo ratings yet

- LIC - Premium - UploadDocument1 pageLIC - Premium - UploadCA Ashish MehtaNo ratings yet

- Reg No: Dl8Cav0116: Registration Certificate For VehicleDocument1 pageReg No: Dl8Cav0116: Registration Certificate For Vehicleh4ckerNo ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- Alok 4Document2 pagesAlok 4Guy LoveNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- Pawan S PDF CompletedDocument1 pagePawan S PDF CompletedAsifshaikh7566No ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid Acknowledgementharsh421No ratings yet

- Summary of Comments On SECTION-80D-1.pdf: Keep in Force An Insurance On The Health of P The Assessee or His FamilyDocument2 pagesSummary of Comments On SECTION-80D-1.pdf: Keep in Force An Insurance On The Health of P The Assessee or His FamilyReeju KarunakaranNo ratings yet

- AugDocument1 pageAugsrikanth0483287No ratings yet

- Homeloancertificate - 38180652 DBFDBDocument1 pageHomeloancertificate - 38180652 DBFDBKRIS BARSAGADE100% (1)

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Screenshot 2023-12-14 at 1.02.56 PMDocument1 pageScreenshot 2023-12-14 at 1.02.56 PMshashikumarsk0711No ratings yet

- Business Women 2010Document1 pageBusiness Women 2010JayNo ratings yet

- ULIP Pension PlansDocument5 pagesULIP Pension PlanskammapurathanNo ratings yet

- Dengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateDocument1 pageDengue Ns1 Antigen Test (Elisa/Elfa) - 600.00 0.00: DuplicateAbhishek GoelNo ratings yet

- LIC Sikha PDFDocument1 pageLIC Sikha PDFsikha singh100% (1)

- ICICI Health InsuranceDocument1 pageICICI Health Insurancecanjiatp76260% (1)

- Subject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inDocument31 pagesSubject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inUday NainNo ratings yet

- 2018091800024Document3 pages2018091800024Gunjan ShahNo ratings yet

- PrmPayRcptSign PR0445228800021011Document1 pagePrmPayRcptSign PR0445228800021011dipakpd100% (1)

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementArpit SinghalNo ratings yet

- AC Bajaj Finance - 2Document2 pagesAC Bajaj Finance - 2prsnjt11No ratings yet

- Father Mediclaim ApplicationDocument2 pagesFather Mediclaim ApplicationAnil VishwakarmaNo ratings yet

- Sridhar Medical Policy SelfDocument5 pagesSridhar Medical Policy SelfSurya GoudNo ratings yet

- ReceiptPrint UIMTH-17890 PDFDocument1 pageReceiptPrint UIMTH-17890 PDFPubg UsaNo ratings yet

- MedicalimDocument1 pageMedicalimsaurabhNo ratings yet

- Tax Invoice: 1046.17 Total Invoice Amount RsDocument2 pagesTax Invoice: 1046.17 Total Invoice Amount RsAayush AggarwalNo ratings yet

- Star Health and AlliedDocument1 pageStar Health and Allieddisk_la_poduNo ratings yet

- DriverSalary 0001Document1 pageDriverSalary 0001Saket SrivastavaNo ratings yet

- Amount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30Document5 pagesAmount Due: Rs 1,146.89 Rs 1,150.00 Rs 0.00 Rs 201.30sonugautam421No ratings yet

- Interest Certificate: Shivam Garg and Ramkrishna GargDocument1 pageInterest Certificate: Shivam Garg and Ramkrishna GargShivamNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- PFguidlines &forms For Mphasis &finsource EmployeesDocument10 pagesPFguidlines &forms For Mphasis &finsource EmployeesBinoy Xavier RajuNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document4 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Ameya SudameNo ratings yet

- Insurance Smart Sampoorna RakshaDocument10 pagesInsurance Smart Sampoorna RakshaArpit ShahNo ratings yet

- Leave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateDocument6 pagesLeave and License Agreement: Particulars Amount Paid GRN/Transaction Id DateAnonymous eCmTYonQ84No ratings yet

- Welcome To Transport Department Government of Telangana - IndiaDocument1 pageWelcome To Transport Department Government of Telangana - Indiashiva kumarNo ratings yet

- Relief Fund Certificate PDFDocument2 pagesRelief Fund Certificate PDFSALVATAASIMNo ratings yet

- SBI LIFE Premium CertificateDocument1 pageSBI LIFE Premium CertificatearithotiNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- CPOLICYdoc 01050048194100210965 PDFDocument2 pagesCPOLICYdoc 01050048194100210965 PDFTanish MaanNo ratings yet

- Higher Education Loans BoardDocument8 pagesHigher Education Loans BoardDON ONNYANGONo ratings yet

- InvoiceDocument1 pageInvoiceAnonymous hoYLBuGNo ratings yet

- Pollution CertificateDocument1 pagePollution CertificateSatish KumarNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid Certificatemsurendra642No ratings yet

- LIC Premium Paid Statement Swapnil Nage 1Document1 pageLIC Premium Paid Statement Swapnil Nage 1Swapnil NageNo ratings yet

- 8.municipal Tax Receipt 2Document1 page8.municipal Tax Receipt 2Ravi ChandraNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- T.D.S. / Tcs Tax Challan: DD MM YyDocument1 pageT.D.S. / Tcs Tax Challan: DD MM Yyar8ku9sh0aNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Challan No. ITNS 281Document1 pageChallan No. ITNS 281jagdish412301No ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- Tandurasti Tamara HathmaDocument43 pagesTandurasti Tamara HathmaJayNo ratings yet

- New PAN Application Form W.E.F. 1.11.2011Document2 pagesNew PAN Application Form W.E.F. 1.11.2011JayNo ratings yet

- Form 16a - TDS - Blank 16aDocument1 pageForm 16a - TDS - Blank 16aJayNo ratings yet

- Form 16a New FormatDocument2 pagesForm 16a New FormatJayNo ratings yet

- Budget Highlights 2011-12Document2 pagesBudget Highlights 2011-12JayNo ratings yet

- Electricity Bill Calculation (Residential)Document4 pagesElectricity Bill Calculation (Residential)JayNo ratings yet

- Obtain Tpin NumberDocument1 pageObtain Tpin NumberJayNo ratings yet

- Electricity Bill Calculation (Residential)Document4 pagesElectricity Bill Calculation (Residential)JayNo ratings yet

- List of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerDocument5 pagesList of Useful Codes With Descriptions To Be Used As Reference Status of TaxpayerJayNo ratings yet

- How To Play SargamDocument1 pageHow To Play SargamJayNo ratings yet

- Form 30 - RtoDocument2 pagesForm 30 - RtoJayNo ratings yet

- Organisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsDocument3 pagesOrganisation Chart Construction Project Manager Purchase/ Accounts Sales / AccountsJay50% (2)