Professional Documents

Culture Documents

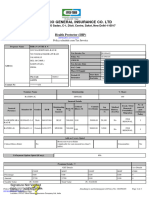

Premium Paid Certificate

Uploaded by

msurendra642Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Paid Certificate

Uploaded by

msurendra642Copyright:

Available Formats

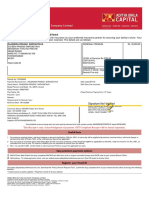

Bajaj Allianz Life Insurance Co. Ltd.

To,

SURENDRA KUMAR Date :28-11-2023

HNO 108 BIJARKHATA UTTRI 1,

POLICE STATION SUAR TEHSIL SUAR~SUAR,

RAMPUR,

RAMPUR,

UTTAR PRADESH,

IN 244924

Certificate For Premium Paid

(01-04-2020 To 31-03-2021)

Assignee: MR SURENDRA KUMAR

This is to certify that the premium under the following policies taken by the policyholder SURENDRA KUMAR have been

received by Bajaj Allianz Life Insurance Company Limited during the Financial Year 2020-2021

Total

Premium Policy Life Health Care

Premium Due Premium Sum Premium

Policy No. Product Name IP Adjustment installment Insurance Premium

Date Type Assured Amount

Date premium Premium (1) (2)

Received

POS_GOAL_SUR First

0435698667 MR SURENDRA KUMAR 25-01-2021 25-01-2021 150000 15000 15000 15000 0

AKSHA Premium

Total: 15000 15000 15000 0

Note:

This certificate is issued for the purpose of claiming deductions, rebates as per the provisions of Income Tax Act, 1961

1. Receipts issued subject to realization of cheques.

2. Life Insurance Premium is eligible for tax rebate/deduction under Section 80C.

3. HCB/CI/Post Hospitalization/Surgical Benefit Rider Premium is eligible for tax rebate/deduction under Section 80D.

4. Partial Withdrawals, surrender Values, Death Benefit and Maturity Benefit are eligible for Tax Benefit as per Sec 10 (10D) of

Income Tax Act.

5. Policies where the premium exceeds 20% of sum assured with date of commencement prior to 1st April 2012 and the policies

where the premium exceeds 10% of sum assured with date of commencement from 01st April 2012, will not be eligible for tax

benefits u/s 10(10D) and u/s 80C.

6. For your actual eligibility please refer to provisions of IT Act 1961 as modified and consult your tax consultant.

Disclaimer:In compliance of the provisions relating to deduction of tax at source under section 194 DA of Income Tax Act,1961 as introduced by Finance

Act,2014,any payment(except payment exempted u/s 194DA) made by Bajaj Allianz Life Insurance Co Ltd shall be subject to deduction of applicable TDS.In

absence of PAN details,TDS would be deducted @20% instead of 1%(w.e.f 01-June-2016)in case where PAN is provided.TDS once deducted shall not be

refunded.**GST is applicable w.e.f 01-July-2017

Note: This is a computer-generated letter and does not required a signature.

Regd. & Head Office : Bajaj Allianz House, Airport Road, Yerwada, Pune 411 006. Mail us: customercare@bajajallianz.co.in, Call on: Toll free

No. 1800 209 7272, Fax No. 02066026789

You might also like

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Document2 pagesYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Premium Paid CertificateDocument1 pagePremium Paid CertificateVishal DNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- 2866100498386100000Document4 pages2866100498386100000E-World Cyber ZoneNo ratings yet

- Family Health Insurance Plan DetailsDocument2 pagesFamily Health Insurance Plan DetailsSudesh ChauhanNo ratings yet

- New - Life Insurance Corporation of India - Sowmya - 2023Document1 pageNew - Life Insurance Corporation of India - Sowmya - 2023boddu sowmyaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Renewal of Your Ican Essential Advanced Insurance PolicyDocument3 pagesRenewal of Your Ican Essential Advanced Insurance PolicySuganthi ChandrasekaranNo ratings yet

- Consolidated Premium Paid STMT 2020-2021 PDFDocument1 pageConsolidated Premium Paid STMT 2020-2021 PDFSHITESH KUMARNo ratings yet

- PolicyDocument55 pagesPolicyBaneNo ratings yet

- Group Activ Travel - Certificate of Insurance: Insured Person DetailsDocument2 pagesGroup Activ Travel - Certificate of Insurance: Insured Person Detailsabhinay anandNo ratings yet

- The New India Assurance Co. Ltd. (Government of India Undertaking)Document4 pagesThe New India Assurance Co. Ltd. (Government of India Undertaking)Ameya SudameNo ratings yet

- Premium Receipt PDFDocument1 pagePremium Receipt PDFAjit Kumar TiwariNo ratings yet

- Bill 12sep2023Document1 pageBill 12sep2023UR12ME148 PrafullaNo ratings yet

- Mediclaim Policy Parents - H1096407Document3 pagesMediclaim Policy Parents - H1096407Lokesh AnandNo ratings yet

- P 131124 01 2023 008806 Policy DocDocument4 pagesP 131124 01 2023 008806 Policy DockasturihospitalsecunderabadNo ratings yet

- Abi Premium 1Document1 pageAbi Premium 1manikandan BalasubramaniyanNo ratings yet

- Online premium receipt confirmationDocument1 pageOnline premium receipt confirmationSasidharKalidindiNo ratings yet

- Consolidated Premium Paid STMT 2012-2013Document1 pageConsolidated Premium Paid STMT 2012-2013jahmeddNo ratings yet

- ICICI Lombard Complete Health Insurance Policy SummaryDocument4 pagesICICI Lombard Complete Health Insurance Policy SummaryarjunNo ratings yet

- For HDFC ERGO General Insurance Company LTDDocument2 pagesFor HDFC ERGO General Insurance Company LTDNAVEEN H ENo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- LIC Premium Paid Statement 2017-2018Document1 pageLIC Premium Paid Statement 2017-2018Swapnil NageNo ratings yet

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Renewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaDocument1 pageRenewal Premium Notice: Mr. Kishor Kumar Gupta Insured Name: MR - Kishor Kumar GuptaYT ENTERTAINMENTNo ratings yet

- Subject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inDocument31 pagesSubject: Policy Number: 0000000009425420-01: Customer - Care@sbigeneral - inUday NainNo ratings yet

- New VinothDocument3 pagesNew VinothRenga NathanNo ratings yet

- Star Health Policy DocDocument6 pagesStar Health Policy DocDev PandayNo ratings yet

- Reliance Individual Mediclaim Policy ScheduleDocument1 pageReliance Individual Mediclaim Policy ScheduleParthiban K100% (1)

- This Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held byDocument1 pageThis Is To Certify That The Following Payments Have Been Made Under Life Insurance Policies Held bySumanthNo ratings yet

- 1865362Document1 page1865362Bhavesh ParekhNo ratings yet

- Get affordable health insurance with HDFC ERGO's Silver PlanDocument4 pagesGet affordable health insurance with HDFC ERGO's Silver Planrohit choudharyNo ratings yet

- Product Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718Document51 pagesProduct Name: Max Bupa Health Recharge, Product UIN: MAXHLIP18129V011718906rahulNo ratings yet

- Premium ReceiptDocument2 pagesPremium Receiptthetrilight2023No ratings yet

- Intermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@AkshayaweaDocument4 pagesIntermediary Code CO0000000062 Akshaya Wealth Management PVT - LTD Phone No 080-26535701/02/8026535701 E-Mail Id Services@Akshayaweapushpkant kumarNo ratings yet

- Pooja Policy Self 80 DDocument2 pagesPooja Policy Self 80 Dcagopalofficebackup100% (1)

- ALisha Medical SelfDocument1 pageALisha Medical SelfaaravaNo ratings yet

- Max Bupa Health Insurance ReceiptDocument1 pageMax Bupa Health Insurance ReceiptSaurabh RaghuvanshiNo ratings yet

- Certificate of Insurance HDFC ERGO Group ProtectDocument5 pagesCertificate of Insurance HDFC ERGO Group Protectzahid aliNo ratings yet

- HSAA188212000100Document3 pagesHSAA188212000100Taquee AhmadNo ratings yet

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- Premium Paid Certificate DetailsDocument2 pagesPremium Paid Certificate DetailsGuy LoveNo ratings yet

- Premium Receipt for Shefali Sawan's Family Health Insurance PolicyDocument1 pagePremium Receipt for Shefali Sawan's Family Health Insurance PolicyanuNo ratings yet

- ICICI Health InsuranceDocument1 pageICICI Health Insurancecanjiatp76260% (1)

- LIC Sikha PDFDocument1 pageLIC Sikha PDFsikha singh100% (1)

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- Icici Lombard Mh!49966Document3 pagesIcici Lombard Mh!49966suresh sivadasanNo ratings yet

- Premium Paid Certificate: Date: 14-DEC-2017Document1 pagePremium Paid Certificate: Date: 14-DEC-2017zuhebNo ratings yet

- Max Bupa Premium Reeipt ParentDocument1 pageMax Bupa Premium Reeipt ParentsanojcenaNo ratings yet

- Aditya Birla Sun Life Insurance Receipt for Rajendra Prasad Shrivastava Rs. 30,675 Renewal PremiumDocument2 pagesAditya Birla Sun Life Insurance Receipt for Rajendra Prasad Shrivastava Rs. 30,675 Renewal PremiumSourabh ShrivastavaNo ratings yet

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- Policy DetailDocument1 pagePolicy DetailJeyavel NagarajanNo ratings yet

- 13 18 0038121 00 PDFDocument7 pages13 18 0038121 00 PDFRaoul JhaNo ratings yet

- Registration Certificate of Vehicle: Issuing Authority: Madhubani, BiharDocument1 pageRegistration Certificate of Vehicle: Issuing Authority: Madhubani, Bihartabrez alamNo ratings yet

- FPPack PDFDocument34 pagesFPPack PDFmeet1996No ratings yet

- Premium paid certificate for ICICI Pru Endowment policyDocument1 pagePremium paid certificate for ICICI Pru Endowment policyPraveen KumarNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificatevictoryNo ratings yet

- Premium Paid CertificateDocument1 pagePremium Paid CertificatevictoryNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyAmit KumarNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanNo ratings yet

- Acc Paper LeakDocument2 pagesAcc Paper LeakHamzaNo ratings yet

- Characteristics of Bank Regulations Act 1949Document8 pagesCharacteristics of Bank Regulations Act 1949ankita16_wlsn100% (1)

- Survey QuestionDocument3 pagesSurvey QuestionAngelica Joy Daiz GuceNo ratings yet

- Accounting 101 - Final Exam Part 3Document12 pagesAccounting 101 - Final Exam Part 3Aurora100% (2)

- Investors Finance Corp vs. Autoworld Sales Corp G.R. No. 128990. September 21, 2000 FactsDocument2 pagesInvestors Finance Corp vs. Autoworld Sales Corp G.R. No. 128990. September 21, 2000 FactsLoNo ratings yet

- Analysis of Credit Risk Management in Sanima BankDocument22 pagesAnalysis of Credit Risk Management in Sanima BankPradip Kumar ShahNo ratings yet

- 1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashDocument7 pages1st Activity Cash and Cash Equivalents Bank Reconciliation Proof of CashSheidee ValienteNo ratings yet

- Answers of Doubtful Accounts AssignmentDocument4 pagesAnswers of Doubtful Accounts AssignmentGee Lysa Pascua VilbarNo ratings yet

- PPIO Cash Funds in Hong Kong and China, Heritage AssetsDocument9 pagesPPIO Cash Funds in Hong Kong and China, Heritage AssetsGarbo BentleyNo ratings yet

- Solved From The Trial Balance of Girtie Lillis Attorney at Law Given inDocument1 pageSolved From The Trial Balance of Girtie Lillis Attorney at Law Given inAnbu jaromiaNo ratings yet

- M and N 1Document1 pageM and N 1DDdNo ratings yet

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Exam List of AUSTDocument2 pagesExam List of AUSTMaruf KhanNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingvikramtambeNo ratings yet

- BDODocument2 pagesBDOBevegel Sasan LlidoNo ratings yet

- Loan Repayment Schedule: Customer DetailsDocument3 pagesLoan Repayment Schedule: Customer DetailsJasbind yadavNo ratings yet

- Sample Personal Statement 2 0Document4 pagesSample Personal Statement 2 0Ly Hoang100% (1)

- SunTrust TemplateDocument1 pageSunTrust TemplateJustin Mason100% (2)

- Chapter 2Document14 pagesChapter 2Ncim PoNo ratings yet

- APr 4 Date of Acquisition ActivityDocument10 pagesAPr 4 Date of Acquisition ActivityAnn SarmientoNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- EL201-Accounting For ITDocument84 pagesEL201-Accounting For ITJc BarreraNo ratings yet

- Ifric 17Document8 pagesIfric 17Xyriel RaeNo ratings yet

- Financial Management Sample 29-07-2022Document32 pagesFinancial Management Sample 29-07-2022Vibrant Publishers100% (1)

- FAR 09 Income Tax 1 PDFDocument5 pagesFAR 09 Income Tax 1 PDFAnnalyn AlmarioNo ratings yet

- Journal Entry: Francis PoloDocument4 pagesJournal Entry: Francis PoloFrancis Trinidad Polo100% (2)

- Study of Mfi: Submitted byDocument13 pagesStudy of Mfi: Submitted bytanvi mohantyNo ratings yet

- CitiDirect Online Banking Bank Handlowy W Warszawie S.A.Document31 pagesCitiDirect Online Banking Bank Handlowy W Warszawie S.A.César OrellanaNo ratings yet

- Bookkeeping NC Iii - Core CompetenciesDocument33 pagesBookkeeping NC Iii - Core CompetenciesRonyla EnriquezNo ratings yet