Professional Documents

Culture Documents

(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048F

Uploaded by

Angad MundraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(0021) Non Company Deductees BPLJ01048F: T.D.S./T.C.S. Tax Challan Challan No./ ITNS 281 2021-22 BPLJ01048F

Uploaded by

Angad MundraCopyright:

Available Formats

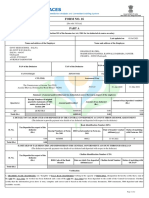

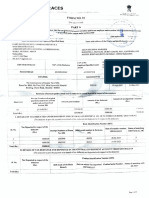

T.D.S./T.C.S.

TAX CHALLAN Single(Copy to be sent the ZAO)

Tax Applicable(Tick One)* Assessment

CHALLAN NO./ TAX DEDUCTED/COLLECTED AT SOURCE FROM Year

ITNS 281 (0020) COMPANY DEDUCTEES (0021) NON COMPANY DEDUCTEES 2021-22

Tax Deduction Account No. TAN

BPLJ01048F BPLJ01048F

Full Name

JHANWAR INDUSTRIES

Complete Address With City and State

RAM MOHALLA,-,MANASA,MANASA,MADHYA PRADESH

Tel. No. 243021 Pin 458110

Type of Payment Code* 94A FOR USE IN RECEIVING BANK

TDS/TCS Payable by TaxPayer(200) debit to A/c /Cheque Credit on

TDS/TCS Regular Assessment(Raised by IT Deptt)(400)

DD MM YY

DETAILS OF PAYMENTS Amount(in Rs.only)

Income Tax 3098

Fee under sec. 234E 0

Surcharge 0

Education Cess 0

Interest 0

Penalty 0

Others 0

Total 3098

Total(in words)

CRORES LACS THOUSANDS HUNDREDS TENS UNITS

THREE ZERO NINE EIGHT

Paid in Cash/Debit to Ac/Cheque No Cash Dated

Drawn on

(Name of Bank and Branch)

Date 03/09/2020 Signature of person making Payment Rs.

Taxpayers Counterfoil(To be Filed up by the tax payer ) SPACE FOR BANK SEAL

TAN BPLJ01048F

Received From JHANWAR INDUSTRIES

Cash/Debit to Ac/Cheque No Cash For Rs. 3098

Rs in Words THREE THOUSAND NINETY EIGHT Only

Drawn on

(Name of the Bank and Branch)

Non Company Deductee

On account of Tax Deducted at Source (TDS)/ Tax Collected at source (TCS)

94A

from

for the Assessment Year 2021-22 Code 3040 Rs.

You might also like

- VyStar's Call Center and online VyChat available dailyDocument13 pagesVyStar's Call Center and online VyChat available dailyPatsy Hilll100% (2)

- BBA Final Internship ReportDocument70 pagesBBA Final Internship ReportTaj Hussain100% (1)

- Credit Appraisal Process ReportDocument44 pagesCredit Appraisal Process ReportMuskan Maheshwari100% (2)

- Ashima Kalra 194 CDocument1 pageAshima Kalra 194 CSudhanshu JaiswalNo ratings yet

- Zero Zero Three Zero Two Zero: DD MM YyDocument1 pageZero Zero Three Zero Two Zero: DD MM YyShubham Pandey WatsonNo ratings yet

- TDS TCS Tax Challan PaymentDocument5 pagesTDS TCS Tax Challan PaymentSachin KumarNo ratings yet

- Self Assessment Tax Challan NiDocument1 pageSelf Assessment Tax Challan NiNitin KarwaNo ratings yet

- PrintTDSChallan (281) 2020-2021 PDFDocument1 pagePrintTDSChallan (281) 2020-2021 PDFAmeyNo ratings yet

- TDS Challan for Shree Raghuvanshi Lohana MahajanDocument2 pagesTDS Challan for Shree Raghuvanshi Lohana Mahajannilesh vithalaniNo ratings yet

- Draft Challan IchhaDocument1 pageDraft Challan IchhaSneha SharmaNo ratings yet

- Challan - 281Document1 pageChallan - 281Kelly WilliamsNo ratings yet

- Itns-281 TDS ChallanDocument1 pageItns-281 TDS Challanvirendra36999100% (2)

- TDS TCS Tax ChallanDocument1 pageTDS TCS Tax Challanjagdish412301No ratings yet

- (0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanDocument3 pages(0021) Non Company Deductees A: T.D.S./T.C.S. Tax ChallanRambabuNo ratings yet

- BZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxDocument1 pageBZVPK1481J: (0020) Income Tax On Companies (Corporation Tax) (0021) Income TaxBhandari AdvNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJainsanjaykumarNo ratings yet

- Challan Advance TaxDocument1 pageChallan Advance Taxamit22505No ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Advance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersDocument1 pageAdvance Tax (100) Surtax (102) Self Assessment Tax (300) Tax On Distributed Profits of Domestic Companies (106) Tax On Regular Assessment (400) Tax On Distributed Income To Unit HoldersAnujaNo ratings yet

- E-26, Asad Street # 1, Mohallah Firdous Park, Ghazi Road, Lahore, Cantonement. Sadaat Naseem KhanDocument3 pagesE-26, Asad Street # 1, Mohallah Firdous Park, Ghazi Road, Lahore, Cantonement. Sadaat Naseem KhanZeeshanNo ratings yet

- Income Tax Challan - 280Document1 pageIncome Tax Challan - 280Subrata SarkarNo ratings yet

- Ganapati TDS ChalanDocument3 pagesGanapati TDS ChalanPruthiv RajNo ratings yet

- Ganraj ConstructionDocument2 pagesGanraj ConstructionSUNIL GAIKWADNo ratings yet

- House No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisDocument3 pagesHouse No. 360-D/7/Gf, Street No. 11, Muhalla Hafizabad, Dhoke Hassu, Rawalpindi Tahira YounisMadiah abcNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Single Copy Tax Challan for Self Assessment TaxDocument1 pageSingle Copy Tax Challan for Self Assessment TaxShilesh GargNo ratings yet

- Challan PDFDocument1 pageChallan PDFShilesh GargNo ratings yet

- TDS ChallanDocument1 pageTDS ChallanJayNo ratings yet

- ITNS 280: Challan No. Challan No. ITNS 281Document1 pageITNS 280: Challan No. Challan No. ITNS 281Sar-Im Teron AcousticNo ratings yet

- Challan Income TaxDocument1 pageChallan Income Taxrahul jhaNo ratings yet

- T.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseDocument10 pagesT.D.S. / T.C.S. Tax Challan: To Any Person or Web Site For Publication or For Commercial or Any Other UseHARDEEPTHAPARNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2020asiashah1975No ratings yet

- TCS TenduDocument1 pageTCS TenduSwetha KarthickNo ratings yet

- Income Tax - Bank Remittance CHALLANDocument1 pageIncome Tax - Bank Remittance CHALLANvivek anandanNo ratings yet

- Happy To Help: No. of Contracts Vodafone No.9885887950Document15 pagesHappy To Help: No. of Contracts Vodafone No.9885887950narramadanNo ratings yet

- For Payment From July 2005 OnwardsDocument1 pageFor Payment From July 2005 Onwardsvijay123*75% (4)

- ChallanDocument1 pageChallanYash KavteNo ratings yet

- TDS Challan FormDocument1 pageTDS Challan FormVipin Kumar ChandelNo ratings yet

- Single (Copy To Be Sent The ZAO)Document1 pageSingle (Copy To Be Sent The ZAO)James GonzalezNo ratings yet

- ITNS 281 TDS/TCS ChallanDocument3 pagesITNS 281 TDS/TCS ChallanC.A. Ankit JainNo ratings yet

- Challanitns 280Document1 pageChallanitns 280saritabh05No ratings yet

- AQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001Document1 pageAQSPS8791C: 1, Pithampur, PITHAMPUR, MADHYA PRADESH-454001pavanNo ratings yet

- Ahhpt7531m 2020-21 PDFDocument2 pagesAhhpt7531m 2020-21 PDFAshish BhartiNo ratings yet

- Tax Acknowledgement SlipDocument2 pagesTax Acknowledgement SlipUmair Jamal IslamianNo ratings yet

- Challan No./ Itns 280: Details of Payments For Use in Receiving BankDocument3 pagesChallan No./ Itns 280: Details of Payments For Use in Receiving BankSatish BatchaNo ratings yet

- Kahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Document3 pagesKahuta, District Kahuta, Pakistan Muhammad Mohsin Razzaq: Mon, 7 Dec 2020 21:17:28 +0500Asif ShahzadNo ratings yet

- Tin 2003818439Document1 pageTin 2003818439Manish JainNo ratings yet

- Challan No. ITNS 280: Tax Applicable Assessment YearDocument1 pageChallan No. ITNS 280: Tax Applicable Assessment YearNalini SenthilkumarNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- TDS Certificate SummaryDocument6 pagesTDS Certificate SummaryMadhusudan rathiaNo ratings yet

- Ahmed Villas, Kacha Shahab Pura, ., Sialkot Sialkot Arifa MamoonaDocument4 pagesAhmed Villas, Kacha Shahab Pura, ., Sialkot Sialkot Arifa MamoonaZeeshan Haider RizviNo ratings yet

- Traces: Form No. 16Document5 pagesTraces: Form No. 16blinkfinance7No ratings yet

- Form16 Till 14 Dec 2019Document11 pagesForm16 Till 14 Dec 2019Aviral SankhyadharNo ratings yet

- Atppn7354l 2020 21 PDFDocument2 pagesAtppn7354l 2020 21 PDFPratik MeswaniyaNo ratings yet

- Declaration 1610111025693Document3 pagesDeclaration 1610111025693Muhammad Aamir AbbasNo ratings yet

- Form 16 TDS certificateDocument2 pagesForm 16 TDS certificateGaurav MishraNo ratings yet

- 1 - Form16 - 218 - FY 2021-22Document9 pages1 - Form16 - 218 - FY 2021-22Sasi NimmakayalaNo ratings yet

- 114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023Document4 pages114 (1) (Return of Income For A Person Deriving Income Only From Salary and Other Sources Eligible To File Salary Return) - 2023asiashah1975No ratings yet

- Form 16 (2022-23) Assessment Year 2023-24Document6 pagesForm 16 (2022-23) Assessment Year 2023-24Hidden future techNo ratings yet

- Arvind Kumar SoniDocument1 pageArvind Kumar SoniAngad MundraNo ratings yet

- Date of Booking Date of JourneyDocument3 pagesDate of Booking Date of JourneyAngad MundraNo ratings yet

- 27 PE Price Circular 11 June 15 DomesticDocument5 pages27 PE Price Circular 11 June 15 DomesticAngad MundraNo ratings yet

- Financial Formulas - Ratios (Sheet)Document3 pagesFinancial Formulas - Ratios (Sheet)carmo-netoNo ratings yet

- Components of RemunerationDocument8 pagesComponents of RemunerationAshis karmakarNo ratings yet

- Business LawDocument3 pagesBusiness LawAngad MundraNo ratings yet

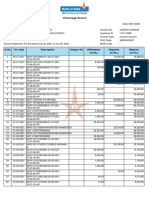

- Bank of IndiaDocument1 pageBank of IndiaAngad MundraNo ratings yet

- #27736409 27475045 NamairDocument3 pages#27736409 27475045 NamairPrima AyuNo ratings yet

- Homework on Sinking Fund CalculationsDocument2 pagesHomework on Sinking Fund CalculationsRose DumadaugNo ratings yet

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- Internship ReportDocument68 pagesInternship Reportbanth100% (1)

- Bangladesh banking general activitiesDocument7 pagesBangladesh banking general activitiesFozle Rabby 182-11-5893No ratings yet

- General Banking Act PDFDocument69 pagesGeneral Banking Act PDFJerwin TiamsonNo ratings yet

- Siddheshwar Agriculture Cooperative LTD.: Bhurakot, KanchanpurDocument6 pagesSiddheshwar Agriculture Cooperative LTD.: Bhurakot, Kanchanpurmadhu chaudharyNo ratings yet

- Session 1 - 4 Banking System & Structure PDFDocument27 pagesSession 1 - 4 Banking System & Structure PDFrizzzNo ratings yet

- IMF and World Bank: Objectives, Functions and StructureDocument23 pagesIMF and World Bank: Objectives, Functions and Structuresanthosh kumaranNo ratings yet

- Casa ManualDocument425 pagesCasa ManualAnton TarasovNo ratings yet

- Affidavit of FactDocument2 pagesAffidavit of FactAlisha GrahamNo ratings yet

- MCQ (New Topics-Special Laws) - PartDocument2 pagesMCQ (New Topics-Special Laws) - PartJEP WalwalNo ratings yet

- Hre ClientsDocument45 pagesHre ClientsSiwema MwitaNo ratings yet

- Problem On Loan ImpairmentDocument26 pagesProblem On Loan ImpairmentYukiNo ratings yet

- HAROON-Icici BankDocument10 pagesHAROON-Icici BankHaroon RasithNo ratings yet

- Government SecuritiesDocument6 pagesGovernment Securitiesrahul baidNo ratings yet

- Jawa 2Document1 pageJawa 2Jawahar ParamasivamNo ratings yet

- Personal Banking: What Is It?Document25 pagesPersonal Banking: What Is It?chala meseretNo ratings yet

- Integrated BAWP_Share_1680347644 (1)Document4,079 pagesIntegrated BAWP_Share_1680347644 (1)aksharasingh1920No ratings yet

- Provisions of Sections 269SS and 269T under Income Tax ActDocument4 pagesProvisions of Sections 269SS and 269T under Income Tax ActJaikumar SinghNo ratings yet

- Revolut Bank UAB Demand Deposit TermsDocument11 pagesRevolut Bank UAB Demand Deposit TermsLarisa Mihaela SfătuțăNo ratings yet

- Vimannagar Branch Account StatementDocument32 pagesVimannagar Branch Account StatementSatyasheel ChandaneNo ratings yet

- Advanced Financial Accounting & Reporting Icwai - Final: CompendiumDocument192 pagesAdvanced Financial Accounting & Reporting Icwai - Final: Compendiumteodora100% (1)

- PDFDocument2 pagesPDFRagini AshokNo ratings yet

- Ebb Midterm PaperDocument14 pagesEbb Midterm PaperPutry LedoNo ratings yet

- Account Name BSB Account Number Account Type Date OpenedDocument6 pagesAccount Name BSB Account Number Account Type Date OpenedSandeep TuladharNo ratings yet

- Sample All-in-One Secretary's CertDocument2 pagesSample All-in-One Secretary's CertEric CortesNo ratings yet