Professional Documents

Culture Documents

2013 Market in Review

Uploaded by

g_nasonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2013 Market in Review

Uploaded by

g_nasonCopyright:

Available Formats

2013 Market in Review

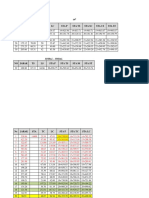

NYSE

Nasdaq

Losers

Gainers

Stock

Last

GrayTvA

12.91

GrayTelev

14.88

Lannett

33.10

PumaBiotc 103.53

Xerium

16.49

MediaGen

22.60

ChinaDEd

18.69

JinkoSolar

29.30

Vipshop

83.68

DaqoNEn

36.30

Stock

Yr.Chg Yr.%Chg

+11.17

+642.0

+12.68

+576.4

+28.14

+567.3

+84.78

+452.2

+13.44

+440.7

+18.30

+425.6

+14.74

+373.2

+23.09

+371.8

+65.84

+369.1

+28.34

+356.0

Most active

Vol.(000)

BkofAm

29372046

S&P500ETF26416903

iShEMkts 14537653

SPDR Fncl 10886034

B iPVix rs 10346816

FordM

10043302

GenElec

9507985

NokiaCp

9305662

iShJapan

9182983

Pfizer

9151306

Last

15.57

184.69

41.80

21.86

42.55

15.43

28.03

8.11

12.14

30.63

Yr.Chg

+3.96

+42.28

-2.56

+5.47

-84.69

+2.48

+7.04

+4.16

+2.39

+5.55

Stock

DxGldBll rs

PrUVxST rs

HomexDev

C-TrCVol rs

Dolan Co

BarcShtB

OxfordRes

HarmonyG

DrSOXBr rs

IAMGld g

Last

27.41

16.78

1.17

3.40

.69

16.10

1.23

2.53

37.52

3.33

Last

44.33

41.71

33.64

10.75

37.98

39.68

35.37

30.86

35.15

65.19

Summary data

2013

Advanced

Declined

Unchanged

Total issues

Share volume

1971

1301

9

3281

822,486,700,000

Stock

ZhoneTech

CdnSolar

ChinaInfo

VisnChina

SuperCm rs

AdeptTech

ChiMobGm

HimaxTch

CorpResSv

ChelseaTh

Best new stocks

Stock

EmergeE n

ChanAdv n

T-MoblUS n

Sprint n

Luxoft n

Barracuda n

500.com n

EraGrp n

ING US n

ArtisanP n

2012

2359

879

9

3247

879,760,000,000

Losers

Gainers

Yr.Chg Yr.%Chg

-521.09

-95.0

-192.22

-92.0

-11.31

-90.6

-26.30

-88.6

-3.20

-82.3

-46.34

-74.2

-3.19

-72.2

-6.43

-71.8

-94.53

-71.6

-8.14

-71.0

Yr.Chg

+27.78

+23.27

+17.12

+5.20

+17.60

+18.13

+15.36

+12.81

+14.31

+26.36

Yr.%Chg

+167.9

+126.2

+103.6

+93.7

+86.4

+84.1

+76.8

+71.0

+68.7

+67.9

Last

5.34

29.82

7.23

23.80

4.62

16.89

25.23

14.71

2.63

4.44

Yr.Chg Yr.%Chg

+4.87 +1029.0

+26.42

+777.1

+6.32

+694.5

+20.75

+680.3

+4.03

+676.5

+14.29

+549.6

+21.32

+545.4

+12.31

+512.9

+2.18

+484.4

+3.68

+483.6

Most active

Stock

Vol.(000)

Facebook 14661756

SiriusXM 12360974

Microsoft 12038549

Intel

9713023

Cisco

9640606

MicronT

9458844

BlackBerry 8373284

PwShs QQQ 7660936

Zynga

6475587

Groupon

4530039

Last

54.65

3.49

37.41

25.96

22.43

21.75

7.44

87.96

3.80

11.77

NYSEMKT

Yr.Chg

+28.03

+.60

+10.70

+5.34

+2.78

+15.41

-4.43

+22.83

+1.44

+6.91

Stock

Last

ProspGR rs

1.74

CSVxSht rs

7.50

NewLead rs 1.77

Celsion rs

3.89

WrightM rt

.32

Aastrom rs

3.23

ColdwCrk

.75

TandyB h

.25

CS VSSlv rs 45.21

vjAlvarion

.65

Best new stocks

Stock

IntrCloud n

GW Phm n

InsysTh n

Oramed n

QIWI n

AtlasFin n

Alcobra n

MiratiTh n

AratanaT n

ExOne n

Last

18.36

41.54

38.71

15.43

56.00

14.65

18.00

16.63

19.10

60.46

Summary data

2011

2013

Advanced

Declined

Unchanged

Total issues

Share volume

1371

1846

8

3225

1,060,902,748,102

2177

592

5

2774

426,164,800,000

2012

1653

1034

4

2691

420,500,000,000

Yr.Chg

+15.20

+32.45

+29.21

+11.47

+38.92

+8.70

+10.45

+9.58

+10.84

+33.94

Losers

Gainers

Yr.Chg Yr.%Chg

-70.76

-97.6

-85.90

-92.0

-16.23

-90.2

-32.97

-89.4

-2.42

-88.2

-21.97

-87.2

-4.06

-84.5

-1.25

-83.5

-215.89

-82.7

-3.07

-82.5

Yr.%Chg

+481.0

+357.0

+307.5

+289.6

+227.9

+146.2

+138.4

+135.9

+131.2

+128.0

2011

974

1800

4

2778

489,055,068,912

Stock

Last

AltisrcAst 930.00

LiberMed

4.17

InovioPhm

2.90

GastarExp

6.92

WidePoint

1.64

HMG

18.00

Organovo

11.07

OrionEngy

6.80

AtlatsaR g

.58

RetractTc

3.08

Stock

Yr.Chg Yr.%Chg

+848.00 +1034.1

+3.46

+487.3

+2.40

+480.0

+5.71

+471.9

+1.27

+343.2

+13.87

+335.5

+8.47

+325.8

+5.14

+309.6

+.42

+275.8

+2.21

+254.0

Most active

Vol.(000)

InovioPhm 1121794

NwGold g

938360

CheniereEn 918928

AlldNevG

864823

GoldStr g

639236

Organovo

620234

NovaGld g

522226

NA Pall g

495188

B2gold g

302559

VantageDrl

299752

Last

2.90

5.24

43.12

3.55

.44

11.07

2.54

.65

2.02

1.84

Yr.Chg

+2.40

-5.79

+24.34

-26.58

-1.40

+8.47

-1.97

-.65

-1.55

+.01

Stock

GoldenMin

AlldNevG

LoncorRs g

VistaGold

T3 Motion

IntTower g

Banro g

Cardium rs

CelSci rs

GoldStr g

Last

.47

3.55

.09

.38

.04

.41

.56

.83

.59

.44

Best new stocks

Stock

AmEagE n

OwensRM n

StrPathC n

InspMD n

IndepRT n

ChenierE n

OrchidIsl n

Last

2.05

12.12

8.19

2.46

8.34

18.75

13.00

Summary data

Advanced

Declined

Unchanged

Total issues

Share volume

2013

208

262

1

471

22,024,000,000

Yr.Chg Yr.%Chg

-4.12

-89.7

-26.58

-88.2

-.62

-86.9

-2.32

-85.9

-.20

-83.8

-1.76

-81.1

-2.24

-80.1

-2.97

-78.2

-2.11

-78.1

-1.40

-76.1

2012

277

224

3

504

20,250,000,000

Yr.Chg

+1.23

+3.57

+2.29

+.46

-.11

-.47

-1.80

Yr.%Chg

+150.0

+41.8

+38.8

+23.0

-1.3

-2.4

-12.2

2011

211

321

1

533

31,324,573,934

New York Stock ExchangE

Stock

Yearly

Div. PE High Low

A-B-C

Last

Yr.Net Yr%

Chg. Chg

AAR

.30 20 31.55 16.02 28.01 +9.33 +49.9

ABB Ltd .74e ... 26.63 20.65 26.56 +5.77 +27.8

ABM

.62f 21 29.20 20.04 28.59 +8.64 +43.3

ACE Ltd 2.14e 13 104.07 79.79 103.53 +23.73 +29.7

ADT Corp .50 22 50.37 38.09 40.47 -6.02 -12.9

AES Corp .20f 16 15.54 10.66 14.51 +3.81 +35.6

AES pfC 3.38 ... 51.92 49.71 50.18 +.53 +1.1

AFLAC 1.48f 10 67.62 48.17 66.80 +13.68 +25.8

AFLAC 52 1.38 ... 27.41 20.45 21.22 -4.23 -16.6

AG MtgeIT 2.40 dd 26.94 15.10 15.64 -7.84 -33.4

AG Mtg pfA 2.06 ... 26.31 21.10 22.06 -3.23 -12.8

AG Mtg pfB 2.00 ... 25.69 20.21 21.64 -3.31 -13.3

AGCO

.40 10 64.60 47.29 59.19 +10.07 +20.5

AGL Res 1.88 17 49.31 38.86 47.23 +7.26 +18.2

AH Belo

.32 cc 8.60 4.72 7.47 +2.82 +60.6

AK Steel

... dd 8.47 2.76 8.20 +3.60 +78.3

AMC Ent n ... ... 20.72 18.81 20.55 +1.65 +8.7

AMCON

.72 10 84.50 65.00 79.93 +15.48 +24.0

AMN Hlth

... 22 16.20 10.34 14.70 +3.15 +27.3

AOL

5.15e 59 46.98 29.16 46.62 +17.01 +57.4

ARC Docu ... cc 9.35 2.12 8.22 +5.66 +221.1

ASA Gold .18e q 22.35 11.39 12.26 -9.27 -43.1

AT&T Inc 1.84f 26 39.00 32.76 35.16 +1.45 +4.3

AU Optron ... ... 4.98 2.80 3.12 -1.38 -30.7

AVG Tech

... ... 26.56 12.10 17.21 +1.38 +8.7

AVX Cp

.35 23 14.19 10.70 13.93 +3.15 +29.2

AZZ Inc

.56 21 49.64 34.61 48.86 +10.43 +27.1

Aarons

.08f 14 30.90 26.20 29.40 +1.12 +4.0

AbtLab s .88f 21 38.81 31.64 38.33 +6.99 +22.3

AbbVie n 1.60 19 54.78 33.33 52.81 +18.65 +54.6

AberFitc

.80 18 55.23 31.14 32.91 -15.06 -31.4

AbdAsPac .42 q 7.97 5.75 5.76 -1.98 -25.6

AbdAustEq1.01e q 12.02 8.35 8.44 -2.00 -19.2

AbdnChile 1.47e q 16.25 10.34 10.55 -4.54 -30.1

AbdGlbInc .84 q 14.80 10.26 10.40 -3.82 -26.9

AbdEMSmC.39e q 15.79 12.47 13.80 -1.15 -7.7

AbdGChina1.34e q 11.81 9.27 10.19 -1.16 -10.2

AbdnIndo 2.51e q 11.80 7.96 8.26 -1.94 -19.0

AbdnIsrael .41e q 17.35 12.92 16.86 +3.76 +28.7

AbdnLatA 2.98e q 38.27 27.66 28.05 -8.19 -22.6

AbSingaFd .92e q 14.79 12.32 12.77 -1.21 -8.7

AcadiaRlt .92f 38 29.32 22.89 24.83 -.25 -1.0

Accenture 1.74e 17 84.23 67.55 82.22 +15.72 +23.6

AccessMid 2.14f 74 57.48 33.76 56.58 +23.04 +68.7

AccoBrds

... 8 9.16 5.56 6.72 -.62 -8.4

AccretivH

... ... 13.54 7.98 9.16 -2.42 -20.9

Accuride

... dd 6.88 3.10 3.73 +.52 +16.2

AcmeU

.32 12 15.50 11.08 14.90 +3.86 +35.0

AcornIntl

... dd 2.97 1.42 1.55 -.98 -38.7

Actavis

... 60 170.51 82.02 168.00 +82.00 +95.3

Actuant

.04 cc 39.84 27.99 36.64 +8.73 +31.3

Acuity

.52 37 111.10 62.39 109.32 +41.59 +61.4

AdamsEx .84e q 13.32 10.72 13.07 +2.48 +23.4

AdmRsc .88 10 71.77 33.75 68.50 +33.43 +95.3

AdcareHlt

... dd 6.26 3.62 4.30 -.45 -9.5

Adcare pfA 2.72 ... 31.90 24.63 27.50 +.36 +1.3

Adecaogro ... ... 9.60 6.01 8.09 -.39 -4.6

AFPProv 16.60e ... 112.61 82.09 86.73 -17.27 -16.6

AdvAuto

.24 20 111.94 71.48 110.68 +38.33 +53.0

AMD

... dd 4.65 2.26 3.87 +1.47 +61.3

AdvPhot

... dd

.88 .40

.69 +.22 +46.8

AdvSemi .18e 16 5.38 3.87 4.80 +.52 +12.1

AdvOil&Gs ... dd 4.51 2.79 4.34 +1.10 +34.0

Advantest

... ... 18.15 11.18 12.25 -3.87 -24.0

AdvClayCv 1.13 q 18.76 16.11 18.53 +2.41 +15.0

AdvCCvII .56 q 7.62 6.54 7.28 +.80 +12.3

AdvClEnh .84 q 10.45 9.20 10.13 +1.03 +11.3

AdSFocGr .13e q 38.99 31.25 37.47 +6.73 +21.9

AdvLgSht

... q 25.49 21.38 22.18 -.20

-.9

AdvPerHY 4.14e q 52.67 49.01 51.71 +1.64 +3.3

AdvAthBear ... q 25.21 22.15 22.51 -2.52 -10.1

AdvNfltMS .94e q 51.01 48.59 49.48 -.55 -1.1

AdvPTBusn.30p q 27.21 25.10 26.32 +1.48 +6.0

AdS EqPro .34e ... 30.29 29.28 30.24 +.59 +2.0

AdvS QAM .48e q 28.95 25.49 28.01 +2.52 +9.9

AdvSStarG ... q 26.06 23.34 25.00 +.25 +1.0

AdvGblEch .02e q 60.72 51.72 60.72 +9.09 +17.6

AdAccuGOp.21e q 30.21 25.36 28.49 +.24

+.8

AdvCambG ... q 25.95 23.21 24.75 +.35 +1.4

AdvTrTabs .15e q 48.56 34.66 48.49 +14.60 +43.1

AdvMeidll

... q 30.06 26.23 30.04 +4.11 +15.9

AdMadGBd .85e q 27.13 24.40 25.13 -1.42 -5.3

AdMadIntl .49e q 28.74 23.28 28.50 +4.47 +18.6

AdMadDm .10e q 38.42 28.30 38.42 +10.62 +38.2

AdvActBear ... q 18.54 12.75 12.76 -5.55 -30.3

AecomTch ... 12 35.24 23.95 29.43 +5.63 +23.7

AegeanMP .04 20 12.72 5.36 11.22 +5.94 +112.5

Aegon

.26e ... 9.50 5.70 9.48 +3.04 +47.2

Aegon cap 1.59 ... 26.96 21.65 23.41 -1.75 -7.0

Aegon 6.8751.72 ... 25.76 23.71 24.77 -.23

-.9

Aegon 7.25 1.81 ... 25.88 24.54 25.37 +.30 +1.2

Aegon 6.5 1.63 ... 26.99 22.67 23.59 -1.28 -5.1

Aegon flt 1.01 ... 25.27 19.35 19.68 -3.60 -15.5

Aegon42 2.00 ... 29.30 25.68 28.19 +.21

+.8

AerCap

... 28 39.10 13.73 38.35 +24.63 +179.5

Aerocntry

... 4 22.30 14.20 17.18 +3.09 +21.9

Aeroflex

... dd 9.25 6.16 6.50 -.50 -7.1

Aeropostl

... dd 17.10 7.78 9.09 -3.92 -30.1

Aetna

.90f 13 69.47 44.38 68.59 +22.28 +48.1

AffilMgrs

... 43 217.48132.98 216.88 +86.73 +66.6

AffMgrs 22 1.31 ... 26.54 24.40 25.53 +.27 +1.1

AffMgrs42 1.59 ... 27.60 22.22 22.75 -3.55 -13.5

Agilent

.53f 21 57.94 40.19 57.19 +16.25 +39.7

Agnico g

.88 14 53.78 23.77 26.38 -26.08 -49.7

AgreeRlt 1.64 19 34.25 26.62 29.02 +2.23 +8.3

Agria Cp

... ... 1.74 .69 1.47 +.78 +113.0

Agrium g 3.00 10 115.31 77.19 91.48 -8.39 -8.4

Air Inds

.50 ... 9.75 2.20 8.98 +1.71 +23.5

AirLease .12f 18 33.57 21.73 31.08 +9.58 +44.6

AirProd

2.84 24 114.75 84.04 111.78 +27.76 +33.0

Aircastle .80f 10 19.50 12.43 19.16 +6.62 +52.8

Airgas

1.92 24 112.60 88.60 111.85 +20.56 +22.5

AlaPw pfN 1.30 ... 26.29 23.47 24.15 -1.75 -6.8

AlaPw pfO 1.46 ... 30.69 24.90 25.44 -2.65 -9.4

AlaPw pfP 1.32 ... 27.03 23.75 24.17 -2.07 -7.9

AlamoGp .28 21 61.27 33.12 60.69 +28.05 +85.9

Alamos gn .20 20 17.38 10.10 12.13 -2.58 -17.5

AlaskaAir .80 12 78.53 43.32 73.37 +30.28 +70.3

AlbnyIn

.60 27 37.43 23.13 35.93 +13.25 +58.4

Albemarle .96 19 70.00 56.64 63.39 +1.27 +2.0

AlcatelLuc .18e ... 4.68 1.27 4.40 +3.01 +216.5

Alcoa

.12 30 10.77 7.63 10.63 +1.95 +22.5

Alcoa pf 3.75 ... 99.44 70.03 76.00 -7.56 -9.0

AlderonIr g ... ... 2.26 .83 1.57 -.23 -12.8

Alere

... dd 36.78 18.64 36.20 +17.70 +95.7

Alere pfB 12.00t ... 300.00186.61 286.30+101.16 +54.6

AlexB Inc .16 64 46.23 28.82 41.73 +12.36 +42.1

Alexanders11.00a 28 354.50266.44 330.00 -.80

-.2

AlexREE 2.72 46 78.43 60.86 63.62 -5.70 -8.2

AlxRE pfE 1.61 ... 27.42 21.15 21.20 -5.20 -19.7

AlexcoR g

... ... 4.72 .90 1.26 -2.31 -64.7

AllegCp

... 20 420.89337.67 399.96 +64.54 +19.2

AllegTch

.72 dd 35.89 25.60 35.63 +5.27 +17.4

Allegion n

... ... 50.00 40.24 44.19 -4.29 -8.8

Allergan

.20 33 116.45 81.33 111.08 +19.35 +21.1

Allete

1.90 19 54.14 41.39 49.88 +8.90 +21.7

AlliCAMun .75 q 15.44 11.60 12.13 -2.46 -16.9

AlliData

... 30 264.31146.39 262.93+118.17 +81.6

AlliBNtlMu .87 q 16.91 11.87 12.53 -2.94 -19.0

AlliancOne ... dd 4.23 2.79 3.05 -.59 -16.2

AlliBGlbHi 1.20a q 17.25 13.72 14.28 -1.37 -8.8

AlliBInco .41a q 8.43 6.80 7.13 -.97 -12.0

AlliNYMun .62 q 14.88 11.35 11.87 -2.45 -17.1

AlliBern 1.59e 15 27.38 17.65 21.34 +3.91 +22.4

AlliantEgy 1.88 15 54.18 43.73 51.60 +7.69 +17.5

AlliantTch 1.04 13 123.34 62.30 121.68 +59.72 +96.4

AlliGlCvInc 1.08 q 9.95 8.69 9.71 +1.02 +11.7

AlliGblCv2 1.02 q 9.10 8.06 8.98 +1.05 +13.2

AlliNFJDv 1.80 q 18.88 15.56 17.71 +2.11 +13.5

AlliGblEq 1.20 q 17.25 13.13 15.30 +1.81 +13.4

AlliGlEqCv1.12a q 19.96 16.80 19.52 +2.88 +17.3

How to read the NYSE stock tables

1

Stock

XYZCorp

Div.

1.75

PE

11

Yearly

High Low

59.25 46.00

Last

50.25

Yr.Net

Chg

-7.94

Yr.%

Chg

-12.8

1 Name of stock.

7 Net change for the year.*

2 Dividend and footnote, if

8 Percent change for the year.*

applicable.

3 PEratio:Stock price divided by *For new stocks, change is from the

12-month earnings per share.

first day of trading.

4 Yearly high price.

5 Yearly low price.

6 Last price for the year.

Stocks in BOLDhad a price change of 75 percent or more vs. their price at the start of 2013.

Underlining denotes the 100 stocks with the greatest volume.

Yearly

Yr.Net Yr%

Stock

Div. PE High Low Last

Chg. Chg

AlldNevG

... 10 31.31 3.01 3.55 -26.58 -88.2

AlldWldA 2.00 9 113.28 79.21 112.81 +34.01 +43.2

AllisonTrn .48 39 28.15 20.13 27.61 +7.19 +35.2

Allstate

1.00 15 54.84 40.65 54.54 +14.37 +35.8

Allstate 53 1.28 ... 27.24 22.95 24.11 -1.36 -5.3

Allstat pfA

... ... 25.47 20.64 21.00 -3.94 -15.8

Allstat pfC 1.69 ... 25.72 24.79 25.65 +.63 +2.5

Allstat pfD

... ... 25.14 24.56 25.00 +.35 +1.4

AllyFn pfB 2.13 ... 27.42 25.42 26.85 +.58 +2.2

AlmadnM g ... ... 3.26 1.01 1.17 -2.00 -63.1

AlonBlueSq ... dd 4.74 2.41 4.21 +1.88 +80.7

AlonUSA .24a 20 21.24 8.55 16.54 -1.55 -8.6

AlonUsaLP ... ... 29.12 10.25 16.66 -7.41 -30.8

AlphaNRs

... dd 10.74 4.78 7.14 -2.60 -26.7

AlphaPro

... 24 2.35 1.42 2.15 +.72 +50.3

AlphaCAlt .45e q 38.08 27.87 37.64 +9.74 +34.9

AlpGlbDD .36a q 5.63 4.40 5.10 -.13 -2.5

AlpGPPrp .60 q 8.98 6.66 7.19 -.09 -1.2

AlpTotDiv .32 q 4.31 3.76 4.19 +.16 +4.0

AlpsETF 2.40e q 44.87 36.84 39.16 -.09

-.2

AlpsEqSect .80e q 51.11 40.50 51.05 +11.16 +28.0

AlpsCRB .88e q 47.08 39.35 43.89 -.83 -1.9

AlpAlerEn .07p q 25.94 24.32 25.86 +.84 +3.4

AlpIntDvDg .42e q 29.75 24.89 29.31 +4.19 +16.7

AlpBarr400 .05p q 29.93 23.91 29.87 +4.99 +20.0

AlpEqHiVol1.91e q 26.49 24.99 25.47 +.43 +1.7

AlpsUSLCap.39e q 31.39 25.25 31.39 +6.96 +28.5

AlpsAsiaxJ .44e q 26.72 21.00 21.49 -3.43 -13.8

AlpsMltAst .45e q 26.63 24.04 25.94 +.94 +3.8

AlpsGEqTr .41e q 26.44 19.54 20.57 -4.49 -17.9

AlpRivStInc .12e q 25.25 24.43 25.04 +.51 +2.1

AlpVSVolLC.26e q 28.37 24.79 28.36 +3.44 +13.8

AlpVSTailR .50e q 27.14 24.83 27.14 +2.31 +9.3

AlpsDvDog1.17e q 34.34 26.88 34.24 +7.76 +29.3

AlpAlerMLP1.07e q 18.36 16.12 17.79 +1.84 +11.5

Alteva

1.08 dd 12.52 5.76 8.17 -2.27 -21.7

AltisrcAst

... ...1079.95 78.25 930.00 +848.00 +1034.1

AltisResid .10p ... 31.90 15.25 30.11 +14.27 +90.1

Altria

1.92 19 38.58 31.85 38.39 +6.95 +22.1

Alumina

... ... 5.26 3.35 3.96 +.10 +2.6

AlumChina ... ... 13.29 7.25 8.70 -3.21 -27.0

AmREIT

.80 ... 21.06 16.22 16.80 -.35 -2.0

ATrFn pfA 1.69 ... 24.35 17.35 18.79 -4.86 -20.5

Ambev n

... ... 7.85 6.75 7.35 +.13 +1.8

AmbwEd

... ... 2.55 .91

.95 -1.30 -57.8

AMCOL

.80 58 37.05 27.59 33.98 +3.30 +10.8

Ameren 1.60 31 37.31 30.64 36.16 +5.44 +17.7

Ameresco

... 46 10.88 6.56 9.66 -.15 -1.5

AMovilL .34e 14 25.71 18.26 23.37 +.23 +1.0

AmApparel ... dd 2.40 1.00 1.23 +.22 +21.8

AmAssets .88f 90 36.27 27.95 31.43 +3.50 +12.5

AmAxle

... 4 21.41 10.94 20.45 +9.25 +82.6

AmCampus1.44 35 48.49 31.64 32.21 -13.92 -30.2

AmDGEn

... dd 2.40 1.12 1.70 -.50 -22.6

AmEagE n ... dd 3.00 .80 2.05 +1.23 +150.0

AEagleOut .50 15 22.63 13.14 14.40 -6.11 -29.8

AEP

2.00f 19 51.60 41.83 46.74 +4.06 +9.5

AEqInvLf .18f 13 26.46 12.33 26.38 +14.17 +116.1

AmExp

.92 21 90.79 58.31 90.73 +33.45 +58.4

AFnclGrp .88a 15 58.44 39.76 57.72 +18.20 +46.1

AFnclGp50 1.75 ... 27.85 24.09 25.35 -1.48 -5.5

AFnclG6-421.59 ... 27.24 22.40 23.68 -2.46 -9.4

AFnclG8-421.44 ... 26.92 20.35 21.34 -3.99 -15.8

AHm4Rnt n .20 ... 16.99 15.10 16.20 +.60 +3.8

AHm4R pfA1.25 ... 26.11 24.36 25.17 -.32 -1.2

AmerInco .48 q 8.92 7.10 7.33 -1.04 -12.4

AIG wt

... ... 21.78 13.50 20.25 +6.45 +46.7

AmIntlGrp .40 24 53.33 34.56 51.05 +15.75 +44.6

AmLorain

... 1 1.40 .61

.79 -.49 -38.3

AMidstrm 1.81f dd 28.80 13.74 27.08 +13.44 +98.5

AMunInc

.96 q 17.04 12.90 12.98 -2.79 -17.7

AmrRlty

... 13 6.69 2.71 5.25 +2.52 +92.3

AResidPr n ... ... 21.05 16.21 17.16 -3.84 -18.3

ASelPort .69a q 11.27 9.16 9.26 -1.67 -15.3

AmShrd

... dd 3.46 1.52 2.77 +.04 +1.5

ASpecRlty ... dd 3.75 1.39 1.82 -1.61 -46.9

AmStWtr s .81 18 33.09 24.01 28.73 +4.74 +19.8

AmSIP

.69a q 11.76 8.70 8.99 -2.46 -21.5

AmSIP2

.60 q 9.15 7.46 7.71 -1.11 -12.6

AmSIP3

.54 q 7.55 6.34 6.56 -.93 -12.4

AmTower 1.16f 54 85.26 67.89 79.82 +2.55 +3.3

AVangrd .17e 15 34.97 21.83 24.29 -6.78 -21.8

AmWtrWks 1.12 21 45.09 36.96 42.26 +5.13 +13.8

Amerigas 3.36 21 50.45 37.67 44.57 +5.83 +15.0

Ameriprise 2.08 17 115.36 63.59 115.05 +52.42 +83.7

Ameripr39 1.94 ... 28.93 25.55 25.65 -1.82 -6.6

AmeriBrgn .94f 38 71.38 43.01 70.31 +27.13 +62.8

Ametek

.24 27 62.05 38.00 52.67 +15.10 +40.2

AmiraNatF ... ... 17.41 6.25 15.76 +7.81 +98.2

Ampco

.72 12 21.02 16.24 19.45 -.53 -2.7

Amphenol .80 24 89.46 65.77 89.18 +24.48 +37.8

AmpioPhm ... dd 10.86 3.50 7.13 +3.54 +98.6

Amrep

... dd 15.49 6.11 7.00 -7.91 -53.1

Anadarko .72 23 98.47 73.60 79.32 +5.01 +6.7

AnglogldA .17e ... 31.88 11.14 11.72 -19.65 -62.6

ABInBev 3.03e ... 106.83 83.94 106.46 +19.05 +21.8

Anixter 5.00e 20 92.46 63.92 89.84 +25.86 +40.4

Ann Inc

... 17 37.40 26.95 36.56 +2.72 +8.0

Annaly 1.50e 3 16.18 9.66 9.97 -4.07 -29.0

Annaly pfA 1.97 ... 26.70 23.26 24.40 -1.01 -4.0

Annaly pfC 1.91 ... 26.58 21.72 22.15 -2.95 -11.8

Annaly pfD 1.88 ... 26.25 21.51 22.00 -2.87 -11.5

Annies

... 48 52.38 33.05 43.04 +9.61 +28.7

AnteroRs n ... ... 63.57 51.56 63.44 +11.43 +22.0

Anworth .50e 7 6.39 4.02 4.21 -1.57 -27.2

Anwrth pfA 2.16 ... 26.25 22.31 24.58 -1.07 -4.2

Anwrth pfB 1.56 ... 26.50 20.10 20.25 -4.20 -17.2

Aon plc

.70 25 84.33 54.65 83.89 +28.28 +50.9

AoxingPh

... dd

.41 .19

.25 +.06 +30.9

Apache

.80 13 94.84 67.91 85.94 +7.44 +9.5

Apache pfD 3.00 ... 48.87 39.10 45.70

...

...

AptInv

.96 25 33.44 24.78 25.91 -1.15 -4.2

AptInv pfZ 1.75 ... 27.25 24.69 25.08 -.72 -2.8

ApolloCRE 1.60 13 18.28 14.56 16.25 +.02

+.1

ApolCR pfA 2.16 ... 27.19 24.48 24.89 -1.20 -4.6

ApolloGM3.95e 9 34.88 17.72 31.61 +14.25 +82.1

Apollo 42 1.66 ... 25.85 20.25 20.62 -3.08 -13.0

ApolloI 43 1.72 ... 24.95 20.72 21.16 -3.57 -14.4

ApolloRM 1.60 4 23.11 14.24 14.78 -5.41 -26.8

ApollRM pf 2.00 ... 25.67 20.86 21.55 -3.25 -13.1

ApollSrFlt 1.20a q 21.03 17.46 18.10 -.67 -3.6

ApolloTact 1.40a q 20.21 16.24 18.00 -2.00 -10.0

ApldIndlT .92 18 53.57 40.39 49.09 +7.08 +16.9

Aptargrp 1.00 26 67.86 48.14 67.81 +20.09 +42.1

AquaAm s .61 18 28.12 20.59 23.59 +3.25 +16.0

Footnotes:

cc - P/E exceeds 99. cld - Issue has been called for redemption by company. dd - Loss in the last 12 months. ec - Company

formerly listed on the American Exchanges Emerging Company Marketplace. g - Dividends and earnings in Canadian dollars.

h - temporary exempt from Nasdaq capital and surplus listing qualification. n - Stock was a new issue in the last year. The 52

week high and low figures date only from the beginning of trading. pf - Preferred stock issue. pr - Preferences. pp - Holder

owes installments of purchase price. q - Stock is a closed-end fund. No P/E ratio shown. rs - Stock has undergone a reverse

stock split of at least 50 percent within the past year. rt - Right to buy security at a specified price. s - Stock has split by at least

20 percent within the last year. wi - Trades will be settled when the stock is issued. wd - When distributed. wt - Warrant,

allowing a purchase of a stock. un - Unit, including more than one security. vj - Company in bankruptcy or receivership, or

being reorganized under the bankruptcy law. Appears in front of the name.

Footnotes for special or extra dividends or payments not designated as regular:

a - Extra dividends were paid, but are not included. b - Annual rate plus stock. c - Liquidating dividend. e - Amount declared

or paid in last 12 months. f - Current annual rate, which was increased by most recent dividend announcement. i - Sum of dividends paid after stock split, no regular rate. j - Sum of dividends paid this year. Most recent dividend was omitted or deferred.

k - Declared or paid this year, a cumulative issue with dividends in arrears. m - Current annual rate, which was decreased by

most recent dividend announcement. p - Initial dividend, annual rate not known. r - Declared or paid in preceding 12 months

plus stock dividend. t - Paid in stock, approximate cash value on ex-distribution date. z - Sales are in total shares. Most active

stocks above must be worth $1 and gainers/losers $2, and do not include warrants or preferred issues. Chg and % Chg figures

are for all of 2013, except for new issues which are calculated from the closing price on the first day of trading.

Source: The Associated Press. Sales figures are unofficial.

Yearly

Yr.Net Yr%

Stock

Div. PE High Low Last

Chg. Chg

Aramark n ... ... 26.72 20.10 26.22 +3.52 +15.5

ArborRT

.52 21 8.60 5.78 6.66 +.67 +11.2

Arbor prA 2.06 ... 26.89 22.87 24.22 -1.02 -4.0

ArborR pfB 1.94 ... 25.69 21.40 22.61 -2.30 -9.2

ArcLogist n ... ... 22.27 18.69 21.90 +2.90 +15.3

ArcelorMit .20 dd 17.99 10.83 17.84 +.37 +2.1

Arcelor 16 1.50 ... 26.73 18.39 26.00 -.66 -2.5

ArchC pfC 1.69 ... 28.88 22.70 22.93 -3.90 -14.5

ArchCoal .12 dd 7.95 3.47 4.45 -2.87 -39.2

ArchDan .96f 19 43.99 27.90 43.40 +16.01 +58.5

ArcosDor .24 23 15.52 10.45 12.12 +.16 +1.3

ArdmoreS n .40 ... 15.84 11.32 15.56 +2.06 +15.3

AresCap 401.94 ... 27.63 24.24 25.31 -1.22 -4.6

AresC 2-22 1.75 ... 27.25 25.03 26.20 -.38 -1.4

AresC 10-221.45 ... 26.24 23.21 24.90 +.33 +1.3

AresCmcl 1.00 ... 17.65 12.04 13.10 -3.32 -20.2

AresDyCr 1.40 q 20.41 17.51 17.98 -2.03 -10.1

AresMSCrd ... q 24.65 20.21 21.17 -3.33 -13.6

Argan

.75e 10 27.76 13.90 27.56 +9.56 +53.1

ArlingAst 3.50 17 29.65 21.24 26.39 +5.62 +27.1

ArlingAst23 ... ... 24.98 20.50 21.62 -2.85 -11.6

ArmadaH n .64 24 11.85 8.89 9.28 -2.30 -19.9

ArmcoMetl ... 15

.64 .18

.31 -.18 -36.6

ArmourRsd .60 3 7.19 3.64 4.01 -2.46 -38.0

ArmrR pfA 2.06 ... 26.09 20.43 21.55 -3.93 -15.4

ArmrR pfB 1.97 ... 25.52 19.64 20.16 -4.64 -18.7

ArmstrWld ... 35 58.48 44.93 57.61 +6.88 +13.6

ArrwDJYld1.68e q 28.49 22.18 26.55 +.34 +1.3

ArrowEl

... 12 54.53 36.11 54.25 +16.17 +42.5

Arrhythm

... dd 4.79 2.13 3.17 +.87 +37.8

ArtisanP n 1.72 ... 66.01 35.14 65.19 +26.36 +67.9

AskanoG g ... ... 4.18 1.58 1.64 -2.32 -58.6

AsburyA

... 15 55.82 31.64 53.74 +21.71 +67.8

AshHPr wi .20 ... 23.28 17.20 18.20 -1.81 -9.0

AshfordHT .48 ... 9.57 6.93 8.28 +1.23 +17.4

AshfHTr wi ... ... 9.51 7.94 8.70 +.12 +1.4

Ashfrd pfA 2.14 ... 26.10 25.06 25.25 -.00

...

Ashfrd pfD 2.11 ... 25.75 24.94 25.22 +.07

+.3

Ashfrd pfE 2.25 ... 29.17 25.55 26.51 -.29 -1.1

Ashland 1.36 11 97.68 72.11 97.04 +16.63 +20.7

AsiaPc

... q 11.37 9.32 10.51 -.31 -2.9

AsiaTigr 2.63e q 13.08 10.49 11.29 -1.30 -10.3

AspenIns .72 12 41.43 32.23 41.31 +9.23 +28.8

AspenI pfA 1.85 ... 27.83 25.15 25.30 -.95 -3.6

AspenI pfB 1.81 ... 28.16 24.05 24.49 -1.69 -6.5

Aspen pfC 1.49 ... 26.80 22.24 22.67 -3.46 -13.2

AscBnc pfB 2.00 ... 29.75 26.12 27.56 +.06

+.2

AsdEstat

.76 cc 19.09 13.10 16.05 -.07

-.4

Assurant 1.00 13 66.73 34.83 66.37 +31.67 +91.3

AssuredG .40 10 24.81 13.95 23.59 +9.36 +65.8

AsdGMu01 1.72 ... 25.87 22.83 23.42 -1.64 -6.5

AsdGMu02 1.56 ... 25.54 20.38 20.39 -4.54 -18.2

AsdGMu03 1.40 ... 25.38 19.06 19.24 -5.01 -20.6

AstoriaF

.16 20 14.16 9.22 13.83 +4.47 +47.8

Astoria pfC 1.63 ... 25.80 20.89 21.92 -2.90 -11.7

AstraZen 2.80e 13 59.67 44.46 59.37 +12.10 +25.6

AthlonEn n ... ... 34.59 25.20 30.25 +2.69 +9.8

AtlPwr g

.40 dd 13.03 3.06 3.48 -7.95 -69.6

AtlasEngy 1.51f dd 55.89 34.74 46.85 +12.11 +34.9

AtlasPpln 2.48 dd 40.06 31.55 35.05 +3.48 +11.0

AtlasRes 2.24f dd 25.71 18.30 20.48 -1.99 -8.9

AtlatsaR g ... ...

.59 .14

.58 +.42 +275.8

ATMOS 1.48f 17 47.44 34.87 45.42 +10.30 +29.3

AtwoodOcn ... 10 59.49 43.91 53.39 +7.60 +16.6

Augusta g

... ... 2.91 .45 1.43 -1.02 -41.6

AuRico g .16 dd 8.41 3.33 3.66 -4.52 -55.3

AutoNatn

... 18 54.49 38.93 49.69 +9.99 +25.2

Autohme n ... ... 37.88 26.00 36.59 +6.52 +21.7

Autoliv

2.08f 14 94.48 63.93 91.80 +24.41 +36.2

AutoZone

... 17 484.16341.98 477.94+123.51 +34.8

AvalonHld

... 58 5.91 3.29 5.20 +1.38 +36.1

AvalnRare ... dd 1.64 .46

.55 -.81 -59.6

AvalonBay 4.28 67 141.95 116.03 118.23 -17.36 -12.8

AveICSFd 1.44a q 19.92 16.24 17.58 -.59 -3.2

AveryD

1.16 24 50.88 35.25 50.19 +15.27 +43.7

Avianca n

... ... 15.52 13.78 15.44 +1.44 +10.3

AvinoSG g ... ... 1.95 .71 1.17 -.66 -36.1

Avista

1.22 18 29.26 24.10 28.19 +4.08 +16.9

AvivREIT n 1.44 ... 31.10 21.31 23.70 +1.15 +5.1

Aviva

.45e ... 15.15 8.95 15.15 +2.74 +22.1

Aviva 41 2.06 ... 29.55 26.03 27.40 -.40 -1.4

Avnet

.60 13 44.47 30.50 44.11 +13.50 +44.1

Avon

.24 dd 24.71 14.57 17.22 +2.86 +19.9

Axiall

.64f 19 64.96 36.31 47.44 +6.16 +14.9

AXIS Cap 1.08f 9 49.75 34.95 47.57 +12.93 +37.3

AXIS pfD 1.38 ... 24.85 18.30 18.59 -6.14 -24.8

AXIS pfC 1.72 ... 28.68 22.92 23.58 -3.12 -11.7

B&G Foods1.32f 29 37.66 27.61 33.91 +5.60 +19.8

B2gold g

... ... 4.06 1.81 2.02 -1.55 -43.4

BB&T Cp .92 17 37.42 29.18 37.32 +8.41 +29.1

BB&T pfD

... ... 27.01 21.00 21.48 -4.50 -17.3

BB&T pfE 1.41 ... 26.33 19.81 20.35 -5.13 -20.1

BB&T pfF 1.30 ... 25.70 18.56 18.75 -5.82 -23.7

BB&T pfG 1.30 ... 25.18 18.53 18.80 -6.19 -24.8

BBVABFrn ... ... 9.37 3.53 6.96 +1.93 +38.4

BBX Cap

... dd 15.73 6.72 15.60 +8.90 +132.8

BCE g

2.33 ... 48.06 38.72 43.29 +.35

+.8

BGCPtrs 422.03 ... 28.57 24.58 25.88

-.11

-.4

BGE pfB 1.55 ... 26.58 22.96 24.51 -1.00 -3.9

BHP BillLt 2.32e ... 80.54 55.66 68.20 -10.22 -13.0

BHPBil plc2.32e ... 72.40 49.56 62.12 -8.25 -11.7

BP PLC 2.28f 11 48.65 39.99 48.61 +6.97 +16.7

BP Pru 9.05e 9 98.22 70.70 79.63 +11.09 +16.2

BPZ Res

... dd 3.33 1.58 1.82 -1.33 -42.2

BRE

1.58 24 61.50 45.76 54.71 +3.88 +7.6

BRE pfD 1.69 ... 25.88 24.38 25.05 -.21

-.8

BRF SA .39e ... 26.35 19.70 20.87 -.14

-.7

BRT

... 21 7.77 6.20 7.07 +.57 +8.8

BT Grp 1.49e ... 63.22 38.23 63.13 +25.10 +66.0

BabckWil .40f 18 34.67 24.84 34.19 +7.99 +30.5

BabsCCInv 1.20 q 17.95 14.11 14.93 -.35 -2.3

BabShDHi 2.01a q 25.40 21.90 23.12 -.65 -2.7

BabCPtInv 1.08 q 15.08 12.01 12.88 -1.03 -7.4

Bacterin

... dd 1.48 .37

.50 -.75 -60.0

BadgerMtr .72 33 56.36 41.88 54.50 +7.09 +15.0

BakrHu

.60 22 58.83 40.98 55.26 +14.41 +35.3

BallCorp

.52 20 51.97 41.52 51.66 +6.91 +15.4

Ballanty

... 19 5.15 3.25 4.63 +1.33 +40.3

BallyTech ... 22 78.60 44.99 78.45 +33.74 +75.5

BalticTrdg .05e dd 6.86 2.97 6.44 +3.46 +116.1

BanColum 1.62e ... 70.62 47.59 49.02 -17.56 -26.4

BcBilVArg .55e ... 12.90 8.13 12.39 +2.97 +31.5

BcoBrades .22e ... 19.50 11.30 14.05 -1.47 -9.5

BcoBrad pf .23e ... 17.79 11.29 12.53 -3.26 -20.7

BcoLatin 1.40f 14 28.82 21.70 28.02 +6.46 +30.0

Yearly

Yr.Net Yr%

Stock

Div. PE High Low Last

Chg. Chg

BcoSantSA .79e ... 9.32 6.31 9.07 +.90 +11.0

BcoSBrasil .26e ... 8.19 5.56 6.10 -1.18 -16.2

BcSanChile1.05e ... 30.69 21.16 23.57 -4.92 -17.3

BcoChile 4.60r ... 102.31 78.80 87.80 -8.70 -9.0

BcpSouth .20 29 25.54 14.14 25.42 +10.88 +74.8

Bcp NJ

.24 15 15.59 12.50 13.39 -.61 -4.4

BancrftFd .56e q 18.63 16.48 18.60 +2.20 +13.4

BkofAm

.04 21 15.98 10.98 15.57 +3.96 +34.1

BkAML pfI 1.59 ... 25.99 23.05 23.25 -1.58 -6.4

BkAML pfJ 1.02 ... 24.99 18.90 19.36 -2.45 -11.2

BkAm pfD 1.55 ... 26.91 23.70 24.09 -.83 -3.3

BkAm pfE 1.02 ... 24.97 18.89 20.13 -1.57 -7.2

BkAm pfI 1.66 ... 28.25 24.74 25.07 -1.18 -4.5

BkA pfJcld 1.81 ... 25.97 24.98 25.00 -.37 -1.5

BkAm pfL 72.50 ...1612.361024.161061.00-74.00 -6.5

BkAm wtA ... ... 6.71 4.91 6.47 +1.05 +19.4

BkAm wtB ... ...

.97 .61

.77

...

...

BkAML pfL 1.02 ... 24.57 18.58 19.57 -2.17 -10.0

BkAML pfH .77 ... 22.84 16.42 17.58 -.73 -4.0

BkAML pfG .77 ... 23.35 16.52 17.47 -1.05 -5.6

BkAm pfZ 1.50 ... 26.00 24.32 24.86 -.25 -1.0

BkA SP2-15 ... ... 16.00 11.92 14.27 +2.52 +21.4

BkADjia6-15 ... ... 16.27 12.35 16.27 +4.12 +33.9

BkAS&P2-14 ... ... 15.82 14.76 15.75 +1.15 +7.9

BkA S&P14 ... ... 15.51 14.36 15.50 +1.28 +9.0

BkADjia3-15 ... ... 14.98 11.53 14.97 +3.65 +32.2

BkA S&P4-14 ... ... 19.38 16.03 19.22 +2.89 +17.7

BkASP7-15 ... ... 13.81 11.60 13.72 +2.29 +20.0

BkA DJ1-15 ... ... 15.98 12.08 15.78 +3.84 +32.2

BofA DJ14 ... ... 15.29 11.88 15.26 +3.63 +31.2

BkADJ4-15 ... ... 14.20 11.17 14.20 +3.10 +27.9

BkA DJ5-15 ... ... 14.34 11.94 14.34 +2.57 +21.8

BkHawaii 1.80 17 59.92 44.88 59.14 +15.09 +34.3

BkIreland

... ... 15.88 6.60 14.41 +7.91 +121.7

BkMont g 2.96 ... 71.26 55.61 66.66 +5.36 +8.7

BkNYMel .60 21 34.99 25.62 34.94 +9.24 +36.0

BkNYM pfC1.30 ... 26.32 19.75 20.75 -4.38 -17.4

BkNova g 2.48 12 63.50 52.05 62.55 +4.67 +8.1

Bankrate

... cc 23.14 9.90 17.94 +5.49 +44.1

BankUtd

.84 16 33.34 24.17 32.92 +8.48 +34.7

Banro g

... dd 3.15 .41

.56 -2.24 -80.1

BarHarb 1.28f 12 41.47 33.89 39.99 +6.34 +18.8

BarFIEur

... q 123.04 79.76 122.61 +25.00 +25.6

BarcFI HY ... q 114.32 83.04 114.06 +15.04 +15.2

BarSelMLP .79e q 27.63 24.16 27.41 +2.51 +10.1

BarcUBS36 ... q 42.63 35.58 36.75 -4.60 -11.1

BarcGSOil ... q 26.17 20.06 23.12 +1.33 +6.1

BarcGsci36 ... q 37.98 30.14 32.57 -.71 -2.1

BiPCop

... q 47.80 36.87 41.45 -4.54 -9.9

BiPNick

... q 26.44 17.08 19.06 -5.04 -20.9

BiPSPBWrt ... q 59.64 52.90 58.67 +6.75 +13.0

BiP GCrb

... q 8.23 3.36 6.05 -1.77 -22.6

BiPGbpUsd ... q 50.25 39.56 44.16 +1.13 +2.6

BiPEurUsd ... q 52.57 48.63 52.31 +.34

+.7

BiP Tin

... q 58.28 41.89 53.21 -.65 -1.2

BiPAg

... q 57.43 46.41 46.53 -8.61 -15.6

BiP Sug

... q 71.29 53.42 55.49 -14.86 -21.1

BiP Softs

... q 53.75 42.49 43.41 -9.59 -18.1

BiP PrM

... q 91.41 59.39 60.61 -28.62 -32.1

BiP Plat

... q 39.33 28.54 29.96 -4.84 -13.9

BiP Lead

... q 60.00 45.50 49.45 -6.87 -12.2

BiP Cottn

... q 60.53 47.97 53.18 +4.04 +8.2

BrcIndiaTR ... q 62.50 41.78 56.96 -2.37 -4.0

BiP Coff

... q 35.58 20.37 21.70 -10.67 -33.0

BiPGrain

... q 55.52 43.00 43.13 -9.80 -18.5

BiP Cocoa ... q 37.61 27.47 35.80 +5.50 +18.2

BiP Alum

... q 25.34 18.03 18.64 -5.54 -22.9

BarcBk prD 2.03 ... 26.10 24.36 25.37 -.06

-.2

BarcBk pr 1.66 ... 26.19 23.70 24.14 -.86 -3.4

BiPIMet

... q 36.22 27.10 29.66 -5.21 -14.9

BiPOpCur

... q 48.36 39.09 41.79 -5.09 -10.9

BiPAsnGulf .45e q 51.15 49.82 50.35 -.26

-.5

BiPGems382.09e q 43.35 38.60 38.65 -3.85 -9.1

BarcB prC 1.94 ... 26.02 24.86 25.33 +.15

+.6

BiPNG

... q 3.34 2.06 2.52 -.17 -6.3

BiPLive

... q 28.87 25.41 27.14 -1.39 -4.9

BiPEngy

... q 18.57 16.09 18.06 +.94 +5.5

BarcBk prA 1.78 ... 25.90 24.25 25.17 +.11

+.4

BiP JpyUsd ... q 67.00 54.58 54.58 -17.36 -24.1

BiPAsia8 1.13e q 49.53 43.21 44.65 -3.55 -7.4

BiPTrLBear ... q 37.62 25.81 36.80 +8.26 +28.9

BiP10yTBear ... q 41.07 23.55 32.87 +6.12 +22.9

BiP2yrTBull ... q 59.18 56.70 58.63 +1.05 +1.8

BiPTrSteep ... q 42.64 32.88 42.05 +6.93 +19.7

BiPUrFlat

... q 64.66 55.03 55.43 -7.05 -11.3

BiP10yTBull ... q 74.03 62.19 64.68 -7.02 -9.8

BiP2yrTBear ... q 42.05 38.19 39.42 -1.09 -2.7

BiPTrLBull ... q 71.87 60.12 60.61 -9.72 -13.8

B iPInvVIX ... q 38.51 38.02 38.49 +.67 +1.8

BarcCAPE ... q 69.33 51.95 67.16 +16.80 +33.4

BiPSPMLP1.34e q 29.77 25.28 29.41 +4.12 +16.3

BarcShtB

... q 58.37 16.10 16.10 -46.34 -74.2

BarcLgC

... q 258.47177.62 258.47 +90.54 +53.9

BarcLgB

... q 168.90105.16 168.89 +68.00 +67.4

Barclay

.42e ... 20.60 15.83 18.13 +.81 +4.7

BiP SPVix

... q 44.73 33.72 33.73 -12.31 -26.7

BarcSPVeq ... q 146.12129.43 146.12 +16.85 +13.0

BarVixMdT ... q 26.99 15.66 15.72 -12.23 -43.8

B iPVix rs

... q 118.16 41.16 42.55 -84.69 -66.6

Bard

.84 78 141.02 97.14 133.94 +36.20 +37.0

BarnesNob ... dd 23.71 12.59 14.95 -.14

-.9

Barnes

.44 8 38.56 21.84 38.31 +15.85 +70.6

Barnwell

... dd 3.89 2.99 3.01 -.31 -9.3

Barracuda n ... ... 39.75 18.63 39.68 +18.13 +84.1

BarrickG

.20 dd 36.08 13.43 17.63 -17.38 -49.6

BasicEnSv ... dd 17.40 11.06 15.78 +4.37 +38.3

Baxter

1.96 18 74.60 62.80 69.55 +2.89 +4.3

BaytexE g 2.64 29 47.47 34.71 39.16 -4.08 -9.4

Beam Inc .90 27 70.63 59.42 68.06 +6.97 +11.4

BS IBM96 1.78 ... 33.40 24.79 30.00 +3.46 +13.0

BeazerH13 1.88 ... 21.30 18.75 20.08 +1.76 +9.6

BeazHTEq 1.88 ... 37.46 24.29 37.40 +8.90 +31.2

BeazerHm ... dd 24.62 13.91 24.42 +7.53 +44.6

BectDck 2.18f 17 110.94 78.73 110.49 +32.30 +41.3

Belden

.20 26 72.07 45.00 70.45 +25.46 +56.6

Bellatrix g

... 15 8.43 4.10 7.33 +3.05 +71.3

Bemis

1.04 21 42.34 33.65 40.96 +7.50 +22.4

BenchElec ... 23 23.63 16.08 23.08 +6.46 +38.9

Berkley

.40 12 45.59 38.03 43.39 +5.65 +15.0

Berkley pfB 1.41 ... 25.60 19.55 20.61 -4.79 -18.9

BerkHa A

... 17178900136850177900+43840 +32.7

BerkH B

... 16 119.30 91.29 118.56 +28.86 +32.2

BerkHBcp .72 15 30.70 23.38 27.27 +3.41 +14.3

BerkIR pf 2.25 ... 32.01 25.53 26.50 +.15

+.6

BerryPlas

... 32 26.50 15.94 23.79 +7.71 +47.9

Yearly

Yr.Net Yr%

Stock

Div. PE High Low Last

Chg. Chg

BigLots

... 11 39.22 27.42 32.29 +3.83 +13.5

BiglariHld

... 5 523.00365.00 506.64+116.62 +29.9

BBarrett

... dd 30.69 15.50 26.78 +8.99 +50.5

BioAmbr n ... ... 8.31 3.96 7.48 -.66 -8.1

BioAmb wt ... ... 1.14 .15

.73 +.33 +82.5

BioRadA

... 38 127.17106.10 123.61 +18.56 +17.7

BioRadB

... 25 125.50106.75 123.71 +19.63 +18.9

BioMedR 1.00f cc 23.13 17.90 18.12 -1.21 -6.3

BioTime

... dd 5.02 3.15 3.60 +.46 +14.6

BirksGrp

... 14 2.50 .68 1.52 +.76 +100.0

BitautoH

... ... 35.04 7.06 31.96 +24.66 +337.8

BlkHillsCp 1.52 21 55.09 36.89 52.51 +16.17 +44.5

BlackRock 6.72 20 323.00208.77 316.47+109.76 +53.1

BlkBldAm 1.58 q 23.44 18.15 19.15 -3.72 -16.3

BlkCA18

.62 q 16.58 14.95 15.77 -.44 -2.7

BlkCAIT

.93 q 17.52 13.02 13.68 -2.66 -16.3

BlkCorBd .91a q 15.90 12.27 12.88 -2.02 -13.6

BlkCpHY VI.97a q 13.30 11.15 12.17 -.22 -1.8

BlkCrdAllo .94 q 14.42 12.12 13.06 -.67 -4.9

BlkDebtStr .30a q 4.65 3.85 3.99 -.31 -7.2

BlkDefOpp .79a q 15.50 13.24 13.61 -.57 -4.0

BlkDivInc .92 q 13.30 11.85 12.96 +.72 +5.9

BlkEcoSol .72 q 9.49 7.49 7.86 -.53 -6.3

BlkEngyRs1.62a q 24.61 21.23 24.30 +3.37 +16.1

BlkEnhC&I 1.20 q 13.87 12.08 13.67 +1.25 +10.1

BlkEEqDv .56 q 8.02 7.15 7.94 +.76 +10.6

BlEnhGvIn .66 q 15.97 13.55 13.95 -1.68 -10.7

BlkFltRtInc .91 q 16.81 14.30 14.61 -.54 -3.6

BlkFloatR .87a q 16.37 13.56 13.96 -1.09 -7.2

BlkFL2020 .60 q 16.15 14.87 15.11 -.53 -3.4

BlkGlbOp 1.25 q 15.01 12.92 14.96 +1.76 +13.3

BlkHlthSci 1.72a q 35.86 28.12 35.44 +7.42 +26.5

BlkIncoOp .71 q 11.83 9.48 9.70 -1.64 -14.5

BlkIT

.44 q 7.45 6.31 6.48 -.87 -11.8

BlkIntlG&I .67 q 8.14 6.99 8.13 +.78 +10.6

BlkIQM

.96a q 17.23 12.72 14.24 -2.10 -12.9

BlkLtdD 1.25a q 19.22 16.11 17.12 -1.05 -5.8

BlkLTMu .74a q 13.50 9.86 10.20 -2.39 -19.0

BlkMDMB .75 q 18.24 11.86 12.63 -3.54 -21.9

BlkMATxE .75 q 16.05 11.16 11.80 -3.05 -20.5

BlkMultSec 1.40 q 20.50 15.51 17.11 -2.89 -14.4

BlkMuIntD .86a q 17.85 13.04 13.90 -2.73 -16.4

BlkMuNYInt .73 q 16.32 12.48 13.14 -2.30 -14.9

BlkMunihCA .86 q 17.12 12.63 13.22 -3.12 -19.1

BlkMunHIQ .86 q 16.95 11.82 12.52 -3.58 -22.2

BlMunhNYQ.85a q 16.64 12.00 12.49 -3.66 -22.7

BlMunhNJQ .89 q 17.34 12.52 13.12 -3.55 -21.3

BlkMunihQ .81a q 16.06 11.33 11.86 -3.24 -21.5

BlkMunHQ2.85a q 16.09 11.67 12.09 -2.99 -19.8

BlMunyCAQ .91 q 17.18 13.00 13.64 -2.79 -17.0

BlkMunyInv .95 q 17.89 12.51 13.72 -3.15 -18.7

BlkMunyIQ .85 q 16.64 11.79 12.23 -3.47 -22.1

BlkMYMIQ .89a q 16.88 11.94 12.46 -3.19 -20.4

BlkMunyNJQ.89a q 17.20 12.48 12.97 -3.26 -20.1

BlMunyNYQ .82 q 15.55 11.64 12.08 -3.02 -20.0

BlkMunyPaQ.89 q 17.09 12.28 12.81 -3.54 -21.7

BlMunyQlty .96a q 18.25 13.05 14.06 -3.58 -20.3

BlkMuniyQ3.86a q 16.24 12.03 12.66 -2.64 -17.3

BlkMuniast .75a q 14.60 11.13 11.55 -2.37 -17.0

Blk2018 .73a q 17.39 15.57 15.94 -.62 -3.8

BlkMu2020 .75 q 17.30 15.46 15.75 -.95 -5.7

BlkMuBdT .94a q 18.14 13.11 13.71 -3.29 -19.4

BlkMuBdIT .91 q 17.99 12.60 13.38 -3.80 -22.1

BlkMuIIQ .82 q 17.25 12.29 12.87 -3.53 -21.5

BlkMunIIT .87 q 16.70 11.89 12.48 -3.39 -21.4

BlkMuIQT .92 q 17.79 12.17 12.68 -3.52 -21.7

BlkMuIT .90a q 16.53 11.95 12.70 -2.82 -18.2

BlkMuIT2 .98a q 17.29 12.59 13.22 -2.99 -18.4

BlkMuTTT 1.13 q 24.81 16.47 17.12 -6.24 -26.7

BlkMunienh .73 q 13.25 9.96 10.40 -1.89 -15.4

BlkMunihld1.06a q 19.76 14.16 14.50 -3.86 -21.0

BlkMunihd21.00a q 18.50 13.06 13.35 -3.29 -19.8

BlkMunvst .68a q 11.78 8.61 8.91 -2.12 -19.2

BlkMuniv2 1.06a q 18.39 13.50 13.92 -3.59 -20.5

BlkMunyAZ .83 q 16.79 12.64 12.91 -2.43 -15.8

BlMunyldCA .95 q 17.78 13.16 13.78 -3.15 -18.6

BlkMuniyld .97a q 17.44 12.29 12.82 -3.55 -21.7

BlkMunyNJ .89a q 17.61 12.67 13.66 -2.94 -17.7

BlMunQlt2 .85 q 15.26 11.25 11.68 -2.76 -19.1

BlkNJMB .89 q 18.13 12.84 13.31 -3.70 -21.7

BlkNJIT

.90 q 18.37 12.74 13.10 -3.95 -23.2

BlkNY18 .54a q 16.94 14.90 15.23 -.82 -5.1

BlkNYMB .80a q 17.27 12.09 12.53 -4.04 -24.4

BlkNYIQT .75 q 17.13 11.58 12.07 -4.04 -25.1

BlkNYIT

.83 q 17.28 12.17 12.45 -4.06 -24.6

BlkNYMu2 .84 q 17.05 12.16 12.65 -3.35 -20.9

BlkPaStr .78a q 16.48 11.11 11.55 -3.66 -24.0

BlkRlAsst .70m q 10.85 8.28 8.71 -1.55 -15.1

BlkRsCmdy.92m q 14.23 10.65 11.59 -1.21 -9.5

BlkStMT .89a q 16.16 11.66 12.13 -2.71 -18.3

BlkU&Inf 1.45 q 20.00 16.74 17.87 -.02

-.1

BlkVAMB .86a q 22.00 14.15 14.40 -4.91 -25.4

BlkstFltRt 1.32 q 22.21 18.14 18.85 -1.48 -7.3

BlkstGSOSt1.40 q 20.08 17.42 17.80 -.75 -4.0

Blackstone1.18e 28 31.94 15.93 31.50 +15.91 +102.1

BlkstnMtg 1.80 1 29.50 18.10 27.13 +6.13 +29.2

BlkLSCrInc 1.30 q 20.03 17.32 17.87 -.88 -4.7

BlockHR

.80 19 32.09 18.86 29.04 +10.47 +56.4

BlonderT

... dd 1.69 .81 1.00 -.15 -13.0

Blount

... 20 17.49 10.52 14.47 -1.35 -8.5

BlueCap n ... ... 19.49 17.61 18.37 -.53 -2.8

BlueLinx

... dd 3.48 1.56 1.95 -.86 -30.6

Blyth

.20 dd 19.98 8.65 10.88 -4.67 -30.0

BdwlkPpl 2.13 20 33.00 24.07 25.52 +.62 +2.5

Boeing 2.92f 24 142.00 72.68 136.49 +61.13 +81.1

BoiseCas n ... 10 34.54 22.55 29.48 +3.33 +12.7

Boise Inc

... 84 12.76 7.45 12.54 +4.59 +57.7

BonanzaCE ... 31 57.47 28.23 43.47 +15.68 +56.4

BoozAllnH .40 13 22.27 12.51 19.15 +5.23 +37.6

BorgWrn s .50 21 56.45 35.22 55.91 +20.10 +56.1

BostBeer

... 47 265.53134.42 241.79+107.34 +79.8

BostProp 2.60a 21 115.85 98.04 100.37 -5.44 -5.1

BosProp pfB1.31 ... 25.60 18.83 19.02 -5.95 -23.8

BostonSci ... 23 12.48 5.76 12.02 +6.29 +109.8

BldrG&IFd .45e q 8.27 6.42 8.04 +1.71 +27.0

BoulderTR .08e q 23.09 18.29 23.01 +4.97 +27.5

BovieMed

... dd 4.79 1.94 2.15 -.27 -11.2

BowlA

.66 16 15.34 12.00 14.32 +1.82 +14.6

BoxShips .24m 7 6.25 2.80 3.29 -.81 -19.8

BoxSh pfC 2.25 ... 26.50 22.27 23.25 -.75 -3.1

BoydGm

... dd 14.75 6.27 11.26 +4.62 +69.6

BradyCp

.78 dd 36.45 28.38 30.93 -2.47 -7.4

Brandyw

.60 dd 16.06 12.10 14.09 +2.05 +17.0

Brandy pfE 1.73 ... 28.54 22.59 23.00 -2.48 -9.7

BrasilAgro .09e ... 5.47 3.84 3.96 -.94 -19.2

Yearly

Stock

Div. PE High Low Last

BreezeE

... 22 9.94 7.30 9.21

BridgptEd

... 16 20.33 9.51 17.71

BrigStrat

.48 dd 25.52 18.21 21.76

BrightH n

... dd 38.39 27.50 36.74

BrigusG g

... 16

.00 .41

.78

Brinker

.96 20 47.86 30.85 46.34

Brinks

.40 cc 34.76 24.07 34.14

BrMySq 1.44f 32 54.49 32.50 53.15

BristowGp 1.00 13 85.70 53.57 75.06

BritATob 4.18e ... 115.21 99.58 107.42

Brixmor n .80 ... 20.99 19.38 20.33

BroadrdgF .84 20 40.36 21.84 39.52

Brookdale

... dd 30.65 24.42 27.18

BrkfldAs g .80f 14 40.82 33.59 38.83

BrkfCda g 1.17 ... 31.88 22.66 25.00

BrkfDtla pf 1.91 ... 27.24 25.37 26.47

BrkGblInf 1.40a q 24.87 18.88 19.77

BrkfInfra 1.72 ... 41.50 34.01 39.22

BrkfMtgOp 1.53 q 20.56 15.75 16.57

BrkfldOfPr .56 9 19.58 15.60 19.25

BrkfldPr n 1.00 ... 25.00 18.80 19.94

BrkfREn n 1.45 ... 30.00 24.69 26.16

BrkfldRP

... 23 26.10 18.03 24.19

BrkfdTotR 2.28 q 27.98 22.03 23.76

BrwnBrn .40f 22 35.13 25.31 31.39

BrownShoe .28 35 28.70 15.24 28.14

BrownFA 1.16f 27 75.77 61.76 73.77

BrownFB 1.16f 26 76.73 60.90 75.57

Brunswick .10f 40 47.08 29.92 46.06

Buckeye 4.30f 27 73.44 45.72 71.01

Buckle

.88f 15 57.68 42.94 52.56

Buenavent .31e 9 36.58 10.54 11.22

BldBear

... dd 10.35 3.87 7.55

BungeLt 1.20 17 84.18 65.74 82.11

BurgerKng .28f 31 23.02 16.08 22.86

BurlStrs n

... ... 32.44 21.54 32.00

C&J Engy

... 14 25.35 17.45 23.10

CTrkMH23 .30p q 26.21 24.77 26.20

C-TrCVol rs ... q 26.35 3.00 3.40

CAE Inc g .24f ... 13.29 9.60 12.74

CAI Intl

... 8 30.28 20.00 23.57

CBIZ Inc

... 13 9.40 5.60 9.12

CBL Asc .98f 29 26.95 17.41 17.96

CBL pfD 1.84 ... 25.83 23.18 23.75

CBL pfE 1.66 ... 26.67 20.72 21.26

CBRE GRE.54a q 10.37 7.64 7.92

CBRE Grp ... 21 26.58 19.78 26.30

CBS A

.48 24 64.00 37.48 63.64

CBS B

.48 22 64.06 37.43 63.74

CCA Inds

... dd 4.80 2.79 2.95

CDI

.52 24 19.19 13.35 18.53

CEC Ent 1.08f 16 48.30 28.95 44.28

CF Inds 4.00f 9 239.40169.33 233.04

CGG

... 19 31.12 15.77 17.35

CGI g

... ... 39.47 22.97 33.46

CIT Grp

.40 14 52.28 38.61 52.13

CKX Lands .28 18 16.13 11.58 14.97

CLECO 1.45 18 50.42 40.39 46.62

CMS Eng 1.02 19 29.98 24.60 26.77

CNA Fn

.80 17 42.93 28.49 42.89

CNH Indl

... 9 13.41 10.09 11.35

CNO Fincl .12 16 17.91 9.34 17.69

CNOOC 7.35e ... 226.77155.27 187.66

CPFL Eng .80e ... 23.00 15.47 16.01

CPI Aero

... 14 15.36 8.25 15.04

CRH

.82e ... 26.75 19.46 25.55

CSS Inds .60 15 31.94 21.57 28.68

CST Brds n .25 ... 36.92 27.01 36.72

CSX

.60 15 28.80 20.01 28.77

CT Ptrs

... dd 6.88 2.55 5.60

CTS

.16f 24 20.10 9.33 19.91

CVR Engy3.00a 10 72.32 33.03 43.43

CVR Ptrs 1.74e 11 30.00 15.11 16.46

CVR Rfg n1.20m ... 35.98 20.80 22.62

CVS Care 1.10f 20 71.99 49.00 71.57

CYS Invest1.28m dd 13.08 6.74 7.41

CYSInv pfA 1.94 ... 25.89 20.33 20.79

CYSInv pfB 1.88 ... 25.24 19.47 19.70

CabGS flt34 .83 ... 22.38 16.21 17.53

CabcoJCP971.91 ... 23.73 14.17 17.08

CabAT&T34 .82 ... 25.00 18.22 21.13

Cabelas

... 22 72.54 42.32 66.66

CblvsnNY .60 15 20.16 13.62 17.93

Cabot

.80 22 51.72 32.13 51.40

CabotOG s .08 59 40.34 23.40 38.76

CACI

... 12 74.27 49.98 73.22

CalDive

... dd 2.38 1.51 2.01

Calgon

... 26 21.00 14.20 20.57

CalifWtr

.64 24 23.43 18.42 23.07

Calix

... dd 13.98 7.26 9.64

CallGolf

.04 dd 8.97 6.15 8.43

CallonPet

... dd 7.60 3.19 6.53

Callon pfA 5.00 ... 49.07 40.01 46.95

Calpine

... 41 22.16 17.95 19.51

CAMAC En ... dd 1.64 .45 1.48

Cambrex

... 9 19.74 10.92 17.83

CambriaYld .36e q 29.50 24.05 29.37

CambFgnY .02p q 26.13 24.60 26.06

CamdenPT 2.52 29 76.06 56.09 56.88

Cameco g .40 ... 22.87 17.27 20.77

CameltInfo ... dd 2.00 .95 2.00

Cameron

... 20 67.42 52.50 59.53

CampSp 1.25 36 48.83 34.84 43.28

CampusCC .66 63 14.36 8.90 9.41

CampC pfA 2.00 ... 29.25 24.36 24.70

Can-Fite

... ... 9.46 3.30 5.54

CIBC g

3.84 10 87.51 69.92 85.41

CdnNR gs .86 ... 58.40 45.67 57.02

CdnNRs gs .80f ... 33.92 26.98 33.84

CP Rwy g 1.40 ... 156.96103.82 151.32

Canon

... ... 40.43 29.82 32.00

CantelMd s .09f 35 38.04 19.11 33.91

CapOne 1.20 11 76.71 50.21 76.61

CapOne wt ... ... 35.71 15.94 35.44

CapOne pfP1.50 ... 26.77 20.93 21.74

CapSenL

... dd 27.90 18.81 23.99

CapitlSrce .04 23 14.64 7.61 14.37

CapsteadM1.24e 14 13.28 11.08 12.08

Capstd pfE 1.88 ... 25.28 22.29 22.84

CarboCer 1.20 32 132.55 62.11 116.53

CardnlHlth 1.21 53 67.75 41.06 66.81

Cardium rs ... dd 4.20 .58

.83

CareFusion ... 23 40.29 28.74 39.82

Carlisle

.88 30 80.21 59.19 79.40

CarMax

... 21 53.08 36.95 47.02

Carnival 1.00a 29 40.47 31.44 40.17

CarnUK 1.00a ... 41.59 32.33 41.45

CarpTech .72 23 62.95 43.30 62.20

CarrSrv

.10 19 22.32 11.90 19.53

Carters

.64 26 77.79 55.20 71.79

CashAm

.14 8 54.12 35.30 38.30

CashStr g

... dd 4.37 1.02 1.60

CastleAM

... dd 18.74 13.20 14.77

CastleBr

... dd 1.10 .25

.76

CatchMrk n .11p ... 14.00 13.35 13.95

Caterpillar 2.40 18 99.70 79.49 90.81

CatoCp 1.00a 16 34.75 22.16 31.80

CedarF 2.80f 23 50.16 33.95 49.58

CedarRlty .20 31 6.83 4.75 6.26

CedarR pfB 1.81 ... 26.87 21.79 23.00

CelSci rs

... dd 3.09 .53

.59

Celadon

.08 18 21.99 16.29 19.48

Celanese .72 14 58.56 41.55 55.31

Celestic g

... 22 11.50 7.60 10.40

Cellcom .24e 16 14.07 7.05 13.92

Cementos .50e ... 15.61 9.94 11.84

Cemex

.45t ... 12.57 9.13 11.83

Cemig pf 2.92e ... 13.24 7.53 7.79

Cemig 2.92e ... 13.00 7.73 8.20

Cencosud .37e ... 19.76 10.33 10.89

CenovusE .97 27 34.50 27.25 28.65

Centene

... 27 67.84 40.57 58.95

Yr.Net Yr%

Chg. Chg

+.96 +11.6

+7.41 +71.9

+.68 +3.2

+8.42 +29.7

-.16 -17.0

+15.35 +49.5

+5.61 +19.7

+20.91 +64.9

+21.40 +39.9

+6.17 +6.1

-.07

-.3

+16.64 +72.7

+1.86 +7.3

+3.35 +9.4

-4.56 -15.4

+.47 +1.8

-.38 -1.9

+3.97 +11.3

-3.44 -17.2

+2.24 +13.2

-2.09 -9.5

-2.84 -9.8

+6.25 +34.8

+.14

+.6

+5.93 +23.3

+9.77 +53.2

+12.27 +20.0

+12.32 +19.5

+16.97 +58.3

+25.60 +56.4

+7.92 +17.7

-24.73 -68.8

+3.73 +97.6

+9.42 +13.0

+6.42 +39.1

+6.99 +27.9

+1.66 +7.7

+.95 +3.8

-26.30 -88.6

+2.59 +25.5

+1.62 +7.4

+3.21 +54.3

-3.25 -15.3

-1.30 -5.2

-3.70 -14.8

-.94 -10.6

+6.40 +32.2

+25.66 +67.6

+25.69 +67.5

-1.51 -33.9

+1.40 +8.2

+11.09 +33.4

+29.88 +14.7

-13.17 -43.2

+10.33 +44.7

+13.49 +34.9

+1.22 +8.9

+6.61 +16.5

+2.39 +9.8

+14.88 +53.1

+.83 +7.8

+8.36 +89.6

-32.34 -14.7

-4.95 -23.6

+5.03 +50.2

+5.21 +25.6

+6.79 +31.0

+8.23 +28.9

+9.04 +45.8

+1.04 +22.8

+9.28 +87.3

-5.36 -11.0

-8.78 -34.8

-2.43 -9.7

+23.22 +48.0

-4.40 -37.3

-4.16 -16.7

-5.20 -20.9

-.58 -3.2

-3.15 -15.6

-.75 -3.4

+24.91 +59.7

+2.99 +20.0

+11.61 +29.2

+13.89 +55.9

+18.19 +33.1

+.28 +16.2

+6.39 +45.1

+4.72 +25.7

+1.95 +25.4

+1.93 +29.7

+1.83 +38.9

+.45 +1.0

+1.38 +7.6

+.89 +150.8

+6.45 +56.7

+4.13 +16.4

+1.09 +4.3

-11.33 -16.6

+1.05 +5.3

+1.00 +100.0

+3.07 +5.4

+8.39 +24.0

-2.85 -23.2

-1.22 -4.7

+.80 +16.9

+4.80 +6.0

+11.52 +25.3

+4.97 +17.2

+49.70 +48.9

-7.21 -18.4

+14.09 +71.1

+18.68 +32.2

+14.28 +67.5

-3.12 -12.6

+5.30 +28.4

+6.79 +89.6

+.61 +5.3

-2.23 -8.9

+38.19 +48.7

+25.63 +62.2

-2.97 -78.2

+11.24 +39.3

+20.64 +35.1

+9.48 +25.3

+3.40 +9.2

+2.70 +7.0

+10.57 +20.5

+7.66 +64.5

+16.14 +29.0

-1.37 -3.5

-2.09 -56.6

...

...

+.48 +171.4

+.45 +3.3

+1.20 +1.3

+4.37 +15.9

+16.13 +48.2

+.98 +18.6

-1.45 -5.9

-2.11 -78.1

+1.43 +7.9

+10.78 +24.2

+2.25 +27.6

+5.64 +68.1

-1.52 -11.4

+2.34 +24.7

-3.07 -28.3

-2.98 -26.7

-5.44 -33.3

-4.89 -14.6

+17.95 +43.8

New York Stock ExchangE / continued

Yearly

Yr.Net Yr%

Stock

Div. PE High Low Last

Chg. Chg

CenterPnt .83 30 25.65 19.33 23.18 +3.93 +20.4

CnElBras pf.81e ... 6.70 3.56 4.40 -.61 -12.2

CenElBras .20e ... 3.99 1.88 2.59 -.53 -17.0

CnEurRusT1.09e q 36.10 27.66 30.55 -3.37 -9.9

CFCda g .01 q 22.29 12.19 13.25 -7.78 -37.0

CentGold g ... ... 64.77 40.92 41.51 -21.27 -33.9

CenPacFn .32 16 20.30 14.67 20.08 +4.49 +28.8

CentSecur3.90e q 22.05 16.93 21.72 +4.58 +26.7

CntryLink 2.16 dd 42.01 29.93 31.85 -7.27 -18.6

Cenveo

... dd 3.57 1.85 3.44 +.74 +27.4

Cervecer .73e ... 34.95 22.89 24.11 -7.52 -23.8

ChambSt n .50 ... 10.10 7.16 7.65 -2.35 -23.5

ChanAdv n ... ... 44.08 14.25 41.71 +23.27 +126.2

ChRvLab

... 24 53.81 37.38 53.04 +15.57 +41.6

ChaseCorp .45f 19 35.49 16.98 35.30 +16.70 +89.8

ChathLTr .84 dd 21.48 14.60 20.45 +5.07 +33.0

Checkpnt

... dd 18.25 10.50 15.77 +5.03 +46.8

Chegg n

... ... 11.25 7.31 8.51 -1.17 -12.1

Chemed

.80 18 82.00 61.68 76.62 +8.03 +11.7

Chemtura

... dd 28.17 19.05 27.92 +6.66 +31.3

CheniereEn ... dd 46.39 18.97 43.12 +24.34 +129.6

CheniereE 1.70 dd 33.00 21.53 28.65 +7.39 +34.8

ChenierE n ... ... 19.69 18.23 18.75 -.47 -2.4

CherHM n .45p ... 19.20 17.13 17.80 -.70 -3.8

ChesEng .35 21 29.06 16.32 27.14 +10.52 +63.3

ChesEn pfD4.50 ... 93.76 80.54 91.99 +11.13 +13.8

ChesGranW2.72e 4 19.15 9.90 10.60 -5.94 -35.9

ChespkLdg 1.04 35 25.69 19.85 25.29 +4.41 +21.1

ChspkL pfA 1.94 ... 28.23 24.02 24.59 -1.86 -7.0

ChesUtl 1.54 18 61.17 45.84 60.02 +14.62 +32.2

Chevron 4.00 10 127.83108.74 124.91 +16.77 +15.5

ChicB&I

.20 30 83.17 46.34 83.14 +36.79 +79.4

ChiRivet .72f 14 47.70 18.83 33.15 +13.70 +70.4

Chicos

.30f 19 19.95 15.27 18.84 +.38 +2.1

Chimera .36a ... 3.34 2.59 3.10 +.49 +18.8

ChiCBlood ... 16 4.60 2.54 4.01 +1.40 +53.6

ChinaDigtl

... 6 2.58 1.35 1.74 +.06 +3.6

ChinaDEd .60e 50 21.15 3.82 18.69 +14.74 +373.2

ChinaEAir

... ... 23.83 14.63 19.24 -.86 -4.3

ChinaFd 3.31e q 21.15 15.99 20.81 +2.40 +13.1

ChiGengM ... dd

.39 .07

.21 -.09 -31.3

ChinaGreen ... 2 5.10 2.57 3.62 +.34 +10.4

ChinHydro ... dd 3.25 1.43 2.68 +.96 +55.8

ChiHyd wt

... ...

.05 .00

.01

...

...

ChinaLife .34e ... 52.72 33.88 47.25 -2.44 -4.9

ChiMarFd

... dd 1.07 .18

.22 -.58 -72.5

ChiMetRur ... ... 2.88 .80

.90 +.13 +17.0

ChiMYWnd ... dd 3.52 1.13 2.45 +1.25 +104.2

ChinaMble2.24e ... 59.73 47.74 52.29 -6.43 -11.0

ChinaNepst .64e 14 2.50 1.46 1.84 +.32 +21.1

ChiNBorun ... 4 4.40 1.05 2.50 +.96 +62.3

ChinaPet s3.86e ... 94.47 64.76 82.17 -6.23 -7.0

ChinaPhH

... dd

.47 .19

.35 +.14 +70.8

ChinaSoAir .41e ... 30.04 17.09 19.74 -6.11 -23.6

ChinaTel 1.10e ... 58.06 44.94 50.57 -6.28 -11.0

ChinaUni .19e ... 17.44 12.18 15.06 -1.23 -7.6

ChiXFash

... 5 2.19 .92 1.31 +.15 +12.9

ChinaYuch .90e 7 26.39 13.43 20.87 +5.10 +32.3

ChinZenix

... 4 4.27 2.11 2.60 -.39 -13.0

Chipotle

... 54 550.28266.02 532.78+235.32 +79.1

Chiquita

... dd 13.68 5.90 11.70 +3.45 +41.8

ChoiceHtls .74 26 49.79 34.00 49.11 +15.49 +46.1

ChrisBnk

... 66 9.33 5.19 8.54 +3.09 +56.7

Chubb

1.76 13 97.79 75.99 96.63 +21.31 +28.3

ChungTel 1.78e ... 33.74 30.12 30.96 -1.38 -4.3

ChurchDwt 1.12 25 66.96 53.80 66.28 +12.71 +23.7

CIBER

... dd 4.99 3.00 4.14 +.80 +24.0

CienaCorp ... dd 27.94 14.14 23.93 +8.23 +52.4

Cigna

.04 15 88.57 53.91 87.48 +34.02 +63.6

Cimarex

.56 23 113.03 56.96 104.91 +47.18 +81.7

CinciBell

... dd 5.64 2.62 3.56 -1.92 -35.0

CincB pfB 3.38 ... 48.95 42.15 45.21 +1.90 +4.4

Cinemark 1.00 24 34.35 25.00 33.33 +7.35 +28.3

Circor

.15 28 83.37 39.01 80.78 +41.19 +104.0

Citigp pfN 1.97 ... 28.98 26.58 27.25 -.65 -2.3

Citigp pfE 1.59 ... 25.58 23.94 25.05 +.02

+.1

CitiSPMid14 .30 ... 11.48 10.07 10.36 -.41 -3.8

CitiR2K3-141.05e ... 12.08 10.27 11.50 +.50 +4.5

CitiS&P14 1.65e ... 10.53 8.67 10.29 +1.57 +17.9

CitiR2K9-14 .30 ... 11.23 10.12 10.18 -.27 -2.6

CitiGold14 .20 ... 10.24 9.95 10.03 -.07

-.7

CitiSP8-14 .30e ... 11.89 10.15 10.51 +.11 +1.1

CitiGold8-14 .30 ... 10.85 10.08 10.09 -.42 -4.0

CitiDJCmd14.30 ... 11.85 10.05 10.22 -.25 -2.4

CitiR2K6-14 .30 ... 12.65 10.20 10.75 -.30 -2.7

CitiS&P5-14.30a ... 12.16 9.27 11.15 +1.92 +20.8

CitiDJaig14 .30 ... 10.68 10.04 10.15 -.16 -1.5

Citigroup

.04 13 53.68 40.28 52.11 +12.55 +31.7

Citigp wtA

... ...

.87 .41

.65 +.23 +54.0

Citigp wtB

... ...

.20 .05

.06 +.01 +14.8

Citigrp pfC 1.45 ... 25.68 20.50 21.24 -3.66 -14.7

Citigp pfJ 1.78 ... 26.35 25.03 25.94 +.69 +2.7

Citigp pfK 1.72 ... 25.39 24.85 25.34 +.34 +1.4

Citigrp pfP 2.03 ... 31.29 27.97 28.50 -.10

-.4

Citigrp pfQ 1.50 ... 25.58 24.24 24.88 +.03

+.1

Citigrp pfS 1.50 ... 25.75 24.34 25.10 +.13

+.5

CitizFT pfA1.88a ... 31.91 24.55 25.24 -5.38 -17.6

CitizInc

... 88 11.71 5.92 8.75 -2.30 -20.8

CityNC

1.00 20 79.72 49.68 79.22 +29.70 +60.0

CityNC pfC 1.38 ... 25.69 19.20 19.61 -4.69 -19.3

CityNC pfD 1.69 ... 26.30 25.06 26.28 +1.20 +4.8

Clarcor

.68 27 64.51 46.91 64.35 +16.71 +35.1

ClaudeR g ... ...

.64 .17

.18 -.38 -67.6

ClayGSCn1.17e q 18.56 16.33 18.06 +1.20 +7.1

ClayEng

... dd 85.05 35.30 81.95 +41.95 +104.9

CleanHarb ... 32 64.12 48.22 59.96 +4.95 +9.0

ClearChan .56e dd 10.69 6.84 10.14 +3.12 +44.4

ClrBrEnTR 1.32 q 25.13 19.19 22.05 +3.01 +15.8

ClrbrgMLP 1.20 q 21.78 16.12 17.84 -2.16 -10.8

ClearEnFd 1.60f q 29.25 23.30 27.22 +4.19 +18.2

ClrbEOpFd 1.36 q 25.06 21.04 23.18 +2.44 +11.8

ClearwPpr ... 27 53.91 38.94 52.50 +13.34 +34.1

CliffsNRs .60 dd 40.40 15.41 26.21 -12.36 -32.0

Cliffs pfA 1.75 ... 24.83 17.03 22.96 -.55 -2.3

Clorox

2.84 21 96.76 73.50 92.76 +19.54 +26.7

CloudPeak ... 17 20.30 14.25 18.00 -1.33 -6.9

CloughGA 1.26 q 16.10 13.68 15.38 +1.68 +12.3

CloughGEq 1.26 q 15.90 13.08 15.71 +2.71 +20.8

ClghGlbOp 1.14 q 13.55 11.82 13.07 +1.33 +11.3

ClubCorp n .48 ... 17.93 13.51 17.74 +3.24 +22.3

Coach

1.35 16 61.94 45.87 56.13 +.62 +1.1

CoastD

... dd 4.56 1.75 3.27 +1.27 +63.5

CobaltIEn

... dd 30.27 13.75 16.45 -8.11 -33.0

CCFemsa 1.19e ... 181.35109.50 121.77 -27.27 -18.3

CocaCola 1.12 22 43.43 36.52 41.31 +5.06 +14.0

CocaCE

.80 19 44.36 32.01 44.13 +12.40 +39.1

CocaCHBC .44e ... 31.82 22.11 29.17 +2.62 +9.9

Coeur wt

... ... 6.70 1.12 1.32 -3.18 -70.7

Coeur

... dd 25.47 9.93 10.85 -13.75 -55.9

CohSClosed1.04 q 13.93 11.95 12.57 +.15 +1.2

CohStGlbI 1.12 q 12.08 9.94 11.34 +1.02 +9.9

Cohen&Str .80a 24 44.44 29.19 40.06 +9.59 +31.5

CohStInfra 1.44 q 21.88 17.75 20.60 +1.85 +9.9

C&SLtDP&I1.87a q 27.64 21.65 22.62 -2.42 -9.7

C&SIncEgy 1.26 q 21.18 15.92 18.32 -1.68 -8.4

CohStQIR .72 q 13.08 9.01 9.48 -.68 -6.7

CohStRE 1.20 q 19.90 14.70 15.70 -1.29 -7.6

CohStSelPf2.06a q 29.60 22.58 24.69 -2.07 -7.7

CohenStTR .88a q 17.14 11.66 11.99 -2.73 -18.5

CohStDiv .92 q 15.88 13.33 14.58 +.74 +5.3

ColeREI n .72 ... 14.68 9.85 14.04 +3.14 +28.8

Colfax

... 48 64.37 40.29 63.69 +23.34 +57.8

ColgPalm s 1.36 27 66.49 52.62 65.21 +12.94 +24.8

ColonyFncl 1.40 18 23.73 19.03 20.29 +.79 +4.1

ColonyF pf 2.13 ... 27.58 24.68 25.00 -1.13 -4.3

ColSelLCV .83e q 41.81 32.05 40.72 +9.76 +31.5

ColLgCpGr2.03e q 41.94 29.36 38.88 +8.42 +27.6

ColSelLCG ... q 44.49 30.78 43.18 +13.33 +44.7

ColuIntMu 1.46e q 55.11 49.94 51.90 -2.50 -4.6

ColCoreBd1.05e q 53.41 49.97 50.12 -2.78 -5.3

ColumPT n 1.20 cc 26.40 21.76 25.00 +2.40 +10.6

ColSelTec 1.85 q 16.41 13.77 14.39 -.12

-.8

Comcst 61 1.25 ... 26.48 20.45 20.64 -5.55 -21.2

Comcst29 1.58 ... 47.87 38.50 39.52 -2.59 -6.1

Comerica .68 16 48.69 30.73 47.54 +17.20 +56.7

Comeric wt ... ... 19.20 8.30 19.05 +10.80 +130.9

ComfrtS

.22 28 20.95 11.66 19.39 +7.23 +59.5

ComndSec ... 34 2.60 1.30 2.06 +.51 +32.9

CmclMtls .48 31 20.65 13.33 20.33 +5.47 +36.8

CmwREIT 1.00 cc 26.38 15.43 23.31 +7.47 +47.2

CmwRe pfD1.63 ... 24.12 19.93 20.51 -2.57 -11.1

CmwRE19 1.50 ... 22.30 19.64 20.98 -.39 -1.8

CmwRe pfE1.81 ... 27.01 21.25 21.80 -3.42 -13.6

CmwReit 421.44 ... 25.21 18.15 19.00 -4.39 -18.8

CmtyBkSy 1.12 19 40.46 27.29 39.68 +12.32 +45.0

CmtyHlt .25e 21 51.29 30.85 39.27 +8.53 +27.7

CBD-Pao .51e ... 57.30 38.70 44.67 +.28

+.6

CompDivHd1.44 12 19.84 14.81 19.63 +4.92 +33.4

CompssMn 2.18 26 91.88 64.24 80.05 +5.34 +7.1

CompSci .80 8 56.20 40.33 55.88 +15.83 +39.5

Compx

.20 5 19.20 11.00 14.08 -.22 -1.5

ComstkMn ... dd 2.32 1.56 1.75 -.53 -23.2

ComstkRs .50 dd 18.91 12.83 18.29 +3.17 +21.0

Con-Way .40 24 46.52 28.33 39.71 +11.89 +42.7

ConAgra 1.00 18 37.28 29.75 33.70 +4.20 +14.2

ConchoRes ... 51 122.81 78.58 108.00 +27.44 +34.1

ConcdMed ... 12 6.00 4.00 5.48 +1.35 +32.7

ConocoPhil 2.76 11 74.59 56.38 70.65 +12.66 +21.8

ConsolEngy .50 75 39.23 26.25 38.04 +5.94 +18.5

ConEd

2.46 16 64.03 54.17 55.28 -.26

-.5

ConsGph

... 22 68.53 33.86 67.44 +32.52 +93.1

CnsTom

.06 98 42.46 31.16 36.29 +5.28 +17.0

ConstellA ... 8 71.62 28.37 70.38 +34.99 +98.9

ConstellB ... 39 72.00 28.71 69.98 +34.87 +99.3

ConsEP

... dd 3.20 1.16 2.40 +1.22 +103.4

Constellm n ... ... 23.47 13.26 23.27 +8.74 +60.2

CnE pfB 4.50 ... 102.00 92.60 96.32 +2.58 +2.8

ContainSt n ... ... 47.07 32.10 46.61 +10.41 +28.8

Contango 2.00e dd 48.80 33.22 47.26 +4.90 +11.6

ContMatls

... 8 20.69 12.99 20.69 +5.69 +37.9

ContlRes

... 25 121.78 72.35 112.52 +39.03 +53.1

Cnvrgys

.24 21 21.40 15.05 21.05 +4.64 +28.3

CooperCo .06 21 135.41 93.46 123.84 +31.36 +33.9

CooperTire .42 6 34.79 20.55 24.04 -1.32 -5.2

CooperStd ... 18 56.85 35.00 49.11 +11.11 +29.2

CopaHold 4.35e 21 161.36 96.38 160.11 +60.66 +61.0

Copel

.25e ... 18.44 11.00 13.14 -2.21 -14.4

CoreLabs 1.28 41 200.00108.16 190.95 +81.64 +74.7

CoreMold ... 14 14.00 6.35 13.70 +7.08 +106.9

CoreLogic

... 25 36.19 21.40 35.53 +8.61 +32.0

CorEngyInf .50 cc 7.99 5.95 7.12 +1.09 +18.1

CoreSite 1.40f 73 38.57 27.51 32.19 +4.53 +16.4

CoreSR pfA1.81 ... 27.36 22.31 22.60 -2.61 -10.4

Yearly

Stock

Div. PE High Low Last

CorMedix

... dd 1.37 .48 1.24

CorMed wt ... ...

.29 .04

.20

CornstProg .93 q 6.25 4.98 5.14

CornstTR 1.05 q 7.15 5.43 6.05

CornerstStr 1.15 q 7.74 6.10 6.60

Corning

.40 14 18.07 11.75 17.82

Corpbanca .74e ... 22.80 13.37 21.15

CpBT JCP 1.75 ... 20.83 13.93 15.33

CorpExc

.90 61 78.59 47.77 77.43

CorpOffP 1.10 dd 29.95 21.48 23.69

CpOfP pfH 1.87 ... 26.34 23.60 24.06

CorpOf pfL ... ... 27.81 23.05 23.54

CorrectnCp 1.92 21 39.90 30.24 32.07

Cort1Aon272.05 ... 31.75 28.40 28.80

Cort2GS34 1.50 ... 25.80 22.62 23.65

CortGS34cld1.50 ... 25.49 24.65 25.37

CortsJCP971.91 ... 23.00 14.31 17.10

CortsJCP 1.75 ... 20.99 14.01 15.47

CortsPE 2.00 ... 33.00 27.51 28.95

Cort2Prv 2.05 ... 30.90 27.20 28.30

Cosan Ltd .30e ... 21.55 13.20 13.72

Costamre 1.08 ... 19.06 13.01 18.27

Costam pfB 1.91 ... 24.98 22.00 22.94

Cott Cp

.24 24 11.25 7.39 8.06

Coty n

.20 ... 17.74 14.46 15.25

CtrySCkg

... 37 11.26 5.95 10.06

Cntwd pfB 1.75 ... 25.66 24.61 25.35

Cntwd pfA 1.69 ... 25.61 24.59 24.89

CousPrp

.18 10 11.45 8.34 10.30

CousPr pfB 1.88 ... 25.60 24.75 25.11

Covance

... 30 91.99 57.49 88.06

CovantaH .66 54 21.89 16.70 17.75

Cover-All

... dd 1.63 1.01 1.40

Covidien 1.28f 19 68.88 56.79 68.10

Crane

1.20 18 67.45 46.68 67.25

CrwfdA

.20 7 8.48 4.70 7.69

CrwfdB

.16 9 11.30 5.62 9.24

Credicp 2.60e 14 167.63 111.05 132.73

CS EnEur50 ... q 126.30101.00 126.30

CSCmdyRtn ... q 20.31 18.91 19.40

CSCmdyBmk ... q 21.26 19.28 20.39

CSVInvNG ... q 25.84 7.31 8.84

CSVInvCrd ... q 57.27 24.37 32.47

CSVLgNGs ... q 40.65 11.92 21.38

CSVLgCrde ... q 44.82 22.07 30.88

CSMktNeut ... q 21.24 18.58 20.22

CSMrgAr31 ... q 21.72 18.03 20.74

CS MrgArb ... q 21.74 19.38 21.10

CS MLP201.36e q 33.13 24.59 31.41

CS LgShLiq ... q 25.08 21.53 23.81

CrSuisInco .28 q 4.27 3.49 3.56

CS BigCG18 ... q 46.72 41.13 45.71

CredSuiss .11e ... 33.98 25.00 31.04

CrSuiHiY .29 q 3.45 2.76 3.07

CrestwdEq .54f dd 16.89 10.88 13.83

InergyM wi ... ... 22.92 22.03 22.72

CrstwdMid 1.62f cc 26.01 20.40 24.89

Crexendo

... dd 3.31 2.40 3.06

CrosTim 2.32e 13 31.92 25.15 29.41

CrwnCstle ... cc 81.16 66.13 73.43

CrwnC pfA 4.50 ... 102.94 97.35 100.38

CrownHold ... 18 45.40 37.00 44.57

Cryolife

.11 35 11.15 5.52 11.09

CrystalRk

... dd 1.12 .82

.97

CubeSmart .52f cc 19.69 14.08 15.94

CubeS pfA 1.94 ... 27.85 25.06 25.15

Cubic

.24 22 56.92 40.61 52.66

CubicEngy ... dd

.36 .15

.20

CullenFr 2.00 20 76.36 54.91 74.43

CullnF pfA 1.34 ... 26.01 19.39 19.79

Culp Inc

.20f 18 20.51 14.76 20.45

Cummins 2.50 19 141.39103.41 140.97

CurEuro

... q 136.71126.30 135.99

CurAstla 1.91e q 106.03 88.24 89.43

CurBrit

... q 163.38146.26 163.30

CurrCda .17e q 101.29 92.76 93.61

CurrChina

... ... 87.00 76.20 81.32

CurJpn

... q 112.93 92.75 92.76

CurSwed .49e q 158.38145.82 154.56

CurSwiss

... q 110.89 99.80 109.82

CurShSinga ... q 81.56 76.82 78.33

CurtisWrt .40 23 62.92 30.64 62.23

CushTRet .90 q 8.59 7.35 8.02

CushngRen1.64 q 25.95 21.67 25.04

CushRyInco2.00 q 22.08 16.21 16.97

CutwtrSel 1.06 q 20.61 17.29 18.31

Cvent n

... ... 46.13 30.01 36.39

Cyan n

... ... 15.05 3.61 5.29

Cytec

.50 24 93.72 68.50 93.16

Yr.Net

Chg.

+.52

+.08

+.13

+.69

+.60

+5.20

+.90

-3.16

+29.97

-1.29

-1.06

-1.60

+2.37

-.23

-1.34

+.38

-2.83

-3.22

-1.86

+.40

-3.59

+4.35

-1.85

+.03

-2.11

+2.90

+.16

+.07

+1.95

+.09

+30.29

-.67

+.16

+10.36

+20.97

+2.05

+1.26

-13.83

+24.50

-.43

+.53

-11.75

-15.39

-.49

+2.18

+.60

+2.56

+1.45

+7.27

+1.45

-.47

+4.24

+6.48

-.13

+3.09

+.24

+2.64

+.23

+2.49

+1.27

-2.45

+7.76

+4.86

-.05

+1.37

-.90

+4.69

+.00

+20.16

-4.91

+5.44

+32.62

+5.03

-14.52

+2.59

-6.52

+1.52

-20.27

+1.48

+2.36

-2.44

+29.40

+.85

+2.35

-2.02

-1.34

+3.47

-5.85

+24.33

dbXEmMkt .43e q 24.65 19.03 21.68

dbXEafeEq .41e q 27.72 22.09 27.42

dbXBrazEq2.21e q 18.76 13.61 15.56

dbXGerEq .85e q 26.20 20.20 26.14

dbXJapnEq .71e q 39.13 26.27 38.74

dbXRegUtl .42e q 30.00 23.78 25.16

dbxMunInf .45e q 25.07 21.32 23.24

dbXAsiaPH .01p q 26.78 25.05 26.19

dbXEurHgd .24p q 27.33 24.73 26.57

dbXUKHdg .42p q 27.30 24.92 26.03

dbXHvChiA ... q 26.37 23.76 24.66

DCP Mid 2.88f 23 58.50 40.44 50.35

DCT Indl

.28 dd 8.45 6.49 7.13

DDR Corp .54 dd 19.54 14.89 15.37

DDR pfH 1.84 ... 25.87 24.29 25.00

DDR pfJ 1.63 ... 26.00 21.05 21.80

DDR pfK 1.56 ... 25.20 20.06 20.88

DGSE

... dd 6.47 2.03 2.23

DHT Hldgs .08 dd 6.95 4.00 6.84

DNP Selct .78 q 10.77 9.41 9.42

DR Horton .15 17 27.75 17.52 22.32

Drdgold .29e ... 8.59 3.16 3.69

DST Sys 1.20 17 91.69 61.30 90.74

DSW Inc s .50 26 47.55 30.13 42.73

DTE

2.62 19 73.32 60.33 66.39

DTE En 61 1.63 ... 28.73 23.07 24.18

DTEEn 62 1.31 ... 26.41 19.13 19.27

DTF TxF .84a q 17.98 13.57 14.02

DWS GlbHi .54 q 9.27 7.52 8.01

DWS HiOp 1.02 q 15.98 13.53 14.40

DWSHiInc .72 q 10.95 8.76 9.14

DWS Multi .72 q 12.01 9.03 9.39

DWS Muni .84a q 15.54 11.55 11.99

DWS StInc 1.02 q 16.09 12.28 12.99

DWC StMu .92a q 15.66 11.72 12.28

DanaHldg .20 dd 23.46 15.17 19.62

Danaher

.10 22 77.39 56.17 77.20

Danaos

... dd 4.90 2.76 4.90

DaqoNEn

... dd 49.59 4.02 36.30

Darden

2.20 20 55.25 44.11 54.37

Darling

... 20 23.95 16.09 20.88

DaVitaH s

... 23 65.67 52.75 63.37

Daxor

.05e ... 8.46 6.80 6.83

db-X 2010 .07e q 25.46 21.20 25.09

db-X 2020 .25e q 27.33 22.34 27.33

db-X 2030 .52e q 28.99 21.50 27.31

db-X 2040 .40e q 28.50 20.67 27.70

db-X In-Tgt .26e q 29.36 23.91 29.36

DeVryEd

.34 34 38.84 22.87 35.50

DeanFds rs ... ... 22.96 14.29 17.19

Deere

2.04 10 95.60 79.50 91.33

DejourE g

... ...

.25 .09

.12

DE EnhGlb .90 q 12.98 10.92 12.22

DelaCO .69a q 16.16 11.93 12.38

DelaDvInc .62 q 9.52 7.98 9.39

DelaNatl

.72 q 14.91 11.10 11.68

DelaMN2 .69a q 16.81 12.00 12.31

DelekLogis 1.62f 17 35.96 22.76 31.65

Delek

.60a 11 41.47 19.83 34.41

Delhaize 1.82e ... 71.61 40.16 59.42

DelphiAuto .68 18 60.42 37.24 60.13

DeltaAir

.24 10 29.44 11.97 27.47

DeltaAprl

... 23 19.23 12.80 16.98

DeltTim

.40 38 73.97 57.29 67.94

Deluxe

1.00 15 52.69 32.32 52.19

DemndMda ... dd 9.75 4.72 5.77

Demandw ... dd 65.17 23.90 64.12

DenaliFd .91e q 20.83 16.34 19.23

DenburyR .25 14 19.65 15.62 16.43

DenisnM g ... dd 1.62 .97 1.20

DeutschBk .97e ... 53.12 38.18 48.24

DBDogs22 ... ... 14.03 10.33 13.87

DBWMTR

... ... 19.71 15.10 19.62

DeutB pf 1.66 ... 25.85 24.08 24.86

DeutBk pf 1.59 ... 25.54 23.73 24.24

DeutBkX pf 1.84 ... 26.10 24.76 25.34

DB Cap pf 1.90 ... 28.50 25.65 25.96

DeutBCT2 pf1.64 ... 27.40 23.34 24.90

DeutBCT5 pf2.01 ... 29.59 26.33 26.70

DBCmdyL ... q 18.75 10.54 12.65

DBCmdyS ... q 34.00 13.60 20.85

DBCmdDL ... q 9.76 6.71 6.71

DBCmdDS ... q 32.78 25.08 27.90

DB AgriLg

... q 22.42 12.55 12.64

DB AgriSh ... q 23.90 20.30 23.55

DB AgriDL ... q 12.15 7.21 7.26

DB AgDS

... q 15.99 12.11 14.21

DBGoldSh ... q 16.09 11.63 15.73

DBGoldDL ... q 53.51 24.36 25.10

DBGoldDS ... q 8.13 4.34 7.69

DBGlbHY23 ... q 114.65 97.31 114.20

DB3xLgUST ... q 50.87 27.98 30.02

DB3xShUST ... q 10.95 6.62 10.54

DbPSInvJB ... q 21.70 18.95 19.37

DbPs3xInJB ... q 19.88 16.40 17.60

DB LgUSD ... q 22.69 18.50 19.41

DB ShtUSD ... q 18.22 12.05 17.57

DevonE

.88 dd 66.92 50.81 61.87

Dex One

... dd 2.63 1.55 2.38

Diageo 2.92e ... 134.08 111.87 132.42

DiaOffs

.50a 12 76.85 54.78 56.92

DiamRsts n ... ... 19.42 14.18 18.46

DiamRk

.34 61 11.83 8.50 11.55

DianaShip ... 20 13.93 7.33 13.29

DiceHldg

... 14 10.43 6.83 7.25

DicksSptg .50a 23 58.40 45.00 58.10

Diebold

1.15 dd 35.40 27.59 33.01

DigitalPwr

... dd

.82 .50

.67

DigitalRlt 3.12 23 74.00 43.04 49.12

DigtlR pfE 1.75 ... 27.69 21.45 21.71

DigtlR pfF 1.66 ... 27.00 20.30 20.58

DigitlR pfG 1.47 ... 25.07 17.98 18.15

-1.16

+5.36

-2.39

+3.25

+12.39

+.34

-1.81

+1.13

+1.35

+1.02

-.14

+8.60

+.64

-.29

-.03

-2.66

-4.00

-3.20

+2.76

-.05

+2.54

-4.37

+30.14

+9.89

+6.34

-3.11

-5.93

-2.80

-.77

-.76

-1.06

-1.05

-2.40

-1.27

-2.27

+4.01

+21.30

+2.15

+28.34

+9.30

+4.84

+8.10

-.77

+3.69

+5.03

+5.84

+6.75

+4.86

+11.77

+1.61

+4.91

-.10

+.62

-2.74

+1.47

-2.35

-2.91

+8.65

+9.09

+18.87

+21.88

+15.60

+3.00

-2.68

+19.95

-3.52

+36.80

+3.01

+.23

-.05

+3.95

+3.58

+4.53

-.21

-.81

+.27

-.98

-.77

-.61

-4.41

-9.85

-2.50

+1.40

-7.36

+2.21

-4.53

+1.18

+3.92

-26.93

+3.22

+14.90

-17.20

+3.07

-.17

-1.03

-.59

-.14

+9.83

+.80

+15.84

-11.04

+2.31

+2.55

+5.99

-1.93

+12.61

+2.40

-.03

-18.77