Professional Documents

Culture Documents

Euro Area - Economic Outlook by Ifo, Insee and Istat

Uploaded by

Eduardo PetazzeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Euro Area - Economic Outlook by Ifo, Insee and Istat

Uploaded by

Eduardo PetazzeCopyright:

Available Formats

7 April 2014

EUROZONE GROWTH RECOVERING

The Eurozone recovery is expected to pick up in the first quarter of 2014 with a GDP growth rate of +0.4% (after +0.2% and +0.1% respectively in the previous two quarters). Growth is forecasted to decelerate slightly in the following two quarters. The recovery is expected to be broad based across sectors and countries and the consolidation of the upturn would be determined by a progressive improvement of domestic demand and a slightly positive contribution of the external sector. Private investment will continue to grow over the forecasting horizon due to the increase in activity and the need for new production capacity after the sharp adjustment phase determined by the financial crisis. However, prospects for consumption remain subdued owing to fiscal austerity measures in some member States combined with a continuing labor market slack and slow growth in real disposable income. Under the assumptions that the oil price stabilizes at USD 107 per barrel and that the euro/dollar exchange rate fluctuates around 1.38, the headline inflation is expected to increase marginally in the next two quarters, remaining well below the threshold of 2%. Weaker external demand in emerging economies, especially in Asia, and an escalation of international tensions in Eastern Europe, which could determine a sharp rise in European gas prices and weight on households and firms expenditure, are key downside risks related to this scenario.

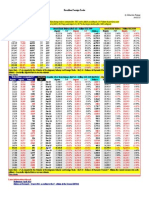

Recovering industrial production

Recent business surveys for the Eurozone show a continuation of the upward trend. The European Commission surveys report output is increasing for all sectors but construction. In the latter sector, the deterioration of confidence indicators has stopped. In January, industrial production surprised on the downside (-0.2%) mainly owing to mild weather during the winter that drastically weighted on production in the energy sector. However, in line with survey indicators and the still positive statistical overhang (+0,2%), we still expect that industrial output will remain on a positive trail, fluctuating around 0.4% in the next three quarters.

FIGURE 1 | Eurozone Industrial Production Index

sa-wda

q/q y/y

Forecasts

6,0% 4,0% 2,0% 0,0% -2,0% -4,0%

10,0% 5,0% 0,0% -5,0% -10,0%

-6,0% -8,0% -10,0% Q1 2004

q/q y/y Q3 2006 Q1 2009 Q3 2011 Q1 2014

-15,0% -20,0%

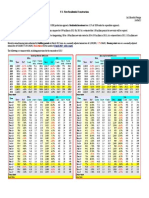

GDP on an upward trend

According to our forecast, the recovery in the Eurozone will continue over the forecast horizon driven mainly by a progressive improvement in domestic demand. It is worth mentioning that the recovery will be more balanced across sectors and countries than in the past few months. All in all, GDP will increase by 0.4% in Q1 and then slightly decelerate in the following two quarters (+0,3% in both Q2 and Q3) partly reflecting a normalization in weather conditions (in particular in Germany). Prospects for private consumption remain subdued owing to a continuing labor market slack and slow growth in real disposable income. Although improving, the pace of the recovery will remain insufficient to significantly reduce the unemployment rate. This is expected to stay at record highs in the short term and to decrease only moderately going forward.

Source: Eurostat and forecasts Ifo-Insee-Istat

FIGURE 2 | Eurozone GDP Growth

sa-wda

1,5% 1,0% 0,5% 0,0% -0,5%

q/q

y/y

Forecasts

4,0% 3,0% 2,0% 1,0% 0,0% -1,0% -2,0% -3,0%

q-1,0%

-1,5% -2,0% -2,5% -3,0% Q1 2004 q/q y/y Q3 2006 Q1 2009 Q3 2011 Q1 2014

-4,0% -5,0% -6,0%

Source: Eurostat and forecasts Ifo-Insee-Istat

ASSOCIATION OF THR THREE LEADING EUROPEAN ECONOMIC INSTITUTES

www.ifo.de

www.insee.fr

www.istat.it

7 April 2014

Thus, real disposable income will grow only marginally and private consumption growth in the Eurozone will remain subdued over the next three quarters (+0.2% in Q1, Q2 and Q3). According to survey data, a lack of equipment is starting to limit manufacturing output. This factor, combined with better profit growth prospects, suggests that investment growth is likely to strengthen over the forecast horizon. Accordingly, we expect that investment will remain vibrant over the next three quarters (+0.8%, +0.4% and +0.7%), with the deceleration in Q2 determined by the effect of the favorable weather conditions in the winter of 2013/2014. Notwithstanding this general trend, construction investment will remain weak. Equipment investment, on the contrary, will expand at a faster pace over the forecast horizon, stimulated by improving confidence, positive external demand and a gradual stabilization of domestic-demand prospects.

2014 forecasts, % changes , sa - wda

q/q y/y IPI Q1 - 2014 forecasts 0.4 1.5 0.4 1.1 0.2 0.5 0.8 2.5 0.7

2.4

Q2 - 2014 forecasts 0.5 1.3 0.3 1.1 0.2 0.6 0.4 2.8 0.8

Q3 - 2014 forecasts 0.4 1.8 0.3 1.2 0.2 0.7 0.7 3.0 0.9

2014 overhang 1.5

GDP

1.0

Consumption

0.5

Investment

2.1

Inflation

0.8

Source: Eurostat and forecasts Ifo-Insee-Istat

Inflation increases only marginally

In Q1 2014 inflation hit a year-on-year growth of +0.7% after the +0.8% increase reported at the end of 2013. Under the assumptions that the oil price stabilizes at USD 107 per barrel and that the euro/dollar exchange rate fluctuates around 1.38 over the coming quarters, headline inflation is expected to increase marginally and to remain well below the 2% threshold (+0.8% and +0,9% respectively in Q2 and Q3). This trend partly reflects impulses from the energy sector, while domestic price pressures are expected to remain subdued. With weak demand and a persistently high unemployment, core inflation would not accelerate in spite of the recovery. .

FIGURE 3 | Eurozone Inflation (HICP)

(y-o-y)

3,5%

Forecasts

2,5%

1,5%

0,5%

headline inflation core inflation Q3 2006 Q1 2009 Q3 2011 Q1 2014

-0,5% Q1 2004

Source: Eurostat and forecasts Ifo-Insee-Istat

Methodological note

This quarterly publication is prepared jointly by the German Ifo institute, the French Insee institute, and the Italian Istat institute. The forecast results are based on consensus estimates building on common methods by the three institutes. They are based on time-series models using auxiliary indicators from business surveys by national institutes, Eurostat, and the European Commission. The joint threequarter forecast covers Eurozone industrial production, GDP, consumption, investment, and inflation. Further economic analysis for each country (Germany, France, Italy) is available by:

Ifo Konjunkturprognose, Ifo Conjoncture in France, Insee Istat

Michael Kleemann +49 (0) 89 92 24 1220 tienne Chantrel +33 (0) 1 41 17 59 63 Roberta De Santis +39 06 46733620

Next release: July 2, 2014 | Next forecast horizon: 2014 Q4

You might also like

- Today's Calendar: Friday 15 November 2013Document9 pagesToday's Calendar: Friday 15 November 2013api-239816032No ratings yet

- BRAM Economic BulletinDocument8 pagesBRAM Economic BulletinPriscila MatulaitisNo ratings yet

- Eeo 20110411 deDocument2 pagesEeo 20110411 demotlaghNo ratings yet

- Macroeconomic Developments in Serbia: September 2014Document20 pagesMacroeconomic Developments in Serbia: September 2014faca_zakonNo ratings yet

- RF EconomyDocument9 pagesRF EconomyLupu TitelNo ratings yet

- KOF Bulletin: Economy and ResearchDocument15 pagesKOF Bulletin: Economy and Researchpathanfor786No ratings yet

- Recent Economic Developments of SingaporeDocument20 pagesRecent Economic Developments of SingaporeHNo ratings yet

- Er 20130719 Bull CPIpreview Q2Document6 pagesEr 20130719 Bull CPIpreview Q2David SmithNo ratings yet

- EC Greece Forecast Autumn 13 PDFDocument2 pagesEC Greece Forecast Autumn 13 PDFThePressProjectIntlNo ratings yet

- Eurostat BDPDocument2 pagesEurostat BDPPravi PosaoNo ratings yet

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Document18 pagesNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUNo ratings yet

- Vietnam Quarterly Macroeconomic ReportDocument26 pagesVietnam Quarterly Macroeconomic ReportThai Quoc NgoNo ratings yet

- Convergence Programme November 2007 2 Macroeconomic ScenarioDocument10 pagesConvergence Programme November 2007 2 Macroeconomic Scenariocristi313No ratings yet

- Romania: Strengthening Domestic Demand Contributes To Robust GrowthDocument2 pagesRomania: Strengthening Domestic Demand Contributes To Robust GrowthAlly CumvreaueuNo ratings yet

- First Cut - GDP - Nov'15 (12017101)Document6 pagesFirst Cut - GDP - Nov'15 (12017101)Abhijit ThakarNo ratings yet

- SEB Report: Norwegian 2012 Growth Forecast Revised UpDocument4 pagesSEB Report: Norwegian 2012 Growth Forecast Revised UpSEB GroupNo ratings yet

- Economic and Fiscal Outlook 2014-USDocument40 pagesEconomic and Fiscal Outlook 2014-USMaggie HartonoNo ratings yet

- New Setbacks, Further Policy Action Needed: Figure 1. Global GDP GrowthDocument8 pagesNew Setbacks, Further Policy Action Needed: Figure 1. Global GDP GrowthumeshnihalaniNo ratings yet

- Chapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofDocument21 pagesChapter - 3 National Income and Related Aggregates 3.1 Background: Performance of An Economy Depends On The Amount ofnavneetNo ratings yet

- Deflation Danger 130705Document8 pagesDeflation Danger 130705eliforuNo ratings yet

- Swiss National Bank Quarterly Bulletin - September 2011Document54 pagesSwiss National Bank Quarterly Bulletin - September 2011rryan123123No ratings yet

- Monetary Policy Report: September 2014Document36 pagesMonetary Policy Report: September 2014Network18No ratings yet

- External Environment of The Polish Economy: Global Economic ActivityDocument11 pagesExternal Environment of The Polish Economy: Global Economic ActivityaliNo ratings yet

- Eurobank Monthly Global Economic Market Monitor September 2016Document24 pagesEurobank Monthly Global Economic Market Monitor September 2016nikoulisNo ratings yet

- Finland - GDP 1Q2014Document10 pagesFinland - GDP 1Q2014Eduardo PetazzeNo ratings yet

- Recent Economic DevelopmentsDocument18 pagesRecent Economic DevelopmentsAtul MoynakNo ratings yet

- Sabbatini-Locarno Economic Outlook 7marzo2011Document13 pagesSabbatini-Locarno Economic Outlook 7marzo2011flag7No ratings yet

- Nordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Document7 pagesNordea Bank, Global Update, Dec 18, 2013. "Happy New Year 2014"Glenn ViklundNo ratings yet

- June 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Document70 pagesJune 28, 2011 July 13, 2011 June 28, 2011 June 28, 2011 January 29, 2001Ilya MozyrskiyNo ratings yet

- Is The Tide Rising?: Figure 1. World Trade Volumes, Industrial Production and Manufacturing PMIDocument3 pagesIs The Tide Rising?: Figure 1. World Trade Volumes, Industrial Production and Manufacturing PMIjdsolorNo ratings yet

- Weak GDP Results Into Unemployment: Source - The Guardian (2015), Retrieved FromDocument6 pagesWeak GDP Results Into Unemployment: Source - The Guardian (2015), Retrieved FromDrJyoti AgarwalNo ratings yet

- International Economic DevelopmentDocument5 pagesInternational Economic DevelopmentHenizionNo ratings yet

- An Interim Assessment: What Is The Economic Outlook For OECD Countries?Document23 pagesAn Interim Assessment: What Is The Economic Outlook For OECD Countries?Jim MiddlemissNo ratings yet

- These Green Shoots Will Need A Lot of Watering: Economic ResearchDocument10 pagesThese Green Shoots Will Need A Lot of Watering: Economic Researchapi-231665846No ratings yet

- Market Report JuneDocument17 pagesMarket Report JuneDidine ManaNo ratings yet

- 1Q2011-Africa and Global Economic TrendsDocument15 pages1Q2011-Africa and Global Economic TrendsTaruna FadillahNo ratings yet

- CRISIL First Cut - CPI - IIP PDFDocument7 pagesCRISIL First Cut - CPI - IIP PDFAnirudh KumarNo ratings yet

- State of The Economy and Prospects: Website: Http://indiabudget - Nic.inDocument22 pagesState of The Economy and Prospects: Website: Http://indiabudget - Nic.inNDTVNo ratings yet

- India Econimic Survey 2010-11Document296 pagesIndia Econimic Survey 2010-11vishwanathNo ratings yet

- First Cut Cpi Iip Jan 2015Document7 pagesFirst Cut Cpi Iip Jan 2015akshay_bitsNo ratings yet

- Eurozone Global OutlookDocument1 pageEurozone Global Outlookshaan1001gbNo ratings yet

- Weekly Export Risk Outlook No26 04072012Document2 pagesWeekly Export Risk Outlook No26 04072012Ali Asghar BazgirNo ratings yet

- Indian EconomyDocument37 pagesIndian EconomyDvitesh123No ratings yet

- ScotiaBank AUG 06 Europe Weekly OutlookDocument3 pagesScotiaBank AUG 06 Europe Weekly OutlookMiir ViirNo ratings yet

- Nedbank Se Rentekoers-Barometer - September 2014Document4 pagesNedbank Se Rentekoers-Barometer - September 2014Netwerk24SakeNo ratings yet

- The Market Call (July 2012)Document24 pagesThe Market Call (July 2012)Kat ChuaNo ratings yet

- GDP Forecast SummaryDocument6 pagesGDP Forecast Summaryritholtz1No ratings yet

- 2016wesp Ch1 enDocument50 pages2016wesp Ch1 enMuhamad Amirul FikriNo ratings yet

- Bulletin: Forecast Q4 CPI 0.2%qtr, Core 0.8%qtrDocument3 pagesBulletin: Forecast Q4 CPI 0.2%qtr, Core 0.8%qtrBelinda WinkelmanNo ratings yet

- Weekly Market Brief: AIB Treasury Economic Research UnitDocument2 pagesWeekly Market Brief: AIB Treasury Economic Research Unitpathanfor786No ratings yet

- Ecb Press CoDocument4 pagesEcb Press Conimish2No ratings yet

- The Economic Outlook For Germany May 8, 2010Document16 pagesThe Economic Outlook For Germany May 8, 2010Ankit_modi2000No ratings yet

- Recent Economic Developments in Singapore: HighlightsDocument14 pagesRecent Economic Developments in Singapore: HighlightsEstelle PohNo ratings yet

- Nedbank Se Rentekoers-Barometer Vir Mei 2016Document4 pagesNedbank Se Rentekoers-Barometer Vir Mei 2016Netwerk24SakeNo ratings yet

- Second Estimate For The Q2 2013 Euro GDPDocument6 pagesSecond Estimate For The Q2 2013 Euro GDPeconomicdelusionNo ratings yet

- Recent Economic Developments in Singapore: 5 September 2017Document20 pagesRecent Economic Developments in Singapore: 5 September 2017Aroos AhmadNo ratings yet

- Collapsing Dow Jones: IndiaDocument6 pagesCollapsing Dow Jones: IndiaPriyanka PaulNo ratings yet

- China - Price IndicesDocument1 pageChina - Price IndicesEduardo PetazzeNo ratings yet

- WTI Spot PriceDocument4 pagesWTI Spot PriceEduardo Petazze100% (1)

- México, PBI 2015Document1 pageMéxico, PBI 2015Eduardo PetazzeNo ratings yet

- Brazilian Foreign TradeDocument1 pageBrazilian Foreign TradeEduardo PetazzeNo ratings yet

- Retail Sales in The UKDocument1 pageRetail Sales in The UKEduardo PetazzeNo ratings yet

- U.S. New Residential ConstructionDocument1 pageU.S. New Residential ConstructionEduardo PetazzeNo ratings yet

- Euro Area - Industrial Production IndexDocument1 pageEuro Area - Industrial Production IndexEduardo PetazzeNo ratings yet

- Comparative Vs Competitive AdvantageDocument19 pagesComparative Vs Competitive AdvantageSuntari CakSoenNo ratings yet

- Provisional Ominibus Karnataka List1Document93 pagesProvisional Ominibus Karnataka List1Jeeva JpNo ratings yet

- Java Curriculumrriculum J2Se (Java 2 Standard Edition) : DURATION: 140 HoursDocument6 pagesJava Curriculumrriculum J2Se (Java 2 Standard Edition) : DURATION: 140 HoursYashjit TeotiaNo ratings yet

- 2018 10 17 - Indicative Bond Prices Southey Capital Bond Illiquid and DistressedDocument5 pages2018 10 17 - Indicative Bond Prices Southey Capital Bond Illiquid and DistressedSouthey CapitalNo ratings yet

- Wharton Casebook 2005 For Case Interview Practice - MasterTheCaseDocument48 pagesWharton Casebook 2005 For Case Interview Practice - MasterTheCaseMasterTheCase.comNo ratings yet

- Industrial Training ReportDocument63 pagesIndustrial Training ReportMohamed Shamal77% (13)

- Lienzo Canvas 1Document3 pagesLienzo Canvas 1Jhesennia Gago MoralesNo ratings yet

- REPLIDYNE INC 10-K (Annual Reports) 2009-02-24Document74 pagesREPLIDYNE INC 10-K (Annual Reports) 2009-02-24http://secwatch.comNo ratings yet

- HAC AeroOverview 2018 Feb enDocument45 pagesHAC AeroOverview 2018 Feb enAnonymous KaoLHAktNo ratings yet

- Dissertation ReportDocument94 pagesDissertation ReportgaryrinkuNo ratings yet

- Lesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSDocument6 pagesLesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSMayeng MonayNo ratings yet

- Purchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousDocument2 pagesPurchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousJosephSousNo ratings yet

- UCC Article 2-PocketGuideDocument2 pagesUCC Article 2-PocketGuidesuperxl2009No ratings yet

- This Study Resource Was: Painter CorporationDocument3 pagesThis Study Resource Was: Painter CorporationIllion IllionNo ratings yet

- ArcGIS For AutoCADDocument2 pagesArcGIS For AutoCADsultanNo ratings yet

- Partnering To Build Customer Engagement, Value, and RelationshipDocument32 pagesPartnering To Build Customer Engagement, Value, and RelationshipSơn Trần BảoNo ratings yet

- Callistus Moses CV19042010Document5 pagesCallistus Moses CV19042010Callistus MosesNo ratings yet

- Introduction To FranchisingDocument45 pagesIntroduction To FranchisingAmber Liaqat100% (2)

- PPP in MP TourismDocument1 pagePPP in MP TourismPrathap SankarNo ratings yet

- Entrepreneurship: Topic-Success Story of Arunachalam MurugananthamDocument14 pagesEntrepreneurship: Topic-Success Story of Arunachalam MurugananthamDichin SunderNo ratings yet

- Pipes and Tubes SectorDocument19 pagesPipes and Tubes Sectornidhim2010No ratings yet

- Cost Accounting: A Managerial EmphasisDocument19 pagesCost Accounting: A Managerial EmphasisAaminah AliNo ratings yet

- SAP SD Transaction Codes and TablesDocument5 pagesSAP SD Transaction Codes and TablesKhitish RishiNo ratings yet

- UMT Efficient Frontier Technique For Analyzing Project Portfolio ManagementDocument8 pagesUMT Efficient Frontier Technique For Analyzing Project Portfolio ManagementVinod SharanNo ratings yet

- Merchant or Two Sided PlatformDocument25 pagesMerchant or Two Sided Platformergu2000No ratings yet

- S cabaleryFlexiblePipeSolutionsDocument23 pagesS cabaleryFlexiblePipeSolutionsprateekchopra1No ratings yet

- Cabutotan Jennifer 2ADocument12 pagesCabutotan Jennifer 2AJennifer Mamuyac CabutotanNo ratings yet

- ILO Declaration For Fair GlobalisationDocument7 pagesILO Declaration For Fair GlobalisationjaishreeNo ratings yet

- Engl2012 PDFDocument9 pagesEngl2012 PDFИрина ГонтаренкоNo ratings yet

- En HaynesPro Newsletter 20140912Document8 pagesEn HaynesPro Newsletter 20140912A-c RoNo ratings yet