Professional Documents

Culture Documents

Chapter 03

Uploaded by

Amir JamaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 03

Uploaded by

Amir JamaCopyright:

Available Formats

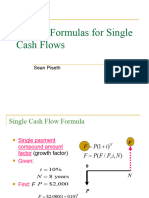

Chapter 3: Interest Rate and Economic Equivalence

Types of Interest

3.1

Simple interest:

years N

N

N

5 . 12

08 . 0

1

2 ) 08 . 0 1 (

) 08 . 0 1 ( 000 , 5 $ 000 , 10 $

= =

= +

+ =

Compound interest:

years N

N

N

2 . 10

2 ) 07 . 0 1 (

) 07 . 0 1 ( 000 , 5 $ 000 , 10 $

=

= +

+ =

3.2

Simple interest:

400 $ ) 5 )( 000 , 1 )($ 08 . 0 ( = = = iPN I

Compound interest:

469 $ ) 1 4693 . 1 ( 000 , 1 $ ] 1 ) 1 [( = = + =

N

i P I

3.3

Option 1: Compound interest with 8%:

408 , 4 $ ) 4693 . 1 ( 000 , 3 $ ) 08 . 0 1 ( 000 , 3 $

5

= = + = F

Option 2: Simple interest with 9%

350 , 4 $ ) 45 . 1 ( 000 , 3 $ ) 5 09 . 0 1 ( 000 , 3 $ = = +

Option 1 is better

3.4

End of Year Principal

Repayment

Interest

payment

Remaining

Balance

0 $10,000

1 $1,671 $900 $8,329

2 $1,821 $750 $6,508

3 $1,985 $586 $4,523

4 $2,164 $407 $2,359

5 $2,359 $212 $0

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

2

Equivalence Concept

3.5

402 , 9 $ ) 7835 . 0 ( 000 , 12 $ ) 5 %, 5 , / ( 000 , 12 $ = = = F P P

3.6

328 , 23 $ ) 1664 . 1 ( 000 , 20 $ ) 2 %, 8 , / ( 000 , 20 $ = = = P F F

Single Payments (Use of F/P or P/F Factors)

3.7

(a) 388 , 7 $ ) 8 %, 5 , / ( 000 , 5 $ = = P F F

(b) 208 , 3 $ ) 12 %, 3 , / ( 250 , 2 $ = = P F F

(c) 161 , 65 $ ) 31 %, 7 , / ( 000 , 8 $ = = P F F

(d) 700 , 45 $ ) 7 %, 9 , / ( 000 , 25 $ = = P F F

3.8

(a) 105 , 3 $ ) 6 %, 10 , / ( 500 , 5 $ = = F P P

(b) 338 , 3 $ ) 15 %, 6 , / ( 000 , 8 $ = = F P P

(c) 418 , 20 $ ) 5 %, 8 , / ( 000 , 30 $ = = F P P

(d) 851 , 3 $ ) 8 %, 12 , / ( 000 , 15 $ = = F P P

3.9

(a) 428 , 5 $ ) 5 %, 13 , / ( 000 , 10 $ = = F P P

(b) 763 , 40 $ ) 4 %, 13 , / ( 000 , 25 $ = = P F F

3.10

years N

N

P P F

N

69 . 9

) 12 . 1 ( log 3 log

) 12 . 0 1 ( 3

=

=

+ = =

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

3

3.11

years N

N

P P F

N

96 . 4

) 15 . 1 ( log 2 log

) 15 . 0 1 ( 2

=

=

+ = =

Rule of 72: 72/15 4.80 years =

Uneven Payment Series

3.12

(a) Single-payment compound amount factors for ) , , / ( N i P F

n 9% 10%

35 20.4140 28.1024

40 31.4094 45.2593

To find , first, interpolate for ) 38 %, 5 . 9 , / ( P F 38 = n

n 9% 10%

38 27.0112 38.3965

Then, interpolate for % 5 . 9 = i

7039 . 32 ) 38 %, 5 . 9 , / ( = P F

As compared to formula determination

4584 . 31 ) 38 %, 5 . 9 , / ( = P F

(b) Single-payment compound amount factors for ) , , / ( N i F P

n 45 50

0.0313 0.0213

Then, interpolate for 47 = n

0273 . 0 ) 47 %, 8 , / ( = F P

As compared with the result from formula

0269 . 0 ) 47 %, 8 , / ( = F P

3.13

437 , 114 $

08 . 1

000 , 28 $

08 . 1

000 , 46 $

08 . 1

000 , 43 $

08 . 1

000 , 32 $

5 4 3 2

= + + + = P

3.14

231 , 11 $ ) 11 %, 6 , / ( 000 , 2 $ ) 13 %, 6 , / ( 800 , 1 $ ) 15 %, 6 , / ( 500 , 1 $ = + + = P F P F P F F

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

4

3.15

$3,000,000 $2,400,000( / ,8%,1)

$3,000,000( / ,8%,10)

$20,734,618

P P

P F

= +

+

=

F +

A

Or,

$3,000,000 $2,400,000( / ,8%,5)

$3,000,000( / ,8%,5)( / ,8%,5)

$20,734,618

P P

P A P F

= +

+

=

3.16

484 , 14 $ ) 7 %, 6 , / ( 000 , 5 $ ) 5 %, 6 , / ( 000 , 6 $ ) 2 %, 6 , / ( 500 , 7 $ = + + = F P F P F P P

Equal Payment Series

3.17

(a) With deposits made at the end of each year

816 , 13 $ ) 10 %, 7 , / ( 000 , 1 $ = = A F F

(b) With deposits made at the beginning of each year

783 , 14 $ ) 07 . 1 )( 10 %, 7 , / ( 000 , 1 $ = = A F F

3.18

(a) 713 , 16 $ ) 5 %, 7 , / ( 000 , 3 $ = = A F F

(b) 043 , 77 $ ) 12 %, 25 . 8 , / ( 000 , 4 $ = = A F F

(c) 575 , 267 $ ) 20 %, 4 . 9 , / ( 000 , 5 $ = = A F F

(d) 236 , 134 $ ) 12 %, 75 . 10 , / ( 000 , 6 $ = = A F F

3.19

(a) 166 , 1 $ ) 13 %, 6 , / ( 000 , 22 $ = = F A A

(b) 388 , 4 $ ) 8 %, 7 , / ( 000 , 45 $ = = F A A

(c) 5 . 479 $ ) 25 %, 8 , / ( 000 , 35 $ = = F A A

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

5

(d) 361 , 1 $ ) 8 %, 14 , / ( 000 , 18 $ = = F A A

3.20

$30,000 $1,500( / , 7%, )

( / , 7%, ) 20

12.94 13

F A N

F A N

N years

=

=

=

3.21

$15,000 ( / , 11%, 5)

$2,408.56

A F A

A

=

=

3.22

(a) 310 , 2 $ ) 5 %, 5 , / ( 000 , 10 $ = = P A A

(b) 70 . 723 , 1 $ ) 4 %, 7 . 9 , / ( 500 , 5 $ = = P A A

(c) 85 . 975 , 2 $ ) 3 %, 5 . 2 , / ( 500 , 8 $ = = P A A

(d) 171 , 3 $ ) 20 %, 5 . 8 , / ( 000 , 30 $ = = P A A

3.23

Equal annual payment:

5 . 132 , 11 $ ) 3 %, 16 , / ( 000 , 25 $ = = P A A

Interest payment for the second year:

End of Year Principal

Repayment

Interest

payment

Remaining

Balance

0 $25,000

1 $7,132.5 $4,000 $17,867.5

2 $8,273.7 $2,858.8 $9,593.8

3 $9,593.8 $1,535 -

3.24

(a) 2 . 781 , 6 $ ) 12 %, 8 . 5 , / ( 800 $ = = A P P

(b) 25 . 403 , 16 $ ) 10 %, 5 . 8 , / ( 500 , 2 $ = = A P P

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

6

(c) 61 . 665 , 3 $ ) 5 %, 25 . 7 , / ( 900 $ = = A P P

(d) 3 . 726 , 30 $ ) 8 %, 75 . 8 , / ( 500 , 5 $ = = A P P

3.2

(a) The capital recovery factor N i P for

5

) , , / (A

n 6% 7%

35 0.0690 0.0772

40 0.0665 0.0750

To find , f nterpolate for

) 38 %, 25 . 6 , / ( P A irst, i 38 = n

n 6% 7%

38 0.0675 0.0759

Then, interpolate for % 25 . 6 = i ; 6 , / ( P F 0696 . 0 ) 38 %, 25 . =

As compared with the result from fo ula rm

0694 . 0 ) 38 %, 25 . 6 , / ( = P F

(b) The equal payment series present-worth factor (P for ) 85 , , / i A

i 9% 10%

11.1038 9.9970

Then, interpolate for

% 25 . 9 = i

8271 . 10 ) 85 %, 25 . 9 , / ( = A P

As compared with the result from for ula m

8049 . 10 ) 85 %, 25 . 9 , / ( = A P

Linear Gradient Series

3.26

3.27

35 . 988 , 50 $

) 5 %, 8 , / )( 5 , % 8 , / ( 000 , 2 $ ) 5 %, 8 , / ( 000 , 5 $

) 5 %, 8 , / ( 000 , 2 $ ) 5 %, 8 , / ( 000 , 5 $

2 1

=

+ =

+ =

+ =

A F G A A F

G F A F

F F F

47 . 889 , 11 $

) 5 %, 7 , / )( 5 , % 7 , / ( 500 $ ) 5 %, 7 , / ( 000 , 3 $

) 5 %, 7 , / ( 500 $ ) 5 %, 7 , / ( 000 , 3 $

=

=

=

P F G P A F

G F A F F

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

7

3.28

26 . 991 $

) 7 %, 9 , / )]( 2 %, 9 , / ( 50 $

) 4 %, 9 , / ( 50 $ ) 6 %, 9 , / ( 50 $ ) 7 %, 9 , / ( 100 [$ 100 $

=

+

+ + + =

F P A F

A F A F A F P

3.29

3.3

)

3 . 404 , 10 $

) 12 %, 8 , / ( 000 , 1 $ 000 , 15 $

=

= G A A

0

(a 076 , 372 , 21 $ ) 7 %, 12 %, 10 , / ( 000 , 000 , 6 $

1

= = A P P

Note that the oil price increases at the annual rate of 5% while the oil

production decreases at the annual rate

(b)

of 10%. Therefore, the annual

revenue can be expressed as follows:

) 945 . 0 ( 000 , 000 , 6 $

) 1 . 0 1 ( 000 , 1000 ) 05 . 0 1 ( 60 $

=

+ =

n

n n

n

A

ies is equivalent to a decreasing geometric gradient series

g =-5.5%.

So,

1

) 055 . 0 1 ( 000 , 000 , 6 $

=

n

This revenue ser

1

1 1

with

896 , 847 , 23 $ ) 7 %, 12 %, 5 . 5 , / ( 000 , 000 , 6 $

1

= = A P P

(c) sent worth of the remaining series at the end

of period 3 gives

1

Computing the pre

4 5 6 7

( , , , ) A A A A

652 , 269 , 14 $ ) 7 %, 12 %, 5 . 5 , / ( 460 , 063 , 5 = P $ = A P

3.31

20

1

20

1

1

20

1

(1 )

(2,000,000) (1.06) (1.06)

1.06

(2,000,000/1.06) ( )

1.06

$396,226,415

n

n

n

n n

n

n

n

P A i

n

n

=

=

=

= +

=

=

=

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

8

1

2

1

Note: if ,

[1 ( 1)

(1 )

When 6% and 8%,

1

0.9815

1

$2,000,000 0.9815[1 (21)(0.6881) 20(0.6756)]

1.06 0.0003

$334,935,843

N N N

n

n

i g

x N x Nx

nx

x

g i

g

x

i

P

+

=

+ +

=

= =

+

= =

+

+

=

=

3.32

(a) The withdrawal series would be

Period Withdrawal

11 $5,000

12 $5,000(1.08)

13 $5,000(1.08)(1.08)

14 $5,000(1.08)(1.08)(1.08)

15 $5,000(1.08)(1.08)(1.08)(1.08)

78 . 518 , 22 $ ) 5 %, 9 %, 8 , / ( 000 , 5 $

1 10

= = A P P

Assuming that each deposit is made at the end of each year, then;

$22,518.78 ( / , 9%, 10) 15.1929

$1482.19

A F A A

A

= =

=

(b) 85 . 491 , 24 $ ) 5 %, 6 %, 8 , / ( 000 , 5 $

1 10

= = A P P

$24,491.85 ( / ,6%, 10) 13.1808

$1858.15

A F A A

A

= =

=

Various Interest Factor Relationships

3.33

(a) 0058 . 0 ) 2703 . 0 )( 0213 . 0 ( ) 17 %, 8 , / )( 50 %, 8 , / ( ) 67 %, 8 , / ( = = = F P F P F P

0058 . 0 ) 08 . 0 1 ( ) 67 %, 8 , / (

67

= + = F P

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

9

(b)

) , , / ( 1

) , , / (

N i F P

i

N i P A

=

0394 . 0 ) 2 %, 8 , / )( 40 %, 8 , / ( ) 42 %, 8 , / ( = = F P F P F P

0833 . 0

0394 . 0 1

08 . 0

) 42 %, 8 , / ( =

= P A

0833 . 0

1 ) 08 . 1 (

) 08 . 1 ( 08 . 0

) 42 %, 8 , / (

42

42

=

= P A

(c) 4996 . 12

08 . 0

) 35 %, 8 , / )( 100 %, 8 , / ( 1 ) , , / ( 1

) , , / ( =

=

F P F P

i

N i F P

N i A P

4996 . 12

) 08 . 1 ( 08 . 0

1 ) 08 . 1 (

) 135 %, 8 , / (

135

135

=

= P A

3.34

(a)

N

N

N

N

i

i

i

i

i i

N i A F i N i P F

) 1 (

1 1 ) 1 (

1

1 ) 1 (

) 1 (

1 ) , , / ( ) , , / (

+ =

+ + =

+

+

= +

+ =

(b)

N

N

N

N

N

N

N

N

i

i

i

i

i

i i

i

i i

i N i A P N i F P

+ =

+

+

+

+

=

+

+

= +

=

) 1 (

) 1 (

1 ) 1 (

) 1 (

) 1 (

) 1 (

1 ) 1 (

1 ) 1 (

) , , / ( 1 ) , , / (

(c)

1 ) 1 (

1 ) 1 (

] 1 ) 1 [(

1 ) 1 (

) 1 (

1 ) 1 (

) 1 (

1 ) 1 (

) , , / ( ) , , / (

+

=

+

+

+

+

=

+

+

=

+

=

N

N

N

N

N

N

N

N

i

i

i

i i

i

i i

i

i

i i

i

i

i N i P A N i F A

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

10

(d)

1 ) 1 (

) 1 (

) 1 (

1

) 1 (

) 1 ( 1 ) 1 (

) 1 (

)] , , / ( 1 [

) , , / (

+

+

=

+

+

+

=

+

+

=

N

N

N N

N N

N

i

i i

i i

i

i

i

i i

N i F P

i

N i P A

(f) & vid (e) (g) Di e the numerator and denominator by and take the

mit .

Equivalence Calculations

3.35

N

i) 1 ( +

li N

49 . 740 $

) 10 %, 12 , / )]( 5 %, 12 , / ( 50 $ ) 7 %, 12 , / ( 50 $ ) 9 %, 12 , / ( 100 [$

=

+ + = F P A F A F A F P

3.36

92 . 373 $

) 4 %, 8 , / ( 300 $

) 3 %, 8 , / ( 120 $ ) 2 %, 8 , / ( 120 $ ) 1 %, 8 , / ( 200 $ 200 $ ) 08 . 1 (

=

+

+ + = +

P

F P

F P F P F P P

.37 Selecting the base period at n =0, we find

.38 Selecting the base period at n =0, we find

75 . 782 $ ) 5 %, 6 , / (

75 . 782 $

) 5 %, 6 , / ( 100 $ ) 4 %, 6 , / ( 50 $ ) 1 %, 6 , / ( 50 $ ) 5 %, 6 , / ( 100 $ 200 $

2

1

=

= =

=

+

3

$100( / ,13%,5) $20( / ,13%,3)( / ,13%,2) ( / ,13%,5)

$351.72 $36.98 (3.5172)

$110.51

P A P A P F A P A

A

A

+ =

+ =

=

3

82 . 185 $

+ + + =

X

A P X P

F P F P F P A P P

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

11

3.39

.40 Establish economic equivalent at

96 . 0 $

) 12 %, 10 , / ( 20 $ ) 5 %, 10 , / ( 20 $

=

= A P G P P

0 1 2 3 4 5 6 7 8 9 10 11 12

$20

$40

$60

$80

$20

3 8 = n :

73 . 334 , 1 $

80 . 699 , 10 $ 0164 . 8

) 7833 . 1 ( 000 , 6 $ ) 2597 . 1 )( 08 . 2 ( 6366 . 10

) 2 %, 8 , / ( 000 , 6 $ ) 3 %, 8 , / )( 2 %, 8 , / ( ) 8 %, 8 , / (

=

=

=

=

C

C

C C

A P P F A F C A F C

3.41 The original cash flow series is

.42 Establishing equivalence at n =8, we find

0 0 6 $900

1 $800 7 $920

2 $820 8 $300

3 $840 9 $300

4 $860 10 $300 $500

5 $880

n n

n A n A

3

13 . 297 $

) 4872 . 9 ( ) 1436 . 2 ( 2 77 . 092 , 4 $

) 7 %, 10 , / ( ) 8 %, 10 , / ( 2 ) 3 %, 10 , / ( 200 $ ) 8 %, 10 , / ( 300 $

=

+ =

+ = +

C

C C

A F C P F C A F A F

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

12

.43 Establishing equivalence at 3 5 = n

.44 Computing equivalence at

$200( / ,8%,5) $50( / ,8%,1)

( / ,8%,5) ($200 )[( / ,8%,2) ( / ,8%,1)]

$1,119.32 (5.8666) ($200 )(2.2464)

$185.09

F A F P

X F A X F P F P

X X

X

= + +

= +

=

3 5 = n

2 . 623 , 29 $ ) 5 %, 9 , / ( 000 , 3 $ ) 5 %, 9 , / ( 000 , 3 $ = + = A P A F X

3.45 (2), (4), and (6)

3.46 (2), (4), and (5)

3.47

25 . 91 $

2638 . 1 ) 5 %, 10 , / (

32 . 115 $ ) 5 %, 10 , / )]( 1 %, 10 , / ( 50 $ 50 [$ ) 5 %, 10 , / ( 50 $ 50 ($

2

1

=

= + =

= + + =

A

A P A A A A

P A F P G A A

3.48 (a)

3.49 (b)

.50 (b)

3

793 , 5 $

60 . 458 , 2 $ 8137 . 6 935 , 41 $

)] 6 %, 10 , / )( 6 %, 10 , / ( 000 , 1 $ ) 12 %, 10 , / (

) 6 %, 10 , / ( 000 , 30 $ 000 , 25 $

=

+ =

+ =

+

C

C

F P A P A P C

F P

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

13

Solving for an Unknown Interest Rate of Unknown Interest Periods

3.51

3.52 Establishing equivalence at

5

2 (1 )

log2 5 log (1 )

14.87%

P P i

i

i

= +

= +

=

0 = n

1

i ) / ( 500 , 2 $ ) 6 , , / ( 000 , 2 $ A P i A P 6 , %, 25 , =

Solving for I with Excel, we obtain % 35 . 92 = i

3.53

+

3.54

5

$35,000 $10,000( / , ,5) $10,000(1 )

28.47%

F P i i

i

= =

=

$1,000,000 $2,000( / ,6%, )

(1 0.06) 1

500

0.06

31 (1 0.06)

log30 log1.06

58.37 years

N

N

F A N

N

N

=

+

=

= +

=

=

Short Case Studies

ST 3. uming that they are paid at the beginning of each year 1 Ass

(a)

62 . 58 $ ) 3 %, 6 , / ( 96 . 15 $ 96 . 15 $ = + A P

It is better to take the offer because of lower cost to renew.

ST 3 payment series at the end of

20 (or beginning of Year 21) is

(b)

$57.12 $15.96 $15.96( / , ,3)

7.96%

P A i

i

= +

=

.2 The equivalent future worth of the prize

Year

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

14

F F A =

quivalent future worth of the lottery receipts is

F F P =

resulting surplus at the end of Year 20 is

pute the equivalent present worth (in 2006) for each option at

F +

P P F P F

P F

= + + +

+

=

(b) sing either Excel or Cash Flow Analyzer, both plans would be

1

$71,819,490 =

$1,952,381( / ,6%,20)

The e

2

$109,516,040 =

($36,100,000 $1,952,381)( / ,6%,20)

The

2 1

$109,516,040 $71,819,490

$37,696,550

F F =

=

ST 3.3

(a) Com % 6 = i .

Deferred

$2,000,000 $566,000( / ,6%,1) $920,000( / ,6%,2)

$1,260,000( / ,6%,11)

$8,574,490

P P F P

P F

= + +

+

=

Non-Deferred

$2,000,000 $900,000( / ,6%,1) $1,000,000( / ,6%,2)

$1,950,000( / ,6%,5)

$7,431,560

At % 6 = i , the deferred plan is a better choice.

U

economically equivalent at % 72 . 15 = i

ST 3 ximum amount to invest in the prevention program is

.4 The ma

467 , 50 $ ) 5 %, 12 , / ( 000 , 14 $ = = A P P

sing the

ST 3.5 geometric gradient series present worth factor, we can establish

e equivalence between the loan amount $120,000 and the balloon payment

s as

U

th

serie

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

15

1)

1

$120,000 ( A =

1

1

1

/ ,10%,9%,5) 4.6721

$25,684.38

P A A =

=

2) Paym series

A

ent

n Payment

1

2

$25,684.38

$28,252.82

3 $31,078.10

4 $34,185.91

ST 3.6

1) Compute the required annual net cash profit to pay off the investment

and interest.

A

A

5 $37,604.50

$70,000,000 ( / ,1 A P A 0%,5) 3.7908

$18,465,759

= =

=

) Decide the number of shoes, X

2

$18,465,759 ($100)

184,657

X

X

=

=

ST 3.7

F P

$1,000( / ,9.4%,5) $500( / ,9.4%,5) $4,583.36 P F F A

$4,583.36( / ,9.4%,60) $1,005,132

+ =

=

ain question is whether or not the U.S. government will be able to

vest the social security deposits at 9.4% interest over 60 years.

F

(b)

A

>

Stay with the original deferred plan.

The m

in

ST 3.8

(a)

Contract

$3,875,000 $3,125,000( / ,6%,1)

$5,525,000( / ,6%,2)

$8,875,000( / ,6%,7)

$39,547,242

P P

P F

P F

= +

+ +

+

=

Bonus

=

$1,375,000 $1,375,000( / P P = + ,6%,7)

$9,050,775 $8,000,000

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

16

ST 3.9

e between two

payment options. Selecting n =0 as the base period, we can calculate the

equivalent present worth for each option as follows:

Basically we are establishing an economic equivalenc

Option 1: $140,000

Option 2: $32,639( / , %,9)

P

P P A i

=

=

Or,

P A i $140,000 $32,639( / , %,9)

18.10% i

=

=

If Mrs. Setchfield can invest her money at a rate higher than 18

.10%, it is

better to go with Option 1. However, it may be difficult for her to find an

investment opportunity that provides a return exceeding 18%.

Contemporary Engineering Economics, Fourth Edition, By Chan S. Park. ISBN 0-13-187628-7.

2007 Pearson Education, Inc., Upper Saddle River, NJ. All rights reserved. This material is protected by Copyright and written permission should be

obtained from the publisher prior to any prohibited reproduction, storage in a retrieval system, or transmission in any form or by means, electronic, mechanical,

photocopying, recording, or likewise. For information regarding permission(s), write to: Rights and Permissions Department,

Pearson Education, Inc., Upper Saddle River, NJ 07458.

You might also like

- English Skills BookDocument49 pagesEnglish Skills BookAngela SpadeNo ratings yet

- FE Electrical and Computer Planner - CourseDocument39 pagesFE Electrical and Computer Planner - CourseMinaSamirNo ratings yet

- Mathematics of InvestmentsDocument9 pagesMathematics of InvestmentsJohndee Mozart Dela CruzNo ratings yet

- Engineering - Economics 2020Document18 pagesEngineering - Economics 2020Arshad MahmoodNo ratings yet

- Fundamentals of Engineering Economics - Chapter 3 SlidesDocument57 pagesFundamentals of Engineering Economics - Chapter 3 SlidesMohammed Al-IsmailNo ratings yet

- Gemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesDocument24 pagesGemmw: Mathematics in The Modern World Module 4: Consumer Math Learning OutcomesMary Grace Angeles50% (2)

- Learning Outcomes:: SolutionDocument4 pagesLearning Outcomes:: Solutiondreamfever0323No ratings yet

- FE Exam TipsDocument17 pagesFE Exam TipsAshraf Badr100% (1)

- Park - Fundamentals of Engineering Economics, 2nd Edition - Solution Manual - ch0Document4 pagesPark - Fundamentals of Engineering Economics, 2nd Edition - Solution Manual - ch0Martin Van Nostrand0% (11)

- FE Review: Engineering EconomicsDocument41 pagesFE Review: Engineering EconomicsNana BaNo ratings yet

- Engineering EconomicsDocument19 pagesEngineering Economicssjois_hsNo ratings yet

- Trignometric Eqn. and IdentitiesDocument71 pagesTrignometric Eqn. and IdentitiesAditya Girdhar100% (1)

- The Etteilla Tarot: Majors & Minors MeaningsDocument36 pagesThe Etteilla Tarot: Majors & Minors MeaningsRowan G100% (1)

- Testimonials from Students Who Passed Exams with Test MastersDocument8 pagesTestimonials from Students Who Passed Exams with Test MastersSamer HouzaynNo ratings yet

- Models of Health BehaviorDocument81 pagesModels of Health BehaviorFrench Pastolero-ManaloNo ratings yet

- Chapter 04Document29 pagesChapter 04arfat_ahmad_khan67% (3)

- Oracle Fusion Financials Book Set Home Page SummaryDocument274 pagesOracle Fusion Financials Book Set Home Page SummaryAbhishek Agrawal100% (1)

- Nature and Scope of Marketing Marketing ManagementDocument51 pagesNature and Scope of Marketing Marketing ManagementFeker H. MariamNo ratings yet

- LLM DissertationDocument94 pagesLLM Dissertationjasminjajarefe100% (1)

- Chapter 5 Present-Worth Analysis: Identifying Cash Inflows and OutflowsDocument23 pagesChapter 5 Present-Worth Analysis: Identifying Cash Inflows and Outflowsahjhnlol50% (2)

- Calculating interest rates, profits, and losses from financial documentsDocument8 pagesCalculating interest rates, profits, and losses from financial documentsHeralynn BaloloyNo ratings yet

- Module 4-Answer KeyDocument100 pagesModule 4-Answer KeyAna Marie Suganob82% (22)

- Chapter 06Document27 pagesChapter 06mazin903No ratings yet

- Park - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Document15 pagesPark - Fundamentals of Engineering Economics - 2nd Edition - Solution Manual - ch2Mobin Akhand50% (6)

- Chapter 12 PDFDocument41 pagesChapter 12 PDFaaaNo ratings yet

- Chapter 10 PDFDocument47 pagesChapter 10 PDFaaaNo ratings yet

- Engineering Economics Lecture 10 PDFDocument29 pagesEngineering Economics Lecture 10 PDFNavinPaudelNo ratings yet

- Engineering Economics Lecture 3 Time Value of MoneyDocument44 pagesEngineering Economics Lecture 3 Time Value of MoneyNavinPaudelNo ratings yet

- FEE ISM Ch08 3e OKDocument15 pagesFEE ISM Ch08 3e OKonlydlonlyNo ratings yet

- 2 Cost Concepts and Design EconomicsDocument16 pages2 Cost Concepts and Design EconomicsAlex XleaNo ratings yet

- MSG 00002 Solution ManualDocument5 pagesMSG 00002 Solution ManualGo Turpin0% (1)

- Engineering EconomyDocument5 pagesEngineering EconomyMarco TremaldiNo ratings yet

- Minggu 2 - Interest and EquivalenceDocument32 pagesMinggu 2 - Interest and EquivalencekasmitaNo ratings yet

- Engineering Economy Chapter 5Document102 pagesEngineering Economy Chapter 5Jason Gabriel JonathanNo ratings yet

- Chapter FourDocument65 pagesChapter FourKhanNo ratings yet

- Engineering EconomyDocument15 pagesEngineering Economyjm1310% (1)

- Engineering Economy BP2 Set B With SolutionsDocument8 pagesEngineering Economy BP2 Set B With SolutionsZach LavineNo ratings yet

- MM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceDocument61 pagesMM 314 Engineering Economy - 2. Interest Rate and Economic EquivalenceOğulcan AytaçNo ratings yet

- 7-Engineering Economics 2014Document42 pages7-Engineering Economics 2014hiva_p_23716778No ratings yet

- OBS 615: Managerial Decision Making Processes and TechniquesDocument51 pagesOBS 615: Managerial Decision Making Processes and Techniquesmohamed2002No ratings yet

- Chapter 05Document26 pagesChapter 05slee11829% (7)

- DASNY Cost Estimating WorkbookDocument6 pagesDASNY Cost Estimating WorkbookanuarNo ratings yet

- Money Time Relationships and EquivalenceDocument34 pagesMoney Time Relationships and EquivalenceRyan Jay EscoriaNo ratings yet

- Rate of ReturnDocument38 pagesRate of ReturnPraz AarashNo ratings yet

- Chapter #19 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDocument15 pagesChapter #19 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'bNo ratings yet

- Dwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFDocument35 pagesDwnload Full Contemporary Engineering Economics 5th Edition Park Solutions Manual PDFnenupharflashilysp5c100% (16)

- Contemporary Engineering Economics 5th Edition Park Solutions ManualDocument35 pagesContemporary Engineering Economics 5th Edition Park Solutions Manualbyronrogersd1nw8100% (17)

- 03 Park ISM ch03 PDFDocument15 pages03 Park ISM ch03 PDFBenn DoucetNo ratings yet

- GENERAL MATHEMATICS Quarter 2 - Module 6: Simple and Compound InterestsDocument3 pagesGENERAL MATHEMATICS Quarter 2 - Module 6: Simple and Compound InterestsAngeline TumananNo ratings yet

- Assignment ExcelDocument3 pagesAssignment ExcelTarek KamelNo ratings yet

- Business Mathematics Midterm ExamDocument10 pagesBusiness Mathematics Midterm ExamYasmin BeltranNo ratings yet

- Part 1Document10 pagesPart 1DantesNo ratings yet

- Lecture5-Equal Payment SeriesDocument25 pagesLecture5-Equal Payment SeriesGanda GandaNo ratings yet

- Business Mathematics Chapter 8&9Document89 pagesBusiness Mathematics Chapter 8&9WiilsoonvegaNo ratings yet

- Module 4 - Consumer MathDocument23 pagesModule 4 - Consumer MathCIELICA BURCANo ratings yet

- Chapter 5 Interest Formulas For Single Cash FlowsDocument10 pagesChapter 5 Interest Formulas For Single Cash FlowsORK BUNSOKRAKMUNYNo ratings yet

- Activity Sheets Obj. 3Document7 pagesActivity Sheets Obj. 3BOBBY BRAIN ANGOSNo ratings yet

- Chapter 9 Simple Interest PDFDocument7 pagesChapter 9 Simple Interest PDFAhmed AymanNo ratings yet

- Assignment 1+2 SolutionsDocument4 pagesAssignment 1+2 SolutionsMinh TuyềnNo ratings yet

- ISE431 L3 3rDocument23 pagesISE431 L3 3rjohnNo ratings yet

- General Mathematics InterestDocument29 pagesGeneral Mathematics InterestDenmark SantosNo ratings yet

- 04 Park ISM ch04 PDFDocument28 pages04 Park ISM ch04 PDFBenn DoucetNo ratings yet

- Chapter3 SolutionsDocument6 pagesChapter3 SolutionsjamalcrawfordNo ratings yet

- Tutorial 2 SolutionsDocument4 pagesTutorial 2 SolutionsSadia R ChowdhuryNo ratings yet

- Surigao Del Sur State University: Mathematics in The Modern World Module Number 5Document8 pagesSurigao Del Sur State University: Mathematics in The Modern World Module Number 5TOP ERNo ratings yet

- Simple CompoundDocument46 pagesSimple CompoundJanelle Ghia RamosNo ratings yet

- Chapter 4: Time Value of Money: FIN 301 Homework Solution Ch4Document8 pagesChapter 4: Time Value of Money: FIN 301 Homework Solution Ch4spicegyalNo ratings yet

- Long Run Average Cost (LRAC) : Economies of ScaleDocument3 pagesLong Run Average Cost (LRAC) : Economies of ScaleA PNo ratings yet

- E Learning: A Student Guide To MoodleDocument16 pagesE Learning: A Student Guide To MoodleHaytham Abdulla SalmanNo ratings yet

- Phys114 Ps 1Document11 pagesPhys114 Ps 1Reine Amabel JarudaNo ratings yet

- Revised Man As A Biological BeingDocument8 pagesRevised Man As A Biological Beingapi-3832208No ratings yet

- Eudragit ReviewDocument16 pagesEudragit ReviewlichenresearchNo ratings yet

- Mesopotamia CivilizationDocument56 pagesMesopotamia CivilizationYashika TharwaniNo ratings yet

- Presentation On Ich Topics & Guidelines With A Special Reference ToDocument79 pagesPresentation On Ich Topics & Guidelines With A Special Reference ToVidyaNo ratings yet

- Mark Dean GR6211 Fall 2018 Columbia University: - Choice Theory'Document5 pagesMark Dean GR6211 Fall 2018 Columbia University: - Choice Theory'bhaskkarNo ratings yet

- VNC Function Operation InstructionDocument11 pagesVNC Function Operation InstructionArnaldo OliveiraNo ratings yet

- Principles of Management NotesDocument61 pagesPrinciples of Management Notestulasinad123No ratings yet

- Brochure - Truemax Concrete Pump Truck Mounted TP25M4Document16 pagesBrochure - Truemax Concrete Pump Truck Mounted TP25M4RizkiRamadhanNo ratings yet

- Interna Medicine RheumatologyDocument15 pagesInterna Medicine RheumatologyHidayah13No ratings yet

- Trove Research Carbon Credit Demand Supply and Prices 1 June 2021Document51 pagesTrove Research Carbon Credit Demand Supply and Prices 1 June 2021Ceren ArkancanNo ratings yet

- 277Document18 pages277Rosy Andrea NicolasNo ratings yet

- EQ - Module - Cantilever MethodDocument17 pagesEQ - Module - Cantilever MethodAndrea MalateNo ratings yet

- FINAL - Plastic Small Grants NOFO DocumentDocument23 pagesFINAL - Plastic Small Grants NOFO DocumentCarlos Del CastilloNo ratings yet

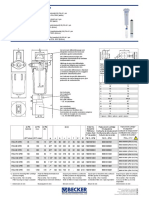

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- Power Bi ProjectsDocument15 pagesPower Bi ProjectssandeshNo ratings yet

- Youth, Time and Social Movements ExploredDocument10 pagesYouth, Time and Social Movements Exploredviva_bourdieu100% (1)

- Credit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaDocument85 pagesCredit Risk Management Practice in Private Banks Case Study Bank of AbyssiniaamogneNo ratings yet

- Wika Type 111.11Document2 pagesWika Type 111.11warehouse cikalongNo ratings yet

- CHEM206 Answers 1Document3 pagesCHEM206 Answers 1Shiro UchihaNo ratings yet