Professional Documents

Culture Documents

Mutual Funds & Investment Cos Guide

Uploaded by

vishnu3gkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Funds & Investment Cos Guide

Uploaded by

vishnu3gkCopyright:

Available Formats

CHAPTER 4: MUTUAL FUNDS & OTHER INVESTMENT COMPANIES

1. The unit investment trust should have lower operating expenses. Because the

investment trust portfolio is fixed once the trust is established, it does not have to

pay portfolio managers to constantly monitor and rebalance the portfolio as

perceived needs or opportunities change.

2. The offering price includes a 6% front-end load, or sales commission, meaning that

every dollar paid results in only $0.94 going toward purchase of shares. Therefore:

Offering price =

06 . 0 1

70 . 10 $

load 1

NAV

= = $11.38

3. NAV = offering price (1 load) = $12.30 0.95 = $11.69

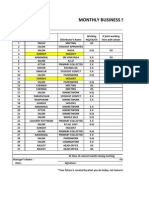

4. Stock Value held by fund

A $ 7,000,000

B 12,000,000

C 8,000,000

D 15,000,000

Total $42,000,000

Net asset value =

000 , 000 , 4

000 , 30 $ 000 , 000 , 42 $

= $10.49

5. Value of stocks sold and replaced = $15,000,000

Turnover rate =

000 , 000 , 42 $

000 , 000 , 15 $

= 0.357 = 35.7%

6. a. NAV =

million 5

million 3 $ million 200 $

= $39.40

b. Premium (or discount) =

NAV

NAV ice Pr

=

40 . 39 $

40 . 39 $ 36 $

= 0.086 = -8.6%

The fund sells at an 8.6% discount from NAV

4-1

7. Rate of return =

50 . 12 $

50 . 1 $ 40 . 0 $

NAV year of Start

n itri!"tio # NAV +

=

+

= 0.0880 = 8.80%

8. a. Start of year price = $12.00 1.02 = $12.24

End of year price = $12.10 0.93 = $11.25

Although NAV increased, the price of the fund fell by $0.99.

Rate of return =

$rice year of Start

on #itri!"ti % ice &Pr +

=

24 . 12 $

50 . 1 $ 99 . 0 $ +

= 0.0417 =

4.17%

b. An investor holding the same portfolio as the fund manager would have

earned a rate of return based on the increase in the NAV of the portfolio:

Rate of return =

NAV year of Start

on #itri!"ti % NAV & +

=

00 . 12 $

50 . 1 $ 10 . 0 $ +

= 0.1333 =

13.33%

9. a. Unit investment trusts: diversification from large-scale investing, lower

transaction costs associated with large-scale trading, low management fees,

predictable portfolio composition, guaranteed low portfolio turnover rate.

b. Open-end funds: diversification from large-scale investing, lower transaction

costs associated with large-scale trading, professional management that may

be able to take advantage of buy or sell opportunities as they arise, record

keeping.

c. Individual stocks and bonds: No management fee, realization of capital gains

or losses can be coordinated with investors personal tax situation, portfolio

can be designed to investors specific risk profile.

10. Open-end funds are obligated to redeem investor's shares at net asset value, and

thus must keep cash or cash-equivalent securities on hand in order to meet potential

redemptions. Closed-end funds do not need the cash reserves because there are no

redemptions for closed-end funds. Investors in closed-end funds sell their shares

when they wish to cash out.

11. Balanced funds keep relatively stable proportions of funds invested in each asset

class. They are meant as convenient instruments to provide participation in a range

of asset classes. Asset allocation funds, in contrast, may vary the proportions

4-2

invested in each asset class by large amounts as predictions of relative performance

across classes vary. Asset allocation funds therefore engage in more aggressive

market timing.

4-3

12. a. Empirical research indicates that past performance of mutual funds is not

highly predictive of future performance, especially for better-performing

funds. While there may be some tendency for the fund to be an above average

performer next year, it is unlikely to once again be a top 10% performer.

b. On the other hand, the evidence is more suggestive of a tendency for poor

performance to persist. This tendency is probably related to fund costs and

turnover rates. Thus if the fund is among the poorest performers, investors

would be concerned that the poor performance will persist.

13. Start of year NAV = $20

Dividends per share = $0.20

End of year NAV is based on the 8% price gain, less the 1% 12b-1 fee:

End of year NAV = $20 (1.08) (1 0.01) = $21.384

Rate of return =

20 $

20 . 0 $ 20 $ 3'4 . 21 $ +

= 0.0792 = 7.92%

14. The excess of purchases over sales must be due to new inflows into the fund.

Therefore, $400 million of stock previously held by the fund was replaced by new

holdings. So turnover is: ($400/$2,200) = 0.182 = 18.2%

15. Fees paid to investment managers were (0.007 $2.2 billion) = $15.4 million.

Since the total expense ratio was 1.1% and the management fee was 0.7%, we

conclude that 0.4% must be for other expenses. Therefore, other administrative

expenses were: (0.004 $2.2 billion) = $8.8 million

16. As an initial approximation, your return equals the return on the shares minus the

total of the expense ratio and purchase costs: (12% 1.2% 4%) = 6.8%

But the precise return is less than this because the 4% load is paid up front, not at

the end of the year.

To purchase the shares, you would have had to invest: [$20,000/(1 .04)] = $20,833.

The shares increase in value from $20,000 to: [$20,000 (1.12 0.012)] = $22,160.

The rate of return is: [(22,160 20,833)/20,833] = 6.37%

4-4

17. Suppose you have $1000 to invest. The initial investment in Class A shares is $940

net of the front-end load. After 4 years, your portfolio will be worth:

$940 (1.10)

4

= $1,376.25

Class B shares allow you to invest the full $1,000, but your investment performance

net of 12b-1 fees will be only 9.5%, and you will pay a 1% back-end load fee if you

sell after 4 years. Your portfolio value after 4 years will be:

$1000 (1.095)

4

= $1,437.66

After paying the back-end load fee, your portfolio value will be:

$1,437.66 0.99 = 1423.28

Class B shares are the better choice if your horizon is 4 years.

With a 15-year horizon, the Class A shares will be worth:

$940 (1.10)

15

= $3926.61

For the Class B shares, there is no back-end load in this case since the horizon is

greater than 5 years. Therefore, the value of the Class B shares will be:

$1000 (1.095)

15

= $3901.32

At this longer horizon, Class B shares are no longer the better choice. The effect of

Class B's 0.5% 12b-1 fees cumulates over time and finally overwhelms the 6% load

charged to Class A investors.

18. Suppose that finishing in the top half of all portfolio managers is purely luck, and

that the probability of doing so in any year is exactly . Then the probability that

any particular manager would finish in the top half of the sample five years in a row

is ()

5

= 1/32. We would then expect to find that [350 (1/32)] = 11 managers

finish in the top half for each of the five consecutive years. This is precisely what

we found. Thus, we should not conclude that the consistent performance after five

years is proof of skill. We would expect to find eleven managers exhibiting

precisely this level of "consistency" even if performance is due solely to luck.

19. a. After two years, each dollar invested in a fund with a 4% load and a portfolio

return equal to r will grow to: [$0.96 (1 + r 0.005)

2

]. Each dollar invested

in the bank CD will grow to [$1 (1.06)

2

]. If the mutual fund is to be the

better investment, then the portfolio return, r, must satisfy:

0.96 (1 + r 0.005)

2

> (1.06)

2

0.96 (1 + r 0.005)

2

> 1.1236

(1 + r 0.005)

2

> 1.1704

1 + r 0.005 > 1.0819

4-5

1 + r > 1.0869

Therefore, r > 0.0869 = 8.69%

4-6

b. If you invest for six years, then the portfolio return must satisfy:

0.96 (1 + r 0.005)

6

> (1.06)

6

= 1.4185

(1 + r 0.005)

6

> 1.4776

1 + r 0.005 > 1.0672

1 + r > 1.0722

r > 7.22%

The cutoff rate of return is lower for the six year investment because the

"fixed cost" (i.e., the one-time front-end load) is spread out over a greater

number of years.

c. With a 12b-1 fee instead of a front-end load, the portfolio must earn a rate of

return (r) that satisfies:

1 + r 0.005 0.0075 > 1.06

In this case, r must exceed 7.25% regardless of the investment horizon.

20. The turnover rate is 50%. This means that, on average, 50% of the portfolio is sold

and replaced with other securities each year. Trading costs on the sell orders are

0.4%; and the buy orders to replace those securities entail another 0.4% in trading

costs. Total trading costs will reduce portfolio returns by: (2 0.4% 0.50) = 0.4%

21. For the bond fund, the fraction of portfolio income given up to fees is:

( 0 . 4

( 6 . 0

= 0.150 = 15.0%

For the equity fund, the fraction of investment earnings given up to fees is:

( 0 . 12

( 6 . 0

= 0.050 = 5.0%

Fees are a much higher fraction of expected earnings for the bond fund, and

therefore may be a more important factor in selecting the bond fund.

This may help to explain why unmanaged unit investment trusts are concentrated in

the fixed income market. The advantages of unit investment trusts are low turnover

and low trading costs and management fees. This is a more important concern to

bond-market investors.

4-7

You might also like

- Soln CH 04 Mutual FundsDocument6 pagesSoln CH 04 Mutual FundsSilviu Trebuian100% (1)

- Chapter 04 - Mutual Funds and Other Investment CompaniesDocument6 pagesChapter 04 - Mutual Funds and Other Investment CompaniesGoogle Play AccountNo ratings yet

- Chapter 4 BKM Investments 9e SolutionsDocument6 pagesChapter 4 BKM Investments 9e Solutionsnpiper2950% (2)

- Chapter 4: Mutual Funds and Other Investment Companies: Problem SetsDocument6 pagesChapter 4: Mutual Funds and Other Investment Companies: Problem SetsBiloni KadakiaNo ratings yet

- Bkm9e Answers Chap004Document6 pagesBkm9e Answers Chap004AhmadYaseenNo ratings yet

- Chapter AnswersDocument6 pagesChapter AnswersMiguelito AlcazarNo ratings yet

- Mutual FundsDocument25 pagesMutual FundsSam Sep A SixtyoneNo ratings yet

- Tutorial 2-IPMDocument8 pagesTutorial 2-IPMNguyễn Phương ThảoNo ratings yet

- Chap 4Document5 pagesChap 4tienpham19893172No ratings yet

- Chap 4 Bodie 9eDocument8 pagesChap 4 Bodie 9eKelly Koh100% (2)

- Investments, Chapter 4: Answers To Selected ProblemsDocument5 pagesInvestments, Chapter 4: Answers To Selected ProblemsRadwan MagicienNo ratings yet

- Filter rule evidence against EMH semi-strong formDocument3 pagesFilter rule evidence against EMH semi-strong formTaySyYinNo ratings yet

- Essentials of Investments (BKM 7 Ed.) Answers To Suggested Problems - Lecture 1Document4 pagesEssentials of Investments (BKM 7 Ed.) Answers To Suggested Problems - Lecture 1masterchocoNo ratings yet

- Chapter 4 GoDocument9 pagesChapter 4 GoPiertotum LocomotorNo ratings yet

- Mutual Funds and Other Investment CompaniesDocument19 pagesMutual Funds and Other Investment CompaniesRemar Allen BautistaNo ratings yet

- 380.760: Corporate Finance: Financing ProjectsDocument19 pages380.760: Corporate Finance: Financing Projectsssregens82No ratings yet

- Hybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument36 pagesHybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesAhsanNo ratings yet

- Cost of Capital PDFDocument34 pagesCost of Capital PDFMera SamirNo ratings yet

- Cost of CapitalDocument5 pagesCost of Capitalblu3t00thNo ratings yet

- Calculate Equilibrium Stock Price with Declining EarningsDocument12 pagesCalculate Equilibrium Stock Price with Declining EarningsJenelle ReyesNo ratings yet

- Cost of Capital - HimaksheeDocument38 pagesCost of Capital - HimaksheeHimakshee BhagawatiNo ratings yet

- Problem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsDocument13 pagesProblem 16-4: Finmar Module 3: Distribution To Shareholders Assigned ProblemsRose Mae GaleroNo ratings yet

- Hybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesDocument30 pagesHybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesannafuentesNo ratings yet

- Accounting RatiosDocument6 pagesAccounting RatiosLulo NnenaNo ratings yet

- a4feacb1-b873-435f-97ca-59e87cbfc949Document9 pagesa4feacb1-b873-435f-97ca-59e87cbfc949Mariam AlraeesiNo ratings yet

- Chapter 4 End of Chapter QuestionsDocument3 pagesChapter 4 End of Chapter QuestionsParlee Barrow100% (2)

- Solved Problems Cost of CapitalDocument16 pagesSolved Problems Cost of CapitalPrramakrishnanRamaKrishnan0% (1)

- Chap8 Cost of CapitalDocument75 pagesChap8 Cost of CapitalBaby Khor50% (2)

- Cost of CapitalDocument20 pagesCost of CapitalGagan RajpootNo ratings yet

- Meseleler 100Document9 pagesMeseleler 100Elgun ElgunNo ratings yet

- Chapter 1Document19 pagesChapter 1chaman_shresthaNo ratings yet

- Lec8.Cost of CapitalDocument52 pagesLec8.Cost of Capitalvivek patelNo ratings yet

- Chapter 4 Valuation of Bonds and Cost of CspitalDocument24 pagesChapter 4 Valuation of Bonds and Cost of Cspitalanteneh hailie100% (7)

- Tugas Kelompok 7Document4 pagesTugas Kelompok 7Bought By UsNo ratings yet

- Northern Pacific seeks $3.25M equityDocument4 pagesNorthern Pacific seeks $3.25M equityBought By UsNo ratings yet

- Calculating WACC and Project NPV with Changing Floatation CostsDocument18 pagesCalculating WACC and Project NPV with Changing Floatation CostsYoga Pratama Rizki FNo ratings yet

- Finance Chapter4 AnswersDocument4 pagesFinance Chapter4 AnswersyumnaNo ratings yet

- Dividend PolicyDocument36 pagesDividend PolicySahana S MendonNo ratings yet

- TCCB REVISIONDocument44 pagesTCCB REVISION21070119No ratings yet

- Cost of Capital AnalysisDocument10 pagesCost of Capital AnalysisnanidoppiNo ratings yet

- Cost of Equity Shares Posted byDocument5 pagesCost of Equity Shares Posted bynafis20No ratings yet

- Brealey. Myers. Allen Chapter 17 SolutionDocument10 pagesBrealey. Myers. Allen Chapter 17 Solutionbharath_rath_2100% (1)

- 1 - Dividend PolicyDocument8 pages1 - Dividend PolicyoryzanoviaNo ratings yet

- Financial Management - Cost of CapitalDocument23 pagesFinancial Management - Cost of CapitalSoledad Perez50% (2)

- QUALITY MANAGEMENT SYSTEM COST OF CAPITALDocument18 pagesQUALITY MANAGEMENT SYSTEM COST OF CAPITALMarium ShabbirNo ratings yet

- Exam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesDocument9 pagesExam Name: CFA Level I Total Questions: 22 Assignment Name: JUN18L1QME/C02 (9dbafcb4) Pass Mark Rate: 65% Assignment Duration: 33 MinutesjuanNo ratings yet

- Module 4 - ValuationDocument29 pagesModule 4 - ValuationKishore JohnNo ratings yet

- Topic 4 Yield Measures and The Yield Curves: FINA 4120 - Fixed Income 1Document73 pagesTopic 4 Yield Measures and The Yield Curves: FINA 4120 - Fixed Income 1MingyanNo ratings yet

- Capital and Revenue ExpenditureDocument87 pagesCapital and Revenue ExpenditurefatynssvNo ratings yet

- Quiz Week 1 SolnsDocument8 pagesQuiz Week 1 SolnsRiri FahraniNo ratings yet

- CH.5 The Cost of CapitalDocument49 pagesCH.5 The Cost of CapitalMark KaiserNo ratings yet

- Investments Bodie Kane Marcus SolutionsDocument10 pagesInvestments Bodie Kane Marcus Solutionsdi50% (2)

- Mod5Act1 - Distribution To ShareholdersDocument12 pagesMod5Act1 - Distribution To ShareholdersArnelli Marie Asher GregorioNo ratings yet

- AnswersDocument9 pagesAnswersJunior LewNo ratings yet

- Bodie Essentials Ch. 10 SolutionsDocument18 pagesBodie Essentials Ch. 10 SolutionsJPM190067% (6)

- Weighted Average Cost of CapitalDocument3 pagesWeighted Average Cost of Capital1abhishek1No ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Orphanage 1Document3 pagesOrphanage 1vishnu3gkNo ratings yet

- Krcdo Project Plans Play SchoolDocument15 pagesKrcdo Project Plans Play SchoolSesagiri MedimiNo ratings yet

- IEEE Copyright FormDocument2 pagesIEEE Copyright FormMatías IgnacioNo ratings yet

- R. BalavigneshDocument2 pagesR. Balavigneshvishnu3gkNo ratings yet

- Mutual FundsDocument9 pagesMutual Fundsvishnu3gkNo ratings yet

- R. BalavigneshDocument2 pagesR. Balavigneshvishnu3gkNo ratings yet

- DemoDocument8 pagesDemoDemo DesignerNo ratings yet

- AMFI-MUTUAL FUND BASIC CURRICULUMDocument10 pagesAMFI-MUTUAL FUND BASIC CURRICULUMJignesh MehtaNo ratings yet

- MiscomDocument22 pagesMiscomvishnu3gkNo ratings yet

- The Darknet and The Future of Content Distribution: Peter Biddle, Paul England, Marcus Peinado, and Bryan WillmanDocument17 pagesThe Darknet and The Future of Content Distribution: Peter Biddle, Paul England, Marcus Peinado, and Bryan WillmanJasdeep BajajNo ratings yet

- Raw Material Equivalent ChartDocument8 pagesRaw Material Equivalent Chartvishnu3gkNo ratings yet

- IEEE Copyright FormDocument2 pagesIEEE Copyright FormMatías IgnacioNo ratings yet

- Pslam (Sangeetham) Chapter 1Document25 pagesPslam (Sangeetham) Chapter 1vishnu3gkNo ratings yet

- Android: Paper OnDocument12 pagesAndroid: Paper OnNatarajan JeetNo ratings yet

- Constitution of IndiaDocument6 pagesConstitution of Indiavishnu3gkNo ratings yet

- Constitution of IndiaDocument6 pagesConstitution of Indiavishnu3gkNo ratings yet

- Constitution of IndiaDocument6 pagesConstitution of Indiavishnu3gkNo ratings yet

- Name: Class: Ix A Subject: History: Muthaiah MuralitharanDocument2 pagesName: Class: Ix A Subject: History: Muthaiah Muralitharanvishnu3gkNo ratings yet

- Pandyan GB-25.02.14 - 1Document8 pagesPandyan GB-25.02.14 - 1vishnu3gkNo ratings yet

- I Met LoveDocument1 pageI Met Lovevishnu3gkNo ratings yet

- Managerial Ethics Part I: Basic Concepts of Ethics & A Review of Some Systems of Ethical ThinkingDocument26 pagesManagerial Ethics Part I: Basic Concepts of Ethics & A Review of Some Systems of Ethical Thinkingvishnu3gkNo ratings yet

- Organizational BehaviorDocument120 pagesOrganizational BehaviorI.s. Ramasamy100% (14)

- Salem Teritory Monthly So Reports I-DecDocument20 pagesSalem Teritory Monthly So Reports I-Decvishnu3gkNo ratings yet

- Sbi Po Advt Jan-2013Document3 pagesSbi Po Advt Jan-2013api-193985166No ratings yet

- Yoga Vasishta Maha RamayanaDocument42 pagesYoga Vasishta Maha RamayanaVarun SainiNo ratings yet

- Assessment Formal AssessmentDocument7 pagesAssessment Formal Assessmentashish33% (3)

- The Impact of StressDocument3 pagesThe Impact of StressACabalIronedKryptonNo ratings yet

- Growth Developt Pearl MilletDocument17 pagesGrowth Developt Pearl MilletdarmaNo ratings yet

- 2 English Course BDocument8 pages2 English Course BAnjana27No ratings yet

- Abstract - Tropen Tag 2011 PDFDocument634 pagesAbstract - Tropen Tag 2011 PDFzmoghesNo ratings yet

- Use Acupressure to Conceive FasterDocument15 pagesUse Acupressure to Conceive Fastersale18100% (1)

- 07 Chapter2Document16 pages07 Chapter2Jigar JaniNo ratings yet

- Bs8161 - Chemistry Laboratory Syllabus: Course ObjectivesDocument47 pagesBs8161 - Chemistry Laboratory Syllabus: Course ObjectiveslevisNo ratings yet

- Li Ching Wing V Xuan Yi Xiong (2004) 1 HKC 353Document11 pagesLi Ching Wing V Xuan Yi Xiong (2004) 1 HKC 353hNo ratings yet

- Reading and Listening 2Document4 pagesReading and Listening 2Hải Anh TạNo ratings yet

- Simple Syrup I.PDocument38 pagesSimple Syrup I.PHimanshi SharmaNo ratings yet

- Week 6 Blood and Tissue FlagellatesDocument7 pagesWeek 6 Blood and Tissue FlagellatesaemancarpioNo ratings yet

- RUKUS March 2010Document32 pagesRUKUS March 2010RUKUS Magazine29% (14)

- Proper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle JDocument15 pagesProper Operating Room Decorum: Lee, Sullie Marix P. Maderal, Ma. Hannah Isabelle Jjoannamhay ceraldeNo ratings yet

- Dr. Namrata Misra Head of Bioinnovations at KIIT UniversityDocument1 pageDr. Namrata Misra Head of Bioinnovations at KIIT Universitymanisha maniNo ratings yet

- Indonesia Organic Farming 2011 - IndonesiaDOCDocument18 pagesIndonesia Organic Farming 2011 - IndonesiaDOCJamal BakarNo ratings yet

- Subaru Forester ManualsDocument636 pagesSubaru Forester ManualsMarko JakobovicNo ratings yet

- History of The Stethoscope PDFDocument10 pagesHistory of The Stethoscope PDFjmad2427No ratings yet

- The Danger of Microwave TechnologyDocument16 pagesThe Danger of Microwave Technologyrey_hadesNo ratings yet

- Genetically Engineered MicroorganismsDocument6 pagesGenetically Engineered Microorganismsaishwarya joshiNo ratings yet

- Owners Manual Water Mist PDFDocument6 pagesOwners Manual Water Mist PDFZeeNo ratings yet

- Nursing Care PlansDocument10 pagesNursing Care PlansGracie S. Vergara100% (1)

- OC - PlumberDocument6 pagesOC - Plumbertakuva03No ratings yet

- Goals Editable PDFDocument140 pagesGoals Editable PDFManuel Ascanio67% (3)

- Business Startup Practical Plan PDFDocument70 pagesBusiness Startup Practical Plan PDFShaji Viswanathan. Mcom, MBA (U.K)No ratings yet

- Mod 6 Soft Tissue InjuriesDocument5 pagesMod 6 Soft Tissue Injuriesrez1987100% (1)

- Malaysia's Trade Potential in Colourful AfricaDocument18 pagesMalaysia's Trade Potential in Colourful AfricaThe MaverickNo ratings yet

- Notice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesDocument2 pagesNotice: Use of Segways® and Similar Devices by Individuals With A Mobility Impairment in GSA-Controlled Federal FacilitiesJustia.comNo ratings yet

- New Microsoft Excel WorksheetDocument4 pagesNew Microsoft Excel WorksheetRaheel Neo AhmadNo ratings yet

- Analisis Dampak Reklamasi Teluk Banten Terhadap Kondisi Lingkungan Dan Sosial EkonomiDocument10 pagesAnalisis Dampak Reklamasi Teluk Banten Terhadap Kondisi Lingkungan Dan Sosial EkonomiSYIFA ABIYU SAGITA 08211840000099No ratings yet